Aarons 2003 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2003 Aarons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

opened in the future is nearly as large as the

year-end franchise store base of 287.

• The 2003 operating performance did not go

unnoticed in the stock market. Our Common

Stock price increased 38% during 2003 and

the Company reached a record market capi-

talization of over $650 million. In August of

2003, we effected a 3-for-2 stock split in the

form of a 50% stock dividend and increased

the cash dividend per share 50%.

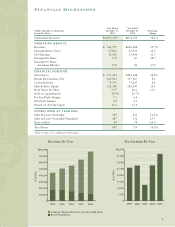

For the year, systemwide revenues were $1 billion,

an 18% increase over 2002. Consolidated

revenues increased 20% to a record $766.8

million compared to $640.7 million in 2002.

Net earnings for the year were $36.4 million,

an increase of 33% over the $27.4 million

earned the previous year. Fully diluted earnings

per share were $1.10 in 2003 compared to

$.86 per diluted share in 2002. Same store rev-

enues for the Aaron’s Sales & Lease Ownership

stores opened in comparable periods increased

10.1% in 2003, an excellent performance.

2

We could not be more proud of the Company’s

2003 performance and are confident that there is

“more growth in store.” Operating highlights for

the year include:

• Systemwide revenues reached an all-time

record, crossing the one billion dollar milestone.

Revenues from Company operations were

$766.8 million, an increase of 20% over the

record 2002 performance. Revenues in the

Aaron’s Sales & Lease Ownership Division

increased 26% for the year.

• Net earnings also set records, up 33% for the

year to $36.4 million.

• We are particularly proud to note that 441 of

our Company-operated and franchise Aaron’s

Sales & Lease Ownership stores had revenues in

excess of $1 million in 2003, more than double

the industry average for annual store revenues.

• We added 143 new stores to the Aaron’s Sales

& Lease Ownership system, an increase of

22%. The Company-operated sales and lease

ownership store count increased 21% and the

number of franchised stores increased 24%.

The Company ended 2003 with 847 stores in

43 states, Puerto Rico, and Canada, including

60 units in the Rent-to-Rent division.

• We accelerated an aggressive acquisition

strategy in 2003, adding 59 Company-operated

stores (of which 26 were acquired franchise

stores) through the purchase of rental

contracts and/or store fronts from various

independent rental operators. We have

identified numerous attractive locations

in existing and new markets as potential

future acquisition candidates. The favorable

economics of acquiring rental contracts and

stores supplement our internal growth strategy.

• Franchise operations set records in both

revenues and earnings in 2003. We awarded

area development agreements for 112 new

franchise stores, including our first ventures into

Canada (six stores to be opened in Ontario) and

Alaska. The number of franchised stores to be

to Our Shareholders

William K. Butler, Jr.

President, Aaron’s Sales &

Lease Ownership Division

R. Charles

Loudermilk, Sr.

Chairman and Chief

Executive Officer

Robert C. Loudermilk, Jr.

President and Chief

Operating Officer