Aarons 2003 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2003 Aarons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3

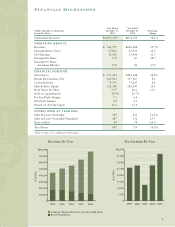

Note that non-GAAP (generally accepted

accounting principles) systemwide revenues are

calculated by adding GAAP revenues to the

revenues of the Company’s franchisees and

subtracting the Company’s royalty revenues.

Franchisee revenues, however, are not revenues

of Aaron Rents, Inc. and are not included in our

consolidated financial statements.

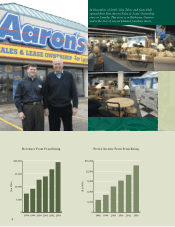

The aggressive growth in new Aaron’s Sales &

Lease Ownership stores over the past several

years began to contribute materially during 2003

as these stores reported higher revenues and

earnings. Approximately 27% of our sales and

lease ownership stores have been added within

the past two years. Since new stores generally

reach maturity in revenues and earnings over

a period of years, margin improvement is

expected to continue in future periods.

MacTavish Furniture Industries, the Company’s

manufacturing division, posted a record year

in 2003, manufacturing more than $60 million

(at cost) of furniture for our stores out of 10

production facilities. Aaron Rents also now

operates twelve distribution centers. We continue

to believe that vertical integration is a strategic

advantage, enabling our stores to offer rapid

delivery of a full product line to our customers

and to operate with lower inventory levels. Our

nimble manufacturing operation can respond

quickly to changes in demand and styling,

allowing us to better serve our customers.

The Company’s financial strength continues to

be a competitive advantage. We have funded

acquisition activity out of cash flow and increased

our dividend payout with little utilization of our

$87 million revolving credit facility. With our

debt-to-capital ratio the lowest in many years,

Aaron’s has the financial strength to fund

expansion goals for the foreseeable future.

Our Board of Directors was strengthened in 2003

by the addition of David L. Kolb, Chief Executive

Officer of Mohawk Industries, Inc. from 1988

to 2001. Mr. Kolb, now Chairman of the Board

of Directors of Mohawk, has broad corporate

experience and serves on a number of corporate

and educational boards. He is a valuable addition

to our Board.

During 2003, growth within the Aaron’s Sales

& Lease Ownership Division necessitated the

creation of another regional field operation.

Michael P. Ryan was named Vice President,

Northern Operations, to oversee this new region.

In addition, David A. Boggan was promoted to

Vice President, Marketing and Merchandising.

We are pleased to recognize and promote

talented employees who have contributed to

the Company’s success for a number of years.

There is more growth in store for Aaron Rents.

Our Aaron’s Sales & Lease Ownership concept

is a proven model and is in the early stages of

penetrating its market. Experience demonstrates

that these stores can be successfully operated

in any town or city with a trading area of at

least 20,000 people. With fewer than 800

stores in operation, we believe our market

potential is substantial.

Our goal is unchanged: to build Aaron’s into

the premier, market-dominant company in our

industry, recognized by our customers and peers

as the standard bearer for integrity, honesty and

fairness, and a company that earns a premium

return for its shareholders.

Reaching the $1 billion level in systemwide

revenues has been a goal for our Company for

several years. We now feel that the $2 billion

level is within reach, just a number of years away.

As always, our success is based on the dedicated

efforts of our associates and the support of our

shareholders, for which we are grateful.

R. Charles Loudermilk, Sr.

Chairman and Chief Executive Officer

Robert C. Loudermilk, Jr.

President and Chief Operating Officer

At the end of

December, we had

an additional 241

franchise stores

in our new store

pipeline.There

is more growth

in store for

Aaron Rents.