iRobot 2012 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2012 iRobot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.4

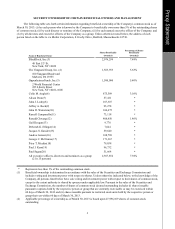

(3) BlackRock Inc. has sole voting power and sole dispositive power with respect to all of these shares. This information

has been obtained from a Schedule 13G/A filed by BlackRock Inc. with the Securities and Exchange Commission on

February 8, 2013.

(4) The Vanguard Group Inc. has sole voting power with respect to 39,134 shares, sole dispositive power with respect to

1,526,119 shares and shared dispositive power with respect to 37,834 shares. Vanguard Fiduciary Trust Company

("VFTC"), a wholly-owned subsidiary of The Vanguard Group, Inc., is the beneficial owner of 37,834 shares as a result

of its serving as investment manager of collective trust accounts. Vanguard Investments Australia, Ltd. ("VIA"), a

wholly-owned subsidiary of The Vanguard Group, Inc., is the beneficial owner of 1,300 shares as a result of its serving

as investment manager of Australian investment offerings. The address of each reporting entity is 100 Vanguard

Boulevard, Malvern, PA 19355. This information has been obtained from a Schedule 13G filed by The Vanguard Group,

Inc. with the Securities and Exchange Commission on February 13, 2013.

(5) OppenheimerFunds, Inc. has shared voting power and shared dispositive power with respect to all of these shares. This

information has been obtained from a Schedule 13G/A filed by OppenheimerFunds, Inc. with the Securities and

Exchange Commission on February 13, 2013, and includes 1,500,000 shares over which Oppenheimer Global

Opportunities Fund has sole voting and shared dispositive power. The address of Oppenheimer Global Opportunities

Fund is 6803 S. Tucson Way, Centennial, CO 80112.

(6) Includes 239,432 shares issuable to Mr. Angle upon exercise of stock options and 13,262 shares issuable to Mr. Angle

upon vesting of restricted stock units.

(7) Includes 48,021 shares issuable to Ms. Dean upon exercise of stock options and 1,656 shares issuable to Ms. Dean upon

vesting of restricted stock units.

(8) Includes 73,190 shares issuable to Mr. Leahy upon exercise of stock options and 5,412 shares issuable to Mr. Leahy

upon vesting of restricted stock units.

(9) Includes 66,294 shares issuable to Mr. Beck upon exercise of stock options and 11,863 shares issuable to Mr. Beck

upon vesting of restricted stock units.

(10) Includes 79,620 shares issuable to Mr. Weinstein upon exercise of stock options and 3,013 shares issuable to Mr.

Weinstein upon vesting of restricted stock units.

(11) Includes 57,625 shares issuable to Mr. Campanello upon exercise of stock options.

(12) Includes an aggregate of 240,000 shares held by iD5 Fund, L.P. Dr. Chwang is a general partner of the management

company for iD5 Fund, L.P. and may be deemed to share voting and investment power with respect to all shares held by

iD5 Fund, L.P. Dr. Chwang disclaims beneficial ownership of such shares except to the extent of his pecuniary interest,

if any. Also includes 53,000 shares issuable to Dr. Chwang upon exercise of stock options, 5,181 shares issuable to Dr.

Chwang upon vesting of restricted stock options and 107,210 shares held in a trust for the benefit of certain of his

family members. As co-trustees of the family trust, Dr. Chwang shares voting and dispositive power over the shares

held by the trust with his spouse.

(13) Includes 5,181 shares issuable to Ms. Deegan upon vesting of restricted stock units.

(14) Includes 5,181 shares issuable to Ms. Ellinger upon vesting of restricted stock units.

(15) Includes 50,000 shares issuable to Dr. Gansler upon exercise of stock options and 5,181 shares issuable to Dr. Gansler

upon vesting of restricted stock units.

(16) Includes 80,000 shares issuable to Mr. Geisser upon exercise of stock options, 5,181 shares issuable to Mr. Geisser

upon vesting of restricted stock units and 12,643 shares issuable to Mr. Geisser upon termination of service.

(17) Includes 90,000 shares issuable to Mr. McNamee upon exercise of stock options, 5,181 shares issuable to Mr.

McNamee upon vesting of restricted stock units and 3,487 shares issuable to Mr. McNamee upon termination of

service.

(18) Includes 50,000 shares issuable to Mr. Meekin upon exercise of stock options, 5,181 shares issuable to Mr. Meekin

upon vesting of restricted stock units, 9,780 shares issuable to Mr. Meekin upon termination of service and 500 shares

owned by Mr. Meekin's IRA. Mr. Meekin's spouse shares voting and dispositive power over the non-IRA shares.

(19) Includes 80,000 shares issuable to Gen. Kern upon exercise of stock options, 5,181 shares issuable to Gen. Kern upon

vesting of restricted stock units and 8,492 shares issuable to Gen. Kern upon termination of service.

(20) Includes 40,000 shares issuable to Mr. Sagan upon exercise of stock options, 5,181 shares issuable to Mr. Sagan upon

vesting of restricted stock units and 3,424 shares issuable to Mr. Sagan upon termination of service.

(21) Includes an aggregate of 1,007,182 shares issuable upon exercise of stock options held by thirteen (13) executive

officers and directors, an aggregate of 81,835 shares issuable upon vesting of restricted stock units held by fourteen

(14) executive officers and directors and an aggregate of 37,826 shares issuable upon termination of service to five

(5) directors.