Yamaha 1998 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 1998 Yamaha annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

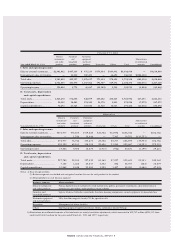

YAMAHA CONSOLIDATED FINANCIAL REPORT 6

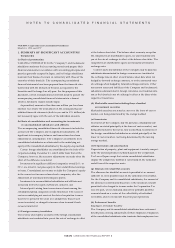

1. SUMMARY OF SIGNIFICANT ACCOUNTING

POLICIES

(a) Basis of presentation

YAMAHA CORPORATION (the “Company”) and its domestic

subsidiaries maintain their accounting records and prepare their

financial statements in accordance with accounting principles and

practices generally accepted in Japan, and its foreign subsidiaries

maintain their books of account in conformity with those of the

countries of their domicile. The accompanying consolidated

financial statements have been prepared from the financial state-

ments filed with the Ministry of Finance as required by the

Securities and Exchange Law of Japan. For the purposes of this

document, certain reclassifications have been made to present the

accompanying consolidated financial statements in a format

which is familiar to readers outside Japan.

As permitted, amounts of less than one million yen have been

omitted. As a result, the totals shown in the accompanying con-

solidated financial statements (both in yen and in U.S. dollars) do

not necessarily agree with the sum of the individual amounts.

(b) Basis of consolidation and accounting for investments

in unconsolidated subsidiaries and affiliates

The accompanying consolidated financial statements include the

accounts of the Company and its significant subsidiaries. All

significant intercompany balances and transactions have been

eliminated in consolidation. The Company’s investments in its

consolidated subsidiaries are eliminated to the underlying net

equity of the consolidated subsidiaries by the step-by-step method.

Certain foreign subsidiaries are consolidated on the basis of fis-

cal periods ending December 31, which differ from that of the

Company; however, the necessary adjustments are made when the

effect of the difference is material.

Investments in significant affiliates (companies owned 20% to

50%) are stated at cost plus equity in their undistributed earnings

or losses. Consolidated net income includes the Company’s equity

in the current net income or loss of such companies, after the

elimination of unrealized intercompany profits.

Investments in unconsolidated subsidiaries and affiliates not

accounted for by the equity method are carried at cost.

Internal profit arising from transactions of assets among the

consolidated group companies is fully eliminated. The excess of

cost over underlying net assets at the date of acquisition is amor-

tized over a period of five years on a straight-line basis if such

excess is material, or charged to income when incurred if such

excess is immaterial.

(c) Foreign currency translation

The revenue and expense accounts of the foreign consolidated

subsidiaries are translated into yen at the rate of exchange in effect

at the balance sheet date. The balance sheet accounts, except for

the components of shareholders’ equity, are also translated into

yen at the rate of exchange in effect at the balance sheet date. The

components of shareholders’ equity are translated at historical

exchange rates.

Current assets and liabilities of the Company and its domestic

subsidiaries denominated in foreign currencies are translated at

the exchange rates in effect at each balance sheet date when not

hedged by forward exchange contracts, or at the contracted rates

of exchange when hedged by forward exchange contracts. Other

noncurrent assets and liabilities of the Company and its domestic

subsidiaries denominated in foreign currencies are translated into

yen at the historical rates of exchange in effect at the dates of the

respective transactions.

(d) Marketable securities including those classified

as investment securities

Marketable securities are stated at cost or at the lower of cost or

market, cost being determined by the average method.

(e) Inventories

Inventories of the Company and the domestic consolidated sub-

sidiaries are stated principally at the lower of cost or market, cost

being determined by the last-in, first-out method. Inventories of

the foreign consolidated subsidiaries are stated principally at the

lower of cost or market, cost being determined by the moving

average method.

(f) Depreciation and amortization

Depreciation of property, plant and equipment is mainly comput-

ed by the declining-balance method based on the Corporation

Tax Law of Japan except that certain consolidated subsidiaries

employ the straight-line method at rates based on the estimated

useful lives of the respective assets.

(g) Allowance for doubtful accounts

The allowance for doubtful accounts is provided at an amount

sufficient to cover possible losses on the collection of receivables.

For the Company and its consolidated subsidiaries, the amount of

the allowance is determined based on (1) the maximum amount

permitted to be charged to income under the Corporation Tax

Law of Japan, (2) an estimated amount for probable doubtful

accounts based on a review of the collectibility of individual

receivables, and (3) an amount based on past experiences.

(h) Retirement benefits

Employees’ retirement benefits:

The Company and its consolidated subsidiaries have retirement

benefit plans covering substantially all their employees. Employees

of the consolidated subsidiaries who terminate their employment are

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

YAMAHA Corporation and Consolidated Subsidiaries

March 31, 1998 and 1997