3M 2004 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2004 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

* Foreign currency exchange rates and fluctuations in those rates may affect the Company’s ability to realize

projected growth rates in its sales and net earnings and its results of operations. Because the Company derives

approximately 60% of its revenues from outside the United States, its ability to realize projected growth rates in

sales and net earnings could be adversely affected if the U.S. dollar strengthens significantly against foreign

currencies.

* The Company’s growth objectives are largely dependent on the timing and market acceptance of its new product

offerings, including its ability to renew its pipeline of new products and to bring those products to market. This

ability may be adversely affected by difficulties or delays in product development, such as the inability to: identify

viable new products; obtain adequate intellectual property protection; gain market acceptance of new products; or

successfully complete clinical trials and obtain regulatory approvals. For example, new 3M pharmaceutical

products, like any pharmaceutical under development, face substantial risks and uncertainties in the process of

development and regulatory review. There are no guarantees that new products will prove to be commercially

successful.

* The Company’s future results are subject to fluctuations in the costs and availability of purchased components

and materials, including oil-derived compounds, due to market demand, currency exchange risks, material

shortages and other factors. The Company depends on various components and materials supplied by others for

the manufacturing of its products and it is possible that any of its supplier relationships could be interrupted or

terminated in the future. Any sustained interruption in the Company’s receipt of adequate supplies could have a

material adverse effect on the Company. In addition, while the Company has a process to minimize volatility in

component and material pricing, no assurance can be given that the Company will be able to successfully manage

price fluctuations due to market demand, currency risks or material shortages, or that future price fluctuations will

not have a material adverse effect on the Company.

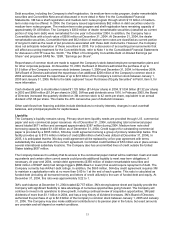

* There is the possibility that acquisitions and strategic alliances may not meet sales and/or profit expectations. As

part of the Company’s strategy for growth, the Company has made and may continue to make acquisitions and

enter into strategic alliances. However, there can be no assurance that the Company will be able to quickly

integrate the acquired business and obtain the anticipated synergies or that acquisitions and strategic alliances

will be beneficial to the Company.

*The Company’s future results may be affected if the Company generates less operating income from its

corporate initiatives than estimated. 3M’s corporate initiatives include Six Sigma, Global Sourcing Effectiveness,

3M Acceleration, eProductivity and Global Business Processes. Cost reduction projects related to these initiatives

are expected to contribute an additional $400 million to operating income in 2005. There can be no assurance that

all of the estimated operating income improvements from the initiatives will be realized.

*The Company’s future results may be affected by various legal and regulatory proceedings, including those

involving product liability, antitrust, environmental or other matters. The outcome of these legal proceedings may

differ from the Company’s expectations because the outcomes of litigation, including regulatory matters, are often

difficult to reliably predict. Various factors or developments can lead the Company to change current estimates of

liabilities and related insurance receivables where applicable, or make such estimates for matters previously not

susceptible of reasonable estimates, such as a significant judicial ruling or judgment, significant settlement or

changes in applicable law. A future adverse ruling, settlement or unfavorable development could result in future

charges that could have a material adverse effect on the Company’s results of operations or cash flows in any

particular period. A specific factor that may influence the Company’s estimate of its future asbestos-related

liabilities is the pending Congressional consideration of legislation to reform asbestos-related litigation and

pertinent information derived from that process. For a more detailed discussion of the legal proceedings involving

the Company and associated accounting estimates, see the discussion of “Legal Proceedings” in Part I, Item 3 of

this document.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

In the context of Item 7A, market risk refers to the risk of loss arising from adverse changes in financial and derivative

instrument market rates and prices, such as fluctuations in interest rates and foreign currency exchange rates. The

Company discusses risk management in various places throughout this document, including discussions in Item 7

concerning Financial Condition and Liquidity, and Financial Instruments, and in the Notes to Consolidated Financial

Statements (Long-Term Debt and Short-Term Borrowings, Derivatives and Other Financial Instruments, and the

Derivatives and Hedging Activities accounting policy). All derivative activity is governed by written policies, and a

value-at-risk analysis is provided for these derivatives. The Company does not have leveraged derivative positions.