Aarons 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Aarons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report

Growth and Performance

Table of contents

-

Page 1

Annual Report Growth and Performance -

Page 2

... plans, quality merchandise and superior service. The Company's strategic focus is on growing the sales and lease ownership business through the addition of new Company-operated stores by both internal expansion and acquisitions, as well as through its successful and expanding franchise program... -

Page 3

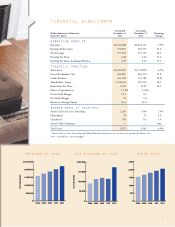

...& Lease Ownership HomeSmart Franchised* Aaron's Office Furniture Total Stores NMF - calculation 1,246 78 749 - 2,073 1,160 71 713 1 1,945 7.4% 9.9 5.0 nmf 6.6% * Aaron's Sales & Lease Ownership and HomeSmart franchised stores are not owned or operated by Aaron's, Inc. is not meaningful Revenues... -

Page 4

...quality home furnishings with personalized store opening goals were achieved. During the year service, no credit checks, ï¬,exible payment plans and the a net of 93 Company-operated and 36 franchised option to return a product at any time with no further stores were added to the Aaron's system. This... -

Page 5

... and new ideas to Aaron's marketing promotions and initiatives. • During the fourth quarter, we selected a new leader for our HomeSmart Division. Roger N. Estep, a 25-year veteran of the weekly rental pay industry and a nine-year Aaron's associate, most recently as a Senior Regional Manager, was... -

Page 6

delivering customer satisfaction for 57 years The AAROn'S SAlES & lEASE OwnERShip model provides credit-constrained consumers a flexible path to ownership. A wide range of products is offered at various price-points and different lease terms, allowing consumers to select a monthly payment that fits... -

Page 7

... a weekly rental. HomeSmart offers products similar to those in our Aaron's Sales & Lease Ownership stores and, we believe, has potential for substantial future growth. RimCO, with a combined 25 Companyoperated and franchised stores, offers tires, wheels, and rims to customers under sales and lease... -

Page 8

... every room in the house. No credit? No problem. Because of the COmpAny'S lARgE REvEnuE bASE, purchasing power is a competitive advantage. Aaron's is able to work with the largest vendors of products all over the world to secure the best products at the best prices. Tablet computers are currently... -

Page 9

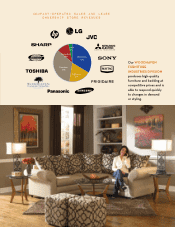

Company-Operated Sales and lease Ownership Store Revenues Other 3% Computers 10% Electronics 32% Furniture 35% Appliances 20% Our wOOdhAvEn FuRniTuRE induSTRiES diviSiOn produces high-quality furniture and bedding at competitive prices and is able to respond quickly to changes in demand or ... -

Page 10

... associates. Yet, Charlie has enjoyed every day of his work - meeting customers, vendors, associates and, yes, even competitors. The pride in being part of the Aaron's family is a hallmark at national managers' meetings, the Aaron's Dream Weekend at Talladega Superspeedway and at each store opening... -

Page 11

...ï" ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2012 OR ï,£ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Transition Period from _____ to _____ Commission file Number... -

Page 12

... price on that date as reported by the New York Stock Exchange. As of February 15, 2013, there were 75,767,000 shares of the Company's common stock outstanding. DOCUMENTS INCORPORATED BY REFERENCE Portions of the registrant's definitive Proxy Statement for the 2013 annual meeting of shareholders... -

Page 13

... ON ACCOUNTING AND FINANCIAL DISCLOSURE ITEM 9A. CONTROLS AND PROCEDURES ITEM 9B. OTHER INFORMATION PART III ITEM 10. DIRECTORS, EXECUTIVE OFFICERS OF THE REGISTRANT AND CORPORATE GOVERNANCE ITEM 11. EXECUTIVE COMPENSATION ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND... -

Page 14

... developments that we expect or anticipate will occur in the future, including growth in store openings, franchises awarded, market share and statements expressing general optimism about future operating results, are forward-looking statements. Forward-looking statements are subject to certain risks... -

Page 15

... sales and lease ownership business, which includes Aaron's Sales & Lease Ownership and HomeSmart stores, through opening new Company-operated stores, expanding our franchise program, and making selective acquisitions. As of December 31, 2012, we had 2,073 stores, comprised of 1,324 Company-operated... -

Page 16

... plans to close all 12 of the then remaining Aaron's Office Furniture stores and focus on the Company's sales and lease ownership business. As of December 31, 2011, we closed 11 of the Aaron's Office Furniture stores and had one remaining store open to liquidate merchandise; this final store... -

Page 17

...for a shorter term until the customer obtains ownership. Flexible payment methods-we offer our customers the opportunity to pay by cash, check, debit card or credit card, compared with the more common cash payment method at typical rent-to-own stores. Aaron's Sales & Lease Ownership stores currently... -

Page 18

... select new geographic markets. Additional stores help us to realize economies of scale in purchasing, marketing and distribution. We added a net of 93 Company-operated sales and lease ownership stores in 2012. Increase our sales and lease ownership franchises - We believe that our franchise program... -

Page 19

..., repair service at no charge to the customer, lifetime reinstatement and other discounts and benefits. We re-lease or sell select merchandise that customers return to us prior to the expiration of their agreements. We also offer, for select merchandise, an up-front cash and carry purchase option... -

Page 20

..., repair service at no charge to the customer, lifetime reinstatement and other discounts and benefits. We re-lease or sell select merchandise that customers return to us prior to the expiration of their agreements. We also offer, for select merchandise, an up-front cash and carry purchase option... -

Page 21

... name merchandise along with the features, options, and benefits of Aaron's lease ownership payment plans. We implement grand opening ―Jump Startâ€- marketing initiatives designed to ensure each new store quickly establishes a strong customer count. Aaron's also distributes millions of email and... -

Page 22

... the 120 days same-as-cash option, repair service at no charge to the customer, lifetime reinstatement and other discounts and benefits. In order to increase leasing at existing stores, we foster relationships with existing customers to attract recurring business, and many new agreements are... -

Page 23

...and Canada. Our stores compete with other national and regional rent-to-own businesses, as well as with rental stores that do not offer their customers a purchase option. With respect to customers desiring to purchase merchandise for cash or on credit, we also compete with retail stores. Competition... -

Page 24

... we currently operate Aaron's Sales & Lease Ownership and HomeSmart stores. Most state lease purchase laws require rent-to-own companies to disclose to their customers the total number of payments, total amount and timing of all payments to acquire ownership of any item, any other charges that may... -

Page 25

...our four reportable segments-Sales and Lease Ownership, Franchise, HomeSmart and Manufacturing-is set forth in Note 12 to our Consolidated Financial Statements. See Item 8 of Part II. Available Information We make available free of charge on or through our Internet website our annual reports on Form... -

Page 26

... economic, operational and other benefits in a timely manner, our profitability may decrease. We frequently acquire other sales and lease ownership businesses. We acquired the lease agreements, merchandise and assets of 44 Aaron's Sales & Lease Ownership stores and four HomeSmart stores through... -

Page 27

... business. Although we have employment agreements with the majority of our key executives, they are generally terminable on short notice and we do not carry key man life insurance on any of our officers. Additionally, we need a growing number of qualified managers to operate our stores successfully... -

Page 28

... operate Aaron's Sales & Lease Ownership and HomeSmart stores. At the present time, no federal law specifically regulates the rent-to-own industry, although federal legislation to regulate the industry has been proposed from time to time. Any adverse changes in existing laws, or the passage of new... -

Page 29

... strategy and cause our franchise revenues to decline. As a franchisor, we are subject to regulation by the Federal Trade Commission, state laws and certain Canadian provincial laws regulating the offer and sale of franchises. Because we plan to expand our business in part by selling more franchises... -

Page 30

... may experience lost revenues and increased costs and expenses. We rely on our information technology systems to process transactions with our customers, including tracking lease payments on merchandise, and to manage other important functions of our business. Failures of our systems -whether due to... -

Page 31

... to be operational in March of 2013. Our executive and administrative offices occupy approximately 41,500 square feet in an 11-story, 87,000 square-foot office building that we own in Atlanta, Georgia. We lease most of the remaining space to third parties under leases with remaining terms averaging... -

Page 32

...Electronic Communications Privacy Act and the Computer Fraud Abuse Act through its use of a software program called ―PC Rental Agent.â€- The District Court dismissed the Company from the lawsuit on March 20, 2012. On September 14, 2012, plaintiffs filed an amended complaint against the Company and... -

Page 33

...plaintiff alleges that the Company failed to account for all of his working hours when it calculated overtime, and consequently underpaid him. On September 28, 2012, the Court issued an order granting conditional certification of a class consisting of all hourly store employees from October 27, 2008... -

Page 34

... shares of Common Stock during 2012 at an average price of $27.60. As of December 31, 2012, 4,044,655 Common Stock shares remained available for repurchase under the purchase authority approved by the Company's Board of Directors and publicly announced from time-to-time. The Company had no purchases... -

Page 35

-

Page 36

... revenue volume than the typical rent-to-own store. Most of our stores are cash flow positive in the second year of operations. We also use our franchise program to help us expand our sales and lease ownership concept more quickly and into more areas than we otherwise would by opening only Company... -

Page 37

... at Company-operated stores, including agreements that result in our customers acquiring ownership at the end of the term. Retail sales represent sales of both new and returned lease merchandise from our stores. Non-retail sales mainly represent new merchandise sales to our Aaron's Sales & Lease... -

Page 38

... closure of the Aaron's Office Furniture stores. Leases and Closed Store Reserves. The majority of our Company-operated stores are operated from leased facilities under operating lease agreements. The majority of the leases are for periods that do not exceed five years, although lease terms range in... -

Page 39

...) REVENUES: Lease Revenues and Fees Retail Sales Non-Retail Sales Franchise Royalties and Fees Other COSTS AND EXPENSES: Retail Cost of Sales Non-Retail Cost of Sales Operating Expenses Lawsuit (Income) Expense Retirement/Separation Charges Depreciation of Lease Merchandise 2012 2011 2010 2012 vs... -

Page 40

... 31, 2012 was 749, reflecting a net addition of 85 stores since the beginning of 2011. Other. Revenues in the ―Otherâ€- segment, which are primarily revenues of the Aaron's Office Furniture division, revenues from leasing space to unrelated third parties in the corporate headquarters building and... -

Page 41

... total number of franchised sales and lease ownership stores at December 31, 2011 was 713, reflecting a net addition of 116 stores since the beginning of 2010. Other. Other segment revenues decreased $7.0 million mainly due to a $7.9 million decrease in the Aaron's Office Furniture division revenues... -

Page 42

... the operations of the Aaron's Office Furniture division in June of 2010. We closed 14 Aaron's Office Furniture stores during 2010 and have one remaining store open to liquidate merchandise. As a result, in 2010 we recorded $3.3 million in closed store reserves and $4.7 million in lease merchandise... -

Page 43

... Alford vs. Aaron Rents, Inc. et al case previously discussed. The Company's increased profitability of new Company-operated sales and lease ownership stores added over the past several years, contributing to a 5.1% increase in same store revenues and a 5.4% increase in franchise royalties and fees... -

Page 44

... of acquisitions of sales and lease ownership businesses. During 2012, the Company acquired 44 Sales and Lease Ownership stores with an aggregate purchase price of $29.7 million. The Company acquired four stores that were converted to HomeSmart with an aggregate purchase price of $1.3 million. The... -

Page 45

... include purchases of property, plant and equipment, expenditures for acquisitions and income tax payments. These capital requirements historically have been financed through cash flow from operations; bank credit; trade credit with vendors; proceeds from the sale of lease return merchandise... -

Page 46

...expect to continue our policy of paying dividends. If we achieve our expected level of growth in our operations, we anticipate we will supplement our expected cash flows from operations, existing credit facilities, vendor credit and proceeds from the sale of lease return merchandise by expanding our... -

Page 47

... cash flow from operations. Because of our sales and lease ownership model, where the Company remains the owner of merchandise on lease, we benefit more from bonus depreciation, relatively, than traditional furniture, electronics and appliance retailers. In future years, we anticipate having to make... -

Page 48

... to make future payments as of December 31, 2012: Contractual Obligations and Commitments (In Thousands) Total Period Less Than 1 Year Period 1-3 Years Period 3-5 Years Period Over 5 Years Credit Facilities, Excluding Capital Leases Capital Leases Interest Obligations Operating Leases Purchase... -

Page 49

.... ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK As of December 31, 2012, we had $125.0 million of senior unsecured notes outstanding at a fixed rate of 3.75%. We had no balance outstanding under our revolving credit agreement indexed to the LIBOR (―London Interbank Offer Rate... -

Page 50

... and their cash flows for each of the three years in the period ended December 31, 2012, in conformity with U.S. generally accepted accounting principles. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), Aaron's, Inc. and... -

Page 51

... income, shareholders' equity and cash flows for each of the three years in the period ended December 31, 2012 of Aaron's, Inc. and subsidiaries, and our report dated February 2 2, 2013 expressed an unqualified opinion thereon. /s/ Ernst & Young LLP Atlanta, Georgia February 22, 2013 41 -

Page 52

...over financial reporting as of December 31, 2012. In making this assessment, the Company's management used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) in Internal Control-Integrated Framework. Based on its assessment, management believes that... -

Page 53

AARON'S, INC. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS December 31, December 31, 2012 2011 (In Thousands, Except Share Data) ASSETS: Cash and Cash Equivalents Investments Accounts Receivable (net of allowances of $6,001 in 2012 and $4,768 in 2011) Lease Merchandise Less: Accumulated ... -

Page 54

... Per Share Data) REVENUES: Lease Revenues and Fees Retail Sales Non-Retail Sales Franchise Royalties and Fees Other COSTS AND EXPENSES: Retail Cost of Sales Non-Retail Cost of Sales Operating Expenses Lawsuit (Income) Expense Retirement/Separation Charges Depreciation of Lease Merchandise $ 1,676... -

Page 55

... (In Thousands) 2012 Year End December 31, 2011 2010 Net Earnings Other Comprehensive Income (Loss): Foreign Currency Translation: Foreign Currency Translation Adjustment Less: Reclassification Adjustments for Net Gains Included in Net Earnings Net Change Available-for-Sale Investments: Change... -

Page 56

-

Page 57

... of Businesses and Contracts Proceeds from Sale of Property, Plant, and Equipment Cash Used by Investing Activities FINANCING ACTIVITIES: Proceeds from Credit Facilities Repayments on Credit Facilities Acquisition of Treasury Stock Dividends Paid Excess Tax Benefits From Stock-Based Compensation... -

Page 58

... wheels, tires and rims under sales and lease ownership agreements. The Company began ceasing the operations of the Aaron's Office Furniture division in June of 2010. The Company closed 14 of its Aaron's Office Furniture stores during 2010 and closed the remaining store in 2012. Refer to Note 2 for... -

Page 59

... provides merchandise, consisting of consumer electronics, computers, residential furniture, appliances, and household accessories, to its customers for lease under certain terms agreed to by the customer. Two primary lease models are offered to customers: one through the Company's Sales & Lease... -

Page 60

and operate Aaron's Sales & Lease Ownership stores. These fees are recognized as income when substantially all of the Company's obligations per location are satisfied, generally at the date of the store opening . Franchise fees and area development fees are received before the substantial completion... -

Page 61

... closure of stores of the Aaron's Office Furniture division. Cash and Cash Equivalents The Company classifies highly liquid investments with maturity dates of less than three months when purchased as cash equivalents. Investments The Company maintains investments in various corporate debt securities... -

Page 62

... due from customers of Company-operated stores, corporate receivables incurred during the normal course of business and franchisee obligations. Accounts receivable, net of allowances, consists of the following as of December 31: (In Thousands) 2012 2011 Customers Corporate Franchisee $ $ 7,840... -

Page 63

... December 31, 2012, the Company has five operating segments and reporting units: Sales and Lease Ownership, RIMCO, HomeSmart, Franchise and Manufacturing. The Company's RIMCO stores lease automobile wheels, tires and rims to customers under sales and lease ownership agreements. Although the products... -

Page 64

... market risks associated with its ongoing operations for a portion of the year. The primary risk it seeks to manage through the use of derivative financial instruments is commodity price risk, including the risk of increases in the market price of diesel fuel used in the Company's delivery vehicles... -

Page 65

... of stores acquired, net Aggregate purchase price (primarily cash consideration) Purchase price allocation: Lease Merchandise Property, Plant and Equipment Other Current Assets and Current Liabilities Identifiable Intangible Assets : Customer Relationships Non-Compete Agreements Acquired Franchise... -

Page 66

...11 of its Aaron's Sales and Lease Ownership stores in 2012, 2011 and 2010, respectively. The effect of these sales on the consolidated financial statements was not significant. The Company began ceasing the operations of the Aaron's Office Furniture division in June of 2010. The Company closed 14 of... -

Page 67

... highly compensated employees and non-employee directors to defer the receipt of base compensation, incentive pay compensation and director fees until a later date based on the terms of the plans. The liability representing benefits accrued for plan participants is valued at the quoted market prices... -

Page 68

... in the company's financial performance to determine if fair value adjustments are necessary. The fair value of fixed-rate long term debt is estimated using the present value of underlying cash flows discounted at a current market yield for similar instruments. The carrying value and fair value of... -

Page 69

... replace the pricing grid schedule to effect slight increases to certain applicable margins. The Company entered into the fourth amendment in order to extend the maturity date of the Credit Agreement, which would have expired on May 23, 2013, to December 13, 2017. The Company's Credit Agreement is... -

Page 70

... by the land and buildings totaling $6.8 million. The Company occupies the land and buildings collateralizing the borrowings under a 15-year term lease, with a five-year renewal at the Company's option, at an aggregate annual rental of $716,000. The transaction has been accounted for as a financing... -

Page 71

... accounted for as operating leases. The Company does not have any retained or contingent interests in the stores nor does the Company provide any guarantees, other than a corporate level guarantee of lease payments, in connection with the sale-leasebacks. Other Debt Other debt at December 31, 2012... -

Page 72

... to uncertain tax benefits as a component of income tax expense. NOTE 8: COMMITMENTS AND CONTINGENCIES Leases The Company leases warehouse and retail store space for most of its operations under operating leases expiring at various times through 2028. The Company also leases certain properties under... -

Page 73

...be renewed or replaced by other leases in the normal course of business. Future minimum lease payments required under operating leases that have initial or remaining non-cancelable terms in excess of one year as of December 31, 2012 are as follows: (In Thousands) 2013 2014 2015 2016 2017 Thereafter... -

Page 74

...Electronic Communications Privacy Act and the Computer Fraud Abuse Act through its use of a software program called ―PC Rental Agent.â€- The District Court dismissed the Company from the lawsuit on March 20, 2012. On September 14, 2012, plaintiffs filed an amended complaint against the Company and... -

Page 75

...million in 2013, $3.6 million in 2014, $383,000 in 2015, and $274,000 in 2016. The Company maintains a 401(k) savings plan for all its full-time employees with at least one year of service and who meet certain eligibility requirements. As of December 31, 2012, the plan allows employees to contribute... -

Page 76

... annual dividend rate in effect and market price of the underlying common stock at the time of grant. No assumption for a future dividend rate increase has been included unless there is an approved plan to increase the dividend in the near term. Shares are issued from the Company's treasury shares... -

Page 77

... granted under the AMP Plan vest over four to five years from the date of grant. The AMP Plan participants include certain vice presidents, director level employees and other key personnel in the Company's home office, divisional vice presidents and regional managers. Any shares of restricted stock... -

Page 78

...) 2012 2011 2010 Franchised stores Franchised stores open at January 1, Opened Added through acquisition Purchased from the Company Purchased by the Company Closed, sold or merged Franchised stores open at December 31, Company-operated Sales & Lease Ownership stores Company-operated Sales & Lease... -

Page 79

... and Services of Reportable Segments As of December 31, 2012, the Company had five operating segments: Sales and Lease Ownership, RIMCO, HomeSmart, Franchise and Manufacturing. The Company's RIMCO stores lease automobile wheels, tires and rims to customers under sales and lease ownership agreements... -

Page 80

... taxes from continuing operations are as follows: Year Ended December 31, 2012 Year Ended December 31, 2011 Year Ended December 31, 2010 (In Thousands) Revenues From External Customers: Sales and Lease Ownership HomeSmart Franchise Manufacturing Other Revenues of Reportable Segments Elimination of... -

Page 81

... in the ―Otherâ€- category are primarily revenues from leasing space to unrelated third parties in the corporate headquarters building, revenues of the Aaron's Office Furniture division through the date of sale in August 2012 and revenues from several minor unrelated activities. The pre-tax... -

Page 82

.... NOTE 15: DEFERRED COMPENSATION PLAN Effective July 1, 2009, the Company implemented the Aaron's, Inc. Deferred Compensation Plan (the ―Planâ€-) an unfunded, nonqualified deferred compensation plan for a select group of management, highly compensated employees and non-employee directors. On a pre... -

Page 83

... Exchange Act of 1934, was carried out by management, with the participation of the Chief Executive Officer (CEO) and Chief Financial Officer (CFO), as of the end of the period covered by this Annual Report on Form 10-K. Based on management's evaluation, the CEO and CFO concluded that the Company... -

Page 84

PART III ITEM 10. DIRECTORS, EXECUTIVE OFFICERS OF THE REGISTRANT AND CORPORATE GOVERNANCE The information contained in the Company's definitive Proxy Statement, which the Company will file with the Securities and Exchange Commission no later than 120 days after December 31, 2012, with respect to: ... -

Page 85

...applicable or the required information is included in the financial statements or notes thereto. 3. EXHIBITS EXHIBIT NO. 2.1 DESCRIPTION OF EXHIBIT Asset Purchase Agreement between CORT Business Services Corporation as Buyer and the Company as Seller dated as of September 12, 2008, filed as Exhibit... -

Page 86

... Development Revenue Bonds (Aaron Rents, Inc. Project), Series 2000 dated October 1, 2000, filed as Exhibit 10(m) to the Company's Annual Report on Form 10-K for the year ended December 31, 2000 (the ―2000 10 -Kâ€-), which exhibit is by this reference incorporated herein. Letter of Credit and... -

Page 87

... and Award Agreement under the Company's 2001 Stock Option and Incentive Award Plan, filed as Exhibit 10(pp) to the Company's Current Report on Form 8 -K, filed with the Commission on December 22, 2006, which exhibit is by this reference incorporated herein. * Revolving Credit Agreement, dated as... -

Page 88

...financial institutions party thereto as participants, dated as of May 18, 2011, filed as Exhibit 10.2 to the Company's Current Report on Form 8-K, filed with the Commission on May 24, 2011, which exhibit is by this reference incorporated herein. Note Purchase Agreement by and among Aaron's, Inc. and... -

Page 89

... as servicer, filed as Exhibit 10.4 to the 7/8/2011 Form 8-K, which exhibit is by this reference incorporated herein. Aaron's Management Performance Plan (Summary of terms for Home Office Vice Presidents), filed as Exhibit 10.1 to the Company's Current Report on Form 8 -K, filed with the Commission... -

Page 90

... OF EXHIBIT Amendment No. 1 to Note Purchase Agreement by and among Aaron's, Inc. and certain other obligors and the purchasers, dated as of December 19, 2012, filed as Exhibit 10 to the Company's Current Report on Form 8 -K, filed with the Commission on December 26, 2012, which exhibit is by this... -

Page 91

-

Page 92

-

Page 93

BOARd OF diRECtORS Ronald W. Allen Chairman of the Board, President and Chief Executive Officer, Aaron's, Inc. OFFiCERS Corporate Ronald W. Allen* Chairman of the Board, President and Chief Executive Officer Aaron's Sales & Lease Ownership Division K. Todd Evans* Vice President, Franchising Scott... -

Page 94

... of new information, future events, changes in assumptions or otherwise. For a discussion of such risks and uncertainties, see "Risk Factors" in Item 1A of the Company's Annual Report on Form 10-K for the year ended December 31, 2012 filed with the Securities and Exchange Commission. Aaron's Canada... -

Page 95

309 E. Paces Ferry Rd., N.E. Atlanta, Georgia 30305-2377 (404) 231-0011 www.aarons.com www.investor.aarons.com