ADP 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 ADP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10

-

K

Commission file number 1

-

5397

AUTOMATIC DATA PROCESSING, INC.

(Exact name of registrant as specified in its charter)

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the Registrant is a well

-

known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes

[x] No

[

]

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes

[

]

No [x]

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12

months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to the filing requirements for the past 90 days. Yes

[x] No

[

]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and

posted pursuant to Rule 405 of Regulation S

-

T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit

and post such files). Yes

[x] No

[

]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S

-

K (§229.405) is not contained herein and will not be contained, to the best of

Registrant’

s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10

-

K or any amendment to this Form 10

-

K.

[ ]

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non

-

accelerated filer or a smaller reporting company. See the definitions of

“

large

accelerated filer,

” “

accelerated filer

”

and

“smaller reporting company

”

in Rule 12b

-

2 of the Exchange Act.

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b

-

2 of the Act).

[

]

Yes

[x] No

The aggregate market value of the voting and non

-

voting common equity held by non

-

affiliates of the Registrant as of the last business day of the Registrant

’s most recently

completed second fiscal quarter was approximately $

22,873,534,847. On August 12, 2011 there were 489,677,633 shares of Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

[X]

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2011

OR

[ ]

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Delaware

22

-

1467904

(State or other jurisdiction of incorporation or organization)

(I.R.S. Employer Identification No.)

One ADP Boulevard, Roseland, New Jersey

07068

(Address of principal executive offices)

(Zip Code)

Registrant’s telephone number, including area code: 973

-

974

-

5000

Securities registered pursuant to Section 12(b) of the Act:

Name of each exchange on

Title of each class

which registered

Common Stock, $.10 Par Value

NASDAQ Global Select Market

(voting)

Chicago Stock Exchange

Large accelerated filer

[x]

Accelerated filer

[ ]

Non

-

accelerated filer

[ ]

Smaller reporting company

[ ]

Portions of the Registrant’s Proxy Statement for its 2011 Annual Meeting of Stockholders.

Part III

Table of contents

-

Page 1

...Employer Identification No.) One ADP Boulevard, Roseland, New Jersey (Address of principal executive offices) 07068 (Zip Code) Registrant's telephone number, including area code: 973-974-5000 Securities registered pursuant to Section 12(b) of the Act: Name of each exchange on Title of each class... -

Page 2

...on Accounting and Financial Disclosure Controls and Procedures Other Information Directors, Executive Officers and Corporate Governance Executive Compensation Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters Certain Relationships and Related Transactions... -

Page 3

... tax and benefits administration solutions and services, including traditional and Web-based outsourcing solutions, that assist employers in the United States, Canada, Europe, South America (primarily Brazil), Australia and Asia to staff, manage, pay and retain their employees. As of June 30, 2011... -

Page 4

... 2011, CAPS in the United States processed and delivered approximately 47 million employee year-end tax statements and over 39 million employer payroll tax returns and deposits, and moved $1.2 trillion in client funds to taxing authorities and its clients' employees via electronic transfer, direct... -

Page 5

... and report employee time and attendance. â- ADP made several acquisitions in fiscal 2011, including MasterTax, a leading provider of do-it-yourself payroll tax filing software, and AdvancedMD®, a leading provider of cloud-based medical practice management and electronic health records solutions... -

Page 6

... and insurance, sales and service. In addition to its DMS solutions, Dealer Services offers its clients a full suite of additional integrated applications to address each department and functional area of the dealership, including customer relationship management (CRM) applications, front-end sales... -

Page 7

... period. ADP's services are provided under written price quotations or service agreements having varying terms and conditions. No one price quotation or service agreement is material to ADP. Systems Development and Programming During the fiscal years ended June 30, 2011, 2010 and 2009, ADP invested... -

Page 8

... breaches may hurt our business We store electronically personal information about our clients and employees of our clients. In addition, our retirement services systems maintain investor account information for retirement plans. We have security systems and procedures in place that are designed... -

Page 9

... credit ratings, may limit our access to short-term debt markets to meet liquidity needs required by our Employer Services business. We invest our client funds in liquid, investment-grade marketable securities, money market securities and other cash equivalents. Nevertheless, our client fund assets... -

Page 10

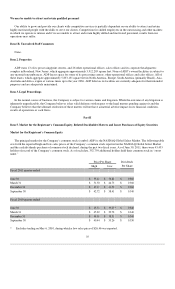

... and Issuer Purchases of Equity Securities Market for the Registrant's Common Equity The principal market for the Company's common stock (symbol: ADP) is the NASDAQ Global Select Market. The following table sets forth the reported high and low sales prices of the Company's common stock reported on... -

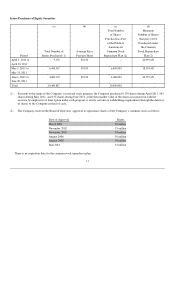

Page 11

Issuer Purchases of Equity Securities (a) (b) (c) Total Number of Shares Purchased as Part of the Publicly Announced Common Stock Repurchase Plan (2) -6,400,000 4,000,000 10,400,000 (d) Maximum Number of Shares that may yet be Purchased under the Common Stock Repurchase Plan (2) 24,959,451 18,559,... -

Page 12

...the Company completed the spin-off of its former Brokerage Services Group business, comprised of Brokerage Services and Securities Clearing and Outsourcing Services, into an independent publicly traded company called Broadridge Financial Solutions, Inc. The cumulative returns of the Company's common... -

Page 13

... outstanding Diluted weighted average shares outstanding Cash dividends declared per share Return on equity from continuing operations (Note 1) At year end: Cash, cash equivalents and marketable securities Total assets Obligation under commercial paper borrowing Long-term debt Stockholders' equity... -

Page 14

... tax and benefits administration solutions and services, including traditional and Web-based outsourcing solutions, that assist employers in the United States, Canada, Europe, South America (primarily Brazil), Australia and Asia to staff, manage, pay and retain their employees. As of June 30, 2011... -

Page 15

... unemployment insurance rates. Dealer Services' revenues growth of 24% resulted mainly from the effects of the Cobalt acquisition in August 2010. Excluding the Cobalt acquisition, Dealer Services' revenues grew 3%. Employer Services' and PEO Services' new business sales, which represent annualized... -

Page 16

...client funds obligations. In addition, our strong longterm and short-term credit ratings have helped us maintain uninterrupted access to the U.S. commercial paper market. Our financial condition and balance sheet remain solid at June 30, 2011, with cash and cash equivalents and marketable securities... -

Page 17

... ANALYSIS OF CONSOLIDATED OPERATIONS Fiscal 2011 Compared to Fiscal 2010 (Dollars in millions, except per share amounts) Years ended June 30, 2011 Total revenues $ 9,879.5 $ 2010 8,927.7 $ Change $ 951.8 % Change 11% Costs of revenues: Operating expenses Systems development and programming costs... -

Page 18

...rates at 2.6%, as compared to the prior year, coupled with declining average daily corporate funds balances which decreased from $3.8 billion in fiscal 2010 to $3.5 billion in fiscal 2011. Earnings from Continuing Operations before Income Taxes Earnings from continuing operations before income taxes... -

Page 19

... operations $ 2.52 Provision for income taxes $ 678.5 1,932.7 $ 678.5 $ 1,254.2 $ 2.52 Year ended June 30, 2010 Earnings from continuing operations before income taxes As Reported Adjustments: Favorable tax items As Adjusted $ $ 1,863.2 Net earnings from continuing operations $ 1,207.3 Diluted... -

Page 20

... in the consolidated interest on funds held for clients resulted from the decrease in the average interest rate earned to 3.6% in fiscal 2010, as compared to 4.0% in fiscal 2009. Employer Services' revenues were flat in fiscal 2010 as compared to fiscal 2009. Total Expenses Our total expenses... -

Page 21

... increase our allowance for doubtful accounts as a result of an increase in estimated credit losses related to our notes receivable from auto, truck and powersports dealers. These decreases in expenses were partially offset by an asset impairment charge of $6.8 million recorded during fiscal 2010 as... -

Page 22

... tax rate 6.3 percentage points. Net Earnings from Continuing Operations and Diluted Earnings per Share from Continuing Operations Net earnings from continuing operations decreased $117.8 million to $1,207.3 million in fiscal 2010, from $1,325.1 million in fiscal 2009, and diluted earnings per share... -

Page 23

...18.2 million shares during fiscal 2010 and the repurchase of 13.8 million shares in fiscal 2009. ANALYSIS OF REPORTABLE SEGMENTS Revenues (Dollars in millions) Years ended June 30, 2011 Employer Services PEO Services Dealer Services Other Reconciling items: Foreign exchange Client funds interest 179... -

Page 24

...of acquisitions. Revenues from our payroll and tax filing business increased 3% in fiscal 2011 due to higher average client funds balances, improved worldwide client retention and an increase in pays per control in the U.S. We credit Employer Services with interest on client funds at a standard rate... -

Page 25

... in the number of new clients and a 1.1 percentage point improvement in our client retention rate from 82.9% in fiscal 2010 to 84.0% in fiscal 2011. Revenues associated with benefits coverage, workers' compensation coverage, and state unemployment taxes for worksite employees that were billed to our... -

Page 26

... the fees for our services and are billed based upon a percentage of wages related to worksite employees, increased $11.8 million, or 5%, in fiscal 2010, due to the increase in the number of average worksite employees. We credit PEO Services with interest on client funds at a standard rate of... -

Page 27

... million in fiscal 2011, 2010 and 2009, respectively. ADP Indemnity provides workers' compensation and employer's liability deductible reimbursement insurance protection for PEO Services worksite employees up to a $1 million per occurrence retention. PEO Services has secured specific per occurrence... -

Page 28

... securities at June 30, 2011. We also have the ability to generate cash through our financing arrangements under our U.S. short-term commercial paper program and our U.S. and Canadian short-term repurchase agreements to meet short-term funding requirements related to client funds obligations... -

Page 29

... by government and government agency securities. These agreements generally have terms ranging from overnight to up to five business days. We have $2 billion available to us on a committed basis under these reverse repurchase agreements. In fiscal 2011 and 2010, we had average outstanding balances... -

Page 30

...the licensing of software. The majority of our lease agreements have fixed payment terms based on the passage of time. Certain facility and equipment leases require payment of maintenance and real estate taxes and contain escalation provisions based on future adjustments in price indices. Our future... -

Page 31

... investments (cash and cash equivalents, short-term marketable securities, and long-term marketable securities) and client funds assets (funds that have been collected from clients but not yet remitted to the applicable tax authorities or client employees). Our corporate investments are invested... -

Page 32

...: (Dollars in millions) Years ended June 30, Average investment balances at cost: Corporate investments Funds held for clients Total $ $ 3,467.6 16,865.4 20,333.0 $ $ 3,839.2 15,194.5 19,033.7 $ $ 3,744.7 15,162.4 18,907.1 2011 2010 2009 Average interest rates earned exclusive of realized gains... -

Page 33

...'s functionality. The adoption of ASU 2009-13 and ASU 2009-14 did not have a material impact on our consolidated results of operations, financial condition or cash flows. In December 2010, we adopted ASU 2010-20, "Disclosures about the Credit Quality of Financing Receivables and the Allowance for... -

Page 34

...on payroll funds, payroll tax filing funds and other Employer Services' client-related funds. We enter into agreements for a fixed fee per transaction (e.g., number of payees or number of payrolls processed). Fees associated with services are recognized in the period services are rendered and earned... -

Page 35

...fair value of the award on the date of grant. We determine the fair value of stock options issued by using a binomial option-pricing model. The binomial option-pricing model considers a range of assumptions related to volatility, dividend yield, risk-free interest rate and employee exercise behavior... -

Page 36

...Consolidated Earnings (In millions, except per share amounts) Years ended June 30, REVENUES: Revenues, other than interest on funds held for clients and PEO revenues Interest on funds held for clients PEO revenues (A) TOTAL REVENUES EXPENSES: Costs of revenues Operating expenses Systems development... -

Page 37

...cash equivalents Short-term marketable securities Accounts receivable, net Other current assets Assets held for sale Total current assets before funds held for clients Funds held for clients Total current assets Long-term marketable securities Long-term receivables, net Property, plant and equipment... -

Page 38

... compensation plans Tax benefits from stock compensation plans Treasury stock acquired (18.2 shares) Dividends ($1.3500 per share) - - 67.6 (85.4) (9.2) - (676.0) 360.7 (766.3) - - Balance at June 30, 2010 Net earnings Foreign currency translation adjustments Unrealized net gain on securities... -

Page 39

... restricted assets held to satisfy client funds obligations Capital expenditures Additions to intangibles Acquisitions of businesses, net of cash acquired Reclassification from cash and cash equivalents to short-term marketable securities Proceeds from the sale of property, plant and equipment Other... -

Page 40

... funds, payroll tax filing funds and other Employer Services' client-related funds. The Company enters into agreements for a fixed fee per transaction (e.g., number of payees or number of payrolls processed). Fees associated with services are recognized in the period services are rendered and earned... -

Page 41

... and interest income are recognized when earned. F. Long-term Receivables. Long-term receivables relate to notes receivable from the sale of computer systems, primarily to auto, truck, motorcycle, marine, recreational vehicle and heavy equipment dealers. Unearned income from finance receivables... -

Page 42

... to purchase 0.9 million, 14.0 million, and 32.9 million shares of common stock for the year ended June 30, 2011, ("fiscal 2011"), the year ended June 30, 2010 ("fiscal 2010"), and the year ended June 30, 2009 ("fiscal 2009"), respectively, were excluded from the calculation of diluted earnings per... -

Page 43

...The objectives of accounting for income taxes are to recognize the amount of taxes payable or refundable for the current year and deferred tax liabilities and assets for the future tax consequences of events that have been recognized in an entity's financial statements or tax returns. The Company is... -

Page 44

... and maturities of available-for-sale securities were $3,305.1 million, $3,406.9 million, and $3,320.4 million for fiscal 2011, 2010, and 2009, respectively. In fiscal 2009, the net asset value of the Primary Fund of the Reserve Fund ("Reserve Fund") decreased below $1 per share as a result of the... -

Page 45

... applications strategy and strongly supports Dealer Services' long-term growth strategy, for approximately $405.4 million in cash, net of cash acquired. The purchase price allocation for Cobalt is as follows: Accounts receivable, net Goodwill Identifiable intangible assets Other assets Total assets... -

Page 46

... acquisitions discussed above for fiscal 2011, 2010, and 2009 were not material, either individually or in the aggregate, to the Company's operations, financial position or cash flows. NOTE 4. DIVESTITURES On March 24, 2010, the Company completed its sale of the non-core Commercial Systems business... -

Page 47

... operations during fiscal 2011. The following table summarizes the revenues and expenses from discontinued operations as reported for the period indicated: Years ended June 30, Revenues $ 2010 17.2 $ 2009 28.7 Earnings from discontinued operations before income taxes Provision for income... -

Page 48

... clients at June 30, 2011 and 2010 are as follows: June 30, 2011 Gross Amortized Cost Type of issue: Money market securities and other cash equivalents Available-for-sale securities: U.S. Treasury and direct obligations of U.S. government agencies Corporate bonds Asset-backed securities Commercial... -

Page 49

... Balance Sheets is as follows: June 30, Corporate investments: Cash and cash equivalents Short-term marketable securities Long-term marketable securities Total corporate investments $ $ 1,389.4 36.3 98.0 1,523.7 $ $ 1,643.3 27.9 104.3 1,775.5 2011 2010 Funds held for clients represent assets... -

Page 50

...for Canadian securities, Dominion Bond Rating Service. All available-for-sale securities were rated as investment grade at June 30, 2011. The amount of collected but not yet remitted funds for the Company's payroll and payroll tax filing and other services varies significantly during the fiscal year... -

Page 51

... Available-for-sale securities included in Level 2 are valued utilizing inputs obtained from an independent pricing service. To determine the fair value of our Level 2 investments, a variety of inputs are utilized, including benchmark yields, reported trades, non-binding broker/dealer quotes, issuer... -

Page 52

... disclosure in relation to corporate investments and funds held for clients. Level 1 U.S Treasury and direct obligations of U.S. government agencies Corporate bonds Asset-backed securities Commercial mortgage-backed securities Municipal bonds Canadian government obligations and Canadian government... -

Page 53

... and non-specific reserves associated with those balances are as follows: June 30, 2011 Notes Receivable Current Specific Reserve Non-specific Reserve Total $ $ 0.6 89.9 90.5 $ Long-term $ 0.9 145.5 146.4 $ Current $ 0.6 5.1 5.7 $ Reserve Long-term $ 0.9 8.5 9.4 June 30, 2010 Notes Receivable... -

Page 54

... Chargeoffs $ 9.4 1.8 (3.7) (1.8) Long-term $ 16.1 3.0 (6.8) (2.9) Balance at June 30, 2011 $ 5.7 $ 9.4 As of June 30, 2011 and June 30, 2010, the allowance for doubtful accounts as a percentage of notes receivable is approximately 6% and 10%, respectively. Notes receivable aged over 30 days... -

Page 55

...buildings remain in Assets Held for Sale on the Consolidated Balance Sheets at June 30, 2011 for $9.1 million. NOTE 10. GOODWILL AND INTANGIBLE ASSETS, NET Changes in goodwill for the fiscal year ended June 30, 2011 and 2010 are as follows: Employer Services Balance as of June 30, 2009 Additions and... -

Page 56

...'s commercial paper in fiscal 2011 and 2010 was less than two days for both fiscal years. The Company's U.S. and Canadian short-term funding requirements related to client funds obligations are sometimes obtained on a secured basis through the use of reverse repurchase agreements. These agreements... -

Page 57

... no derivative financial instruments outstanding at June 30, 2011, 2010, or 2009. NOTE 14. EMPLOYEE BENEFIT PLANS A. Stock Plans. The Company recognizes stock-based compensation expense in net earnings based on the fair value of the award on the date of grant. Stock-based compensation consists of... -

Page 58

...under the Company's employee stock purchase plan and restricted stock awards. Stock-based compensation expense of $76.3 million, $67.6 million, and $96.0 million was recognized in earnings from continuing operations in fiscal 2011, 2010, and 2009, respectively, as well as related tax benefits of $28... -

Page 59

... following activity occurred under our existing plans: Stock Options: Number of Options Year ended June 30, 2011 Options outstanding, beginning of year Options granted Options exercised Options canceled Options outstanding, end of year 35,000 1,398 (11,403) (3,281) 21,714 (in thousands) Weighted... -

Page 60

... stock plan issuances were as follows: Year ended June 30, Performance-based restricted stock Time-based restricted stock $ $ 2011 40.20 44.58 B. Pension Plans. The Company has a defined benefit cash balance pension plan covering substantially all U.S. employees, under which employees are credited... -

Page 61

...funded status as of June 30, 2011 and 2010 is as follows: June 30, Change in plan assets: Fair value of plan assets at beginning of year Actual return on plan assets Employer contributions Benefits paid $ 981.7 208.1 158.1 (34.6) $ 787.0 117.6 112.3 (35.2) 2011 2010 Fair value of plan assets at end... -

Page 62

... the net pension expense generally were: Years ended June 30, Discount rate Expected long-term rate of return on assets Increase in compensation levels 2011 5.25% 7.25% 5.50% 2010 6.80% 7.25% 5.50% 2009 6.95% 7.25% 5.50% The discount rate is based upon published rates for high-quality fixed-income... -

Page 63

... of our Level 2 plan assets, a variety of inputs are utilized, including benchmark yields, reported trades, non-binding broker/dealer quotes, issuer spreads, two-sided markets, benchmark securities, bids, offers, reference data, new issue data, and monthly payment information. The Plan has no Level... -

Page 64

... up to 10% of their compensation annually. The Company matches a portion of employee contributions, which amounted to approximately $57.5 million, $55.8 million, and $52.1 million for the calendar years ended December 31, 2011, 2010, and 2009, respectively. NOTE 15. INCOME TAXES Earnings (loss) from... -

Page 65

... and their balance sheet classifications are as follows: Years ended June 30, Deferred tax assets: Accrued expenses not currently deductible Stock-based compensation expense Net operating losses Other $ 205.8 95.7 111.4 10.8 $ 227.4 100.9 80.8 3.0 2011 2010 423.7 Less: valuation allowances (62... -

Page 66

... 92.8 $ $ $ Interest expense and penalties associated with uncertain tax positions have been recorded in the provision for income taxes on the Statements of Consolidated Earnings. During the fiscal years ended June 30, 2011, 2010, and 2009, the Company recorded interest expense of $1.7 million... -

Page 67

... operations are as follows: Taxing Jurisdiction U.S. (IRS) California Illinois New Jersey France Fiscal Years under Examination 2009 - 2011 2006 - 2008 2004 - 2005 2002 - 2008 2008 - 2009 Canada completed its joint audit with the Province of Ontario for the fiscal years ended June 30, 2005 through... -

Page 68

... to fiscal years ending June 30, 2014 through fiscal 2016. In September 2010, a purported class action lawsuit was filed against the Company in the Superior Court of the State of California, County of Los Angeles. The lawsuit was subsequently removed to the United States District Court, Central... -

Page 69

... actual interest income earned on invested funds held for clients and interest credited to Employer Services and PEO Services at a standard rate of 4.5%. The reportable segments' results also include an internal cost of capital charge related to the funding of acquisitions and other investments... -

Page 70

... 1,494.4 $ 12.9 $ 179.5 $ (212.9) $ $ 9,879.5 PEO Services Dealer Services Other Foreign Exchange Fund Interest Cost of Capital Charge Total Year ended June 30, 2010 Revenues from continuing operations Earnings from continuing operations before income taxes Assets from continuing operations Capital... -

Page 71

... States Year ended June 30, 2011 Revenues from continuing operations Assets from continuing operations $ $ 7,930.3 29,294.8 $ $ 1,190.6 2,027.6 $ $ 428.2 2,497.6 $ $ 330.4 418.3 $ $ 9,879.5 34,238.3 Europe Canada Other Total Year ended June 30, 2010 Revenues from continuing operations Assets from... -

Page 72

.... Roseland, New Jersey We have audited the accompanying consolidated balance sheets of Automatic Data Processing, Inc. and subsidiaries (the "Company") as of June 30, 2011 and 2010, and the related consolidated statements of earnings, stockholders' equity, and cash flows for each of the three years... -

Page 73

...with Accountants on Accounting and Financial Disclosure None. Item 9A. Controls and Procedures Attached as Exhibits 31.1 and 31.2 to this Annual Report on Form 10-K are certifications of ADP's Chief Executive Officer and Chief Financial Officer, which are required by Rule 13a-14(a) of the Securities... -

Page 74

...Chief Executive Officer /s/ Christopher R. Reidy Christopher R. Reidy Chief Financial Officer Roseland, New Jersey August 24, 2011 Changes in Internal Control over Financial Reporting There were no changes in ADP's internal control over financial reporting that occurred during the quarter ended June... -

Page 75

... over financial reporting at Cobalt, which was acquired in August 2010 and whose financial statements constitute 1.4 % of total assets, 2.5 % of total revenues, and 1.0 % of operating income before taxes of the consolidated financial statement amounts as of and for the year ended June 30, 2011... -

Page 76

... Executive Officer Vice President and Chief Information Officer Vice President and Treasurer Vice President, Employer Services-Sales President, Employer Services- National Account Services, Major Account Services, Benefits Services, Canada, and GlobalView President, Employer Services-Small Business... -

Page 77

...ADP in 1982. Prior to her promotion to President - National Account Services, Major Account Services, Benefits Services, Canada, and GlobalView in 2011, she served as President, Employer Services - Small Business Services and Major Account Services in 2010, as President, Employer Services - National... -

Page 78

...in Part II, Item 8 hereof: Report of Independent Registered Public Accounting Firm Statements of Consolidated Earnings - years ended June 30, 2011, 2010 and 2009 Consolidated Balance Sheets - June 30, 2011 and 2010 Statements of Consolidated Stockholders' Equity - years ended June 30, 2011, 2010 and... -

Page 79

..., 2009 (Management Compensatory Plan) - 1989 Non-Employee Director Stock Option Plan - incorporated by reference to Exhibit 10(iii)(A)-#7 to the Company's Annual Report on Form 10-K for the fiscal year ended June 30, 1990 (Management Compensatory Plan) - Amendment to 1989 Non-Employee Director Stock... -

Page 80

... Plan) - Amended and Restated Employees' Savings-Stock Purchase Plan - incorporated by reference to Exhibit 10.13 to the Company's Quarterly Report on Form 10-Q for the fiscal quarter ended December 31, 2010 (Management Compensatory Plan) - 364-Day Credit Agreement, dated as of June 22, 2011... -

Page 81

... to Exhibit 10.27 to the Company's Quarterly Report on Form 10-Q for the fiscal quarter ended December 31, 2008 (Management Compensatory Plan) - Form of Stock Option Grant Agreement under the 2008 Omnibus Award Plan (Form for Non- Employee Directors) for grants after November 11, 2008 - incorporated... -

Page 82

... linkbase document - XBRL taxonomy extension presentation linkbase document - XBRL taxonomy extension definition linkbase document As provided in Rule 406T of Regulation S-T, this information is furnished and not filed for purposes of Sections 11 and 12 of the Securities Act of 1933, as amended... -

Page 83

...Additions Balance at beginning of period Year ended June 30, 2011: Allowance for doubtful accounts: Current Long-term Deferred tax valuation allowance Year ended June 30, 2010: Allowance for doubtful accounts: Current Long-term Deferred tax valuation allowance Year ended June 30, 2009: Allowance for... -

Page 84

...Butler) Title Chief Executive Officer, Director (Principal Executive Officer) Chief Financial Officer (Principal Financial Officer) Corporate Controller (Principal Accounting Officer) Director August 24, 2011 August 24, 2011 August 24, 2011 Date August 24, 2011 /s/ Christopher R. Reidy (Christopher... -

Page 85

.... ADP Screening and Selection Services, Inc. ADP Tax Services, Inc. ADP Technology Services, Inc. ADP TotalSource Group, Inc. ADP Vehicle Information Technology (Shanghai) Co., Ltd Automatic Data Processing Limited Automatic Data Processing Limited (UK) Business Management Software Limited Digital... -

Page 86

..., Inc. and subsidiaries (the "Company"), and the effectiveness of the Company's internal control over financial reporting, appearing in the Annual Report on Form 10-K of Automatic Data Processing, Inc. for the year ended June 30, 2011. /s/Deloitte & Touche LLP Parsippany, New Jersey August 24... -

Page 87

... and report financial information; and (b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: August 24, 2011 /s/Gary C. Butler Gary C. Butler Chief Executive Officer -

Page 88

... report financial information; and (b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: August 24, 2011 /s/Christopher R. Reidy Christopher R. Reidy Chief Financial Officer -

Page 89

... In connection with the Annual Report of Automatic Data Processing, Inc. (the "Company") on Form 10-K for the fiscal year ending June 30, 2011 as filed with the Securities and Exchange Commission on the date hereof (the "Report"), I, Gary C. Butler, Chief Executive Officer of the Company, certify... -

Page 90

... OFFICER CERTIFICATION PURSUANT TO 18 U.S.C. SECTION 1350, AS ADOPTED PURSUANT TO SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002 In connection with the Annual Report of Automatic Data Processing, Inc. (the "Company") on Form 10-K for the fiscal year ending June 30, 2011 as filed with the Securities... -

Page 91

... filing via EDGAR Automatic Data Processing, Inc.'s Annual Report on Form 10-K for the fiscal year ended June 30, 2011, including the financial statements, schedules and exhibits thereto (the "Annual Report"). The financial statements in the Annual Report reflect (i) the adoption on July 1, 2010...