Aarons 2012 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2012 Aarons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

9

The typical Aaron’s Sales & Lease Ownership store layout is a combination showroom and warehouse of 8,000 to

10,000 square feet, with an average of approximately 9,000 square feet. In selecting locations for new sales and lease

ownership stores, we generally look for sites in well-maintained strip shopping centers with good access, which are

strategically located in established working class neighborhoods and communities. We also build to suit or occupy

stand-alone stores in certain markets. Many of our stores are placed near existing competitors’ stores. Each sales and

lease ownership store usually maintains at least two trucks and crews for pickups and deliveries and generally offers

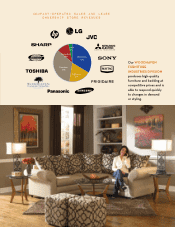

same or next day delivery for addresses located within approximately ten miles of the store. We emphasize a broad

selection of brand name electronics, computers and appliances, and offer customers a wide selection of furniture,

including furniture manufactured by our Woodhaven Furniture Industries division.

We believe that our sales and lease ownership stores offer lower merchandise prices than similar items offered by

traditional rent-to-own operators, and substantially equivalent to the ―all-in‖ contract price of similar items offered by

retailers who finance merchandise. Approximately 92% of our Aaron’s Sales & Lease Ownership agreements are

monthly and approximately 8% are semi-monthly as compared to the industry standard of weekly agreements, and our

agreements usually provide for a shorter term leading to customer ownership. Through Aaron’s Service Plus, customers

receive benefits including the 120 days same-as-cash option, repair service at no charge to the customer, lifetime

reinstatement and other discounts and benefits. We re-lease or sell select merchandise that customers return to us prior

to the expiration of their agreements. We also offer, for select merchandise, an up-front cash and carry purchase option

at prices that are competitive with traditional retailers.

During the latter part of 2004, we opened two experimental stores under the RIMCO name that lease automobile

wheels, tires and rims to customers under sales and lease ownership agreements. Although the products offered are

different, these stores are managed, monitored and operated similarly to our other sales and lease ownership stores. At

December 31, 2012, we had 19 Company-operated and six franchised RIMCO stores open.

Aaron’s Sales & Lease Ownership Franchise Program

We began franchising Aaron’s Sales & Lease Ownership stores in select markets in 1992 and have continued to attract

franchisees. Our franchised stores do not compete with Company-operated stores, nor do we anticipate any such

competition, as we mainly award franchises in markets where we have no operations and no current plans to enter. As

of December 31, 2012, we had 749 franchised stores open and area development agreements with franchisees to open

180 stores in the future.

Franchisees are approved on the basis of the applicant’s business background and financial resources. We generally

seek franchisees who will enter into area development agreements for several stores, although some franchisees

currently operate a single store. Most franchisees are involved in the day-to-day operations of their stores.

We enter into franchise agreements with our franchisees to govern the opening and operation of franchised stores.

Under our current standard agreement, we require the franchisee to pay a franchise fee from $15,000 to $50,000 per

store depending upon market size. Agreements are for a term of ten years, with one ten-year renewal option, and

franchisees are obligated to remit to us royalty payments of 5% or 6% of the franchisee’s weekly cash collections. The

royalty payments increased from 5% to 6% for most franchise agreements entered into or renewed after December 31,

2002.

We assist each franchisee in selecting the proper site for each store. Because of the importance of location to the

Aaron’s sales and lease ownership concept, one of our pre-opening consultants visits the intended market and helps

guide the franchisee through the selection process. Once a site is selected, we help in designing the floor plan, including

the proper layout of the showroom and warehouse. In addition, we provide assistance in assuring that the design and

decor of the showroom is consistent with our requirements. We also lease the exterior signage to the franchisee and

assist with placing pre-opening advertising, ordering initial inventory and obtaining delivery vehicles.

We have an arrangement with several banks to provide financing to qualifying franchisees to assist with establishing

and operating their stores. An inventory financing plan to provide franchisees with the capital to purchase inventory is

the primary component of the financing program. For qualified established franchisees, we have arranged in some cases

for these institutions to provide a revolving credit line to allow franchisees the flexibility to expand. We guarantee

amounts outstanding under the franchisee financing programs.