Aarons 1997 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 1997 Aarons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

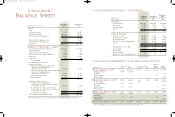

Consolidated Statements of Shareholders’ Equity

Nine Months

Year Ended Year Ended Ended

(In Thousands, December 31, December 31, December 31,

Except Per Share) 1997 1996 1995

Revenues

Rentals and Fees $231,207 $208,463 $137,098

Retail Sales 58,602 52,757 35,537

Non-Retail Sales 14,621 8,770 3,681

Other 6,321 4,255 1,908

310,751 274,245 178,224

Costs & Expenses

Retail Cost of Sales 42,264 37,848 24,983

Non-Retail Cost of Sales 13,650 8,320 3,367

Operating Expenses 149,728 135,012 90,027

Depreciation of Rental Merchandise 71,151 64,437 41,612

Interest 3,721 3,449 2,323

280,514 249,066 162,312

Earnings Before Income Taxes 30,237 25,179 15,912

Income Taxes 11,841 9,786 6,032

Net Earnings $ 18,396 $ 15,393 $ 9,880

Earnings Per Share $ .96 $ .81 $ .51

Earnings Per Share Assuming Dilution .94 .77 .49

Additional

Treasury Stock Common Stock Paid-In Retained

(In Thousands) Shares Amount Common Class A Capital Earnings

Balance, March 31, 1995 (2,179) $(13,578) $ 3,318 $ 2,681 $ 15,314 $ 77,216

Reacquired Shares (194) (3,134)

Dividends (732)

Reissued Shares 13 72 56 1

Net Earnings 9,880

Balance, December 31, 1995 (2,360) (16,640) 3,318 2,681 15,370 86,365

Stock Dividend 4,767 (4,767)

Reacquired Shares (164) (2,889)

Dividends (765)

Reissued Shares 689 4,427 75

Net Earnings 15,393

Balance, December 31, 1996 (1,835) (15,102) 8,085 2,681 15,445 96,226

Reacquired Shares (795) (8,918)

Dividends (758)

Reissued Shares 47 361 39

Net Earnings 18,396

Balance, December 31, 1997 (2,583) $(23,659) $8,085 $2,681 $15,484 $113,864

The accompanying notes are an integral part of the Consolidated Financial Statements.

17

Consolidated Statements of Earnings

Consolidated

December 31, December 31,

(In Thousands, Except Share Data) 1997 1996

Assets

Cash $ 96 $ 84

Accounts Receivable 11,794 10,491

Rental Merchandise 246,498 210,516

Less: Accumulated Depreciation (69,530) (60,532)

176,968 149,984

Property, Plant & Equipment, Net 39,757 33,267

Prepaid Expenses & Other Assets 10,767 4,277

Total Assets $239,382 $198,103

Liabilities & Shareholders’ Equity

Accounts Payable & Accrued Expenses $ 31,071 $ 24,999

Dividends Payable 379 382

Deferred Income Taxes Payable 6,687 2,882

Customer Deposits & Advance Payments 8,304 7,140

Bank Debt 75,904 55,125

Other Debt 582 240

Total Liabilities 122,927 90,768

Commitments & Contingencies

Shareholders’ Equity

Common Stock, Par Value $.50 Per Share;

Authorized: 25,000,000 Shares;

Shares Issued: 16,170,987 8,085 8,085

Common Stock, Class A, Par Value $.50 Per Share;

Authorized: 25,000,000 Shares;

Shares Issued: 5,361,761 2,681 2,681

Additional Paid-In Capital 15,484 15,445

Retained Earnings 113,864 96,226

140,114 122,437

Less: Treasury Shares at Cost,

Common Stock, 1,058,041 Shares

at December 31, 1997 and 415,941 Shares

at December 31, 1996 (9,523) (2,315)

Class A Common Stock, 1,525,255 Shares

at December 31, 1997 and 1,418,855 Shares

at December 31, 1996 (14,136) (12,787)

Total Shareholders’ Equity 116,455 107,335

Total Liabilities & Shareholders’ Equity $239,382 $198,103

The accompanying notes are an integral part of the Consolidated Financial Statements.

16

Balance Sheets

AR layout Final.wpc 4/24/98 8:24 AM Page 19