ADP 2011 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2011 ADP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

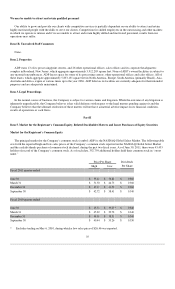

The safety, liquidity, and diversification of our clients

’

funds are the foremost objectives of our investment strategy. We continue to

promote this strategy by investing in a prudent and conservative manner in accordance with our investment guidelines with a

predominant focus on AAA/AA securities. Our investment portfolio does not contain any asset

-

backed securities with underlying

collateral of sub

-

prime mortgages, alternative

-

A mortgages, sub

-

prime auto loans or home equity loans, collateralized debt

obligations, collateralized loan obligations, credit default swaps, asset

-

backed commercial paper, derivatives, auction rate securities,

structured investment vehicles, or non

-

investment

-

grade fixed

-

income securities. We own senior tranches of fixed rate credit card,

rate reduction, and auto loan asset

-

backed securities, secured predominately by prime collateral. All collateral on asset

-

backed

securities is performing as expected. In addition, we own senior debt directly issued by Federal Home Loan Banks, Federal Farm

Credit Banks, Federal Home Loan Mortgage Corporation (“Freddie Mac”

)

and Federal National Mortgage Association (“Fannie

Mae”

).

We do not own subordinated debt, preferred stock, or common stock of any of these agencies. We do own AAA rated

mortgage

-

backed securities, which represent an undivided beneficial ownership interest in a group or pool of one or more residential

mortgages. These securities are collateralized by the cash flows of 15

-

year and 30

-

year residential mortgages and are guaranteed by

Fannie Mae and Freddie Mac as to the timely payment of principal and interest. Our client funds investment strategy is structured to

allow us to average our way through an interest rate cycle by laddering investments out to five years (in the case of the extended

portfolio) and out to ten years (in the case of the long portfolio). This investment strategy is supported by our short

-

term financing

arrangements necessary to satisfy short

-

term funding requirements relating to client funds obligations. In addition, our strong long

-

term and short

-

term credit ratings have helped us maintain uninterrupted access to the U.S. commercial paper market.

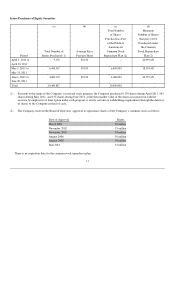

Our financial condition and balance sheet remain solid at June 30, 2011, with cash and cash equivalents and marketable securities of

$1,523.7 million. Our net cash flows provided by operating activities were $1,705.8 million in fiscal 2011, as compared to $1,682.1

million in fiscal 2010. This increase in cash flows from fiscal 2010 to fiscal 2011 was due to positive year over year variances in the

timing of our tax related estimated cash payments and receipts, offset by higher bonus payments, and increased pension plan

contributions. The increase in cash used in investing activities is due to the timing of purchases of and proceeds from the sales or

maturities of marketable securities, as compared to the prior year. The increase in cash provided by financing activities is primarily

due to the timing of cash received and payments made related to client funds, as compared to the prior year.

We have a strong business model with a high percentage of recurring revenues, excellent margins, the ability to generate consistent,

healthy cash flows, strong client retention, and low capital expenditure requirements. Additionally, ADP has continued to return

excess cash to our shareholders. In the last five fiscal years, we have reduced the Company

’

s common stock outstanding by

approximately 13% through share buybacks, partially offset by common stock issued under employee stock

-

based compensation

programs. We have also raised the dividend payout per share for 36 consecutive years.

16