Access America 2004 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2004 Access America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

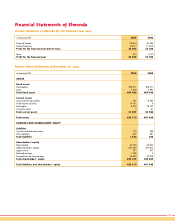

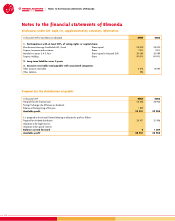

Notes to the consolidated financial statements

26

Information on liabilities

Technical provisions

Technical provisions include unearned premium reserves,

claim reserves and other technical provisions.

Premiums written attributable to income of future periods are

accrued under unearned premium reserves. These premiums

are distributed to the current fiscal year and subsequent years

over the period of the contract for every day that the premium

has to cover.

Claim reserves are assessed according to local supervisory

instances’ requirements, are computed on a case by case

basis and are supplemented by IBNR reserves (reserves for

claims Incurred But Not yet Reported) based on management

and statistical estimates.

Non-technical provisions

These include personnel provisions and similar liabilities,

provision for income taxes and other non-technical provisions.

Pension and similar reserves are calculated taking local

circumstances into account as well as expected future trends in

salaries and wages, retirement rates and pension increases.

Defined benefit plans are recognised under IAS 19, using

the method of accruing actuarial gains and losses.

Provision for income taxes are calculated in accordance with

the relevant local tax regulations.

Other liabilities

Other liabilities include deposits received from reinsurers,

loans, liabilities direct /indirect business, liabilities with

associated companies (current accounts), deferred income,

deferred service income and other liabilities. These are reported

at fair value.

Deferred tax liabilities

The calculation of deferred tax is based on temporary

differences between the carrying amounts of assets or liabilities

in the published balance sheet and their tax basis, and on

differences arising from the application of uniform valuation

policies for consolidation purposes. The tax rates used for the

calculation of deferred taxes are the local rates applicable in

the countries concerned. Anticipated changes are already

taken into account as at balance sheet date.

Information on income statement

Turnover

Turnover includes insurance premiums and service revenue.

Premiums earned

Premiums written for travel insurance are reported proportio-

nately as income over the term of the insurance contract for

every day that the premium has to cover. Unearned premiums

are calculated separately for each policy in order to determine

the portion of premium income that has not been earned.

Claims and service administration expenses

(ICHC / ISHC)

Claims and service handling costs are assessed according to

business management criteria and transferred from the general

expenses to the claims and service administration expenses,

respectively.

Ordinary result

Interest income and interest expenses are recognised on an

accrual basis. Dividends are recognised as income when

received. Interest on finance leases is recognised as interest

expenses over the term of the respective lease.

Income Taxes

Income tax expense includes current income taxes and deferred

income taxes. Certain items of income and expense are not

reported in tax returns and financial statements in the same

year. The tax effect of these timing differences is booked as

deferred taxes.

Explanation of the accounting and

valuation policies differing from Swiss law

The most important differences are summarised below.

Shareholders’ equity

Shareholders’ equity increases overall because investments

available for sale are shown in the balance sheet at market

value with the unrealised gains / losses being included under

other reserves.

Claim equalisation reserves

Claim equalisation reserves and major risk reserves are not

allowed under Mondial Assistance Group accounting policy

because they do not represent a present obligation toward

third parties.

Claims reserves

Claims reserves tend to be somewhat lower under Mondial

Assistance Group accounting policy because they are not

calculated in accordance with the prudence concept but at the

best estimate of the ultimate cost.

Acquisition costs

Under Mondial Assistance Group accounting policy acquisition

costs are capitalised and amortised over the term of policy.

Goodwill

Goodwill is amortised through income over its estimated

useful life under Mondial Assistance Group accounting policy,

but not exceeding 10 years.