Aer Lingus 2010 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2010 Aer Lingus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2

Annual Report 2010

Chairman’s statement Aer Lingus Group Plc

Chairman’s statement

Dear fellow shareholders,

Last year in my Chairman’s Statement I wrote of

some of the problems facing Aer Lingus and of

the measures that we were taking to overcome

them. I specifi cally referred to the measures

that we were taking to make our products more

attractive to our customers, to make the Group

sustainably profi table by changing our culture,

our work practices and our cost base and the

measures that we were taking to preserve and

grow our cash. I also referred to issues relating

to our shareholder base.

I am happy to report a year later that we have

made signifi cant progress on all these fronts

and that these improvements will continue to

benefi t Aer Lingus and its shareholders into

the future.

Commercial overview

In 2010 the global airline environment was

more benign than a year earlier, with IATA

reporting that its member airlines experienced

total passenger traffi c growth of 8.2% in the

year. Unfortunately Ireland did not benefi t

from this more benign environment and total

traffi c into and out of Ireland declined with

Dublin Airport reporting a traffi c decline of

approximately 10% in 2010.

Fortunately Aer Lingus responded well to this

situation and trimmed its capacity to match

the demand, resulting in a 1.6 point increase

in our system load factor allied to a 12.0%

increase in our average fare per passenger.

This demand-led approach to capacity

deployment continues to generate positive

results, with our focus being on maximising

revenue per seat fl own rather than on chasing

passenger numbers. However, we continue to

offer keenly priced fares in order to remain

competitive with Ryanair, which is our

strongest competitor on most of our European

routes. Meanwhile, Aer Lingus gained market

share on key routes during the last year.

In 2010, Aer Lingus’ passenger offering was

also improved, with greater emphasis on

offering each market segment a customised

product rather than adopting a “one size fi ts

all” approach. An example of this has been a

better integration of our North Atlantic

operations with our European schedules and

with the US schedules of jetBlue and United

Airlines so that we are now providing

convenient connections to more people in

more cities in both continents. Our recent

move to Dublin’s new state of the art Terminal

2 will improve these products even further. Our

partnership with Aer Arann is another

important ingredient in our improved

passenger offering, allowing us to offer more

connecting services from regional locations in

Ireland and the United Kingdom.

We also achieved signifi cant progress in

implementing the cost reduction programme

that was agreed with our employees in early

2010. We have received overwhelming support

from most of our staff for these initiatives as

they realise that if Aer Lingus is to provide

them with a secure, vibrant and positive

working environment then we must be effi cient

and cost competitive. Unfortunately one staff

group, represented by the IMPACT trade union,

decided to engage in industrial action in late

2010 and early 2011 in protest against the

new rosters that were designed to achieve the

agreed working conditions and productivity

targets. While the issue was resolved

satisfactorily, and the targets will be achieved,

this negative action was damaging to the

Group and its stakeholders, including their

colleagues.

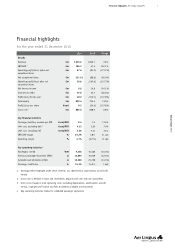

As a result of the initiatives described above,

Aer Lingus’ trading performance improved

signifi cantly in 2010. The Group has produced

an operating profi t before exceptional items of

€57.6 million for 2010 against an operating

loss of €81.0 million in the prior year. This

turnaround was achieved on fl at revenues in a

contracting market and despite service

interruptions resulting from volcanic ash and

unusually severe winter weather.

I would like to express the appreciation of

myself and my Board colleagues for the

innovation and application shown by

management and staff in achieving this hugely

improved result in what have been diffi cult

market and operating conditions.

We have continued to focus on maintaining

our balance sheet strength. At the end of 2010

Aer Lingus had a gross cash balance of €885.0

million as compared to €828.5 million a year

earlier. In an industry such as ours a strong

cash balance provides an airline with strength

to endure any unexpected disruptions and to

respond positively to any opportunities that

may arise.

Despite the positive developments in 2010, we

remain cautious for the current year, given the

continuing weakness of the Irish economy,

major increases in airport charges at Dublin

and London Heathrow and recent fuel price

volatility.

Shareholders

In 2010 we made progress in reducing our

share concentration among a small group of

shareholders by ensuring that the block of

shares held in trust on behalf of current and

former employees by the Aer Lingus Employee

Share Ownership Trust (“ESOT”) was distributed

to the individual benefi ciaries. This had the

effect of adding over 4,000 new shareholders

to our register and of signifi cantly increasing

the free fl oat of Aer Lingus.

The ESOT shareholding arose out of

arrangements described in Aer Lingus’ 2006

IPO Prospectus, whereby the ESOT held a

12.5% stake in Aer Lingus. A signifi cant part

of this shareholding was acquired with

borrowed funds. These borrowed funds, and

applicable interest, were to be repaid out of a

profi t share arrangement under which Aer

Lingus was required to pay up to 7.5% of its

annual profi t before tax and exceptional items

until the earlier of 2023 or such time as the

loan and all interest were fully repaid. As a

result of the recent turmoil in fi nancial

markets and the fact that no profi t share had

been paid in 2008 and 2009, the interest rate

on the ESOT loan would have increased

signifi cantly (and to a multiple of Aer Lingus’