ADP 2011 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2011 ADP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Provision for Income Taxes

The effective tax rate in fiscal 2011 and 2010 was 35.1% and 35.2%, respectively. The reduction in the effective tax rate for fiscal 2011

is due to the resolution of certain tax matters in fiscal 2010 that resulted in a decrease to the effective tax rate of 0.7 percentage points

for that period, offset by a decrease in federal and state income tax expense and a favorable mix of earnings in foreign jurisdictions in

fiscal 2011.

Net Earnings from Continuing Operations and Diluted Earnings per Share from Continuing Operations

Net earnings from continuing operations increased $46.9 million to $1,254.2 million in fiscal 2011, from $1,207.3 million in fiscal 2010,

and diluted earnings per share from continuing operations increased 5%, to $2.52. The increase in net earnings from continuing

operations in fiscal 2011 reflects the increase in earnings from continuing operations before income taxes and the impact of the tax

matters discussed above. The increase in diluted earnings per share from continuing operations in fiscal 2011 reflects the increase in

earnings from continuing operations and the impact of the tax matters discussed above coupled with the effects of fewer shares

outstanding.

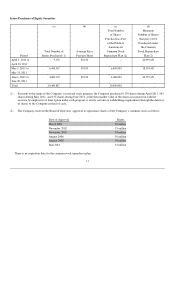

The following table reconciles the Company

’

s results for fiscal 2011 and fiscal 2010 to adjusted results that exclude the impact of

favorable tax items. The Company uses certain adjusted results, among other measures, to evaluate the Company

’

s operating

performance in the absence of certain items and for planning and forecasting of future periods. The Company believes that the

adjusted results provide relevant and useful information for investors because it allows investors to view performance in a manner

similar to the method used by the Company

’

s management and improves their ability to understand the Company

’

s operating

performance. Since adjusted earnings from continuing operations and adjusted diluted EPS are not measures of performance

calculated in accordance with accounting principles generally accepted in the United States of America (“

U.S. GAAP

”

),

they should

not be considered in isolation from, or as a substitute for, earnings from continuing operations and diluted EPS from continuing

operations, respectively, and they may not be comparable to similarly titled measures employed by other companies.

Net earnings from continuing operations, as adjusted, increased $59.1 million to $1,254.2 million for fiscal 2011, from $1,195.1 million

for fiscal 2010, and the related diluted earnings per share from continuing operations, as adjusted, increased $0.15 to $2.52. The

increase in diluted earnings per share from continuing operations in fiscal 2011 reflects the increase in earnings from continuing

operations described above coupled with the effects of fewer shares outstanding.

19

Year ended June 30, 2011

Diluted EPS

Earnings from

Net earnings from

from

continuing operations

Provision for

continuing

continuing

before income taxes

income taxes

operations

operations

As Reported

$

1,932.7

$

678.5

$

1,254.2

$

2.52

Adjustments:

Favorable tax items

-

-

-

-

As Adjusted

$

1,932.7

$

678.5

$

1,254.2

$

2.52

Year ended June 30, 2010

Diluted EPS

Earnings from

Net earnings from

from

continuing operations

Provision for

continuing

continuing

before income taxes

income taxes

operations

operations

As Reported

$

1,863.2

$

655.9

$

1,207.3

$

2.40

Adjustments:

Favorable tax items

-

12.2

12.2

0.02

As Adjusted

$

1,863.2

$

668.1

$

1,195.1

$

2.37