Activision 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Activision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL

REPORT

2012

Table of contents

-

Page 1

A N NUA L R EPORT 2012 -

Page 2

OUTSTANDING RESULTS NON-GAAP REVENUES (1) INCREASED 11% YEAR ON YEAR RECORD NON-GAAP OPERATING MARGIN(1) $ 5.0B 34 (1) % For a full reconciliation, see tables at the end of the annual report. -

Page 3

/ 2012 ANNUAL REPORT / 1 $ 1.18 1.3B $ RECORD NON-GAAP EPS (1) OPERATING CASH FLOW INCREASED 27% YEAR ON YEAR INCREASED 41% YEAR ON YEAR LONG-TERM STRATEGY: FOCUS INNOVATION TALENT COMMITMENT ACTIVISION BLIZZARD, INC. -

Page 4

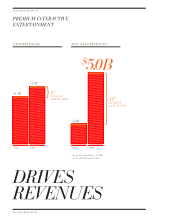

... INTERACTIVE ENTERTAINMENT GAAP REVENUES NON-GAAP REVENUES (1) $ $ 5.0B INCREASE YEAR ON YEAR 4.9B $ 4.8B INCREASE YEAR ON YEAR 2% 11% $ 4.5B 2011 2012 2011 (1) 2012 For a full reconciliation, see tables at the end of the annual report. DRIVES REVENUES ACTIVISION BLIZZARD, INC. -

Page 5

-

Page 6

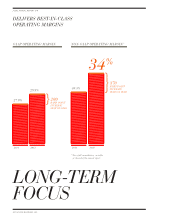

...GAAP OPERATING MARGIN NON-GAAP OPERATING MARGIN (1) 34 29.9% 27.9% 30.3% % 370 BASIS POINT INCREASE YEAR ON YEAR 200 BASIS POINT INCREASE YEAR ON YEAR 2011 2012 2011 (1) 2012 For a full reconciliation, see tables at the end of the annual report. LONG-TERM FOCUS ACTIVISION BLIZZARD, INC. -

Page 7

-

Page 8

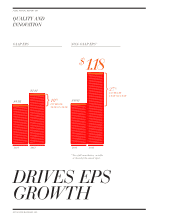

... ANNUAL REPORT / 6 QUALITY AND INNOVATION GAAP EPS NON-GAAP EPS (1) $ $1.01 $0.92 1. 1 8 INCREASE YEAR ON YEAR 27 % INCREASE YEAR ON YEAR 10 % $0.93 2011 2012 2011 (1) 2012 For a full reconciliation, see tables at the end of the annual report. DRIVES EPS GROWTH ACTIVISION BLIZZARD... -

Page 9

-

Page 10

... Expenditures. For a full reconciliation, see tables at the end of the annual report. (2) Dividends and share repurchases. (3) Defined as dividends and share repurchases as a percentage of free cash flow. (4) Includes short- and long-term investments. INCREASING VALUE ACTIVISION BLIZZARD, INC. -

Page 11

-

Page 12

POSITIONED FOR GROWTH ESTABLISHED FRANCHISES NEW INTELLECTUAL PROPERTIES NEW MODELS AND NEW MARKETS -

Page 13

-

Page 14

...the calendar year with approximately $4.4 billion in cash and investments and no debt. We have always believed that prioritizing opportunities based on our abilities to make the very best games with the very best financial returns for our shareholders is the key to longterm, sustained success. While... -

Page 15

... better serve our audience by making all elements of the Call of Duty Elite service free to our entire Call of Duty player community and move to a season pass/Ã la carte model for DLC. We launched our first DLC for Call of Duty: Black Ops II in late January of this year. Early results suggest we... -

Page 16

...and the original Call of Duty: Black Ops each remained top-five games played on the service, in spite of having been released in 2011 and 2010 respectively. The company is well into development on two new Call of Duty games-a console game that will be released in 2013, and Call of Duty Online, which... -

Page 17

... Skylanders Spyro's Adventure, was the #4 best-selling game. Additionally, through January 2013, we have sold more than 100 million Skylanders toys worldwide and in 2012 we outsold the largest action-figure line in North America and Europe. In 2013, the company plans to release Skylanders SWAP Force... -

Page 18

... shared dedication from great teams of people whose sense of mutual respect and teamwork drives our performance to new levels. Lastly, we are committed to managing our finances to grow our business and deliver and return long-term value to our shareholders. We have an unwavering culture of financial... -

Page 19

... July 9, 2008 are those of Vivendi Games (see Note 1 of the Notes to Consolidated Financial Statements included in this Annual Report). Therefore, 2012, 2011, 2010, 2009 and 2008 financial data is not comparable with prior periods. The terms "Activision Blizzard," the "Company," "we," "us," and "our... -

Page 20

... from value-added services such as realm transfers, faction changes and other character customizations within the World of Warcraft gameplay); retail sales of physical "boxed" products; online download sales of PC products; and licensing of software to third-party or related party companies that... -

Page 21

• In North America and Europe combined, including toys and accessories, Activision Publishing was the #1 console and handheld publisher for the calendar year with the #1 and #3 best-selling franchises-Call of Duty® and Skylanders. Activision Blizzard reported record digital revenues for the ... -

Page 22

... Blizzard's proprietary online-game related service, Battle.net. In 2011, Activision launched Call of Duty Elite, a digital service that provides both free and paid subscription-based content and features for Call of Duty: Modern Warfare 3. In conjunction with the release of Call of Duty: Black Ops... -

Page 23

...our short-term results. In addition, 2013 compared to 2012 will be a difficult year-over-year comparison due to the highly successful launch of Diablo III in May 2012. We will continue to invest in our established franchises, as well as new titles we think have the potential to drive our growth over... -

Page 24

...-online subscriptions ...Cost of sales-software royalties and amortization ...Cost of sales-intellectual property licenses ...Product development ...Sales and marketing ...General and administrative ...Impairment of intangible assets ...Restructuring ...Total costs and expenses ...Operating income... -

Page 25

... tax expense for the years ended December 31, 2012, 2011, and 2010 are presented in the table below (amounts in millions): For the Years Ended December 31, Increase/ (decrease) 2011 2010 2012 v 2011 2012 Increase/ (decrease) 2011 v 2010 Segment net revenues: Activision ...Blizzard ...Distribution... -

Page 26

... III, which we published on behalf of Lucas Arts in Europe and certain countries in Asia Pacific; and benefits from foreign exchange as compared to the prior year. The increase was partially offset by a more focused release schedule in 2011 than in 2010, and lower catalog sales of games in the music... -

Page 27

... market. Distribution's net revenues increased in 2011 as compared to 2010, primarily due to additional customer sales opportunities i n the U.K. and benefits from foreign exchange as compared to prior year. Segment Income from Operations Activision Activision's operating income increased in 2012... -

Page 28

... 11 (7)% (1) We currently define revenues from digital online channels as revenues from subscriptions and memberships, licensing royalties, value-added services, downloadable content, and digitally distributed products. We have determined that some of our game's online functionality represents an... -

Page 29

...of Pandaria, and revenues from Call of Duty Elite memberships. The increase in GAAP net revenues from digital online channels for 2011 as compared to 2010 was primarily due to the stronger performance and greater number of downloadable content packs for Call of Duty: Black Ops, which was released in... -

Page 30

... from Call of Duty: Modern Warfare 3. Consolidated net revenues from Europe and Asia Pacific increased in 2011 as compared to 2010, primarily due to the success of Call of Duty catalog titles, stronger performance of downloadable content packs for Call of Duty: Black Ops and the release of World of... -

Page 31

... almost entirely offset by the success of Call of Duty catalog titles, stronger performance of downloadable content packs for Call of Duty: Black Ops, the releases of World of Warcraft: Cataclysm and StarCraft II: Wings of Liberty in 2010, and the launch of Skylanders Spyro's Adventure, all of which... -

Page 32

... offset by sales from the Skylanders franchise. Net revenues from PS3 and Xbox 360 increased in 2011 as compared to 2010, primarily due to the launch of Skylanders Spyro's Adventure, the success of the Call of Duty franchise, and downloadable content packs for Call of Duty: Black Ops as compared... -

Page 33

... number of products distributed through digital online channels; a decrease in inventory obsolescence charges, as the prior year included higher inventory obsolescence charges relating to peripherals; a decrease in amortization of capitalized software development and intellectual property license... -

Page 34

... on sales and marketing activities to support the launch of Skylanders Spyro's Adventure, Call of Duty: Modern Warfare 3 and Call of Duty Elite in the fourth quarter of 2011. General and Administrative (amounts in millions) Increase (Decrease) 2012 v 2011 Increase (Decrease) 2011 v 2010 Year Ended... -

Page 35

... of the development of music-based games, the closure of the related business unit and the cancellation of other titles then in production, along with a related reduction in studio headcount and corporate overhead. The costs related to the 2011 Restructuring activities included severance... -

Page 36

... Vivendi Games tax returns for the 2005 through 2008 tax years. Activision Blizzard's tax years 2008 through 2011 remain open to examination by the major taxing jurisdictions to which we ar e subject. The IRS is currently examining the Company's federal tax returns for the 2008 and 2009 tax years... -

Page 37

... for 2010 and 2012 as compared to 2011, when there were no major releases from Blizzard. Additionally, the strong performance of Activision's Skylanders franchise and Call of Duty: Black Ops II contributed to strong operating cash flows in 2012. Cash Flows Provided by (Used in) Investing Activities... -

Page 38

... and equipment, the development, production, marketing and sale of new products, the provision of customer service for our subscribers, the acquisition of intellectual property rights for future products from third parties, and to fund our stock repurchase program and dividends. As of December... -

Page 39

... business units prepare quarterly reports regarding their current quarter operational performance, future trends, subsequent events, internal controls, changes in internal controls and other accounting and disclosure relevant information. These quarterly reports are reviewed by certain key corporate... -

Page 40

...' items sold together with physical "boxed" software) and our sales of World of Warcraft boxed products, expansion packs and value-added services, each of which is considered with the related subscription services for these purposes. Our assessment of deliverables and units of accounting does not... -

Page 41

... costs of sales, is subjective and require management's judgment. We recognize revenues from World of Warcraft boxed product, expansion packs and value-added services, in each case with the related subscription service revenue, ratably over the estimated service period beginning upon activation of... -

Page 42

... under development agreements, as well as direct costs incurred for internally developed products. We account for software development costs in accordance with the Financial Accounting Standards Board ("FASB") guidance for t he costs of computer software to be sold, leased, or otherwise marketed... -

Page 43

..., including our estimates of the fair value of acquired intangible assets, we use the income approach. Using the income approach requires the use of financial models, which require us to make various estimates including, but not limited to (1) the potential future cash flows for the asset, liability... -

Page 44

.... Our estimates for market growth, our market share and costs are based on historical data, various internal estimates and certain external sources, and are based on assumptions that are consistent with the plans and estimates we are using to manage the underlying business. If future forecasts are... -

Page 45

... to our employees and senior management vest based on the achievement of pre-established performance or market goals. We estimate the fair value of performance-based restricted stock rights at the closing market price of the Company's common stock on the date of grant. Each quarter, we update our... -

Page 46

... In February 2013, the FASB issued an accounting standards update requiring new disclosures about reclassifications from accumulated other comprehensive loss to net income. These disclosures may be presented on the face of the statements or in the notes to the consolidated financial statements. The... -

Page 47

... securities. Conversely, the fair value of such a portfolio is less sensitive to market fluctuations than a portfolio of longer term securities. We do not use derivative financial instruments to manage interest rate risk in our investment portfolio. At December 31, 2012, our $4.0 billion of cash and... -

Page 48

... independent registered public accounting firm, as stated in their report included in this Annual Report. Changes in Internal Control Over Financial Reporting. There have not been any changes in our internal control over financial reporting during the most recent fiscal quarter that have materially... -

Page 49

Report of Independent Registered Public Accounting Firm To the Board of Directors and Shareholders of Activision Blizzard, Inc.: In our opinion, the accompanying consolidated balance sheets and the related consolidated statements of operations, comprehensive income, changes in shareholders' equity ... -

Page 50

... at December 31, 2012 and 2011, respectively ...Inventories, net ...Software development ...Intellectual property licenses ...Deferred income taxes, net ...Other current assets ...Total current assets ...Long-term investments...Software development ...Intellectual property licenses ...Property and... -

Page 51

...-online subscriptions ...Cost of sales-software royalties and amortization ...Cost of sales-intellectual property licenses ...Product development ...Sales and marketing ...General and administrative ...Impairment of intangible assets ...Restructuring ...Total costs and expenses ...Operating income... -

Page 52

ACTIVISION BLIZZARD, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (Amounts in millions) For the Year Ended December 31, 2012 2011 2010 Net income...$1,149 Other comprehensive income (loss): Foreign currency translation adjustment ...46 Unrealized gains on investments, net ... -

Page 53

... expense related to employee stock options and restricted stock rights ...Return of capital to Vivendi related to taxes (see Note 15) ...Dividends ($0.15 per common share) ...Shares repurchased (see Note 19) ...Balance at December 31, 2010 ...Components of comprehensive income: Net income ...Other... -

Page 54

... common stock to employees...33 Tax payment related to net share settlements of restricted stock rights (16) Repurchase of common stock ...(315) Dividends paid...(204) Excess tax benefits from stock option exercises ...5 Net cash used in financing activities ...(497) Effect of foreign exchange rate... -

Page 55

... from value-added services such as realm transfers, faction changes, and other character customizations within the World of Warcraft gameplay, retail sales of physical "boxed" products; online download sales of PC products; and licensing of software to third-party or related party companies that... -

Page 56

... basis of quoted market prices of financial instruments with similar characteristics. Unrealized gains and losses of the Company's available-for-sale securities are excluded from earnings and reported as a component of "Other comprehensive income (loss)." Investments with original maturities greater... -

Page 57

... for the Activision and Blizzard segments, GameStop, who accounted for approximately 10% and 12% of net revenues for the years ended December 31, 2012 and 2010, respectively. We did not have any single customer that accounted for 10% or more of net revenues for the year ended December 31, 2011. We... -

Page 58

... under development agreements, as well as direct costs incurred for internally developed products. We account for software development costs in accordance with the Financial Accounting Standards Board ("FASB") guidance for t he costs of computer software to be sold, leased, or otherwise marketed... -

Page 59

.... As of December 31, 2012 and 2011, the Company's reporting units are the same as our operating segments: Activision, Blizzard, and Distribution. We test goodwill for possible impairment by first determining the fair value of the related reporting unit and comparing this value to the recorded net... -

Page 60

...' items sold together with physical "boxed" software) and our sales of World of Warcraft boxed products, expansion packs and value-added services, each of which is considered with the related subscription services for these purposes. Our assessment of deliverables and units of accounting does not... -

Page 61

...World of Warcraft boxed product, expansion packs and value-added services, in each case with the related subscription service revenue, ratably over the estimated service period beginning upon activation of the software and delivery of the related services. Revenues attributed to the sale of World of... -

Page 62

... our customer, such as sales and value added tax. Allowances for Returns, Price Protection, Doubtful Accounts, and Inventory Obsolescence We closely monitor and analyze the historical performance of our various titles, the performance of products released by other publishers, market conditions, and... -

Page 63

...periods presented. "Diluted earnings per share" is computed by dividing i ncome (loss) available to common shareholders by the weighted average number of common shares outstanding, increased by the weighted average number of common stock equivalents. Common stock equivalents are calculated using the... -

Page 64

... to our employees and senior management vest based on the achievement of pre-established performance or market goals. We estimate the fair value of performance-based restricted stock rights at the closing market price of the Company's common stock on the date of grant. Each quarter we update our... -

Page 65

...maturities of our short-term and long-term investments classified as availablefor-sale at December 31, 2012 (amounts in millions): Amortized cost Fair Value At December 31, 2012 U.S. government agency securities and corporate bonds due in 1 year or less...$398 Auction rate securities due after ten... -

Page 66

...): For the Years Ended December 31, 2012 2011 2010 Amortization ...$205 Write-offs and impairments ...12 7. Restructuring $258 60 $322 63 On February 3, 2011, the Board of Directors of the Company authorized a restructuring plan (the "2011 Restructuring") involving a focus on the development and... -

Page 67

... reporting unit. The impairment was due to declines in our expected future performance of the distribution business, which was a reflection of a continuing shift in the distribution of interactive entertainment software from retail distribution channels towards digital distribution and online gaming... -

Page 68

... charge Net carrying amount Acquired definite-lived intangible assets: License agreements and other ...Game engines ...Internally developed franchises ...Distribution agreements ...Acquired indefinite-lived intangible assets: Activision trademark ...Acquired trade names ...Total ... 3 - 10 years... -

Page 69

...This resulted in impairment charges of $67 million, $9 million and $250 million to license agreements, game engines and internally developed franchises intangible assets, respectively, recorded within our Activision segment for the year ended December 31, 2010. 12. Current Accrued Expenses and Other... -

Page 70

...Skylanders franchise standalone toys products, mobile sales and other physical merchandise and accessories. Revenue from online subscriptions consists of revenue from all World of Warcraft® products, including subscriptions, boxed products, expansion packs, licensing royalties, value-added services... -

Page 71

... Years Ended December 31, 2012 2011 2010 Long-lived assets* by geographic region: North America ...Europe ...Asia Pacific ...Total long-lived assets by geographic region ... $90 40 11 $141 $105 46 12 $163 $113 46 10 $169 * The only long-lived assets that we classify by region are our long term... -

Page 72

... 31, 2012 2011 2010 Federal income tax provision at statutory rate ...$510 State taxes, net of federal benefit ...31 Research and development credits ...(10) Domestic production activity deduction ...(17) Foreign rate differential...(241) Change in tax reserves ...53 Shortfall from employee stock... -

Page 73

...the President of the United States. Under the provisions of the American Taxpayer Relief Act of 2012, the research and development ("R&D") tax credit that had expired Dece mber 31, 2011, was reinstated retroactively to January 1, 2012, and is now scheduled to expire on December 31, 2013. The Company... -

Page 74

... foreign, state and local income tax returns filed by Activision Blizzard. Vivendi Games tax years 2005 through 2008 remain open to examination by the major taxing authorities. The Internal Revenue Service is currently examining Vivendi Games tax returns for the 2005 through 2008 tax years. Although... -

Page 75

... most appropriate level within the fair value hierarchy based on the inputs used to determine the fair value at the measurement date (amounts in millions): Fair Value Measurements at December 31, 2012 Using Quoted Prices in Active Markets for Identical Financial Instruments (Level 1) As of December... -

Page 76

... Using Quoted Prices in Active Markets for Identical Financial Instruments (Level 1) As of December 31, 2011 Significant Other Observable Inputs (Level 2) Significant Unobservable Inputs (Level 3) Balance Sheet Classification Financial assets: Money market funds...U.S. treasuries with original... -

Page 77

... written down to their fair value during in the quarter ended December 31, 2010 within our Activision operating segment. The write down resulted in impairment charges of $67 million, $9 million and $250 million to license agreements, game engines and internally developed franchises intangible assets... -

Page 78

... in place at December 31, 2012 are scheduled to be paid as follows (amounts in millions): Contractual Obligations(1) Developer and Intellectual Properties Marketing Facility and Equipment Leases Total For the years ending December 31, 2013 ...2014 ...2015 ...2016 ...2017 ...Thereafter ...Total... -

Page 79

... expected future changes in model inputs during the option's contractual term. The inputs required by our binomial-lattice model include expected volatility, risk-free interest rate, risk-adjusted stock return, dividend yield, contractual term, and vesting schedule, as well as measures of employees... -

Page 80

For the Year Ended December 31, 2012 Employee and director options For the Year Ended December 31, 2011 For the Year Ended December 31, 2010 Expected life (in years) ...Risk free interest rate...Volatility ...Dividend yield ...Weighted-average fair value at grant date ... 7.05 1.12% 40.76% 1.65% ... -

Page 81

... of restricted stock rights, we may withhold shares otherwise deliverable to satisfy tax withholding requirements. In connection with the consummation of the Business Combination, on July 9, 2008, Robert A. Kotick, our Chief Executive Officer, received a grant of 2,500,000 market performance-based... -

Page 82

... ...$9 Product development ...20 Sales and marketing ...8 General and administrative...89 Stock-based compensation expense before income taxes ...126 Income tax benefit ...(46) Total stock-based compensation expense, net of income tax benefit ...$80 For the Years Ended December 31, 2012 2011 2010... -

Page 83

... 12, 2011, the Company made dividend equivalent payments of $2 million related to that cash dividend to the holders of restricted stock units. On February 10, 2010, Activision Blizzard's Board of Directors declared a cash dividend of $0.15 per common share payable on April 2, 2010 to shareholders of... -

Page 84

... in "Investment and other income, net" at December 31, 2012 2011, and 2010, respectively. Others Activision Blizzard has entered into various transactions and agreements, including cash management services, investor agreement, tax sharing agreement, and music royalty agreements with Vivendi and its... -

Page 85

25. Quarterly Financial and Market Information (Unaudited) For the Quarters Ended September 30, June 30, 2012 2012 December 31, 2012 March 31, 2012 (Amounts in millions, except per share data) Net revenues ...Cost of sales...Operating income ...Net income...Basic earnings per share ...Diluted ... -

Page 86

...periods prior to July 9, 2008, before the Business Combination, the share price information for the Company is for Activision, Inc. In connection with the Business Combination, Activision, Inc. changed its name to Activision Blizzard, Inc. and changed its fiscal year end from March 31 to December 31... -

Page 87

... 1, 2012, the Company made dividend equivalent payments of $3 million related to that cash dividend to the holders of restricted stock units. On February 9, 2011, our Board of Directors declared a cash dividend of $0.165 per common share payable on May 11, 2011 to shareholders of record at the close... -

Page 88

... agreement, occurred immediately prior to the close of the Business Combination. 10b5-1 Stock Trading Plans The Company's directors and employees may, at a time they are not in possession of material non -public information, enter into plans ("Rule 10b5-1 Plans") to purchase or sell shares... -

Page 89

... compensation plans involving the delivery to the Company of an aggregate of 40,26 2 shares of our common stock, with an average value of $12.40 per share as of the date of delivery, to satisfy tax withholding obligations in connection with the vesting of restricted stock awards to our employees... -

Page 90

... historical fact and include, but are not limited to: (1) projections of revenues, expenses, income or loss, earnings or loss per share, cash flow or other financial items; (2) statements of our plans and objectives, including those relating to product releases; (3) statements of future financial or... -

Page 91

...from online subscriptions consists of revenue from all World of Warcraft products, including subscriptions, boxed products, expansion packs, licensing royalties, and value-added services. It also includes revenues from Call of Duty Elite memberships. 2 Downloadable content and their related revenues... -

Page 92

... December 31, 2010 $ 993 $ 21 972 134 $ 4 130 (78) $ 14 (92) 46 $ 29 17 850 25 825 (14)% 19 (15) $ 154 $ 8 146 93 $ 17 76 122 $ 21 101 March 31, 2011 Three Months Ended June 30, 2011 September 30, 2011 December 31, 2011 March 31, 2012 Year over Year % Increase (Decrease) Three Months Ended June... -

Page 93

... Total Activision and Blizzard 56 35 91 9 100 % $ 570 40 610 (112) 498 23 3 15 (27) 11 % Distribution Total non-GAAP net revenues 3 1 Net revenues from digital online channel represent revenues from subscriptions and memberships, licensing royalties, value-added services, downloadable content... -

Page 94

... 31, 2012 Amount % of Total $ 2,436 1,968 452 4,856 50 % 41 9 100 2,405 1,990 360 4,755 50 % 42 8 100 $ $ 31 (22) 92 101 Year Ended December 31, 2011 Amount % of Total $ Increase (Decrease) % Increase (Decrease) 1% (1) 26 2 GAAP Net Revenues by Geographic Region North America Europe Asia Pacific... -

Page 95

... products and contents. Blizzard - Blizzard Entertainment, Inc. and its subsidiaries ("Blizzard") publishes PC games and online subscription-based games in the MMORPG category. Activision Blizzard Distribution ("Distribution") - distributes interactive entertainment software and hardware products... -

Page 96

... from purchase price accounting. 78 The company calculates earnings per share pursuant to the two-class method which requires the allocation of net income between common shareholders and participating security holders. Net income attributable to Activision Blizzard Inc. common shareholders used to... -

Page 97

... related to stock-based compensation. (c) Reflects restructuring related to our Activision Publishing operations. (d) Reflects amortization of intangible assets from purchase price accounting. (e) Reflects impairment of goodwill. The company calculates earnings per share pursuant to the two-class... -

Page 98

... of sales. (b) Includes expense related to stock-based compensation. (c) Reflects restructuring related to the Business Combination with Vivendi Games. Restructuring activities includes severance costs, facility exit costs and balance sheet write down and exit costs from the cancellation of projects... -

Page 99

... Roberts & Co. Régis Turrini Senior Executive Vice President, M&A, Vivendi TRANSFER AGENT Continental Stock Transfer & Trust Company 17 Battery Place New York, New York 10004 (800) 509-5586 AUDITOR PricewaterhouseCoopers LLP Los Angeles, California CORPORATE HEADQUARTERS Activision Blizzard... -

Page 100

3100 OCEAN PARK BOULEVARD SANTA MONICA, CALIFORNIA 90405 T: (310) 255-2000 F: (310) 255-2100 WWW.ACTIVISIONBLIZZARD.COM