Yamaha 1998 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 1998 Yamaha annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YAMAHA CONSOLIDATED FINANCIAL REPORT 7

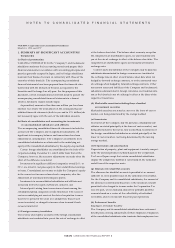

entitled to lump-sum payments determined by reference to their

current basic rate of pay, length of service and the conditions

under which the termination occurs. Accrued employees’ retire-

ment benefits are stated at the amount which would be required

to be paid if all employees covered by the plan voluntarily termi-

nated their employment as of the balance sheet date.

In addition, certain group companies have introduced defined

benefit pension plans covering certain employees who meet the

stipulated eligibility requirements as to age and length of service.

The balance of retirement allowances at the date of introduction

of the pension plans has been amortized over the period of pay-

ment for past service cost.

Directors’ retirement benefits:

The Company’s directors are generally entitled to receive lump-sum

payments based on the Company’s internal rules. The Company

provides retirement allowances for its directors at 100% under its

internal rules and this balance is included in Retirement benefits

in the balance sheets.

(i) Warranty reserve

A warranty reserve is provided to cover the costs for possible

repairs which may be claimed by customers after group compa-

nies’ sales. The amount is estimated based on a percentage of sales

or sales volume considering past experience.

(j) Leases

Noncancelable lease transactions are accounted for as operating

leases regardless of whether such leases are classified as operating

or finance leases except that lease agreements which stipulate the

transfer of ownership of the leased assets to the lessee are account-

ed for as finance leases.

(k) Income taxes

Income taxes are principally calculated on taxable income and are

charged to income on an accrual basis. Deferred income taxes are

not provided by the Company and its consolidated subsidiaries

for timing differences between financial and tax reporting except

for deferred taxes relating to the elimination of internal profits

between consolidated companies.

(l) Appropriation of retained earnings

Under the Commercial Code of Japan, the appropriation of

retained earnings with respect to a given financial period is made

by resolution of the shareholders at a general meeting held subse-

quent to the close of such financial period. The accounts for that

period do not, therefore, reflect such appropriation. See Note 11.

2. U.S. DOLLAR AMOUNTS

For the convenience of the reader, the accompanying financial

statements with respect to the year ended March 31, 1998 have

been presented in U.S. dollars by translating all yen amounts at

¥132.10=U.S.$1.00, the exchange rate prevailing on March 31,

1998. This translation should not be construed as a representation

that yen have been, could have been, or could in the future be,

converted into U.S. dollars at the above or any other rate.

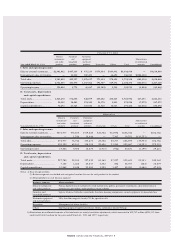

3. ACCUMULATED DEPRECIATION

Accumulated depreciation at March 31, 1998 and 1997 was

¥230,376 million ($1,743,952 thousand) and ¥205,825 million,

respectively.

4. PLEDGED ASSETS

The assets pledged as collateral for long-term debt and certain

other current liabilities at March 31, 1998 were as follows:

Thousands of

Millions of yen U.S. dollars

Bank deposits...................................... ¥ 30 $ 227

Marketable securities........................... 824 6,238

Property, plant and equipment ........... 17,406 131,764

Investment securities........................... 11,662 88,282

5. LEGAL RESERVE AND ADDITIONAL PAID-IN

CAPITAL

In accordance with the Commercial Code of Japan, the Company

has provided a legal reserve as an appropriation of retained earn-

ings. The Code provides that neither additional paid-in capital

nor the legal reserve is available for dividends, but both may be

used to reduce or eliminate a deficit by resolution of the share-

holders or may be transferred to common stock by resolution of

the Board of Directors.

6. RETIREMENT BENEFITS

The charges to income for retirement allowances of the Company

and its consolidated subsidiaries for the years ended March 31,

1998 and 1997 were as follows:

Thousands of

Millions of yen U.S. dollars

1998 1997 1998

Provision for retirement

allowances............................... ¥4,278 ¥1,683 $32,385