Aarons 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 Aarons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

flexibility

solid

large

custome

base

FRANCHISING

Proven

Busines

Moel

Selection and Service

GROWTH

LA R G E CU S T O M E R BA S E

solid

ADAPTABLE

FI N A N C I A L ST R E N G T H

Annual Report

Financial Strength

Table of contents

-

Page 1

resilient adaptable Financial strength Value LARGE CUSTOMER BASE solid Value flexibility solid Growth stable growth large Selection and Service customer base Annual Report consistent Franchising Proven Business Model FINANCI AL STRENGTH -

Page 2

... franchise program. aaron Rents, Inc. Financial Highlights ...1 Letter to Shareholders ...2-3 The Aaron's Story ...4-13 Financial Information ...14-45 Common Stock Market Prices and Dividends ...42 Store Locations ...43 Board of Directors and Officers ...44 Corporate and Shareholder Information... -

Page 3

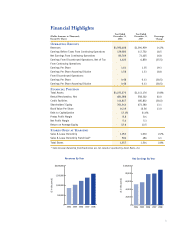

... Rental Merchandise, Net Credit Facilities Shareholders' Equity Book Value Per Share Debt to Capitalization Pretax Profit Margin Net Profit Margin Return on Average Equity Stores Open at Year-end Sales & Lease Ownership Sales & Lease Ownership Franchised* Total Stores * Sales & Lease Ownership... -

Page 4

... 2008. In February 2009, another signiï¬cant expansion of our franchise program was achieved through an agreement with Kelly Rentals, Inc. to convert its 23 sales and lease ownership stores in North Carolina and Virginia to Aaron's stores. We will continue to explore opportunities with other rental... -

Page 5

... career with Aaron's in 1974 as a Store Manager. In addition during 2008 Steven A. Michaels was promoted to Vice President, Finance for the Aaron's Sales & Lease Ownership division. The past year was difï¬cult and challenging, yet a rewarding validation of our business model. Your Company closed... -

Page 6

...consistent Proven Business Model solid flexibility over Selection and Service million customers Franchising solid FINANCI AL STRENGTH growth Proven Business Model resilient Financial strength Value LARGE CUSTOMER BASE solid Value stable large Selection and Service customer base Growth... -

Page 7

..., the ability of Aaron's to thrive and adapt for more than half a century stands out as a hallmark of resiliency. From its beginning in 1955, the Company has focused on proï¬table growth, and since going public in 1982, management has been dedicated to building shareholder value, quickly adapting... -

Page 8

... model Aaron's Sales & Lease Ownership offers creditconstrained consumers a broad array of quality home furnishings, appliances and electronics and an attractive cost-competitive path to ownership. Our management team executes very well in a business that requires a high level of customer service... -

Page 9

... than the customers of an average retailer. With a market that we believe comprises approximately half of all American households, the Company has ample opportunities for continuing expansion. The majority of Aaron's customers rent their home. We believe our average customer has market is % of... -

Page 10

..., and insure uniform customer service standards. National brand marketing Innovative marketing is Aaron's forte. Our in-house marketing department currently produces over 27 million circulars that are distributed to households each month. Our NASCAR sponsorship puts the Aaron's name before... -

Page 11

openings and racetracks. The Company is the title sponsor of the Aaron's Dream Weekend at Talladega Superspeedway consisting of the Aaron's 499 NASCAR Sprint Cup Series Race and the Aaron's 312 NASCAR Nationwide Series Race. In 2009 the Company is sponsoring David Reutimann driving the Aaron's #00 ... -

Page 12

...our business model. Unlike a typical credit sale where the customer enters into a legal commitment for the purchase price of a product, the Aaron's customer leases the product generally on a month to month basis. If a customer can no longer pay or no longer wishes to pay, the product is returned and... -

Page 13

... real estate market has enabled the Company to secure new locations at attractive prices and, in some cases, renegotiate leases at more favorable rates. Aaron's Sales & Lease Ownership stores are open six days a week and are serviced by one of 17 regional fulï¬llment centers. This distribution... -

Page 14

... to leverage the Aaron's name and accelerate the growth of the sales and lease ownership concept. In addition, the pipeline of franchised stores to be opened in the next several years provides visibility of growth. During 2008, we awarded 149 new franchised locations and ended with 282 stores in the... -

Page 15

... name merchandise at competitive prices. Our 17 fulï¬llment centers and trucking ï¬,eet service customers across the country in a timely fashion. Most importantly, even though our business model is tested and proven, we are constantly pursuing opportunities for improvement. stores in franchise... -

Page 16

... 31, 2008 Year Ended December 31, 2007 Year Ended December 31, 2006 Year Ended December 31, 2005 Year Ended December 31, 2004 (Dollar Amounts in Thousands, Except Per Share) Operating Results Revenues: Rentals and Fees Retail Sales Non-Retail Sales Franchise Royalties and Fees Other Costs and... -

Page 17

... agreements that result in our customers acquiring ownership at the end of the term. Retail sales represent sales of both new and rental return merchandise from our stores. Non-retail sales mainly represent merchandise sales to our sales and lease ownership division franchisees. Franchise royalties... -

Page 18

Rental Merchandise Our sales and lease ownership division depreciates merchandise over the agreement period, generally 12 to 24 months when rented, and 36 months when not rented, to 0% salvage value. Our policies require weekly rental merchandise counts by store managers and write-offs for unsalable... -

Page 19

... in non-retail sales (which mainly represents merchandise sold to our franchisees), to $309.3 million in 2008 from $261.6 million in 2007, was due to the growth of our franchise operations and our distribution network. The total number of franchised sales and lease ownership stores at December... -

Page 20

...result of the maturing of new company-operated sales and lease ownership stores added over the past several years, contributing to a 3.1% increase in same store revenues, and a 16.0% increase in franchise royalties and fees. Additionally, included in other revenues in 2008 is an $8.5 million gain on... -

Page 21

...'s corporate headquarters and a $2.7 million gain on the sale of the assets of 11 stores in 2007. Included in other revenues in 2006 was a $7.2 million gain from the sale of the assets of our 12 stores located in Puerto Rico and three additional stores located in the continental United States. Cost... -

Page 22

... outstanding under our revolving credit agreement. The credit facilities balance decreased by $71.0 million in 2008 primarily as a result of net payments made on our credit facility during the period, primarily with cash received from the sale of the Aaron's Corporate Furnishings division. On May 23... -

Page 23

... (other than rental merchandise depreciation) and amortization expense, and other non-cash charges. The Company is also required to maintain a minimum amount of shareholders equity. See the full text of the covenants themselves in our credit and guarantee agreements, which we have filed as exhibits... -

Page 24

... by the LLC for a total purchase price of approximately $5.0 million. This LLC is leasing back these properties to Aaron Rents for a 15-year term at an aggregate annual rental of $572,000. During 2006, a property sold by Aaron Rents to a second LLC controlled by the Company's major shareholder for... -

Page 25

...do not have significant agreements for the purchase of rental merchandise or other goods specifying minimum quantities or set prices that exceed our expected requirements for three months. Market Risk From time-to-time, we manage our exposure to changes in short-term interest rates, particularly to... -

Page 26

...82,293 28,590 185,832 6,124 439,796 Liabilities & Shareholders' Equity: Accounts Payable and Accrued Expenses Dividends Payable Deferred Income Taxes Payable Customer Deposits and Advance Payments Credit Facilities Liabilities of Discontinued Operations Total Liabilities Commitments & Contingencies... -

Page 27

Consolidated Statements of Earnings Year Ended December 31, 2008 Year Ended December 31, 2007 Year Ended December 31, 2006 (In Thousands, Except Per Share) Revenues: Rentals and Fees Retail Sales Non-Retail Sales Franchise Royalties and Fees Other $1,178,719 43,187 309,326 45,025 16,351 1,592,608 ... -

Page 28

... of Shareholders' Equity Accumulated Other Comprehensive (Loss) Income Foreign Retained Comprehensive Currency Marketable Earnings Income Translation Securities (In Thousands, Except Per Share) Treasury Stock Shares Amount Common Stock Common Class A Additional Paid-In Capital Balance, January... -

Page 29

...Additions to Rental Merchandise Book Value of Rental Merchandise Sold or Disposed Change in Deferred Income Taxes Loss (Gain) on Sale of Property, Plant, and Equipment Gain on Asset Dispositions Change in Income Tax Receivable, Prepaid Expenses and Other Assets Change in Accounts Payable and Accrued... -

Page 30

..., shipping costs and warehousing costs. The sales and lease ownership division depreciates merchandise over the rental agreement period, generally 12 to 24 months when on rent and 36 months when not on rent, to a 0% salvage value. The Company's policies require weekly rental merchandise counts... -

Page 31

...-term debt approximated its carrying value. REVENUE RECOGNITION - Rental revenues are recognized as revenue in the month they are due. Rental payments received prior to the month due are recorded as deferred rental revenue. Until all payments are received under sales and lease ownership agreements... -

Page 32

... (bearing interest at 5.83%) was outstanding under the revolving credit agreement. The Company pays a .20% commitment fee on unused balances. The weighted average interest rate on borrowings under the revolving credit agreement was 3.66% in 2008, 5.99% in 2007, and 5.97% in 2006. The revolving... -

Page 33

...to Aaron Rents for a 15-year term at an annual rental of $681,000 was sold to an unrelated third party. The Company entered into a new capital lease with the unrelated third party. No gain or loss was recognized on this transaction. SALE-LEASEBACKS - The Company finances a portion of store expansion... -

Page 34

... normal purchase options. Leasehold improvements related to these leases are generally amortized over periods that do not exceed the lesser of the lease term or five years. While a majority of our leases do not require escalating payments, for the leases which do contain such provisions the Company... -

Page 35

... rental payments required under operating leases that have initial or remaining non-cancelable terms in excess of one year as of December 31, 2008, are as follows: (In Thousands) Note G: Shareholders' Equity The Company held 6,853,006 common shares in its treasury and was authorized to purchase... -

Page 36

... of additional shares at the Annual Meeting scheduled for May 2009. The Company believes that the shareholder approval of additional shares is perfunctory as R. Charles Loudermilk, Sr., Chairman of the Board, holds more than 50% of the shares eligible to vote. The weighted average fair value of... -

Page 37

.... Deferred franchise and area development agreement fees, included in customer deposits and advance payments in the accompanying consolidated balance sheets, were $5.7 million as of both December 31, 2008 and 2007, respectively. Company-operated stores open at January 1, Opened Added through... -

Page 38

.... During 2008, the Company sold its corporate furnishings division. The sales and lease ownership division offers electronics, residential furniture, appliances, and computers to consumers primarily on a monthly payment basis with no credit requirements. The Company's franchise operation sells and... -

Page 39

... are business units that service different customer profiles using distinct payment arrangements. The reportable segments are each managed separately because of differences in both customer base and infrastructure. As discussed in Note N, the Company sold the Aaron's Corporate Furnishings division... -

Page 40

... Racing team in the NASCAR Nationwide Series at an estimated cost of $1.6 million. During the first quarter of 2008, the Company purchased for $704,000 the land and building of a Company-operated store location owned by the daughter of the Chairman of the Company and previously leased to the Company... -

Page 41

...'s inventory at closing and in the monthly rent potential of the division's merchandise on rent at closing as compared to certain benchmark ranges set forth in the purchase agreement. The assets transferred include all of the Aaron's Corporate Furnishings division's rental contracts with customers... -

Page 42

... the Company's internal control over financial reporting as of December 31, 2008. Report of Independent Registered Public Accounting Firm on Financial Statements The Board of Directors and Shareholders of Aaron Rents, Inc. We have audited the accompanying consolidated balance sheets of Aaron Rents... -

Page 43

...standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Aaron Rents, Inc. as of December 31, 2008 and 2007, and the related consolidated statements of earnings, shareholders' equity, and cash flows for each of the three years in the period ended... -

Page 44

...fiscal years of the Company, the yearly percentage change in the cumulative total shareholder returns (assuming reinvestment of dividends) on the Company's Common Stock with that of the S&P SmallCap 600 Index and a Peer Group. For 2008, the Peer Group consisted of Rent-A-Center, Inc. The stock price... -

Page 45

Locations Within the United States and Canada StoreCount Count As as of 31, 2008 Store OfDecember December 31, 2006 Company Stores Stores - 1,037 Company - 845 Franchise Stores - 441 Franchised Stores - 504 Corporate Furnishings Stores - 59 Aaron's Office Furniture Stores - 16 Fulfillment Centers ... -

Page 46

... of the Board, Aaron Rents, Inc. Officers Corporate R. Charles Loudermilk, Sr.* Chairman of the Board Aaron's Sales & Lease Ownership Division K. Todd Evans* Vice President, Franchising Ronald W. Allen (1) Retired Chairman of the Board, President and Chief Executive Officer, Delta Air Lines, Inc... -

Page 47

...RNTA," respectively. RNT General Counsel Kilpatrick Stockton LLP Atlanta, Georgia Aaron Rents Canada, ULC 309 E. Paces Ferry Rd., N.E. Atlanta, Georgia 30305-2377 (404) 231-0011 Pursuant to the requirements of the New York Stock Exchange, in 2008 our Chief Executive Officer certified to the NYSE... -

Page 48

309 E. Paces Ferry Rd., N.E. Atlanta, Georgia 30305-2377 (404) 231-0011 www.aaronrents.com www.shopaarons.com