AIG 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 AIG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

American International Group, Inc.

2012 Annual Report

Bring on tomorrow

Table of contents

-

Page 1

American International Group, Inc. 2012 Annual Report Bring on tomorrow -

Page 2

... U.S. government support to AIG during the height of the ï¬nancial crisis $205 billion Total amount returned to America by December 14, 2012, through asset sales and other actions by AIG, the Federal Reserve, and Treasury $22.7 billion Positive return realized on America's investment in AIG -

Page 3

... in 2012 18 million Americans who AIG helps plan for retirement 98% Percent of Fortune 500 companies AIG serves $6.7 million Donations made by AIG's Matching Grants Program to match employees' gifts to charitable organizations in 2012 OUR GLOBAL NETWORK Countries where AIG products are sold 1 -

Page 4

...smaller, more focused company. Today, I am very proud that the insurance businesses that we identiï¬ed in 2009 as core to the new AIG - property casualty, life and retirement, and mortgage guaranty - continue to thrive as we have sold off other businesses, and streamlined our operations and support... -

Page 5

... 2012. And, even with interest rates at continued historic lows, AIG Life and Retirement is a market leader delivering innovative, compelling retirement products that provide meaningful, long-term peace of mind to our customers while making sense for AIG. â- United Guaranty reported new insurance... -

Page 6

... AIG's 2011 Annual Report that "time will tell" if the people of AIG had executed the largest turnaround in corporate history, it was with optimism that I believed it would happen so quickly. Beyond its impressive exit of government ownership, AIG continued to make sound business decisions in 2012... -

Page 7

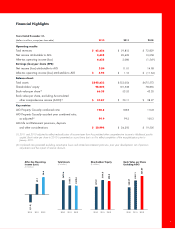

....34 ) Total assets Shareholders' equity Book value per share (1) $ 548,633 98,002 66.38 $ 553,054 101,538 53.53 $ 675,573 78,856 43.20 Book value per share, excluding Accumulated other comprehensive income (AOCI)(1) Key metrics: $ 57.87 $ 50.11 $ 38.27 AIG Property Casualty combined ratio AIG... -

Page 8

UNITED Bring on tomorrow Together, we're working to help see, build, and secure a better future for everyone. Bring on tomorrow As AIG's brand promise, these three words are more than window dressing to go along with our refreshed logo. They are a call to action, a rallying cry for our employees. ... -

Page 9

~63,000 AIG EMPLOYEES AROUND THE WORLD WORKING TOWARD A COMMON GOAL 7 -

Page 10

...-term care, disability, and life insurance needs. SunAmerica Retirement Markets provides guaranteed lifetime income - no matter how long retirement lasts. Bring on rebuilding We promise our customers that we will be there for the unexpected. When tornadoes destroyed schools in Kentucky in March 2012... -

Page 11

$115.1million AVERAGE CLAIMS PAID EACH DAY BY AIG PROPERTY CASUALTY IN 2012 9 -

Page 12

... make and deliver meals to local low-income families. In the Philippines, employees raised funds and donated essential goods to help victims of the August 2012 Habagat ï¬,oods. Bring on doing more For the past 24 years, AIG has held its Winter Summit, combining business sessions led by AIG Property... -

Page 13

$10,000 MAXIMUM DONATION MADE BY AIG'S MATCHING GRANTS PROGRAM TO MATCH AN EMPLOYEE DONATION TO A CHARITABLE ORGANIZATION 11 -

Page 14

... Business Group, and Head of Financial Services Swiss Re Morris W. Ofï¬t Chairman, Ofï¬t Capital Founder and Former Chief Executive Ofï¬cer OFFITBANK Suzanne Nora Johnson Former Vice Chairman The Goldman Sachs Group, Inc. Robert S. Miller Non-Executive Chairman of the Board American International... -

Page 15

American International Group, Inc. Form 10-K 13 -

Page 16

...31, 2012 Commission file number 1-8787 26OCT201220500047 American International Group, Inc. (Exact name of registrant as specified in its charter) Delaware (State or other jurisdiction of incorporation or organization) 180 Maiden Lane, New York, New York (Address of principal executive offices) 13... -

Page 17

-

Page 18

AMERICAN INTERNATIONAL GROUP, INC. ANNUAL REPORT ON FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 2012 TABLE OF CONTENTS FORM 10-K Item Number Description Page ...PART I ...Item 1. Business 2 • AIG's Global Insurance Operations 3 • A Review of Liability for Unpaid Claims and Claims Adjustment ... -

Page 19

..., mortgage insurance and other financial services to customers in more than 130 countries. Our diverse offerings include products and services that help businesses and individuals protect their assets, manage risks and provide for retirement security. AIG common stock is listed on the New York Stock... -

Page 20

... down payment. Other operations also include Global Capital Markets, Direct Investment book, Retained Interests and Corporate & Other operations. On December 9, 2012, AIG announced an agreement to sell 80.1 percent of International Lease Finance Corporation (ILFC) with an option for the purchaser to... -

Page 21

... AIG LIFE AND RETIREMENT AIG PROPERTY CASUALTY 13% 29% 2% MORTGAGE GUARANTY $867 Retirement Services $7,258 Consumer Insurance $14,403 41% 25% 69% 15FEB201302432775 For financial information concerning our reportable segments, including geographic areas of operation and changes made in 2012... -

Page 22

... income • Improved 2012 current accident year loss ratio, excluding catastrophe losses and prior year development • Completed cash redeployment in 2011 • Strategic investments in People's Insurance Company (Group) of China Limited (PICC), Woodbury Financial Services, Inc. and Service Net... -

Page 23

...AIG Property Casualty Business Strategy Business Mix Shift: Grow in higher value lines of business and geographies... Underwriting Excellence: Enhance pricing and risk-selection tools through investments in data mining, science and technology... Claims Best Practices: Reduce loss costs through new... -

Page 24

... 2012 Net premiums written by product line (dollars in millions) Consumer Insurance Casualty $8,574 42% Property $4,191 21% 18% 19% Personal Lines $7,181 Financial Lines $3,959 16FEB201301144436 51% 49% Accident & Health $6,969 Specialty $3,576 16FEB201301144901 Consumer products: Accident... -

Page 25

... at AIG Property Casualty Global Footprint AIG Property Casualty has a significant international presence in both developed markets and growth economy nations. It distributes its products through three major geographic regions: • Americas: Includes the United States, Canada, Central America, South... -

Page 26

...AIG Property Casualty competes against approximately 3,300 stock companies, specialty insurance organizations, mutual companies and other underwriting organizations. In international markets, we compete for business with the foreign insurance operations of large U.S. insurers global insurance groups... -

Page 27

... returns on capital Service - focused on customer needs, providing strong global claims, loss prevention and mitigation, engineering, underwriting and other related services Expertise - experienced employees complemented with new talent Financial strength - well capitalized, strong balance sheet... -

Page 28

... income solutions and AIG Life and Retirement's capital base, risk controls, innovative product designs, expanded distribution initiatives and financial discipline to grow variable annuity business. Pursue selected institutional market opportunities where AIG Life and Retirement's scale and capital... -

Page 29

...include life insurance and accident and health (A&H), fixed annuities, variable annuities and income solutions, brokerage services and retail mutual funds. Institutional product lines will include group retirement, group benefits and institutional markets. The institutional markets product line will... -

Page 30

... mutual funds Other includes fixed, equity indexed and runoff annuities. Products include a full line of life insurance, deferred and payout annuities, A&H products, worksite and group benefits. Products and services focus on investment, retirement savings and income solution products. AIG Life... -

Page 31

...t. anagemen AIG Life and Retirement conducts its business primarily through three major insurance operating companies: American General Life Insurance Company, The Variable Annuity Life Insurance Company and The United States Life Insurance Company in the City of New York. ...14 AIG 2012 Form 10-K -

Page 32

... benefit policies and deposits on life contingent payout annuities. Premiums, deposits and other considerations is a non-GAAP measure that includes life insurance premiums and deposits on annuity contracts and mutual funds. See Item 7. MD&A - Result of Operations - AIG Life and Retirement Operations... -

Page 33

... risk-acceptance (underwriting) criteria, product pricing, service, and terms and conditions. Retirement services companies also compete through crediting rates and through offering guaranteed benefits features. AIG Life and Retirement competes in the life insurance and retirement savings businesses... -

Page 34

... to deliver effective solutions across a range of markets. AIG Life and Retirement has an expansive product suite including life insurance, accident and health, annuity, mutual fund, group retirement, group benefit and institutional products as well as other solutions to help provide a secure future... -

Page 35

... mortgage guaranty insurance, which protects mortgage lenders and investors from loss due to borrower default and loan foreclosure. With over 1,100 employees, United Guaranty currently insures over one million mortgage loans in the United States and has operations in nine other countries. In 2012... -

Page 36

... business. Other operations also include: Global Capital Markets (GCM) consist of the operations of AIG Markets, Inc. (AIG Markets) and the remaining derivatives portfolio of AIG Financial Products Corp. and AIG Trading Group Inc. and their respective subsidiaries (collectively AIGFP). AIG Markets... -

Page 37

... to internal controls and the financial and operating platforms, corporate initiatives, certain compensation plan expenses, corporate level net realized capital gains and losses, certain litigation-related charges and credits, the results of AIG's real estate investment operations and net gains... -

Page 38

... for a description of our loss reserving process. A significant portion of AIG Property Casualty's business is in the U.S. commercial casualty class, which tends to involve longer periods of time for the reporting and settlement of claims and may increase the risk and uncertainty with respect to... -

Page 39

.... and sold 21st Century Insurance Group and HSB Group, Inc. The sales and deconsolidation are reflected in the table above as a reduction in December 31, 2009 net reserves of $9.7 billion and as an $8.6 billion increase in paid losses for the years 2000 through 2008 to remove the reserves for these... -

Page 40

... program substantially mitigates our exposure to potentially significant losses. See Item 7. MD&A - Enterprise Risk Management - Insurance Operations Risks - AIG Property Casualty Key Insurance Risks - Reinsurance Recoverables for a summary of significant reinsurers. ...AIG 2012 Form 10-K 23 -

Page 41

... AIG's insurance operations, excluding the results of discontinued operations Years Ended December 31, (in millions) Annual Average Investments(a) Net Investment Income Pre-tax Return on Average Investments(b) AIG Property Casualty: 2012 2011 2010 AIG Life and Retirement: 2012 2011 2010 (a) (b) Net... -

Page 42

..., either generally or as applicable to insurance businesses. Further, we cannot predict how the FRB will exercise general supervisory authority over us, although the FRB could, as a prudential matter, for example, limit our ability to pay dividends, purchase shares of AIG Common Stock or acquire... -

Page 43

...institutions as of July 21, 2010. The regulatory capital requirements currently applicable to insured depository institutions, such as AIG Federal Savings Bank, are computed in accordance with the U.S. federal banking agencies' generally applicable risk-based capital requirements, which are based on... -

Page 44

... of the amounts paid by us into state guaranty funds). We cannot predict whether these actions will become effective or the effect they may have on the financial markets or on our business, results of operations, cash flows, financial condition and credit ratings. However, it is possible that such... -

Page 45

... policy, deposits of securities for the benefit of policyholders, requirements for acceptability of reinsurers, periodic examinations of the affairs of insurance companies, the form and content of reports of financial condition required to be filed and reserves for unearned premiums, losses and... -

Page 46

... LIFE AND RETIREMENT AIG Property Casualty Domestic 12,000 15,000 AIG PROPERTY CASUALTY 6,000 OTHER OPERATIONS* AIG Property Casualty International 30,000 45,000 15FEB201315344305 * Includes approximately 500 employees of ILFC, which was held for sale at December 31, 2012. ...AIG 2012 Form... -

Page 47

... 46 2009 2011 2011 2009 2009 2005 2010 2009 2008 2005 2010 2009 2011 1992 2010 2005 2010 2010 2010 2002 1999 2011 All directors of AIG are elected for one-year terms at the annual meeting of shareholders. All executive officers are elected to one-year terms, but serve at the pleasure of the Board... -

Page 48

... in the Finance and Risk practice of Oliver Wyman Financial Services and served as Canadian Market Manager since 2006. Charles S. Shamieh joined AIG in 2007 as Executive Director of Enterprise Risk Management. In January 2011, Mr. Shamieh was elected to his current position of Senior Vice President... -

Page 49

... adverse effect on our businesses, results of operations, financial condition and liquidity. Under difficult economic conditions, we could experience reduced demand for our financial and insurance products and an elevated incidence of claims and lapses or surrenders of policies. Contract holders... -

Page 50

..., see Item 7. MD&A - Enterprise Risk Management - Insurance Operations Risks - AIG Property Casualty Key Insurance Risks - Catastrophe Exposures. Insurance liabilities are difficult to predict and may exceed the related reserves for losses and loss expenses. We regularly review the adequacy of the... -

Page 51

... lines of business. These include, but are not limited to, general liability, commercial automobile liability, environmental, workers' compensation, excess casualty and crisis management coverages, insurance and risk management programs for large corporate customers and other customized structured... -

Page 52

... long-term senior debt ratings, AIG would be required to post additional collateral of $226 million, and certain of our counterparties would be permitted to elect early termination of contracts. AIG Parent's ability to access funds from our subsidiaries is limited. As a holding company, AIG Parent... -

Page 53

... expose us to risks that may affect our operations. We provide insurance, investment and other financial products and services to both businesses and individuals in more than 130 countries. A substantial portion of our AIG Property Casualty business is conducted outside the United States, and we... -

Page 54

... to perform necessary business functions, including providing insurance quotes, processing premium payments, making changes to existing policies, filing and paying claims, administering variable annuity products and mutual funds, providing customer support and managing our investment portfolios... -

Page 55

... of business with existing customers and counterparties. General insurance and life insurance companies compete through a combination of risk acceptance criteria, product pricing, and terms and conditions. Retirement services companies compete through crediting rates and the issuance of guaranteed... -

Page 56

...our businesses, results of operations and cash flows. On July 21, 2010, Dodd-Frank, which effects comprehensive changes to the regulation of financial services in the United States, was signed into law. Dodd-Frank directs existing and newly created government agencies and bodies ...AIG 2012 Form 10... -

Page 57

... general supervisory authority over us. • The FRB, as a prudential matter, may limit our ability to pay dividends and purchase shares of AIG Common Stock. • The FRB is required to impose minimum leverage and risk-based capital requirements on us that are not less than those applicable to insured... -

Page 58

... effect on our financial condition and results of operations. The NAIC Model Regulation ''Valuation of Life Insurance Policies'' (''Regulation XXX'') requires insurers to establish additional statutory reserves for term life insurance policies with long-term premium guarantees and universal life... -

Page 59

... an annual limitation on its pre-ownership change tax losses and credits carryforwards equal to the equity value of the corporation immediately before the ownership change, multiplied by the long-term, tax-exempt rate posted monthly by the IRS (subject to certain adjustments). The annual limitation... -

Page 60

... and combined ratios of our subsidiaries; • investment yields; • our subsidiaries' capacity to distribute dividends to AIG Parent; • our ability to deploy capital towards share purchases, dividend payments, acquisitions or organic growth; • the impact of a change in our credit ratings on... -

Page 61

...AIG and its subsidiaries operate from over 400 offices in the United States and approximately 600 offices in over 75 foreign countries. The following offices are located in buildings in the United States owned by AIG and its subsidiaries: AIG Property Casualty: • 175 Water Street in New York, New... -

Page 62

... on the payment of dividends to AIG by some of its insurance subsidiaries, see Item 1A. Risk Factors - Liquidity, Capital and Credit - AIG Parent's ability to access funds from our subsidiaries is limited, and Note 17 to the Consolidated Financial Statements. EQUITY COMPENSATION PLANS ...Our table... -

Page 63

... total shareholder return on AIG Common Stock to the return of a group of companies (the Old Peer Group) consisting of ten insurance companies to which we compared our business and operations in our Annual Report on Form 10-K for the year ended December 31, 2011: • ACE Limited • Allianz Group... -

Page 64

... PURCHASES OF EQUITY SECURITIES ... Five-Year Cumulative Total Shareholder Returns Value of $100 Invested on December 31, 2007 $150 $100 $50 $0 2007 2008 2009 2010 2011 2012 Years Ending S&P 500 INDEX NEW PEER GROUP OLD PEER GROUP AMERICAN INTERNATIONAL GROUP 15FEB201317493176 2011 2012... -

Page 65

...data: Total investments Total assets Long-term debt Total liabilities Total AIG shareholders' equity Total equity Book value per share(a) Book value per share, excluding Accumulated other comprehensive income (loss)(a)(c) AIG Property Casualty combined ratio(d) Other data (from continuing operations... -

Page 66

... operations Income (loss) attributable to AIG December 31, 2009 balance sheet data: Total assets Total liabilities Total AIG shareholders' equity Total equity Other data (from continuing operations): Adjustment to federal and foreign deferred tax valuation allowance Year Ended December 31, 2008... -

Page 67

... taxes recorded from 2008 through 2010. Capitalization and Book Value Per Share ...As a result of the closing of the Recapitalization on January 14, 2011, the remaining SPV Preferred Interests held by the FRBNY of approximately $26.4 billion were purchased by AIG and transferred to the Department... -

Page 68

... income (loss) Total common shares outstanding Issuable for equity units Shares assumed converted Pro forma common shares outstanding Pro forma book value per share Pro forma book value per share, excluding Accumulated other comprehensive income (loss) $ 2012 98,002 $ - - 98,002 12,574 2011... -

Page 69

...deployable capital; • AIG's return on equity and earnings per share long-term aspirational goals; • AIG's strategies to grow net investment income, efficiently manage capital and reduce expenses; • AIG's strategies for customer retention, growth, product development, market position, financial... -

Page 70

... Off-Balance Sheet Arrangements and Commercial Commitments 133 Debt 135 Credit Ratings 136 Regulation and Supervision 137 Dividend Restrictions 137 138 INVESTMENTS ...Market Conditions 138 Investment Strategies 138 Investment Highlights 138 Impairments 150 155 ENTERPRISE RISK MANAGEMENT ...Overview... -

Page 71

...in fair value of AIG Life and Retirement fixed income securities designated to hedge living benefit liabilities, change in benefit reserves and deferred policy acquisition costs (DAC), value of business acquired (VOBA), and sales inducement assets (SIA) related to net realized capital (gains) losses... -

Page 72

...the operating performance of the underlying business by highlighting the results from ongoing operations. • Premiums, deposits and other considerations: includes life insurance premiums and deposits on annuity contracts and mutual funds. • Other Operations - Operating income (loss): income (loss... -

Page 73

... operating income and the business also has continued to experience positive pricing trends. • AIG Life and Retirement assets under management grew significantly in 2012 from deposits and net flows from individual variable annuities and retail mutual funds and appreciation due to higher equity... -

Page 74

... 7 / EXECUTIVE SUMMARY 2012 2011 2010 Results of operations data: Total revenues Income from continuing operations Net income attributable to AIG Income per common share attributable to AIG (diluted) Balance sheet data: Total assets Long-term debt Total AIG shareholders' equity Book value per... -

Page 75

... AIG LIFE AND RETIREMENT OTHER OPERATIONS ITEM 7 / EXECUTIVE SUMMARY $21,405 $39,781 $40,722 $37,207 $16,767 $15,315 $14,747 $9,974 $4,079 2012 2011 15FEB201316543853 5 2010 2012 2011 15FEB201316544108 5 LONG-TERM DEBT ($ millions) 2010 2012 2011 15FEB201316543980 5 2010 TOTAL ASSETS... -

Page 76

... EXECUTIVE SUMMARY 2012 2011 2010 AIG Property Casualty Pre-tax income (loss) Net realized capital (gains) losses Legal settlements* Bargain purchase gain Other (income) expense - net Operating income (loss) AIG Life and Retirement Pre-tax income Legal settlements* Changes in fair value of fixed... -

Page 77

... insurance companies that can be capitalized in connection with acquiring or renewing insurance contracts. AIG Property Casualty Operating Segment Changes ...To align financial reporting with changes made during 2012 to the manner in which AIG's chief operating decision makers review the businesses... -

Page 78

...in the housing sector which drove strong performance in our structured products portfolios. • The overall credit ratings of our fixed maturity investments were largely unchanged from last year, reflecting a continued focus on long term risk adjusted portfolio performance. ...AIG 2012 Form 10-K 61 -

Page 79

... effect on our industry. Investment returns have declined as the U.S. fixed income market remains in a low interest rate environment. In addition, current market conditions may not necessarily permit insurance companies to increase pricing across all our product lines. ...62 AIG 2012 Form... -

Page 80

... following priorities for 2013: • Strengthen and improve the operating performance of our core businesses; • Consummate the sale of up to 90 percent of our interest in ILFC; • Enhance the yield on our investments while maintaining focus on credit quality; • Manage AIG's capital and interest... -

Page 81

... plan to continue to execute capital management initiatives by enhancing broad-based risk tolerance guidelines for our operating units, implementing underwriting strategies to increase return on equity by line of business and reducing exposure to businesses with inadequate pricing and increased loss... -

Page 82

... approach to new business pricing of interest sensitive products (e.g. fixed annuities), active management of renewal crediting rates, increased pricing in certain life insurance products and re-filing of products to continue lowering minimum rate guarantees. AIG Life and Retirement is focused... -

Page 83

... American General Life Insurance Company effective December 31, 2012. This merger will allow for more effective capital and dividend planning while creating operating efficiencies and making it easier for producers and customers to do business with AIG Life and Retirement. AIG Life and Retirement... -

Page 84

...and its subsidiaries will be executed through AIG Markets. AIGFP's derivative portfolio consists primarily of interest rate, currency, credit, commodity and equity derivatives. Additionally, AIGFP has a credit default swap portfolio being managed for economic benefit and with limited risk. The AIGFP... -

Page 85

... Change 2012 vs. 2011 2011 vs. 2010 2012 2011 2010 Revenues: Premiums Policy fees Net investment income Net realized capital gains (losses) Other income Total revenues Benefits, claims and expenses: Policyholder benefits and claims incurred Interest credited to policyholder account balances... -

Page 86

...the announced sale of ILFC. After-tax operating income for 2012 was $6.6 billion compared to $2.1 billion for 2011. A Year Year ea o of fP Progress rogress og e • For the third consecutive year we posted a full year profit. • Our total AIG Property Casualty accident year loss ratio, as adjusted... -

Page 87

... Ltd. (AIG Star) and AIG Edison Life Insurance Company (AIG Edison). This compared to a net loss of $969 million in 2010, which included goodwill impairment charges of $4.6 billion associated with the sale of American Life Insurance Company (ALICO), AIG Star and AIG Edison. ...70 AIG 2012 Form 10-K -

Page 88

... fee asset Changes in fair value of AIG Life and Retirement fixed income securities designated to hedge living benefit liabilities Change in benefit reserves and DAC, VOBA and SIA related to net realized capital (gains) losses (Gain) loss on extinguishment of debt Net realized capital (gains) losses... -

Page 89

... of the change in business mix from Commercial Insurance to Consumer Insurance and higher general operating expenses and lower net realized capital gains. AIG Life and Retirement - Pre-tax income increased in 2012 compared to 2011, principally due to efforts to actively manage net investment spreads... -

Page 90

... claims not yet filed with its life insurance companies. Other Operations - Other Operations recorded a pre-tax loss in 2011 compared to pre-tax income in 2010 due to a net gain on sale of divested businesses in 2010, primarily related to AIA. AIG Property Casualty AIG Property Casualty 2012... -

Page 91

...income (loss), loss ratio, acquisition ratio, general operating expense ratio and combined ratio. We are developing new value-based metrics that provide management shorter-term measures to evaluate our performance across multiple lines and various countries. As an example, we have implemented a risk... -

Page 92

... 2011 2010 Percentage Change 2012 vs. 2011 2011 vs. 2010 Commercial Insurance Underwriting results: Net premiums written Decrease in unearned premiums Net premiums earned Claims and claims adjustment expenses Underwriting expenses Underwriting loss Net investment income Operating income Consumer... -

Page 93

... allocated net investment income resulting primarily from the strategic group benefits partnership with AIG Life and Retirement. Underwriting results improved due to the combination of lower catastrophe losses, favorable loss reserve development, the effect of rate increases, enhanced risk selection... -

Page 94

...) Percentage Change 2012 2011 2010 2012 vs. 2011 2011 vs. 2010 Commercial Insurance Casualty Property Specialty Financial lines Total net premiums written Consumer Insurance Accident & Health Personal lines Total net premiums written Other Total AIG Property Casualty net premiums written $ 8,574... -

Page 95

...180 Financial lines Specialty Property Casualty $6,969 $6,762 $5,572 $7,000 Personal lines Accident & Health $8,574 $9,820 $9,940 $5,774 2012 2011 2010 2012 2011 2010 15FEB201321461922 2012 and 2011 Comparison Commercial Insurance Net Premiums Written In 2012, Commercial Insurance focused... -

Page 96

... U.S. and Canada that did not meet internal performance targets in Personal lines business. A&H net premiums written increased primarily due to the Fuji acquisition, direct marketing, group and individual accident, travel business, and the execution of new business strategies at Fuji Life. Excluding... -

Page 97

... meet internal performance targets. Personal Lines continued to grow in key markets, including Japan and other Asia Pacific countries, Latin America, and in key lines, such as personal property and specialty personal lines products. ITEM 7 / RESULTS OF OPERATIONS AIG Property Casualty Net Premiums... -

Page 98

... modest growth in travel, warranty, and specialty personal lines products while focused on re-building its direct marketing programs that it previously shared with American Life Insurance Company (ALICO). 2011 and 2010 Comparison The Americas net premiums written increased slightly as a result... -

Page 99

... 2010 Increase (Decrease) 2012 vs. 2011 2011 vs. 2010 ITEM 7 / RESULTS OF OPERATIONS Commercial Insurance Loss ratio Catastrophe losses and reinstatement premiums Prior year development net of premium adjustments Change in discount Accident year loss ratio, as adjusted Acquisition ratio General... -

Page 100

... exposure management and claims processing. Although the execution of these strategies resulted in a reduction of Casualty net premiums written, it also improved the accident year loss ratio as we remediated our primary and excess Casualty books in both the Americas and EMEA regions. Financial lines... -

Page 101

... of the general operating expense ratio increase was primarily due to higher personnel costs, as part of AIG's continued investment in its employees. Consumer Insurance Ratios The accident year loss ratio, as adjusted, in the year ended December 31, 2012 improved in both A&H and Personal lines. The... -

Page 102

... to regional governance, risk management capabilities and investments within growth economy nations. Consumer Insurance Ratios The accident year loss ratio, as adjusted, in the year ended December 31, 2011 decreased, primarily due to rate strengthening and underwriting actions taken since 2010 and... -

Page 103

... presents AIG Property Casualty's investing and other results: Years Ended December 31, (in millions) Percentage Change 2012 vs. 2011 2011 vs. 2010 2012 2011 2010 Net investment income Commercial Insurance Consumer Insurance Other Total net investment income Net realized capital gains (losses... -

Page 104

... in the S&P 500 Index during 2012. Other investment income also increased by $72 million due to the strategic group benefits partnership with AIG Life and Retirement, all of which is reported in Consumer Insurance. Net Realized Capital Gains (Losses) Net realized capital losses for the year ended... -

Page 105

... following discussion of the consolidated liability for unpaid claims and claims adjustment expenses (loss reserves) presents loss reserves for AIG Property Casualty as well as the loss reserves pertaining to the Mortgage Guaranty reporting unit, which is reported in Other. ...88 AIG 2012 Form 10-K -

Page 106

... the components of net loss reserves by business unit: December 31, (in millions) 2012 2011 AIG Property Casualty: Commercial Insurance Consumer Insurance Other Total AIG Property Casualty Other operations - Mortgage Guaranty Net liability for unpaid claims and claims adjustment expense at end... -

Page 107

... Financial Statements for additional information on discounting of loss reserves. The following table presents the net reserve discount benefit (charge): Years Ended December 31, (in millions) 2012 2011 2010 Change in loss reserve discount - current accident year Change in loss reserve... -

Page 108

...) or unfavorable, of incurred losses and loss expenses for prior years, net of reinsurance: Years Ended December 31, (in millions) 2012 2011 2010 Prior accident year development by accident year: Accident Year 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 and prior Total $ (162) (75) (45... -

Page 109

... Insurance Total Consumer Insurance Other Asbestos and environmental (1986 and prior) U.S. International Total asbestos and environmental Environmental (1987 - 2004) - U.S. Excess workers' compensation - U.S. All other, net Total Other Total AIG Property Casualty Other operations - Mortgage Guaranty... -

Page 110

... jury verdicts, which increased the value of severe tort claims. Director and Officer (D&O) and Related Management Liability - U.S. We experienced favorable development in 2012 and 2011. The favorable development over the two-year period related primarily to accident years 2005-2007, 2010, and, to... -

Page 111

...exception of these claims, this class experienced claim activity in line with expectations. Healthcare business written by AIG Property Casualty's Americas region produced moderate favorable development in 2011 and 2010. Healthcare loss reserves have benefited from favorable market conditions and an... -

Page 112

...this business pertained to accident years 2007 through 2009. For similar reasons, the Commercial Risk division strengthened workers' compensation reserves in 2010. For more information on our Loss Reserving Process, see Critical Accounting Estimates. ITEM 7 / RESULTS OF OPERATIONS ...AIG 2012 Form... -

Page 113

... potential for involvement of multiple policy periods for individual claims; • claims filed under the non-aggregate premises or operations section of general liability policies; • the number of insureds seeking bankruptcy protection and the effect of prepackaged bankruptcies; • diverging legal... -

Page 114

... June 17, 2011, we completed a transaction under which the bulk of AIG Property Casualty's net domestic asbestos liabilities were transferred to NICO, a subsidiary of Berkshire Hathaway, Inc. This was part of our ongoing strategy to reduce our overall loss reserve development risk. This transaction... -

Page 115

... the closing of this transaction, but effective as of January 1, 2011, we ceded the bulk of AIG Property Casualty's net domestic asbestos liabilities to NICO under a retroactive reinsurance agreement with an aggregate limit of $3.5 billion. Within this aggregate limit, NICO assumed collection risk... -

Page 116

... capital loss tax carryforwards. The sales of securities in unrealized gain positions that support certain payout annuity products, and subsequent reinvestment of the proceeds at generally lower yields, triggered loss recognition accruals in 2012. AIG Life and Retirement Operations Commencing... -

Page 117

... capital losses Change in benefit reserves and DAC, VOBA and SIA related to net realized capital losses Pre-tax income Total AIG Life and Retirement: Revenue: Premiums Policy fees Net investment income Other income Operating expenses: Policyholder benefits and claims incurred Interest credited... -

Page 118

...higher term insurance premiums. Policy fees increased in 2012 as a result of growth in variable annuity assets under management from higher net flows and separate account performance, driven in large part by higher equity markets. Net investment income increased in 2012 reflecting higher base yields... -

Page 119

... credited rates, discipline on new business pricing and re-filing products to reduce minimum rate guarantees. As a result of a comprehensive review of reserves for the GIC portfolio, AIG Life and Retirement recorded an increase to such reserves through interest credited of $110 million for 2012... -

Page 120

... AIG Life and Retirement Operating Income ...Operating income decreased in 2011 due to lower net investment income, higher DAC amortization and higher policyholder benefit expense in its variable annuity business due to separate account performance, and an increase in death claim reserves. Policy... -

Page 121

...$557 million higher fair value losses on variable annuity embedded derivatives, which were primarily due to declining credit spreads and declines in long-term interest rates. AIG Life and Retirement reported net realized capital gains in 2011 compared to net realized capital losses in 2010. This was... -

Page 122

... loss recognition reserves. In addition, due to the reinvestment of the assets at lower yields, earnings related to this payout annuity block of business are expected to decline beginning in 2013. Premiums Premiums represent amounts received on traditional life insurance policies, group benefit... -

Page 123

... private placement variable annuity sale in 2010. Retail mutual fund annual sales growth was driven by SunAmerica Asset Management Corp.'s Specialty Series product offerings (Alternative Strategies and Global Trends) and the Focused Dividend Strategy Portfolio. AIG Life and Retirement grew new sales... -

Page 124

...life sales during 2010. Retirement Services Net Flows The following table presents the account value rollforward for Retirement Services: Years Ended December 31, (in millions) Group retirement products Balance, beginning of year Deposits - annuities Deposits - mutual funds Total deposits Surrenders... -

Page 125

... annuities net flows improved from 2010 levels due primarily to higher deposits throughout 2011 and turned positive in the fourth quarter of 2011. The following table presents reserves by surrender charge category and surrender rates: 2012 At December 31, (in millions) Group Retirement Products... -

Page 126

...in structured securities and re-deployment of cash in 2011 to increase yields • Continued disciplined approach to new business pricing • Actively managing renewal credited rates • Re-priced certain life insurance and annuity products to reflect current low rate environment • Re-filed certain... -

Page 127

... that we cannot achieve targeted net investment spreads on new business, products are re-priced or discontinued. Additionally, current products with higher minimum rate guarantees have been re-filed with lower rates as permitted under state insurance product regulations. ...110 AIG 2012 Form 10-K -

Page 128

... AIG's Other operations results: Years Ended December 31, (in millions) Percentage Change 2012 2011 2010 2012 vs. 2011 2011 vs. 2010 Mortgage Guaranty Global Capital Markets Direct Investment book Retained interests: Change in fair value of AIA securities, including realized gain in 2012 Change... -

Page 129

...Change 2012 2011 2010 2012 vs. 2011 2011 vs. 2010 Underwriting results: Net premiums written (Increase) decrease in unearned premiums Net premiums earned Claims and claims adjustment expenses incurred Underwriting expenses Underwriting profit (loss) Net investment income Operating income (loss) Net... -

Page 130

... expire as the loan balances are repaid. 2011 and 2010 Comparison Mortgage Guaranty recorded an operating loss in 2011 compared to operating income in 2010, primarily due to: • an increase in claims and claims adjustment expenses of $334 million, primarily in first-lien business. This reflected... -

Page 131

...) 2012 2011 2010 Counterparty Credit Valuation Adjustment on Assets: Bond trading securities Loans and other assets Increase (decrease) in assets AIG's Own Credit Valuation Adjustment on Liabilities: Notes and bonds payable Hybrid financial instrument liabilities Guaranteed Investment Agreements... -

Page 132

...loss in 2011, representing the decline in the securities' value, due to market conditions, from December 31, 2010 through the date of their sale in the first quarter of 2011. Corporate & Other ...Corporate & Other reported lower operating losses in 2012 compared to 2011 primarily due to the effects... -

Page 133

... 31, (in millions) 2012 2011 2010 Foreign life insurance businesses AGF ILFC Net gain (loss) on sale Consolidation adjustments Interest allocation Income (loss) from discontinued operations Income tax expense (benefit) Income (loss) from discontinued operations, net of tax $ - $ 1,170 $ (1,602... -

Page 134

... long-duration products are sold at their stated aggregate fair value and reinvested at current yields. This increase in future policy benefits in other comprehensive income was partially offset by loss reserve recognition in net income resulting from sales of securities in unrealized gain positions... -

Page 135

... interest-sensitive products. The declines also reflect the divestiture of multiple life insurance operations, including the sales of Nan Shan, AIG Star and AIG Edison in 2011, the deconsolidation of AIA in 2010 and sale of ALICO in 2010. Change in Foreign Currency Translation Adjustments ...The... -

Page 136

...rate on pre-tax Other Comprehensive Income was 42.5 percent, primarily due to the effects of the AIA initial public offering, the ALICO disposition and changes in the estimated U.S. tax liability with respect to the potential sale of subsidiaries, including AIG Star and AIG Edison. ...AIG 2012 Form... -

Page 137

... markets. See Enterprise Risk Management - Risk Appetite, Identification, and Measurement and Liquidity Risk Management for additional information. Capital refers to the long-term financial resources available to support the operation of our businesses, fund business growth, and cover financial... -

Page 138

... includes repayments by AIG Parent of $3.2 billion. • AIG Parent Funding to Subsidiaries We made $1.2 billion in net capital contributions to subsidiaries, including a contribution of approximately $1.0 billion to AIG Property Casualty in the aftermath of Storm Sandy. ...AIG 2012 Form 10-K 121 -

Page 139

... investing activities Changes in policyholder contract balances Issuance of other long-term debt Federal Reserve Bank of New York credit facility borrowings Proceeds from drawdown on the Department of Treasury Commitment Issuance of Common Stock Net cash provided by other financing activities Total... -

Page 140

... the payment of claims or policy benefits. The ability of insurance companies to generate positive cash flow is affected by the frequency and severity of losses under their insurance policies, policy retention rates and operating expenses. Cash provided by AIG Property Casualty operating activities... -

Page 141

... in financing activities in 2010 reflected declines in policyholder contract withdrawals, due to improved conditions for the life insurance and retirement services businesses. This was partially offset by the issuance of long-term debt. Liquidity and Capital Resources of AIG Parent and Subsidiaries... -

Page 142

... from AIG Life and Retirement subsidiaries funded by payments of dividends from subsidiaries of which $1.6 billion represented proceeds from the FRBNY's sale of ML II assets; • approximately $1.5 billion in cash dividends from AIG Property Casualty; • $400 million in dividends from the AIA SPV... -

Page 143

... 2012, AIG Parent contributed $1.0 billion of capital to AIG Property Casualty U.S. insurance companies to strengthen capital levels, as a result of the impact of Storm Sandy-related catastrophe losses. AIG Parent could be required to provide additional funding to AIG Property Casualty subsidiaries... -

Page 144

...Parent, Chartis Inc. and certain AIG Property Casualty domestic insurance subsidiaries, entered into a single CMA, which replaced the CMAs entered into in February 2011. Under the 2012 CMA, the total adjusted capital and total authorized control level Risk-Based Capital (RBC) (as defined by National... -

Page 145

...minimum percentage of their respective Company Action Level RBC, AIG Parent will contribute cash or instruments admissible under applicable regulations to these AIG Life and Retirement insurance subsidiaries in the amount necessary to increase total adjusted capital to a level at least equal to such... -

Page 146

... holdings in municipal and corporate bonds totaling $3.5 billion at December 31, 2012. Global Capital Markets ...GCM acts as the derivatives intermediary between AIG and its subsidiaries and third parties to provide hedging services. It executes its derivative trades under International Swaps... -

Page 147

... the unconditional right, prior to December 15, 2015, to issue up to $500 million in senior debt to the counterparty, based on a put option agreement between AIG Parent and the counterparty. Our ability to borrow under this facility is not contingent on our credit ratings. ...130 AIG 2012 Form 10-K -

Page 148

...: December 31, 2012 (in millions) Total Payments 2013 Payments due by Period 2014 2015 2016 2017 Thereafter Insurance operations Loss reserves Insurance and investment contract liabilities Borrowings Interest payments on borrowings Operating leases Other long-term obligations Total Other and... -

Page 149

... liquidity in the form of cash and short-term investments. In addition, AIG Life and Retirement businesses maintain significant levels of investmentgrade fixed income securities, including substantial holdings in government and corporate bonds, and could seek to monetize those holdings in the event... -

Page 150

... in asset sales agreements. See Note 16 to the Consolidated Financial Statements for further information on indemnification obligations. . (c) Includes commitments to invest in private equity, hedge funds and mutual funds and commitments to purchase and develop real estate in the United States... -

Page 151

... 7 / LIQUIDITY AND CAPITAL RESOURCES Securities Financing ...At December 31, 2012, there were no securities transferred under repurchase agreements accounted for as sales and no related cash collateral obtained. See Note 2 to the Consolidated Financial Statements for additional information on the... -

Page 152

... financings and other secured financings Junior subordinated debt Total ILFC debt Other subsidiaries notes, bonds, loans and mortgages payable Debt of consolidated investments Total debt not guaranteed by AIG Total debt (a) Balance at December 31, 2011 Issuances Maturities and Repayments Effect... -

Page 153

... termination or limitation of credit availability or require accelerated repayment, (ii) the termination of business contracts or (iii) requirement to post collateral for the benefit of counterparties. In the event of adverse actions on our long-term debt ratings by the major rating agencies, AIGFP... -

Page 154

... into with our insurance subsidiaries, see Liquidity and Capital Resources of AIG Parent and Subsidiaries - AIG Property Casualty and Liquidity and Capital Resources of AIG Parent and Subsidiaries - AIG Life and Retirement. Dividend Restrictions ...Payment of future dividends to our shareholders... -

Page 155

... model for each of the businesses: AIG Property Casualty, AIG Life and Retirement, and the Direct Investment book. The primary objectives are generation of investment income, preservation of capital, liquidity management and growth of surplus to support the insurance products. The majority of assets... -

Page 156

... other structured securities to improve yields and increase net investment income. • We purchased an aggregate of $7.1 billion of CDOs sold in the FRBNY auctions of ML III assets, and elected fair value option accounting treatment on those assets. • Blended investment yields on new AIG Life and... -

Page 157

...AIG credit ratings of our fixed maturity securities calculated on the basis of their fair value: Available for Sale December 31, 2012 December 31, 2011 Trading December 31, 2012 December 31, 2011 Total December 31, 2012 December 31, 2011 ITEM 7 / INVESTMENTS Rating: Other fixed maturity securities... -

Page 158

... lines is greater than other lines. As differentiated from the life insurance and retirement services companies, the focus is not on asset-liability matching, but on preservation of capital and growth of surplus. Fixed income holdings of AIG Property Casualty domestic operations, with an average... -

Page 159

...taken positions in certain derivative financial instruments in order to hedge the impact of changes in equity markets and interest rates on these benefit guarantees. We execute listed futures and options contracts on equity indexes to hedge certain guarantees of variable and indexed annuity products... -

Page 160

... 3,624 Equity securities available for sale: Common stock Preferred stock Mutual funds Total equity securities available for sale Total $ 273,171 $ 267,605 * At December 31, 2012 and December 31, 2011, bonds available for sale held by us that were below investment grade or not rated totaled $29... -

Page 161

...: Money Center /Global Bank Groups Regional banks - other Life insurance Securities firms and other finance companies Insurance non-life Regional banks - North America Other financial institutions Utilities Communications Consumer noncyclical Capital goods Energy Consumer cyclical Other Total... -

Page 162

...available for sale investments by year of vintage: Fair Value at December 31, 2012 Fair Value at December 31, 2011 (in millions) Total RMBS 2012 2011 2010 2009 2008 2007 and prior* Total RMBS Agency 2012 2011 2010 2009 2008 2007 and prior Total Agency Alt-A 2010 2007 and prior Total Alt-A Subprime... -

Page 163

... Financial Statements, Investments - Purchased Credit Impaired (PCI) Securities, for additional discussion. (b) The weighted average expected life was 6 years at both December 31, 2012 and December 31, 2011, respectively. Our underwriting practices for investing in RMBS, other asset-backed... -

Page 164

... our CMBS available for sale investments by year of vintage: Fair Value at December 31, 2012 Fair Value at December 31, 2011 (in millions) Year: 2012 2011 2010 2009 2008 2007 and prior Total The following table presents our CMBS available for sale investments by credit rating: $ 1,427 1,347 807... -

Page 165

...on amortized cost: December 31, 2012 2011 Industry: Office Multi-family* Retail Lodging Industrial Other Total * Includes Agency-backed CMBS. 27% 23 25 13 6 6 100% 28% 26 25 8 6 7 100% The fair value of CMBS holdings remained stable throughout 2012. The majority of our investments in CMBS are in... -

Page 166

...credit rating: Fair Value at December 31, 2012 Fair Value at December 31, 2011 ITEM 7 / INVESTMENTS (in millions) Rating: AAA AA A BBB Below investment grade Total $ 144 542 1,284 485 583 $ 130 299 745 467 591 $ 3,038 $ 2,232 Commercial Mortgage Loans ...At December 31, 2012, we had direct... -

Page 167

... for sale Equity securities, available for sale Private equity funds and hedge funds Subtotal Life settlement contracts(a) Aircraft trusts Alternative investments Real estate(b) Total (a) (b) Impairments of investments in Life settlement contracts are recorded in Other realized losses. Impairments... -

Page 168

... on fixed maturity securities, equity securities, private equity funds and hedge funds. Other-than-temporary impairment charges by reportable segment and impairment type: Reportable Segment (in millions) AIG Property Casualty AIG Life and Retirement Other Operations Total ITEM 7 / INVESTMENTS For... -

Page 169

...Other Fixed Maturity Equities/Other Invested Assets* Total ITEM 7 / INVESTMENTS For the Year Ended December 31, 2012 Impairment Type: Severity Change in intent Foreign currency declines Issuer-specific credit events Adverse projected cash flows Total For the Year Ended December 31, 2011 Impairment... -

Page 170

...and • other impairments, including equity securities, private equity funds, hedge funds, direct private equity investments, aircraft trusts and investments in life settlement contracts. There was no significant impact to our consolidated financial condition or results of operations from other-than... -

Page 171

... to monitor these positions for potential credit impairments that could result from further deterioration in commercial and residential real estate fundamentals. See also Note 7 to the Consolidated Financial Statements for further discussion of our investment portfolio...154 AIG 2012 Form 10-K -

Page 172

...Officer (CRO) reports to both the FRMC and AIG's Chief Executive Officer (CEO). The Group Risk Committee (the GRC) is the senior management group charged with assessing all significant risk issues on a global basis in order to protect our financial strength, optimize our intrinsic value, and protect... -

Page 173

... business planning and are integrated into the management of our operations. Risk tolerances cover insurance company capital ratios as well as metrics associated with AIG Parent resources, including consolidated company capital ratios and parent liquidity. Our GRC routinely reviews the level of risk... -

Page 174

...credit ratings. We devote considerable resources to managing our direct and indirect credit exposures. These exposures may arise from fixed income investments, equity securities, deposits, reverse repurchase agreements and repurchase agreements, commercial paper, corporate and consumer loans, leases... -

Page 175

... credit exposure, apart from ILFC leasing arrangements secured by aircraft with airlines having below investment grade ratings, was related to a non-financial corporate counterparty and that exposure was 0.6 percent of Total equity, compared to 0.5 percent at December 31, 2011. Government Credit... -

Page 176

...the financial condition of issuers and adjust internal risk ratings as warranted. The result of these continuing reviews has led us to believe that our combined credit risk exposures to sovereign governments, financial institutions and non-financial corporations in the Euro-Zone are manageable risks... -

Page 177

... December 31, 2012 based on external rating agency ratings. In addition, we had commercial real estate-related net equity investments in Europe totaling $497 million at December 31, 2012 and related unfunded commitments of $105 million. ITEM 7 / ENTERPRISE RISK MANAGEMENT ...160 AIG 2012 Form 10-K -

Page 178

... and trading securities (at fair value), and exposure related to other insurance and financial services operations. We have a risk concentration in the residential mortgage sector in the form of non-agency RMBS, CDO of RMBS as well as our mortgage guaranty insurance business. See Investments... -

Page 179

..., minimum benefit guarantees embedded in the structure of certain variable annuity and variable life insurance products and other equity-like investments, such as hedge funds and private equity funds, private equity investments, commercial real estate and real estate funds. ...162 AIG 2012 Form 10... -

Page 180

... prices include investments in common stock, preferred stocks, mutual funds, hedge funds, private equity funds, commercial real estate and real estate funds, but exclude consolidated separate account assets. Total exposure in these areas decreased 30.3 percent or approximately $11.8 billion in 2012... -

Page 181

...our liquidity governance includes a number of liquidity and funding policies and monitoring tools to address both AIG-specific, broader industry and market related liquidity events. Sources of Liquidity risk can include, but are not limited to: • financial market movements - significant changes in... -

Page 182

... respective areas. These control functions include: SarbanesOxley (SOX), Business Continuity Management (BCM), Information Technology Security Risk, Compliance, and Vendor Management. Senior business operational risk executives report to their respective business unit chief risk officer and to the... -

Page 183

...• Mortgage Guaranty (United Guaranty Corporation) - We manage risks in the mortgage insurance business through geographic location of the insured properties, the relative economic conditions in the local housing markets, credit attributes of the borrowers, and the loan amount relative to the value... -

Page 184

... place as of January 1, 2013. Losses include loss adjustment expenses and the net values include reinstatement premiums. Net of 2013 Reinsurance, After Tax ITEM 7 / ENTERPRISE RISK MANAGEMENT At December 31, 2012 (in millions) Gross Net of 2013 Reinsurance Percent of Total Equity Natural Peril... -

Page 185

...other countries through various insurance products and participate in country terrorism pools when applicable. International terrorism exposure is managed through active aggregation control and targeted reinsurance purchases for lines of business such as commercial property, political risk, aviation... -

Page 186

... reinsurance subsidiaries of the companies listed as of February 6, 2013. Total reinsurance assets include both Property Casualty and Life and Retirement reinsurance recoverable. Excludes collateral held in excess of applicable treaty balances. (d) Includes $1.6 billion recoverable under the 2011... -

Page 187

... and assets to changes in interest rates; and • Equity market risk - represents the potential exposure to higher claim costs for guaranteed benefits associated with variable annuities and the potential reduction in expected fee revenue. AIG Life and Retirement manages these risks through product... -

Page 188

... Other Operations ...Global Capital Markets GCM actively manages its exposures to limit potential economic losses, and in doing so, GCM must continually manage a variety of exposures including credit, market, liquidity, operational and legal risks. The senior management of AIG defines the policies... -

Page 189

... of: • classification of ILFC as held for sale; • insurance liabilities, including property and casualty and mortgage guaranty unpaid claims and claims adjustment expenses and future policy benefits for life and accident and health contracts; • income tax assets and liabilities, including... -

Page 190

... (other than life-insurance-business capital loss carryforwards) prior to their expiration. For additional discussion of the recoverability of our net deferred tax asset, see Note 24 to the Consolidated Financial Statements. U.S. Income Taxes on Earnings of Certain Foreign Subsidiaries ...The... -

Page 191

...property, personal lines and certain casualty classes. Long-tail casualty classes of business include excess and umbrella liability, D&O, professional liability, medical malpractice, workers' compensation, general liability, products liability and related classes. Short-Tail Reserves For operations... -

Page 192

...longer appropriate, the loss ratio for current business is changed to reflect the revised assumptions. We conduct a comprehensive loss reserve review at least annually for each AIG Property Casualty subsidiary and class of business. The reserve analysis for each class of business is performed by the... -

Page 193

... of medical services) • underlying policy pricing, terms and conditions including attachment points and policy limits; • claims handling processes and enhancements; and • third-party actuarial reviews that are periodically performed for key classes of business. Loss reserve development can... -

Page 194

... of homogeneous types of claims for which loss severity trends from one year to the next are reasonably consistent. Generally these methods work best for high frequency, low severity classes of business such as personal auto. ITEM 7 / CRITICAL ACCOUNTING ESTIMATES Structural drivers analytics seek... -

Page 195

... the class of business for reported claims with extrapolation for unreported claims; • The effects of various runoff claims management strategies that have been developed by AIG's newly created run-off unit. Overall, our loss reserve reviews for long-tail classes typically utilize a combination of... -

Page 196

...claims. The expected loss ratios used for recent accident years are based on the projected ultimate loss ratios of prior years, adjusted for rate changes, estimated loss cost trends and all other changes that can be quantified. During 2012, we also completed a third party review of certain insureds... -

Page 197

... business from other business in evaluating workers' compensation reserves. In 2012, we segmented out New York from the other states to reflect its different development pattern and changing percentage of the mix by state. We also revised our assumptions to reflect changes in our claims management... -

Page 198

...of recently enacted health care reform on workers' compensation costs; • underlying policy pricing, terms and conditions; • claims settlement trends that can materially alter the mix and ultimate cost of claims; • changes in claims reporting and management practices of insureds and their third... -

Page 199

... long-tail nature of general liability business, and the many subclasses that are reviewed individually, there is less credibility given to the reported losses and increased reliance on expected loss ratio methods for recent accident years... Commercial Automobile Liability We generally use loss... -

Page 200

...an appropriate balance between credibility and homogeneity of the data. We also use claim department projections of the ultimate value of each reported claim to supplement and inform the standard actuarial approaches... Catastrophic Casualty We use expected loss ratio methods for all accident years... -

Page 201

... of risk in force. Reserves are reviewed separately for each line of business considering the loss development characteristics, volume of claim data available and applicability of various actuarial methods to each line. Reserves for mortgage guaranty insurance losses and loss adjustment expenses... -

Page 202

... reserves without any of business written by AIG Property Casualty internationally is distortion from changes in exchange rates over time. Our short-tail, high frequency and low severity in nature. For this actuaries segment the international data by region, country or business, loss development... -

Page 203

... of the changes in the loss trends, terms and conditions, claims handling practices, and large loss impact when determining the methods, assumptions and the estimations. This multi-disciplinary process engages underwriting, claims, risk management, business unit executives and senior management and... -

Page 204

... deviation in loss year-end 2012 reserve review. The loss cost development factors might not be discernible for trend assumption is critical for the excess an extended period of time subsequent to the casualty class of business due to the long-tail recording of the initial loss reserve estimates for... -

Page 205

... for all but the most recent accident year's reserves, so there is limited need to rely on loss cost trend assumptions for primary workers' compensation business. Excess Workers' Compensation Excess workers' compensation is an extremely long-tail class of business, with a much greater than normal... -

Page 206

... benefit reserves are: • Investment returns: which vary by year of issuance and products. • Mortality, morbidity and surrender rates: based upon actual experience modified to allow for variation in policy form, risk classification and distribution channel. • Premium rate increases (Long-term... -

Page 207

...balance sheet date, as if the securities had been sold at their stated aggregate fair value and the proceeds reinvested at current yields. Significant unrealized appreciation on investments in a prolonged low interest rate environment may cause DAC to be adjusted and additional future policy benefit... -

Page 208

... 2012 balances. The effect of changes in the equity markets, volatility and interest rates primarily impacts individual variable annuities (SunAmerica Retirement Markets) and group retirement products (VALIC). The effect of changes in mortality primarily impacts the universal life insurance business... -

Page 209

... Financial Statements for more detailed information about the measurement of fair value of financial assets and financial liabilities and how our accounting policy incorporates credit risk in fair value measurements. The following table presents the fair value of fixed maturity and equity securities... -

Page 210

... other invested assets, as well as discussion of transfers of Level 3 assets and liabilities. ITEM 7 / CRITICAL ACCOUNTING ESTIMATES Super Senior Credit Default Swap Portfolio ...The entities included in GCM wrote credit protection on the super senior risk layer of collateralized loan obligations... -

Page 211

...- ITEM 7 / CRITICAL ACCOUNTING ESTIMATES (dollars in millions) Bond prices Weighted average life Recovery rates Diversity score(a) Discount curve(b) (a) Change Increase of 5 points Decrease of 5 points Increase of 1 year Decrease of 1 year Increase of 10% Decrease of 10% Increase of 5 Decrease of... -

Page 212

...gains) losses, and changes in benefit reserves and DAC, VOBA, and SIA related to net realized capital (gains) losses. AIG Life and Retirement - Premiums, deposits and other considerations includes life insurance premiums and deposits on annuity contracts and mutual funds. AIG Property Casualty - Net... -

Page 213

... group of claims. Loss reserves Liability for unpaid claims and claims adjustment expense. The estimated ultimate cost of settling claims relating to insured events that have occurred on or before the balance sheet date, whether or not reported to the insurer at that date. LTV Loan-to-Value Ratio... -

Page 214

... of property, personal lines and certain casualty classes. SIA Sales Inducement Asset Represents amounts that are credited to policyholder account balances related to the enhanced crediting rates that a seller offers on certain of its annuity products. SIFI Systemically Important Financial... -

Page 215

...a social security number during their lifetimes, maintained by the U.S. Social Security Administration. Surrender charge A charge levied against an investor for the early withdrawal of funds from a life insurance or annuity contract, or for the cancellation of the agreement. Unearned premium reserve... -

Page 216

... and Health Insurance ABS Asset-Backed Security CDO Collateralized Debt Obligation CDS Credit Default Swap CLO Collateralized Loan Obligations CMA Capital Maintenance Agreement CMBS Commercial Mortgage Backed Securities FASB Financial Accounting Standards Board FRBNY Federal Reserve Bank of New York... -

Page 217

... DISCLOSURES ABOUT MARKET RISK ...The information required by this item is set forth in the Enterprise Risk Management section of Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations and is incorporated herein by reference. ...200 AIG 2012 Form 10-K -

Page 218

...AND SCHEDULES ITEM 8 / FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA ... AMERICAN INTERNATIONAL GROUP, INC. INDEX TO FINANCIAL STATEMENTS AND SCHEDULES Page ... FINANCIAL STATEMENTS ...Report of Independent Registered Public Accounting Firm 203 Consolidated Balance Sheet at December 31, 2012 and 2011... -

Page 219

...Schedule I Summary of Investments - Other than Investments in Related Parties at December 31, 2012 357 Schedule II Condensed Financial Information of Registrant at December 31, 2012 and 2011 and for the years ended December 31, 2012, 2011 and 2010 358 Schedule III Supplementary Insurance Information... -

Page 220

... statements, as of January 1, 2012, AIG retrospectively adopted a new accounting standard that amends the accounting for costs incurred by insurance companies that can be capitalized in connection with acquiring or renewing insurance contracts. A company's internal control over financial reporting... -

Page 221

... 2011 (portion measured at fair value: 2012 - $696; 2011 - $0) Separate account assets, at fair value Assets held for sale Total assets Liabilities: Liability for unpaid claims and claims adjustment expense Unearned premiums Future policy benefits for life and accident and health insurance contracts... -

Page 222

... INTERNATIONAL GROUP, INC. CONSOLIDATED STATEMENT OF OPERATIONS Years Ended December 31, (dollars in millions, except per share data) Revenues: Premiums Policy fees Net investment income Net realized capital gains (losses): Total other-than-temporary impairments on available for sale securities... -

Page 223

AMERICAN INTERNATIONAL GROUP, INC. CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME (LOSS) Years Ended December 31, (in millions) 2012 2011 2010 Net income Other comprehensive income (loss), net of tax Change in unrealized appreciation (depreciation) of fixed maturity investments on which other-than-... -

Page 224

... INTERNATIONAL GROUP, INC. CONSOLIDATED STATEMENT OF EQUITY Non Total AIG redeemable Sharenonholders' controlling Equity Interests (in millions) Balance, January 1, 2010 Cumulative effect of change in accounting principle, net of tax Series F drawdown Common stock issued Equity unit exchange Net... -

Page 225

... assets Changes in operating assets and liabilities: General and life insurance reserves Premiums and other receivables and payables - net Reinsurance assets and funds held under reinsurance treaties Capitalization of deferred policy acquisition costs Current and deferred income taxes - net Payment... -

Page 226

... Cash Flow Information Years Ended December 31, (in millions) 2012 2011 2010 Cash paid during the period for: Interest* Taxes Non-cash financing/investing activities: Interest credited to policyholder contract deposits included in financing activities Exchange of equity units and extinguishment... -

Page 227

... of International Lease Finance Corporation (ILFC) as held for sale; • insurance liabilities, including property and casualty and mortgage guaranty unpaid claims and claims adjustment expenses and future policy benefits for life and accident and health contracts; • income tax assets and... -

Page 228

... our interests in AIA Group Ltd. (AIA) and American Life Insurance Company (ALICO). There was no effect on Total AIG shareholders' equity or on Total equity as a result of this reclassification. • Changes were made to the presentation within the Consolidated Statement of Operations to align the... -

Page 229

... and securities sold under agreements to repurchase for which the fair value option was elected. • Realized capital gains and losses from the sales of available for sale securities and investments in private equity funds and hedge funds and other investments. • Income earned on real estate based... -

Page 230

... paid and changes in future policy benefits liabilities. Benefits for universal life and investment-type products primarily consist of benefit payments made in excess of policy account balances except for certain contracts for which the fair value option was elected, for which benefits represent the... -

Page 231

... value of the reporting units was determined by allocating the carrying value of AIG Property Casualty to those units based upon an internal capital allocation model. In connection with the announcement of the ILFC sale, discussed in Note 4, and management's determination that the reporting unit... -

Page 232

... table presents the changes in goodwill by reportable segment: AIG Property Casualty Aircraft Leasing ITEM 8 / NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (in millions) Other Total Balance at December 31, 2010: Goodwill - gross Accumulated impairments Net goodwill Increase (decrease) due... -

Page 233

... values of spot commodities sold but not yet purchased are based on current market prices of reference spot futures contracts traded on exchanges. For further discussion of secured financing arrangements, see Note 7 herein. (q) Long-term debt: For a discussion of our accounting policies on long-term... -

Page 234

... or renewal of insurance contracts. We also defer a portion of employee total compensation and payroll-related fringe benefits directly related to time spent performing specific acquisition or renewal activities, including costs associated with the time spent on underwriting, policy issuance and... -

Page 235

... Statement of Operations: Total net realized capital gains Total revenues Interest credited to policyholder account balances Amortization of deferred acquisition costs Other acquisition and other insurance expenses Net (gain) loss on sale of properties and divested businesses Total benefits, claims... -

Page 236

... 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Statement of Operations: Total net realized capital losses Total revenues Interest credited to policyholder account balances Amortization of deferred acquisition costs Other acquisition and other insurance expenses Net (gain) loss on sale of properties... -

Page 237

... International Financial Reporting Standards (IFRS). The measurement and disclosure requirements under GAAP and IFRS are now generally consistent, with certain exceptions including the accounting for day one gains and losses, measuring the fair value of alternative investments using net asset value... -

Page 238

... financial condition, results of operations or cash flows. ITEM 8 / NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Accounting Standards Adopted During 2011 ...In January 2010, the FASB issued an accounting standard that requires fair value disclosures about significant transfers between Level... -

Page 239

...the application of the fair value option to the entire hybrid instrument. The adoption of these standards did not have a material effect on our consolidated financial condition, results of operations or cash flows. ITEM 8 / NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES ...222 AIG 2012 Form 10... -

Page 240

... savings and income solutions. AIG Life and Retirement offers a comprehensive suite of products and services to individuals and groups, including term life insurance, universal life insurance, accident and health (A&H) insurance, fixed and variable deferred annuities, fixed payout annuities, mutual... -

Page 241

... 2011 AIG Property Casualty Commercial Insurance Consumer Insurance Other Total AIG Property Casualty AIG Life and Retirement Life Insurance Retirement Services Total AIG Life and Retirement Other Operations Mortgage Guaranty Global Capital Markets Direct Investment Book Retained Interests Corporate... -

Page 242

...2010 AIG Property Casualty Commercial Insurance Consumer Insurance Other Total AIG Property Casualty AIG Life and Retirement Life Insurance Retirement Services Total AIG Life and Retirement Other Operations Mortgage Guaranty Global Capital Markets Direct Investment Book Retained Interests Corporate... -

Page 243

... Insurance Other Total AIG Property Casualty AIG Life and Retirement Life Insurance Retirement Services Consolidation and Elimination Total AIG Life and Retirement Other Operations Mortgage Guaranty Global Capital Markets Direct Investment Book Retained Interests Corporate & Other Aircraft Leasing... -

Page 244

... table presents AIG's consolidated operations and long-lived assets by major geographic area: Real estate and other fixed assets, net of accumulated depreciation 2010 2012 2011 2010 ITEM 8 / NOTE 3. SEGMENT INFORMATION Total revenues(a) (in millions) 2012 2011 United States Asia Other Foreign... -

Page 245

... 2012. Prior to the disposition, we accounted for our investment in AIA under the fair value option with gains and losses recorded in Net investment income. At December 31, 2011, the fair value of our retained interest in AIA was approximately $12.4 billion, and was included in Other invested assets... -

Page 246

...: Equity securities Mortgage and other loans receivable, net Flight equipment primarily under operating leases, net of accumulated depreciation Short-term investments Cash Premiums and other receivables, net of allowance Other assets Assets of businesses held for sale Less: Loss Accrual Total assets... -

Page 247

... the sale of Delaware American Life Insurance Company by AIG to MetLife, for consideration then valued at approximately $15.5 billion, consisting of $6.8 billion in cash and the remainder in equity securities of MetLife, subject to closing adjustments. The ALICO sale closed on November 1, 2010. We... -

Page 248

... (loss) from discontinued operations: Years Ended December 31, (in millions) 2012 2011 2010 Revenues: Premiums Net investment income Net realized capital gains Aircraft leasing revenue Other income Total revenues Benefits, claims and expenses, excluding Aircraft leasing expenses Aircraft leasing... -

Page 249