AIG 2007 Annual Report Download

Download and view the complete annual report

Please find the complete 2007 AIG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERICAN INTERNATIONAL GROUP, INC.

Annual Report

Table of contents

-

Page 1

Annual Report A M E R I C A N I N T E R N A T I O N A L G R O U P, I N C . -

Page 2

... customers through the most extensive worldwide property-casualty and life insurance networks of any insurer. In addition, AIG companies are leading providers of retirement services, ï¬nancial services and asset management around the world. AIG's common stock is listed on the New York Stock... -

Page 3

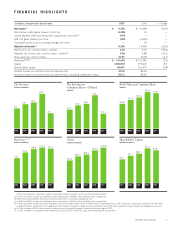

... gains and losses. (e) In 2006, includes a $730 million increase in revenue for out of period adjustments related to the accounting for UCITS. (f) In 2007, includes an unrealized market valuation loss of $11.5 billion on AIGFP's super senior credit default swap portfolio. AIG 2007 Annual Report 1 -

Page 4

... to the AIG Financial Products Corp. (AIGFP) super senior credit default swap portfolio. Based upon its most current analysis, AIG believes any losses that are realized over time on the super senior credit default swap portfolio of AIGFP will not be material to AIG's 2 AIG 2007 Annual Report -

Page 5

... to establish a wholly owned general insurance subsidiary in China (pictured, Shanghai skyline). The AIG Private Client Group's Wildï¬re Protection Unit® uses the latest ï¬re-mitigation technology to help protect policyholders' properties in the western United States. AIG 2007 Annual Report 3 -

Page 6

...compete more effectively in the U.S. auto insurance marketplace. Through AIG-managed funds, we are a leading investor in the infrastructure business. In 2007, our investments in P&O Ports North America, AMPORTS and MTC Holdings were organized under one management structure. We believe the new entity... -

Page 7

...market conditions. The Domestic Brokerage Group (DBG), which provides commercial insurance products and services to a wide range of businesses in the United States, had a record year, with operating income climbing 25 percent. DBG is the largest property-casualty insurance organization in the United... -

Page 8

... Domestic Personal Lines businesses. However, consolidation and product innovation will improve our market position going forward. AIG Private Client Group, which insures more than one-third of the Forbes 400 Richest Americans, achieved net written premium growth in excess of 37 percent. The group... -

Page 9

...of AIG's retirement services capabilities while supporting our global branding initiative. Financial Services AIG's International Lease Finance Corporation (ILFC) has the largest aircraft ï¬,eet in the world, as measured by ï¬,eet value, and is the largest single customer to date for the new Boeing... -

Page 10

.... AIG Global Real Estate Investment Corp. expanded its investment and development platforms, increasing its equity under management to more than $23 billion, and adding new employees in strategic markets such as the Middle East, India and other countries throughout Asia. Public Policy and Corporate... -

Page 11

... and generate excess capital. In March, the Board approved a new dividend policy, which provides that, under ordinary circumstances, AIG plans to increase its common stock dividend by approximately 20 percent annually. The new policy became effective in May 2007, when the Board voted to increase the... -

Page 12

...; all of our dedicated employees around the world, who truly make AIG the great company that it is; and you, our shareholders, for your support and conï¬dence in investing in AIG. Sincerely, Martin J. Sullivan President and Chief Executive Ofï¬cer March 14, 2008 10 AIG 2007 Annual Report -

Page 13

... and sales representatives strive to exceed client expectations with market-leading products and services. In the following pages, we share with you, our shareholders, what we see and what we do every day to help our clients achieve success-in both local and global markets. AIG 2007 Annual Report... -

Page 14

... process, the client entrusted AIG Investments with $175 million to invest in its International Small Cap equity strategy, based on its strong long-term performance record and proven investment process, as well as the depth of experience of the portfolio management team. 12 AIG 2007 Annual Report -

Page 15

... within American International Underwriters is focused on giving corporations with sales of over $500 million broader access to the AIG enterprise. Average products per customer increased from 3.63 to 4.12 in 2007- equating to 1,866 new products for existing customers. The cross-sell rate for... -

Page 16

... and healthcare services. This demographic shift presents great opportunities for AIG's Life Insurance & Retirement Services businesses, as well as Asset Management, to provide products such as supplemental medical coverage, investment options and retirement advice. 14 AIG 2007 Annual Report -

Page 17

... life insurance, consumer goods and travel. This trend will continue to increase demand for AIG's personal lines, travel insurance, consumer lending products and International Lease Finance Corporation's modern aircraft. Increases in severe risks continue to be a challenge for all global businesses... -

Page 18

...insurance, consumer ï¬nance, real estate, asset management, infrastructure investments, mutual funds and private equity. Consumerism is gaining ground in many Eastern European countries. The appetite for consumer goods and upscale lifestyles offers AIG more opportunities to sell insurance products... -

Page 19

As trade barriers fall and more countries open their markets, AIG sees growth opportunities around the world for its full range of products and services. The demand for insurance, retirement services, consumer ï¬nance, private banking and asset management offerings is growing in tandem with the ... -

Page 20

... customers, producers and employees. For the ï¬rst time, AIG made BusinessWeek 's annual list of the top 100 global brands in 2007, ranking 47th overall and ï¬rst among insurance companies, with an estimated $7.5 billion brand value. AIG also ranked 30th on the Barron's 2007 survey of "The World... -

Page 21

... convey the products and services they offer, several U.S. business units changed their names last year. For example, National Union was re-branded as AIG Executive Liability, and AIG Global Investment Group as AIG Investments. A number of business units in international markets also underwent... -

Page 22

... management and investment decision making. We also grew our philanthropic programs at both the corporate and local levels, leveraging our global reach and relationships with partners in the community. WE SEE THE CHANCE TO MAKE THE WORLD A MORE PROSPEROUS AND LIVABLE PLACE. 20 AIG 2007 Annual Report -

Page 23

... ethnic groups and women around the world. AIG is also recognized for reaching out to people with disabilities. In 2007, New York City Mayor Michael R. Bloomberg recognized AIG with the ADA (Americans with Disabilities Act) Employment Award for its disability initiatives. AIG 2007 Annual Report 21 -

Page 24

... AIG's ï¬nancial strength. AIG's franchise has remarkable reach, relationships and resources. Our global footprint, diverse distribution model, extensive product range and ï¬nancial strength make AIG uniquely suited to serve customers and communities around the world. 22 AIG 2007 Annual Report -

Page 25

... role in our company's global growth and success. Both distinctive and inclusive, the AIG Vision is: To be the world's ï¬rst-choice provider of insurance and ï¬nancial services. We will create unmatched value for our customers, colleagues, business partners and shareholders as we contribute... -

Page 26

...provider of commercial umbrella and excess casualty liability insurance. ï® AIG Specialty Workers' Compensation® is a market-leading workers' compensation insurer for small and midsize businesses. ï® AIG Risk Management® provides casualty risk management products and services to large commercial... -

Page 27

... United States. Revenues by Major Business Segment* (billions of dollars) 49.2 51.7 50.9 53.6 2006 2007 7.8 4.5 (1.3) 5.6 * Includes net realized capital gains (losses). General Insurance Life Insurance & Retirement Services Financial Services Asset Management AIG 2007 Annual Report... -

Page 28

...-casualty network, a personal lines business with an emphasis on auto insurance and high-net-worth clients, a mortgage guaranty insurance operation and an international reinsurance organization. General Insurance Financial Results (in millions, except ratios) Domestic Brokerage Group AIG's Domestic... -

Page 29

Domestic Brokerage Group- Gross Premiums Written by Line of Business Total = $31.8 billion Workers' Compensation General Liability/Auto Liability Property Management/Professional Liability Commercial Umbrella/Excess Programs A&H Products Multinational P&C Environmental Boiler and Machinery Aviation... -

Page 30

... risks. Personal Lines-Gross Premiums Written Total = $5.0 billion aigdirect.com AIG Agency Auto AIG Private Client Group 59.2% 22.5% 18.3% the efï¬ciency and service capabilities of customer call centers; and introduced processes and systems to support a faster, fairer and consistent claims... -

Page 31

... strategy to diversify income sources, UGC added new customers and products in the domestic private education loan business; opened a business development ofï¬ce in India; obtained licenses in Korea and Mexico; and began writing mortgage insurance in Canada. As mortgage lenders and investors return... -

Page 32

...customers in Southeast Asia. Foreign General Insurance- Gross Premiums Written by Division Total = $19.8 billion Property/Energy/Marine Accident and Health Specialty Lines Personal Lines Casualty Lloyd's Aviation Other/Service Business 24.3% 18.4% 16.2% 15.9% 11.9% 5.7% 3.0% 4.6% The acquisition... -

Page 33

... proï¬table strategies in directors and ofï¬cers liability coverage for companies trading on the London Stock Exchange's Alternative Investment Market. The acquisition of Direct Travel Insurance Services Limited in 2007 will further complement AIG's accident and health insurance business in this... -

Page 34

... in Shanghai in 1992. In 2007, AIA China reached the milestone of 30,000 agents, the largest agency force among foreign life insurance companies in the country. It established 29 new sales and service centers for a total of 104 centers in 19 cities in the country. 32 AIG 2007 Annual Report -

Page 35

... premium and proï¬t growth. This was achieved by direct life insurance sales via sponsoring partners, direct sales to the public, credit life and growth in the broker distribution channels. ALICO opened a new branch in Germany to sell various life, and accident and sickness protection products... -

Page 36

... through AIG's various foreign life companies and partners around the globe, the AIG Group Management Division (GMD) provides group employee beneï¬ts, credit insurance, and pension products and services to corporate customers in more than 80 countries. In 2007, each of GMD's three core businesses... -

Page 37

... account management team helped AIG Annuity strengthen existing client relationships and improve market share at its largest bank partners. Group Retirement Products Individual Fixed Annuities and Run off Individual Variable Annuities Life Insurance Payout Annuities Home Service Group Life/Health... -

Page 38

...in 1995, AIG Consumer Finance Group, Inc. (CFG) now has four million customers worldwide, offering products that include personal loans, auto loans, credit cards, sales ï¬nance and mortgages. 2007 was both a year of organic growth and global expansion. CFG made several strategic acquisitions, added... -

Page 39

... presence in emerging and developing countries throughout the world. Imperial A.I. Credit Companies, Inc., the largest ï¬nancer of insurance premiums in North America, continued to grow its high-net-worth life insurance ï¬nancing business in 2007. It implemented new marketing initiatives to grow... -

Page 40

... AIG insurance company invested assets.These businesses include retail mutual funds, broker-dealer services, private banking and spread-based investment businesses. Asset Management Financial Results (in millions) 2007 2006 Revenues(a) Operating income excluding net realized capital gains (losses... -

Page 41

... its market positioning with value-added programs, such as Retirement Income Strategy. This comprehensive tool assists ï¬nancial advisors nationwide in helping clients plan for both accumulation and distribution of assets in retirement. The AIG Advisor Group, Inc., the nation's largest independent... -

Page 42

... a modest allocation to public and private equities. For Domestic Life Insurance & Retirement Services and Asset Management companies, the portfolios consist principally of investment grade corporate debt securities and highly rated mortgagebacked and asset-backed securities. In addition, a small... -

Page 43

... of guaranteed investment agreements, notes and other bonds in short- and medium-term securities of high credit quality. Aircraft owned by ILFC for lease to commercial airlines around the world is the other principal component of Financial Services cash and invested assets. At year end, the net book... -

Page 44

... ratio, excluding current year catastrophe-related losses, change in estimate for asbestos and environmental reserves, and reserve charge Life Insurance & Retirement Services revenues: Premiums and other considerations Net investment income Net realized capital gains (losses) Total Life Insurance... -

Page 45

..., AIGFP began applying hedge accounting for certain of its interest rate swaps and foreign currency forward contracts, hedging its investments and borrowings. (g) In 2007, includes an unrealized market valuation loss of $11.5 billion on AIGFP's super senior credit default swap portfolio. (h) In 2005... -

Page 46

... report for the composition of total cash and invested assets. (b) Represents consolidated General Insurance net reserves for losses and loss expenses. (c) 2007 revenues include an unrealized market valuation loss of $11.5 billion on AIGFP's super senior credit default swap portfolio. See Management... -

Page 47

American International Group, Inc. and Subsidiaries (in millions, except per share amounts and ratios) Years Ended /As of December 31, 2007 2006 2005 2004 2003 Compound Annual Growth Rate 2003-2007 Return on Equity (ROE):(a) ROE, GAAP basis Per Common Share Data: Net income Basic Diluted ... -

Page 48

... ratios) Consolidated(a) 2007 2006 Years Ended December 31, General Insurance Operating Results Gross premiums written Net premiums written Net premiums earned Underwriting proï¬t (loss) Net investment income Operating income (loss) before net realized capital gains (losses) Net realized capital... -

Page 49

American International Group, Inc. and Subsidiaries Domestic Brokerage Group 2007 2006 Domestic Personal Lines 2007 2006 Mortgage Guaranty (UGC) 2007 2006 Transatlantic 2007 2006 Foreign General 2007 2006 $ 31,759 24,112 23,849 3,501 3,879 7,380 (75) $ 7,305 85.52 $31,584 24,312 23,910 2,336 ... -

Page 50

... non-GAAP basis. Excludes net realized capital gains (losses). Includes structured settlements, single premium immediate annuities and terminal funding annuities. Primarily represents run off annuity business sold through discontinued distribution relationships. Life Insurance & Retirement Services... -

Page 51

...33.9 Domestic Foreign 50.8 17.5 16.9 Life Insurance Personal Accident and Health Group Life /Health 78.1% 12.8% 9.1% 2003 2004 2005 2006 2007 * Excludes net realized capital gains (losses). Foreign Retirement Services-Premiums, Deposits and Other Considerations by Major Product Total = $19... -

Page 52

...Global Business Services IBM Corporation Stephen L. Hammerman Retired Vice Chairman Merrill Lynch & Co., Inc. Former Deputy Police Commissioner New York City Police Department Martin J. Sullivan President and Chief Executive Ofï¬cer American International Group, Inc. Frank G. Zarb Senior Advisor... -

Page 53

...of AIG Companies in Japan and Korea Kevin H. Kelley Edward T. Cloonan Vice President Corporate Affairs Senior Vice President Domestic General Insurance Jacob A. Frenkel Vice Chairman Global Economic Strategies Mark T. Willis Stephen P. Collesano Vice President Research and Development Senior Vice... -

Page 54

... General and Chairman of the Board of Directors Arab Fund for Economic and Social Development Frank Chan Senior Vice President Life Insurance Edward E. Matthews Matthew E. Winter Senior Vice President Life Insurance Retired Senior Vice Chairman American International Group, Inc. New York, New York... -

Page 55

... Street, New York, New York (Address of principal executive ofï¬ces) Registrant's telephone number, including area code (212) 770-7000 Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common Stock, Par Value $2.50 Per Share... -

Page 56

... and Corporate Governance Executive Compensation Security Ownership of Certain Beneï¬cial Owners and Management and Related Stockholder Matters Certain Relationships and Related Transactions, and Director Independence Principal Accountant Fees and Services Exhibits and Financial Statement Schedules... -

Page 57

... Services International Lease Finance Corporation (ILFC) AIG Financial Products Corp. and AIG Trading Group Inc. and their respective subsidiaries (collectively, AIGFP) American General Finance, Inc. (AGF) AIG Consumer Finance Group, Inc. (AIGCFG) Imperial A.I. Credit Companies (A.I. Credit) Asset... -

Page 58

... 1 and 2 to Consolidated Financial Statements. Years Ended December 31, (in millions) 2007 2006(a) 2005(a) 2004(a) 2003(a) General Insurance operations: Gross premiums written Net premiums written Net premiums earned Net investment income(b) Net realized capital gains (losses) Operating income... -

Page 59

... accounting for certain of its interest rate swaps and foreign currency forward contracts hedging its investments and borrowings. (h) In 2007, both revenues and operating income (loss) include an unrealized market valuation loss of $11.5 billion on AIGFP super senior credit default swap portfolio... -

Page 60

...Agency Auto Division, as well as a broad range of coverages for high net worth individuals through the AIG Private Client Group. DBG AIG's primary Domestic General Insurance division is DBG. DBG's business in the United States and Canada is conducted through American Home, National Union, Lexington... -

Page 61

American International Group, Inc. and Subsidiaries changes in currency rates. See also Note 1(ff) to Consolidated Financial Statements. Management reviews the adequacy of established loss reserves utilizing a number of analytical reserve development techniques. Through the use of these techniques,... -

Page 62

...environmental claims. See also Management's Discussion and Analysis of Financial Condition and Results of Operations - Operating Review - General Insurance Operations - Reserve for Losses and Loss Expenses. (in millions) 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 Net Reserves... -

Page 63

...environmental claims. See also Management's Discussion and Analysis of Financial Condition and Results of Operations - Operating Review - General Insurance Operations - Reserve for Losses and Loss Expenses. (in millions) 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 Net Reserves... -

Page 64

...AIG's Life Insurance & Retirement Services operations provide insurance, ï¬nancial and investment-oriented products throughout the world. Insurance-oriented products consist of individual and group life, payout annuities (including structured settlements), endowment and accident and health policies... -

Page 65

... structured notes and other securities and entering into guaranteed investment agreements (GIAs). Financial Services Operations AIG's Financial Services subsidiaries engage in diversiï¬ed activities including aircraft and equipment leasing, capital markets, consumer ï¬nance and insurance premium... -

Page 66

..., AIG Investments offers hedge and private equity fund-of-funds, direct investments and distressed debt investments. AIG Global Real Estate provides a wide range of real estate investment and management services for AIG subsidiaries, as well as for third-party institutional investors, high net worth... -

Page 67

... to measure the adequacy of an insurer's statutory surplus in relation to the risks inherent in its business. Thus, inadequately capitalized general and life insurance companies may be identiï¬ed. The U.S. RBC formula develops a risk-adjusted target level of statutory AIG 2007 Form 10-K 13 -

Page 68

... Condition and Results of Operations - Capital Resources and Liquidity - Regulation and Supervision and Note 15 to Consolidated Financial Statements. Competition AIG's Insurance, Financial Services and Asset Management businesses operate in highly competitive environments, both domestically... -

Page 69

... President - Domestic General Insurance Executive Vice President and Chief Investment Ofï¬cer Executive Vice President - Domestic Personal Lines Executive Vice President - Foreign General Insurance Executive Vice President - Retirement Services Senior Vice President - Financial Services Senior Vice... -

Page 70

... structured securities, direct private equities, limited partnerships, hedge funds, mortgage loans, flight equipment, finance receivables and real estate are relatively illiquid. These asset classes represented approximately 23 percent of the carrying value of AIG's total cash and invested assets... -

Page 71

American International Group, Inc. and Subsidiaries including the residential mortgage-backed securities portfolio. If AIG requires significant amounts of cash on short notice in excess of normal cash requirements or is required to post or return collateral in connection with its investment ... -

Page 72

... upon surrender and withdrawals of certain life insurance policies and annuity contracts, AIG's results of operations could be negatively affected. DAC for both insurance-oriented and investment-oriented products as well as retirement services products is reviewed for recoverability, which involves... -

Page 73

... - Management's Report on Internal Control Over Financial Reporting. Foreign Operations Foreign operations expose AIG to risks that may affect its operations, liquidity and ï¬nancial condition. AIG provides insurance, investment and other ï¬nancial products and services to both businesses and... -

Page 74

.... An excess policy issued by a subsidiary of AIG with respect to the 1999 litigation was expressly stated to be without limit of liability. In the current actions, plaintiffs allege that the judge approving the 1999 settlement was misled as to the extent of available insurance coverage and would... -

Page 75

...Fund. The National Association of Insurance Commissioners has formed a Market Analysis Working Group directed by the State of Indiana, which has commenced its own investigation into the underreporting of workers compensation premiums. In early 2008, AIG was informed that the Market Analysis Working... -

Page 76

... AIG's insurance coverage limits. Securities Action - Oregon State Court. On February 27, 2008, The State of Oregon, by and through the Oregon State Treasurer, and the Oregon Public Employee Retirement Board, on behalf of the Oregon Public Employee Retirement Fund, ï¬led a lawsuit against American... -

Page 77

...contracted with the broker defendants for the provision of insurance brokerage services for a variety of insurance needs. The broker defendants are alleged to have placed insurance coverage on the plaintiffs' behalf with a number of insurance companies named as defendants, including AIG subsidiaries... -

Page 78

... employers alleging claims on behalf of two separate nationwide purported classes: an employee class and an employer class that acquired insurance products from the defendants from August 26, 1994 to the date of any class certiï¬cation. The First Employee Beneï¬ts Complaint names AIG, as well... -

Page 79

... Department of Financial Services, and the Florida Ofï¬ce of Insurance Regulation. The agreement with the Texas Attorney General also settles allegations of anticompetitive conduct relating to AIG's relationship with Allied World Assurance Company and includes an additional settlement payment... -

Page 80

... of dividends to AIG by some of its insurance subsidiaries, see Note 14 to Consolidated Financial Statements. The following table summarizes AIG's stock repurchases for the three-month period ended December 31, 2007: Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs... -

Page 81

...St. Paul Travelers Companies, Inc.) and XL Capital Ltd. FIVE-YEAR CUMULATIVE TOTAL SHAREHOLDER RETURNS Value of $100 Invested on December 31, 2002 $250 $200 $150 $100 $50 $0 2002 2003 2004 Years Ending 2005 2006 2007 AMERICAN INTERNATIONAL GROUP S&P 500 INDEX PEER GROUP As of December... -

Page 82

..., except per share data) 2007 2006(a) 2005(a) 2004(a) 2003(a) Revenues : Premiums and other considerations Net investment income Net realized capital gains (losses) Unrealized market valuation losses on AIGFP super senior credit default swap portfolio Other income Total revenues Beneï¬ts... -

Page 83

... effect on AIG's businesses, financial condition, results of operations, cash flows and liquidity, AIG's exposures to subprime mortgages, monoline insurers and the residential real estate market and AIG's strategy for growth, product development, market position, financial results and reserves... -

Page 84

... among the largest life insurance and retirement services operations as well. AIG's Financial Services businesses include commercial aircraft and equipment leasing, capital markets operations and consumer ï¬nance, both in the United States and abroad. AIG also provides asset management services to... -

Page 85

... of the 2007 combination of AIG Direct and 21st Century Insurance Group (21st Century) operations, to support growth. The high net worth market continues to provide opportunities for growth as a result of AIG's innovative products and services speciï¬cally designed for that market. Losses caused by... -

Page 86

... high net worth consumers through the newly formed Wealth Management Group. Domestically, AIG plans to continue expansion of its Life Insurance & Retirement Services businesses through direct marketing and independent agent distribution channels. The aging population in the United States provides... -

Page 87

... to credit and market risk in the form of investments in, among other asset classes, U.S. residential mortgage-backed securities, assetbacked securities, commercial mortgage-backed securities and single name corporate credit default swaps entered into by the MIP. In addition, earnings volatility for... -

Page 88

... credit default swap portfolio. Net realized capital losses totaled $2.6 billion before tax in the fourth quarter of 2007, arising primarily from other-than-temporary impairment charges in AIG's investment portfolio, with an additional $643 million impairment charge related to Financial Services... -

Page 89

.... See Note 24 to Consolidated Financial Statements for further information. Income Taxes The effective tax rate declined from 30.1 percent in 2006 to 16.3 percent in 2007, primarily due to the unrealized market valuation losses on AIGFP's super senior credit default swap portfolio and other-than... -

Page 90

... Statements. Percentage Increase/(Decrease) (in millions) 2007 (b) 2006(a) 2005(a) 2007 vs. 2006 2006 vs. 2005 Revenues : General Insurance(c) Life Insurance & Retirement Services(c)(d) Financial Services(e)(f) Asset Management Other Consolidation and eliminations Total Operating Income (loss... -

Page 91

American International Group, Inc. and Subsidiaries General Insurance AIG's General Insurance operations provide property and casualty products and services throughout the world. Revenues in the General Insurance segment represent net premiums earned, net investment income and net realized capital ... -

Page 92

...of Financial Condition and Results of Operations Liquidity AIG manages liquidity at both the subsidiary and parent company levels. At December 31, 2007, AIG's consolidated invested assets, primarily held by its subsidiaries, included $65.6 billion in cash and short-term investments. Consolidated net... -

Page 93

... AIG obtains the fair value of its investments in limited partnerships and hedge funds from information provided by the general partner or manager of the investments, the ï¬nancial statements of which generally are audited annually. Derivative assets and liabilities can be exchange-traded or traded... -

Page 94

... net cash ï¬,ows: based upon current lease rates, projected future lease rates and estimated terminal values of each aircraft based on third-party information. Operating Review General Insurance Operations AIG's General Insurance subsidiaries write substantially all lines of commercial property... -

Page 95

... and net realized capital gains (losses) and statutory ratios in 2007, 2006 and 2005 were as follows: (in millions, except ratios) 2007 2006 2005 Percentage Increase/(Decrease) 2007 vs. 2006 2006 vs. 2005 Net premiums written: Domestic General Insurance DBG Transatlantic Personal Lines Mortgage... -

Page 96

... losses in 2007 and 2005 by reporting unit were as follows: 2007 Insurance Related Losses Net Reinstatement Premium Cost Insurance Related Losses 2005 Net Reinstatement Premium Cost (in millions) Reporting Unit: DBG Transatlantic Personal Lines Mortgage Guaranty Foreign General Insurance Total... -

Page 97

American International Group, Inc. and Subsidiaries (in millions) Domestic Brokerage Group Transatlantic Personal Lines Mortgage Guaranty Foreign General Insurance Reclassiï¬cations and Eliminations Total 2007: Statutory underwriting proï¬t (loss) Increase in DAC Net investment income Net... -

Page 98

American International Group, Inc. and Subsidiaries Management's Discussion and Analysis of Financial Condition and Results of Operations catastrophe losses and prior accident year development, and growth in Net investment income. The combined ratio improved to 89.1, a reduction of 15.6 points from... -

Page 99

... rates. Net premiums written were ï¬,at in 2006 compared to 2005, with growth in the Private Client Group and Agency Auto divisions offset by termination of The Robert Plan relationship. Growth in the Private Client Group spans multiple products, with a continued penetration of the high net worth... -

Page 100

... business. The expense ratio remained ï¬,at as premium growth covered increased expenses related to expansion internationally and continued investment in risk management resources. Foreign General Insurance Results 2007 and 2006 Comparison written for commercial lines increased due to new business... -

Page 101

... General Insurance gross reserve for losses and loss expenses (loss reserves) as of December 31, 2007 and 2006 by major lines of business on a statutory Annual Statement basis(a): (in millions) 2007 2006(b) Other liability occurrence Workers compensation Other liability claims made Auto liability... -

Page 102

... in net loss reserves relating to Foreign General Insurance business. These reserves are carried on an undiscounted basis. The companies participating in the American Home/National Union pool have maintained a participation in the business written by AIU for decades. As of December 31, 2007, these... -

Page 103

...4,680(b) (15) 33,091 Prior Accident Year Development by Major Class of Business: Excess casualty (DBG) D&O and related management liability (DBG) Excess workers compensation (DBG) Reinsurance (Transatlantic) Asbestos and environmental (primarily DBG) All other, net Prior years, other than accretion... -

Page 104

...casualty, workers compensation, excess workers compensation, and post-1986 environmental liability classes of business, all within DBG, from asbestos reserves within DBG and Foreign General Insurance, and from Transatlantic. 2005 Net Loss Development In 2005, net loss development from prior accident... -

Page 105

... to this development with rate increases and policy form and coverage changes to better contain future loss costs in this class of business. For the year-end 2005 loss reserve review, AIG's actuaries responded to the continuing adverse development by further increasing the loss development factor... -

Page 106

... of property, personal lines and certain casualty classes. The other group is long-tail casualty classes of business which includes excess and umbrella liability, D&O, professional liability, medical malpractice, workers compensation, general liability, products liability, and related classes. Shor... -

Page 107

...the effect of rate changes and other quantiï¬able factors on the loss ratio. For low-frequency, high-severity classes such as excess casualty, expected loss ratios generally are used for at least the three most recent accident years. ( Loss development factors which are used to project the reported... -

Page 108

American International Group, Inc. and Subsidiaries Management's Discussion and Analysis of Financial Condition and Results of Operations Actuarial methods used by AIG for most long-tail casualty classes of business include loss development methods and expected loss ratio methods, including ''... -

Page 109

American International Group, Inc. and Subsidiaries frequency/severity methods to test loss reserves, due to the general nature of AIG's reserves being applicable to lower frequency, higher severity commercial classes of business where average claim severity is volatile. Excess Casualty: AIG ... -

Page 110

... Healthcare: AIG generally uses a combination of loss development methods and expected loss ratio methods for healthcare classes of business. The largest component of the healthcare business consists of coverage written for hospitals and other healthcare facilities. Reserves for excess coverage are... -

Page 111

... of loss reserve estimates. Because a large portion of the loss reserves from AIG's General Insurance business relates to longer-tail casualty classes of business driven by severity rather than frequency of claims, such as excess casualty and D&O, developing a range around loss reserve estimates... -

Page 112

... exceptionally high deviation. For D&O and related management liability classes of business, the assumed loss development factors are also an important assumption but less critical than for excess casualty. Because these classes are written on a claims made basis, the loss reporting and development... -

Page 113

... 2007 for this class was higher than historical averages, resulting in an increase in loss reserves for prior accident years. During 2007, reserves from prior accident years developed adversely by approximately $300 million for AIG's primary workers compensation business. AIG relies on longer term... -

Page 114

... analysis for each signiï¬cant account were examined by AIG's claims staff for reasonableness, for consistency with policy coverage terms, and any claim settlement terms applicable. Adjustments were incorporated accordingly. The results from the universe of modeled accounts, which as noted above re... -

Page 115

...such claims arise from policies written in 1984 and prior years. The current environmental policies that AIG underwrites on a claims-made basis have been excluded from the table below. 2007 (in millions) 2006 Net Gross(e) Net Gross(e) 2005 Net Gross Asbestos: Reserve for losses and loss expenses... -

Page 116

... Life Insurance & Retirement Services operations include insurance and investment-oriented products such as whole 62 AIG 2007 Form 10-K Domestic Life Insurance ( ( American General Life Insurance Company (AIG American General) The United States Life Insurance Company in the City of New York... -

Page 117

... Annuity) ( AIG SunAmerica Life Assurance Company (AIG SunAmerica) Life Insurance & Retirement Services Results Life Insurance & Retirement Services results for 2007, 2006 and 2005 were as follows: Premiums and Other Considerations Net Investment Income Net Realized Capital Gains (Losses) Total... -

Page 118

American International Group, Inc. and Subsidiaries Management's Discussion and Analysis of Financial Condition and Results of Operations Life Insurance & Retirement Services total revenues in 2007 reï¬,ect growth in premiums and other considerations compared to 2006 due principally to strong life ... -

Page 119

...Foreign Life Insurance & Retirement Services results on a sub-product basis for 2007, 2006 and 2005 were as follows: Premiums and Other Considerations Net Investment Income Net Realized Capital Gains (Losses) Total Revenues Operating Income (in millions) 2007 Life insurance Personal accident Group... -

Page 120

... sub-product basis for 2007, 2006 and 2005 were as follows: Premiums and Other Considerations Net Investment Income Net Realized Capital Gains (Losses) Total Revenues Operating Income (in millions) 2007 Life insurance Personal accident Group products Individual ï¬xed annuities Individual variable... -

Page 121

.... Net investment income increased due to higher average investment yields and higher levels of assets under management. Operating income declined in 2007 compared to 2006 due to realized capital losses in 2007 versus realized capital gains in 2006. Individual variable annuity deposits in 2007... -

Page 122

... a sub-product basis for 2007, 2006 and 2005 were as follows: Premiums and Other Considerations Net Investment Income Net Realized Capital Gains (Losses) Total Revenues Operating Income (Loss) (in millions) 2007 Life insurance Personal accident Group products Individual ï¬xed annuities Individual... -

Page 123

...: Premiums and Other Considerations Net Investment Income Net Realized Capital Gains (Losses) Total Revenues Operating Income (Loss) (in millions) 2007 Life insurance Home service Group life/health Payout annuities(a) Individual ï¬xed and runoff annuities Total 2006 Life insurance Home service... -

Page 124

... Management's Discussion and Analysis of Financial Condition and Results of Operations (in millions) Continued Premiums and Other Considerations Net Investment Income Net Realized Capital Gains (Losses) Total Revenues Operating Income (Loss) 2005 Life insurance Home service Group life/health... -

Page 125

... loss related to exiting the ï¬nancial institutions credit business and a $25 million charge for litigation reserves. Payout annuities premiums and other considerations increased in 2007 compared to 2006 reï¬,ecting increased sales of structured settlements and terminal funding annuities. Net... -

Page 126

... due to increased net realized capital losses. Net realized capital losses for Domestic Retirement Services increased due to higher otherthan-temporary impairment charges of $1.2 billion in 2007 compared to $368 million in 2006 and sales to reposition assets in certain investment portfolios for both... -

Page 127

... product line. Group retirement products total revenues were ï¬,at in 2006 as improvements in partnership income and variable annuity fees were offset by increased net realized capital losses. The ï¬,at revenues, coupled with higher amortization of deferred acquisition costs related to internal... -

Page 128

...margins of this business. Individual ï¬xed annuity sales continued to face increased competition from bank deposit products and money market funds offering very competitive short-term rates in the current yield curve environment, and as a result deposits decreased 5 percent in 2007 compared to 2006... -

Page 129

American International Group, Inc. and Subsidiaries Life Insurance & Retirement Services Net Investment Income and Net Realized Capital Gains (Losses) The following table summarizes the components of net investment income for the years ended December 31, 2007, 2006 and 2005: (in millions) 2007 ... -

Page 130

American International Group, Inc. and Subsidiaries Management's Discussion and Analysis of Financial Condition and Results of Operations (in millions) Continued 2007 2006 2005 Total: Fixed maturities, including short-term investments Equity securities Interest on mortgage and other loans ... -

Page 131

... due, in part, to the recent volatility in the securities markets. Net realized capital losses in the Foreign Life Insurance & Retirement Services operations in 2007 included losses of $135 million related to derivatives that did not qualify for hedge accounting treatment under FAS 133 compared to... -

Page 132

... life of the contract similar to DAC. Total deferred acquisition and sales inducement costs increased $549 million in 2007 compared to 2006 primarily due to higher production in the Foreign Life Insurance operations partially offset by lower Domestic Life Insurance & Retirement Services sales. Total... -

Page 133

...(a) Change in unrealized gains (losses) on securities Balance at end of year Total Life Insurance & Retirement Services Balance at beginning of year Acquisition costs deferred Amortization (charged) or credited to operating income: Related to net realized capital gains (losses) Related to... -

Page 134

... 2007. However, this net increase resulted from a number of items that had varying effects on the results of operations of certain operating units and lines of business. These adjustments resulted in an increase of $183 million in operating income for Foreign Life Insurance & Retirement Services... -

Page 135

American International Group, Inc. and Subsidiaries Financial Services Operations AIG's Financial Services subsidiaries engage in diversiï¬ed activities including aircraft and equipment leasing, capital markets, consumer ï¬nance and insurance premium ï¬nance. Financial Services Results ... -

Page 136

American International Group, Inc. and Subsidiaries Management's Discussion and Analysis of Financial Condition and Results of Operations In order to better align ï¬nancial reporting with the manner in which AIG's chief operating decision makers manage their businesses, beginning in 2007, net ... -

Page 137

... or related assets and liabilities. For further information on the effect of FAS 133 on AIGFP's business, see Risk Management - Segment Risk Management - Financial Services - Capital Markets Derivative Transactions and Note 8 to Consolidated Financial Statements. Effective January 1, 2008, AIGFP... -

Page 138

... 133. The net loss also reï¬,ects the effect of increases in U.S. interest rates and a weakening of the U.S. dollar on derivatives hedging AIGFP's assets and liabilities. Financial market conditions in 2007 were characterized by increases in global interest rates, widening of credit spreads, higher... -

Page 139

... subsidiaries of AIG. Accordingly, the ï¬nancial results of those companies are allocated between Financial Services and Life Insurance & Retirement Services according to their ownership percentages. While products vary by market, the businesses generally provide credit cards, unsecured and secured... -

Page 140

... warehoused investments. AIG consolidates the operating results of warehoused investments until such time as they are sold or otherwise divested. Asset Management operating income decreased in 2007 compared to 2006, due to foreign exchange, interest rate and credit-related mark to market losses and... -

Page 141

American International Group, Inc. and Subsidiaries reported in the Life Insurance & Retirement Services segment. Also, commencing in 2007, the effect of consolidating managed partnerships and funds, which were historically reported as a component of the Institutional Asset Management business, are... -

Page 142

... to purchase shares of AIG's common stock. A total of 76,361,209 shares were purchased during 2007. * Includes expenses of corporate staff not attributable to speciï¬c business segments, expenses related to efforts to improve internal controls, corporate initiatives and certain compensation plan... -

Page 143

... AIG Finance Taiwan Limited commercial paper Other subsidiaries Borrowings of consolidated investments: A.I. Credit(c) AIG Investments(d) AIG Global Real Estate Investment(d) AIG SunAmerica ALICO Total borrowings of consolidated investments Total borrowings not guaranteed by AIG Consolidated: Total... -

Page 144

American International Group, Inc. and Subsidiaries Management's Discussion and Analysis of Financial Condition and Results of Operations Continued At December 31, 2007 and 2006, AIG's net borrowings amounted to $20.3 billion and $15.4 billion, respectively, as follows: (in millions) 2007 2006... -

Page 145

...fulï¬ll the short-term cash requirements of AIG and its subsidiaries. The issuance of AIG Funding's commercial paper, including the guarantee by AIG, is subject to the approval of AIG's Board of Directors or the Finance Committee of the Board if it exceeds certain pre-approved limits. As backup for... -

Page 146

... debt. AIG Credit Card Company (Taiwan), a consumer ï¬nance business in Taiwan, and AIG Retail Bank PLC, a full service consumer bank in Thailand, have issued commercial paper for the funding of their respective operations. AIG does not guarantee any borrowings for AIGCFG businesses, including... -

Page 147

... rating by the rating agencies to denote relative position within such generic or major category. Short-term Debt S&P Moody's(a) Senior Long-term Debt S&P(b) Fitch(c) Moody's Fitch AIG AIG Financial Products Corp.(d) AIG Funding, Inc.(d) ILFC American General Finance Corporation American General... -

Page 148

American International Group, Inc. and Subsidiaries Management's Discussion and Analysis of Financial Condition and Results of Operations These credit ratings are current opinions of the rating agencies. As such, they may be changed, suspended or withdrawn at any time by the rating agencies as a ... -

Page 149

... AIG SunAmerica construction guarantees connected to affordable housing investments. (c) Includes commitments to invest in limited partnerships, private equity, hedge funds and mutual funds and commitments to purchase and develop real estate in the United States and abroad. (d) Written generally... -

Page 150

...Consolidated Financial Statements. A signiï¬cant portion of AIG's overall exposure to VIEs results from AIG Investment's real estate and investment funds. In certain instances, AIG Investments acts as the collateral manager or general partner of an investment fund, private equity fund or hedge fund... -

Page 151

... existence of investment opportunities. Share Repurchases From time to time, AIG may buy shares of its common stock for general corporate purposes, including to satisfy its obligations under various employee beneï¬t plans. In February 2007, AIG's Board of Directors increased AIG's share repurchase... -

Page 152

American International Group, Inc. and Subsidiaries Management's Discussion and Analysis of Financial Condition and Results of Operations $7 billion, including a $1.0 billion commitment entered into in December 2007 but not funded until January 2008. A total of 76,361,209 shares were purchased ... -

Page 153

... and Realized Capital Gains (Losses) herein. General Insurance Liquidity AIG manages liquidity at both the subsidiary and parent company levels. At December 31, 2007, AIG's consolidated invested assets included $65.6 billion in cash and short-term investments. Consolidated net cash provided from... -

Page 154

... tax recoverables to certain domestic general insurance subsidiaries and $500 million to certain domestic life insurance subsidiaries, both effective December 31, 2007. AIG parent funds its short-term working capital needs through commercial paper issued by AIG Funding. As of December 31, 2007, AIG... -

Page 155

... AIG's invested assets by segment: General Insurance Life Insurance & Retirement Services Financial Services Asset Management (in millions) Other Total 2007 Fixed maturities: Bonds available for sale, at fair value $ 74,057 Bonds held to maturity, at amortized cost 21,355 Bond trading securities... -

Page 156

... unit level, the strategies are based on considerations that include the local market, liability duration and cash ï¬,ow characteristics, rating agency and regulatory capital considerations, legal investment limitations, tax optimization and diversiï¬cation. In addition to local risk management... -

Page 157

American International Group, Inc. and Subsidiaries The amortized cost or cost and estimated fair value of AIG's available for sale and held to maturity securities at December 31, 2007 and 2006 were as follows: December 31, 2007* Amortized Cost or Cost Gross Unrealized Gains Gross Unrealized Losses... -

Page 158

American International Group, Inc. and Subsidiaries Management's Discussion and Analysis of Financial Condition and Results of Operations The industry categories of AIG's available for sale corporate debt securities at December 31, 2007 were as follows: Industry Category Percentage Continued ... -

Page 159

... the Life Insurance & Retirement Services companies, the focus is not on asset-liability matching, but on preservation of capital and growth of surplus. Fixed income holdings of the Domestic General Insurance companies are comprised primarily of tax-exempt securities, which provide attractive risk... -

Page 160

American International Group, Inc. and Subsidiaries Management's Discussion and Analysis of Financial Condition and Results of Operations Life Insurance & Retirement Services Invested Assets With respect to Life Insurance & Retirement Services, AIG uses asset-liability management as a tool ... -

Page 161

... trading securities are purchased and sold as necessary to meet the risk management and business objectives of Capital Markets operations. The gross unrealized gains and gross unrealized losses of Capital Markets operations included in Financial Services assets and liabilities at December 31, 2007... -

Page 162

...by credit rating at December 31, 2007 was as follows: (in millions) AAA AA A BBB/Not Rated ShortTerm Total Corporate debt Mortgage-backed, asset-backed and collateralized Cash and short-term investments Total Participation in the securities lending program by reporting unit at December 31, 2007 was... -

Page 163

... a discussion of accounting policies related to changes in fair value of invested assets, see Note 1 to Consolidated Financial Statements. Portfolio Review Other-Than-Temporary Impairments AIG assesses its ability to hold any ï¬xed maturity security in an unrealized loss position to its recovery... -

Page 164

...: Life Insurance & Retirement Services (in millions) General Insurance Financial Services Asset Management Other Total Impairment Type: Severity Lack of intent to hold to recovery Foreign currency declines Issuer-speciï¬c credit events Adverse projected cash ï¬,ows on structured securities... -

Page 165

American International Group, Inc. and Subsidiaries There have been disruptions in the commercial mortgage markets in general, and the CMBS market in particular, with credit default swaps indices and quoted prices of securities at levels consistent with a severe correction in lease rates, occupancy... -

Page 166

... credit ratings which were below investment grade. AIG did not consider these securities in an unrealized loss position to be other-than-temporarily impaired at December 31, 2007, as management has the intent and ability to hold these investments until they recover their cost basis. AIG believes... -

Page 167

... to provide foreign exchange to service a credit or equity exposure incurred by another AIG business unit located outside that country. AIG's credit risks are managed at the corporate level by the Credit Risk Management department (CRM) whose primary role is to support and supplement the work of... -

Page 168

American International Group, Inc. and Subsidiaries Management's Discussion and Analysis of Financial Condition and Results of Operations Continued The following table presents AIG's largest credit exposures at December 31, 2007 as a percentage of total shareholders' equity: Credit Exposure as a ... -

Page 169

...- Financial Services herein. For the insurance segments, assets included are invested assets (excluding direct holdings of real estate) and liabilities included are reserve for losses and loss expenses, reserve for unearned premiums, future policy beneï¬ts for life and accident and health insurance... -

Page 170

... risk during 2007 was driven by a combination of three factors: ( increased U.S. equity investment allocation in the General Insurance and Life Insurance & Retirement Services segments, ( increased volatility in U.S. equity prices, and ( rising correlations between U.S. equities and AIG's structural... -

Page 171

... agreement covering U.S. commercial property insurance business written by Lexington on a risk attaching basis. This agreement was effective in July 2006 and was due to expire on January 15, 2008. For 2008, AIG purchased a U.S. catastrophe coverage of approximately $1.1 billion in excess of a per... -

Page 172

..., management liability and mortgage insurance. Risks in the general insurance segment are managed through aggregations and limitations of concentrations at multiple levels: policy, line of business, correlation and catastrophic risk events. ( Life Insurance & Retirement Services - risks include... -

Page 173

... below. Single event modeled property and workers compensation losses to AIG's worldwide portfolio of risk for key geographic areas are set forth below. Gross values represent AIG's liability after the application of policy limits and deductibles, and net values represent losses after reinsurance is... -

Page 174

... term reinsurance. In Life Insurance & Retirement Services, the reinsurance programs provide risk mitigation per policy, per individual life for life and group covers and for catastrophic risk events. Pandemic Influenza Terrorism Exposure to loss from terrorist attack is controlled by limiting... -

Page 175

... and customized interest rate, currency, equity, commodity, energy and credit products with top-tier corporations, ï¬nancial institutions, governments, agencies, institutional investors and high-net-worth individuals throughout the world. The senior management of AIG deï¬nes the policies and... -

Page 176

... 31, 2007 the notional amounts and unrealized market valuation loss of the super senior credit default swap portfolio by asset classes were as follows: Notional Amount (in billions) Unrealized Market Valuation Loss (in millions) Continued Corporate loans(a) Prime residential mortgages(a) Corporate... -

Page 177

... and lack of trading in the asset backed securities market during the fourth quarter of 2007 and early 2008. The valuations produced by the BET model therefore represent the valuations of the underlying super senior CDO cash securities with no recognition of the effect of the basis differential on... -

Page 178

...AIG conducted certain ratings-based stress tests, which centered around scenarios of further stress on the portfolio resulting from downgrades by the rating agencies from current levels on the underlying collateral in the CDO structures supported by AIGFP's credit default swaps. These rating actions... -

Page 179

..., non-real estate loans, retail sales ï¬nance and credit-related insurance to customers in the United States, the U.K., Puerto Rico and the U.S. Virgin Islands. AIGCFG, through its subsidiaries, is engaged in developing a multi-product consumer ï¬nance business with an emphasis on emerging markets... -

Page 180

... credit losses existing in that portfolio as of the balance sheet date. Continued AIG Global Real Estate is exposed to the general conditions in global real estate markets and the credit markets. Such exposure can subject Asset Management to delays in real estate property development and sales... -

Page 181

... management strategies have been formulated for long duration liability structures and low interest rate environments in certain markets using the technology developed for AIG's Economic Capital model. In 2008, AIG plans to extend the model's application by building on the work per formed in 2007... -

Page 182

...Item 8. Financial Statements and Supplementary Data American International Group, Inc. and Subsidiaries Index to Financial Statements and Schedules Page Report of Independent Registered Public Accounting Firm Consolidated Balance Sheet at December 31, 2007 and 2006 Consolidated Statement of Income... -

Page 183

... or projected changes in the timing of cash ï¬,ows relating to income taxes generated by leveraged lease transactions. As described in Notes 1 and 17 to the consolidated ï¬nancial statements, AIG changed its accounting for certain hybrid ï¬nancial instruments, life settlement contracts and share... -

Page 184

... Deferred policy acquisition costs Investments in partially owned companies Real estate and other fixed assets, net of accumulated depreciation (2007 - $5,446; 2006 - $4,940) Separate and variable accounts Goodwill Other assets Total assets See Accompanying Notes to Consolidated Financial Statements... -

Page 185

American International Group, Inc. and Subsidiaries Consolidated Balance Sheet December 31, (in millions, except share data) Continued 2007 2006 Liabilities: Reserve for losses and loss expenses Unearned premiums Future policy beneï¬ts for life and accident and health insurance contracts ... -

Page 186

American International Group, Inc. and Subsidiaries Consolidated Statement of Income Years Ended December 31, (in millions, except per share data) 2007 2006 2005 Revenues: Premiums and other considerations Net investment income Net realized capital gains (losses) Unrealized market valuation ... -

Page 187

American International Group, Inc. and Subsidiaries Consolidated Statement of Shareholders' Equity Years Ended December 31, (in millions, except share and per share data) Amounts 2007 2006 2005 Shares 2007 2006 2005 Common stock: Balance, beginning and end of year Additional paid-in capital: ... -

Page 188

American International Group, Inc. and Subsidiaries Consolidated Statement of Cash Flows Years Ended December 31, (in millions) 2007 2006 2005 Summary: Net cash provided by operating activities Net cash used in investing activities Net cash provided by ï¬nancing activities Effect of exchange ... -

Page 189

... issued Finance receivables held for investment - originations and purchases Change in securities lending invested collateral Net additions to real estate, ï¬xed assets, and other assets Net change in short-term investments Net change in non-AIGFP derivative assets and liabilities Net cash used... -

Page 190

American International Group, Inc. and Subsidiaries Consolidated Statement of Comprehensive Income Years Ended December 31, (in millions) 2007 2006 2005 Net income Other comprehensive income (loss): Unrealized (depreciation) appreciation of investments - net of reclassiï¬cation adjustments ... -

Page 191

...16. Fair Value of Financial Instruments Note 17. Share-based Employee Compensation Plans Note 18. Employee Beneï¬ts Note 19. Beneï¬ts Provided by Starr International Company, Inc. and C.V. Starr & Co., Inc. Note 20. Ownership and Transactions with Related Parties Note 21. Federal Income Taxes Note... -

Page 192

... International Group, Inc. and Subsidiaries Notes to Consolidated Financial Statements 1. Summary of Signiï¬cant Accounting Policies Basis of Presentation The consolidated ï¬nancial statements include the accounts of AIG, its controlled subsidiaries, and variable interest entities in which AIG... -

Page 193

... payments made in excess of policy account balances. (b) Income Taxes: Deferred tax assets and liabilities are recorded for the effects of temporary differences between the tax basis of an asset or liability and its reported amount in the consolidated ï¬nancial statements. AIG assesses its ability... -

Page 194

American International Group, Inc. and Subsidiaries Notes to Consolidated Financial Statements 1. Summary of Signiï¬cant Accounting Policies Continued Continued When AIG does not have the positive intent to hold bonds until maturity, these securities are classiï¬ed as available for sale or as ... -

Page 195

...-term investment objectives and are accounted for as available for sale, carried at fair values and recorded on a trade-date basis. This portfolio is hedged using interest rate, foreign exchange, commodity and equity derivatives. The market risk associated with such hedges is managed on a portfolio... -

Page 196

American International Group, Inc. and Subsidiaries Notes to Consolidated Financial Statements 1. Summary of Signiï¬cant Accounting Policies Continued Continued (p) Cash: Cash represents cash on hand and non-interest bearing demand deposits. Finance receivables originated and intended for sale ... -

Page 197

American International Group, Inc. and Subsidiaries 1. Summary of Signiï¬cant Accounting Policies Continued (v) Goodwill: Goodwill is the excess of cost over the fair value of identiï¬able net assets acquired. Goodwill is reviewed for impairment on an annual basis, or more frequently if ... -

Page 198

American International Group, Inc. and Subsidiaries Notes to Consolidated Financial Statements 1. Summary of Signiï¬cant Accounting Policies Continued Continued sales inducement assets totaled $1.7 billion and $1.3 billion at December 31, 2007 and 2006, respectively. The amortization expense ... -

Page 199

..., net of tax, to the opening balance of retained earnings on the date of adoption. This adoption reï¬,ected changes in unamortized DAC, VOBA, deferred sales inducement assets, unearned revenue liabilities and future policy beneï¬ts for life and accident and health insurance contracts resulting... -

Page 200

American International Group, Inc. and Subsidiaries Notes to Consolidated Financial Statements 1. Summary of Signiï¬cant Accounting Policies Continued Continued Change in the Timing of Cash Flows Relating to Income Taxes Generated by a Leveraged Lease Transaction'' (FSP 13-2). FSP 13-2 addresses... -

Page 201

...and group life, payout annuities (including structured settlements), endowment and accident and health policies. Retirement savings products consist generally of ï¬xed and variable annuities. Revenues in the Life Insurance & Retirement Services segment represent Life Insurance & Retirement Services... -

Page 202

American International Group, Inc. and Subsidiaries Notes to Consolidated Financial Statements 2. Segment Information Continued Continued capital markets, consumer ï¬nance and insurance premium ï¬nance. AIG's Aircraft Leasing operations represent the operations of International Lease Finance ... -

Page 203

American International Group, Inc. and Subsidiaries 2. Segment Information Continued The following table summarizes AIG's operations by reporting segment for the years ended December 31, 2007, 2006 and 2005: Operating Segments Life Insurance General & Retirement Insurance Services(a) Consolidation... -

Page 204

American International Group, Inc. and Subsidiaries Notes to Consolidated Financial Statements 2. Segment Information Continued Continued (c) Represents the sum of General Insurance net premiums earned, Life Insurance & Retirement Services premiums and other considerations, net investment income,... -

Page 205

American International Group, Inc. and Subsidiaries 2. Segment Information Continued The following table summarizes AIG's Life Insurance & Retirement Services operations by major internal reporting unit for the years ended December 31, 2007, 2006 and 2005: Life Insurance & Retirement Services ... -

Page 206

... Financial Statements 2. Segment Information Continued Continued The following table summarizes AIG's Financial Services operations by major internal reporting unit for the years ended December 31, 2007, 2006 and 2005: Financial Services Aircraft Leasing(a) Capital Markets(b) Consumer Finance... -

Page 207

...the United States and Canada. The following table summarizes AIG's operations by major geographic segment. Allocations have been made on the basis of the location of operations and assets. Geographic Segments (in millions) Domestic(a) Far East Other Foreign Consolidated 2007 Total revenues Real... -

Page 208

American International Group, Inc. and Subsidiaries Notes to Consolidated Financial Statements 3. Investments Continued Continued (c) Net Realized Gains and Losses: The Net realized capital gains (losses) and increase (decrease) in unrealized appreciation of AIG's available for sale investments ... -

Page 209

American International Group, Inc. and Subsidiaries 3. Investments Continued The following table presents the amortized cost and estimated fair values of AIG's available for sale and held to maturity ï¬xed maturity securities at December 31, 2007, by contractual maturity. Actual maturities may ... -

Page 210

... consolidated statement of income. Further information regarding life settlement contracts at December 31, 2007 is as follows: (dollars in millions) Partnerships(a) Mutual funds Investment real estate(b) Aircraft asset investments(c) Life settlement contracts(d) Consolidated managed partnerships... -

Page 211

..., volatility, concentrations) and capital planning locally (branch and subsidiary). It also allows AIG to pool its insurance risks and purchase reinsurance more efï¬ciently at a consolidated level, manage global counterparty risk and relationships and manage global life catastrophe risks. General... -

Page 212

... Life Insurance & Retirement Services operations utilize internal and third-party reinsurance relationships to manage insurance risks and to facilitate capital management strategies. Pools of highly-rated third-party reinsurers are utilized to manage net amounts at risk in excess of retention limits... -

Page 213

American International Group, Inc. and Subsidiaries 6. Deferred Policy Acquisition Costs The following reï¬,ects the policy acquisition costs deferred for amortization against future income and the related amortization charged to income for General Insurance and Life Insurance & Retirement Services... -

Page 214

... credits and issues trust certiï¬cates or debt securities that represent interests in the portfolio of assets. These transactions can be cash-based or synthetic and are actively or passively managed. For investment partnerships, hedge funds and private equity funds, AIG acts as the general partner... -

Page 215

... structures with respect to funding development costs for the operating partnerships, and as guarantor that investors will receive the tax beneï¬ts projected at the time of syndication. AIG Retirement Services, Inc. consolidates these investment partnerships as a result of the guarantee provided... -

Page 216

American International Group, Inc. and Subsidiaries Notes to Consolidated Financial Statements 8. Derivatives and Hedge Accounting AIG uses derivatives and other ï¬nancial instruments as part of its ï¬nancial risk management programs and as part of its investment operations. AIGFP also transacts ... -

Page 217

American International Group, Inc. and Subsidiaries 8. Derivatives and Hedge Accounting Continued The following table presents the notional amounts by remaining maturity of Capital Markets' interest rate, credit default and currency swaps and swaptions derivatives portfolio at December 31, 2007 ... -

Page 218

...International Group, Inc. and Subsidiaries Notes to Consolidated Financial Statements 8. Derivatives and Hedge Accounting Continued Continued At December 31, 2007 and 2006, the notional amounts and unrealized market valuation loss of the super senior credit default swap portfolio by asset classes... -

Page 219

... and lack of trading in the asset backed securities market during the fourth quarter of 2007 and early 2008. The valuations produced by the BET model therefore represent the valuations of the underlying super senior CDO cash securities with no recognition of the effect of the basis differential on... -

Page 220

American International Group, Inc. and Subsidiaries Notes to Consolidated Financial Statements 8. Derivatives and Hedge Accounting Continued Continued currency denominated debt attributable to changes in the benchmark interest rate and foreign exchange rates. AIG assesses, both at the hedge's ... -

Page 221

... 31, (in millions) 2007 2006 Future policy beneï¬ts: Long duration contracts Short duration contracts Total Policyholders' contract deposits: Annuities Guaranteed investment contracts Universal life products Variable products Corporate life products Other investment contracts Total $135,202 866... -

Page 222

... net investment gains and losses, and the related liability changes are offset within the same line item in the consolidated statement of income for those accounts that qualify for separate account treatment under SOP 03-1. Net investment income and gains and losses on trading accounts for contracts... -

Page 223

... rate ranged from two percent to seven percent. In addition to GMDB, AIG's contracts currently include to a lesser extent GMIB. The GMIB liability is determined each period end by estimating the expected value of the annuitization beneï¬ts in excess of the projected account balance at the date... -

Page 224

American International Group, Inc. and Subsidiaries Notes to Consolidated Financial Statements 11. Debt Outstanding Continued At December 31, 2007 and 2006, AIG's total borrowings were as follows: (in millions) 2007 2006 Total long-term borrowings Commercial paper and extendible commercial ... -

Page 225

...general corporate purposes, $873 million was used by AIGFP and $3.2 billion was used to fund the Matched Investment Program (MIP). The maturity dates of these notes range from 2008 to 2052. To the extent deemed appropriate, AIG may enter into swap transactions to manage its effective borrowing rates... -

Page 226

American International Group, Inc. and Subsidiaries Notes to Consolidated Financial Statements 11. Debt Outstanding Continued Continued would be required to be accounted for separately under FAS 133. Upon AIG's early adoption of FAS 155, AIGFP elected the fair value option for these notes. The ... -

Page 227

.... An excess policy issued by a subsidiary of AIG with respect to the 1999 litigation was expressly stated to be without limit of liability. In the current actions, plaintiffs allege that the judge approving the 1999 settlement was misled as to the extent of available insurance coverage and would... -

Page 228

... Fund. The National Association of Insurance Commissioners has formed a Market Analysis Working Group directed by the State of Indiana, which has commenced its own investigation into the underreporting of workers compensation premium. In early 2008, AIG was informed that the Market Analysis Working... -

Page 229

... AIG's insurance coverage limits. Securities Action - Oregon State Court. On February 27, 2008, The State of Oregon, by and through the Oregon State Treasurer, and the Oregon Public Employee Retirement Board, on behalf of the Oregon Public Employee Retirement Fund, ï¬led a lawsuit against American... -

Page 230

American International Group, Inc. and Subsidiaries Notes to Consolidated Financial Statements 12. Commitments, Contingencies and Guarantees Continued Continued pursuing claims ï¬led a stipulation providing for all claims in the New York action against such defendants to be dismissed with ... -

Page 231

...contracted with the broker defendants for the provision of insurance brokerage services for a variety of insurance needs. The broker defendants are alleged to have placed insurance coverage on the plaintiffs' behalf with a number of insurance companies named as defendants, including AIG subsidiaries... -

Page 232

... consolidated ï¬nancial condition, although it is possible that the effect would be material to AIG's consolidated results of operations for an individual reporting period. (b) Commitments Flight Equipment At December 31, 2007, ILFC had committed to purchase 234 new aircraft deliverable from 2008... -

Page 233

... and loss reserves is a complex process for long-tail casualty lines of business, which include excess and umbrella liability, directors and ofï¬cers liability (D&O), professional liability, medical malpractice, workers compensation, general liability, products liability and related classes, as... -

Page 234

American International Group, Inc. and Subsidiaries Notes to Consolidated Financial Statements 13. Preferred Shareholders' Equity in Subsidiary Companies At December 31, 2007, preferred shareholders' equity in subsidiary companies represents preferred stocks issued by ILFC, a wholly owned ... -

Page 235

... from outstanding employee stock plans (treasury stock method)* Contingently convertible bonds Weighted average shares outstanding - diluted* Earnings per share: Basic: Income before cumulative effect of an accounting change Cumulative effect of an accounting change, net of tax Net income Diluted... -

Page 236

American International Group, Inc. and Subsidiaries Notes to Consolidated Financial Statements 15. Statutory Financial Data Statutory surplus and net income for General Insurance and Life Insurance & Retirement Services operations in accordance with statutory accounting practices were as follows: ... -

Page 237

...investments in limited partnerships and hedge funds from information provided by the general partner or manager of these investments, the accounts of which generally are audited on an annual basis. The transaction price is used as the best estimate of fair value at inception. Policyholders' contract... -

Page 238

...on swaps, options and forward transactions Trade receivables Securities purchased under agreements to resell Finance receivables, net of allowance Securities lending invested collateral Other invested assets(b) Short-term investments Cash Liabilities: Policyholders' contract deposits Securities sold... -

Page 239

American International Group, Inc. and Subsidiaries 17. Share-based Employee Compensation Plans Continued value recognition provisions of FAS 123R. FAS 123R requires that companies use a fair value method to value share-based payments and recognize the related compensation expense in net earnings.... -

Page 240

American International Group, Inc. and Subsidiaries Notes to Consolidated Financial Statements 17. Share-based Employee Compensation Plans Continued Continued Additional information with respect to AIG's stock option plans at December 31, 2007, and changes for the year then ended, were as follows... -

Page 241

American International Group, Inc. and Subsidiaries 17. Share-based Employee Compensation Plans Continued AIG DCPPP In September 2005, AIG adopted the AIG DCPPP to provide sharebased compensation to key AIG employees, including senior executive ofï¬cers. The AIG DCPPP was modeled on the SICO ... -

Page 242

American International Group, Inc. and Subsidiaries Notes to Consolidated Financial Statements 17. Share-based Employee Compensation Plans Continued Continued The following table presents a summary of shares relating to outstanding awards unvested under the foregoing plans at December 31, 2007, ... -

Page 243

... value of plan assets, end of year Funded status, end of year Amounts recognized in the consolidated balance sheet: Assets Liabilities Total amounts recognized Amounts recognized in Accumulated other comprehensive income (loss): Net loss Prior service cost (credit) Total amounts recognized (a) AIG... -

Page 244

American International Group, Inc. and Subsidiaries Notes to Consolidated Financial Statements 18. Employee Beneï¬ts Continued Continued The accumulated beneï¬t obligations for both non-U.S. and U.S. pension beneï¬t plans at December 31, 2007 and 2006 were as follows: (in millions) 2007 2006... -

Page 245

... for the local economic environments of each of the subsidiaries providing such beneï¬ts. Assumed health care cost trend rates for the U.S. plans were as follows: 2007 2006 Following year: Medical (before age 65) Medical (age 65 and older) Ultimate rate to which cost increase is assumed to... -

Page 246

... 2006 Asset class: Equity securities Debt securities Other Total Other includes cash, insurance contracts, real estate, private equity and hedge funds asset classes. No shares of AIG common stock were included in the U.S. plans at December 31, 2007 and 55,680 shares of AIG common stock with a value... -

Page 247