Xcel Energy 2001 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2001 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

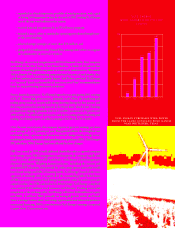

– expanded its already impressive portfolio of wind generation, with a goal

of having 500 megawatts on line by the end of 2002, making Xcel Energy

one of the top wind utilities in the nation;

– received national recognition for its WindSource program;

– initiated a major effort to standardize operating procedures through state-

of-the-art technology;

– achieved merger synergies of more than $50 million; and

– pledged $3.5 million to the United Way, among other efforts to support

the communities in its service territory.

Xcel Energy also received recognition in 2001 for financial results. Your company

was added to the Dow Jones Sector Titans Indexes, a family of 18 indexes that

represent the leading global companies in several stock market sectors. We ranked

55th in Barron’s 500 top-performing companies based on a mix of stock market data,

cash flow analysis and revenue growth figures. And Forbes.com listed Xcel Energy

as a “top stock” based on the number of times it received “buy” recommendations

from the top-performing investment newsletters.

From a financial perspective, Xcel Energy began the year anticipating 2001 earnings

of $2.20. Due to high power prices, primarily in the West, the marketing and

trading group made an exceptionally strong showing during the first quarter, and

the company revised its earnings forecast to $2.30 per share, which it met. Earnings

per share from ongoing operations were $2.31 in 2001, an increase of 9 percent over

2000 results. Even with lower power prices and lower earnings from marketing and

trading, Xcel Energy expects to achieve earnings of $2.40 to $2.50 in 2002.

Over the next several years, the company expects to grow its earnings per share

at an average of 7 to 9 percent per year. This growth reflects the strength of our

traditional utility operations and numerous recent changes in the energy sector,

including the lower valuation of independent power producers (IPPs). Xcel Energy’s

IPP subsidiary, NRG Energy, has been affected by these changes.

NRG was created in 1989 to build additional shareholder value as a growth company

in the energy sector. NRG’s management team has grown the company rapidly and

today it is the third-largest IPP worldwide, with almost 20,000 megawatts

of power generation. Weighing numerous factors, including the current and

anticipated IPP valuations, the potential for credit rating agency action that would

lower bond ratings and NRG’s financing needs, Xcel Energy’s board of directors

approved an exchange offer to acquire all of the outstanding publicly held shares

of NRG as a way to increase Xcel Energy shareholder value. In order to provide

capital to infuse into NRG and reduce its debt leverage, Xcel Energy completed

a successful $500-million stock issuance in February. Pending successful

completion of the exchange offer, Xcel Energy will invest $600 million of equity

into NRG. It will focus NRG primarily on managed growth within the United

States, a stronger balance sheet, cost savings opportunities and reduced dependence

on external financing. NRG’s contribution to Xcel Energy’s earnings is expected

to grow about 15 percent per year.

XCEL ENERGY PURCHASES WIND POWER

FROM THE LLANO ESTACADO WIND RANCH

NEAR WHITE DEER, TEXAS.

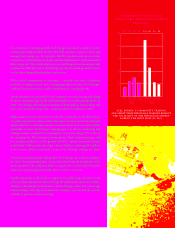

XCEL ENERGY

WIND GENERATION ON LINE

in megawatts

100

200

300

400

500

097 98 99 00 01

25

138

316

348

469