Aarons 2003 Annual Report Download

Download and view the complete annual report

Please find the complete 2003 Aarons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Annual Report

Table of contents

-

Page 1

2003 Annual Report -

Page 2

... its market niche, serves consumers and businesses through the sale and lease ownership, rental and retailing of consumer electronics, residential and office furniture, household appliances, computers and accessories. The Company operates over 850 stores in the United States, Puerto Rico and Canada... -

Page 3

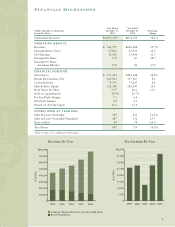

.... Revenues By Year $800,000 700,000 600,000 500,000 ($ in 000s) 400,000 300,000 200,000 100,000 0 1999 2000 2001 2002 2003 $40,000 35,000 30,000 25,000 20,000 15,000 10,000 5,000 0 Net Earnings By Year ($ in 000s) 1999 2000 2001 2002 2003 Company-Operated Sales & Lease Ownership Stores Rent... -

Page 4

... store revenues. • We added 143 new stores to the Aaron's Sales & Lease Ownership system, an increase of 22%. The Company-operated sales and lease ownership store count increased 21% and the number of franchised stores increased 24%. The Company ended 2003 with 847 stores in 43 states, Puerto Rico... -

Page 5

..., David A. Boggan was promoted to Vice President, Marketing and Merchandising. We are pleased to recognize and promote talented employees who have contributed to the Company's success for a number of years. There is more growth in store for Aaron Rents. Our Aaron's Sales & Lease Ownership concept is... -

Page 6

4 -

Page 7

... of our customers pay by either check or credit card. The typical rent-to-own consumer does not qualify for a credit card account and normally pays in cash. Weekly payments are the norm for the rent-to-own industry while the Aaron's lease ownership program is based on semimonthly or monthly payments... -

Page 8

... fleet of trucks, which will improve fleet operating efficiency and enable stores to more precisely schedule customer deliveries. The Company's marketing program is built around the "Drive Dreams Home" sponsorship of NASCAR championship racing, which serves the prime demographic for Aaron's products... -

Page 9

...,000 Sales & Lease Ownership Rental Revenues 787* Other 1% 800,000 644* 573* 456* ($ in 000s) 600,000 400,000 368* 200,000 $176 0 1999 2000 2001 2002 2003 $177 $152 $122 $110 Electronics and Appliances 54% Furniture 35% Computers 10% Franchisee Revenues Company-Operated Revenues * Number... -

Page 10

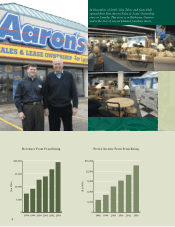

In November of 2003, Clay Tabor and Gene Hall opened their first Aaron's Sales & Lease Ownership store in Canada. This store is in Kitchener, Ontario and is the first of several planned franchise stores. Revenues From Franchising Pretax Income From Franchising $20,000 $15,000 12,000 15,000 9,... -

Page 11

...Company-operated stores. The Aaron's Franchise Association and the Aaron's Management Team, comprised of both franchise principals and representatives of the Company, are the key vehicles for communication and cross-fertilization. Aaron's leadership in franchising is confirmed through annual surveys... -

Page 12

... Revenues of Franchised Stores...2003 *Number of Stores Charles Smithgall now owns and operates 44 Aaron's stores with a long-term goal of 100 stores. Charles acquired his first franchise in 1995. His company, SEI/Aaron's Inc., is the Company's largest franchisee with stores in Kentucky, Rhode Island... -

Page 13

...in El Paso, Texas was opened as a franchise store in 2002 and was acquired by the Company in 2003. This profitable and growing store represents an ideal acquisition for Aaron's. Acquisitions Strengthening Existing Markets and Entering New T he Company continues to pursue acquisition opportunities... -

Page 14

... Corporate business, consisting of residential furniture for employee relocations and office furniture, now represents the majority of divisional revenues. Aaron's meets the needs of each customer category, offering flexible options of renting, purchasing or lease ownership. To the corporate market... -

Page 15

...purchasing are competitive advantages and key factors in assuring timely delivery of merchandise to customers. Unique in its industry, Aaron's produces the majority of the furniture for its stores at the ten MacTavish facilities comprising the Company's manufacturing division, creating cost benefits... -

Page 16

... to give their time and talents as volunteers in many worthy causes, and Aaron's Community Outreach Program (ACORP) has made substantial contributions to communities served by the Company's stores. Through this program, a store may earn, based on attained performance goals, up to $500 each month to... -

Page 17

...$547,255 Revenues: Rentals & Fees Retail Sales Non-Retail Sales Other Costs & Expenses: Retail Cost of Sales Non-Retail Cost of Sales Operating Expenses Depreciation of Rental Merchandise Interest Earnings Before Income Taxes Income Taxes Net Earnings Earnings Per Share Earnings Per Share Assuming... -

Page 18

... and fees includes all revenues derived from rental agreements from our sales and lease ownership and rent-to-rent stores, including agreements that result in our customers acquiring ownership at the end of the term. Retail sales represents sales of both new and rental return merchandise. Non-retail... -

Page 19

..., respectively. Revenues from the sale of residential and office furniture and other merchandise are recognized at the time of shipment. INSURANCE PROGRAMS Aaron Rents maintains insurance contracts for paying of workers' compensation and group health insurance claims. Using actuarial analysis... -

Page 20

...operating expenses improved to 45.0% for 2003 from 45.8% for 2002, with the decrease driven by the maturing of new Company-operated sales and lease ownership stores added over the past several years and a 10.1% increase in same store revenues. The 20.3% increase in depreciation of rental merchandise... -

Page 21

... higher costs in 2001 associated with the acquisition of sales and lease ownership store locations formerly operated by one of the nation's largest furniture retailers along with other new store openings, coupled with noncash charges of $5.6 million related to the rent-to-rent division. In addition... -

Page 22

...and $10.1 million, respectively. Our cash flows include profits on the sale of rental return merchandise. Our primary capital requirements consist of buying rental merchandise for both 20 Company-operated sales and lease ownership and rent-to-rent stores. As Aaron Rents continues to grow, the need... -

Page 23

... of rental merchandise or other goods specifying minimum quantities or set prices that exceed our expected requirements for three months. Market Risk We manage our exposure to changes in short-term interest rates, particularly to reduce the impact on our variable payment construction and lease... -

Page 24

...-16). EITF 02-16 addresses accounting and reporting issues related to how a reseller should account for cash consideration received from vendors. Generally, cash consideration received from vendors is presumed to be a reduction of the prices of the vendor's products or services and should, therefore... -

Page 25

... Payable Deferred Income Taxes Payable Customer Deposits & Advance Payments Credit Facilities Total Liabilities Commitments & Contingencies Shareholders' Equity Common Stock, Par Value $.50 Per Share; Authorized: 50,000,000 Shares; Shares Issued: 29,993,475 and 29,993,980 at December 31, 2003... -

Page 26

... REVENUES Rentals & Fees Retail Sales Non-Retail Sales Other COSTS & EXPENSES $553,773 68,786 120,355 23,883 766,797 $459,179 72,698 88,969 19,842 640,688 $403,385 60,481 66,212 16,603 546,681 Retail Cost of Sales Non-Retail Cost of Sales Operating Expenses Depreciation of Rental Merchandise... -

Page 27

... Additions to Rental Merchandise Book Value of Rental Merchandise Sold Deferred Income Taxes Gain on Sale of Property, Plant & Equipment Change in Accounts Payable & Accrued Expenses Change in Accounts Receivable Other Changes, Net Cash Provided by Operating Activities INVESTING ACTIVITIES... -

Page 28

... residential and office furniture, consumer electronics, appliances and other merchandise throughout the U.S., Puerto Rico, and Canada. The Company manufactures furniture principally for its rent-to-rent and sales and lease ownership operations. Rental Merchandise - Rental merchandise consists... -

Page 29

... the month due are recorded as deferred rental revenue. The Company maintains ownership of the rental merchandise until all payments are received under sales and lease ownership agreements. Revenues from the sale of residential and office furniture and other merchandise are recognized at the time of... -

Page 30

... or upon being subject to a sales and lease ownership agreement. Under the previous and the new depreciation method, rental merchandise in distribution centers does not begin being depreciated until 12 months from the date of acquisition. The Company believes the new depreciation method results... -

Page 31

...%) was outstanding under the revolving credit agreement, respectively. The Company pays a .25% commitment fee on unused balances. The weighted average interest rate on borrowings under the revolving credit agreement (before giving effect to interest rate swaps) was 2.53% in 2003, 3.86% in 2002, and... -

Page 32

... the Company's majority shareholder is a partner under a lease expiring in 2008 for annual rentals aggregating $212,700. The Company maintains a 401(k) savings plan for all full-time employees with at least one year of service with the Company and who meet certain eligibility requirements. The plan... -

Page 33

... to purchase shares of the Company's Common Stock are granted to certain key employees. Under the plans, options granted become exercisable after a period of three years, and unexercised options lapse 10 years after the date of the grant. Options are subject to forfeiture upon termination of service... -

Page 34

... rentto-rent store. The purchase price of the 2003 rent-to-rent acquisition was not significant. During 2002, the Company acquired 10 sales and lease ownership stores and 25 credit retail stores with an aggregate purchase price of approximately $14,033,000. The excess cost over the fair market value... -

Page 35

... a monthly payment basis with no credit requirements. The rent-to-rent division rents and sells residential and office furniture to businesses and consumers who meet certain minimum credit requirements. The Company's franchise operation sells and supports franchises of its sales and lease ownership... -

Page 36

...266 .31 .31 * Gross profit is the sum of rentals and fees, retail sales, and non-retail sales less retail cost of sales, non-retail cost of sales, and depreciation of rental merchandise. Report of Independent Auditors To the Board of Directors and Shareholders of Aaron Rents, Inc.: We have audited... -

Page 37

... respectively. The approximate number of shareholders of the Company's Common Stock and Class A Common Stock at March 5, 2004 was 2,600. The closing prices for the Common Stock and Class A Common Stock at March 5, 2004 were $24.79 and $22.25, respectively. Cash Dividends Per Share Subject to our... -

Page 38

Store Locations in the United States, puerto Rico, and Canada AT D E C E M B E R 3 1 , 2 0 0 3 Company-Operated Sales & Lease Ownership Franchised Sales & Lease Ownership Rent-to-Rent Total Stores Manufacturing & Distribution Centers 500 287 60 847 21 36 -

Page 39

... Rd., N.E. Atlanta, Georgia 30305-2377 (404) 231-0011 http://www.aaronrents.com Subsidiaries Aaron Investment Company 4005 Kennett Pike Greenville, Delaware 19807 (302) 888-2351 Aaron Rents, Inc. Puerto Rico Avenue Barbosa #376 Hato Rey, Puerto Rico 00917 (787) 764-0420 Annual Shareholders Meeting... -

Page 40

309 E. Paces Ferry Rd., N.E. Atlanta, Georgia 30305-2377 (404) 231-0011 www.aaronrents.com