Xcel Energy 2001 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2001 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

To contribute to earnings growth, Xcel Energy introduced a number of new

revenue-generating products in 2001 that help customers conserve energy and

manage their energy use. For example, InfoWise products and services allow

customers to use the Internet to obtain real-time information to track and analyze

their energy use. The overall objective is to build long-term relationships with

customers in which they turn to Xcel Energy not only for natural gas and electricity,

but for other energy-related products and services.

With a solid commitment to customers, a sizeable asset base, a balanced

portfolio of energy sources and a strong geographic position, Xcel Energy’s

regulated business provides a stable foundation for earnings growth.

Similar attributes are responsible for the company’s success in buying and selling

electricity and natural gas on the wholesale market, a second earnings driver. In

2001, Xcel Energy achieved gross margins of $264 million from trading and

short-term wholesale energy sales, compared with $133 million in 2000.

High market prices for electricity in early 2001, primarily on the West Coast,

are partly responsible for those results. Since then, electricity prices have dropped

significantly due to a slowing economy, increased conservation, new power plants

and milder weather. Xcel Energy’s ongoing goal is to increase marketing and

trading’s annual contribution to earnings by 15 percent, using 1999 results as

the starting point. The company’s e prime group, which trades natural gas, will

be a strong contributor to that growth. In 2001, e prime increased volumes

traded from 1 billion cubic feet of gas a day to 4 billion, achieving $8.5 million

in net income, which contributed 2 cents to Xcel Energy earnings per share.

As part of its marketing and trading effort, Xcel Energy also works to maximize

the value of its generating plants, an asset base that forms the foundation of the

entire operation. The company’s ability to acquire low-cost fuel and to keep the

plants operating during peak market times is vital to its success.

Equally important is the ability to negotiate favorable long- and short-term

power purchase agreements and to leverage the intellectual capital of its traders.

Trading is a knowledge-based business, and Xcel Energy traders have a thorough

understanding of the region in which the company operates and the systems

available to generate and move energy.

11

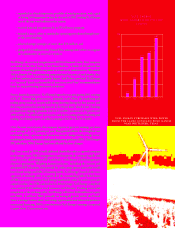

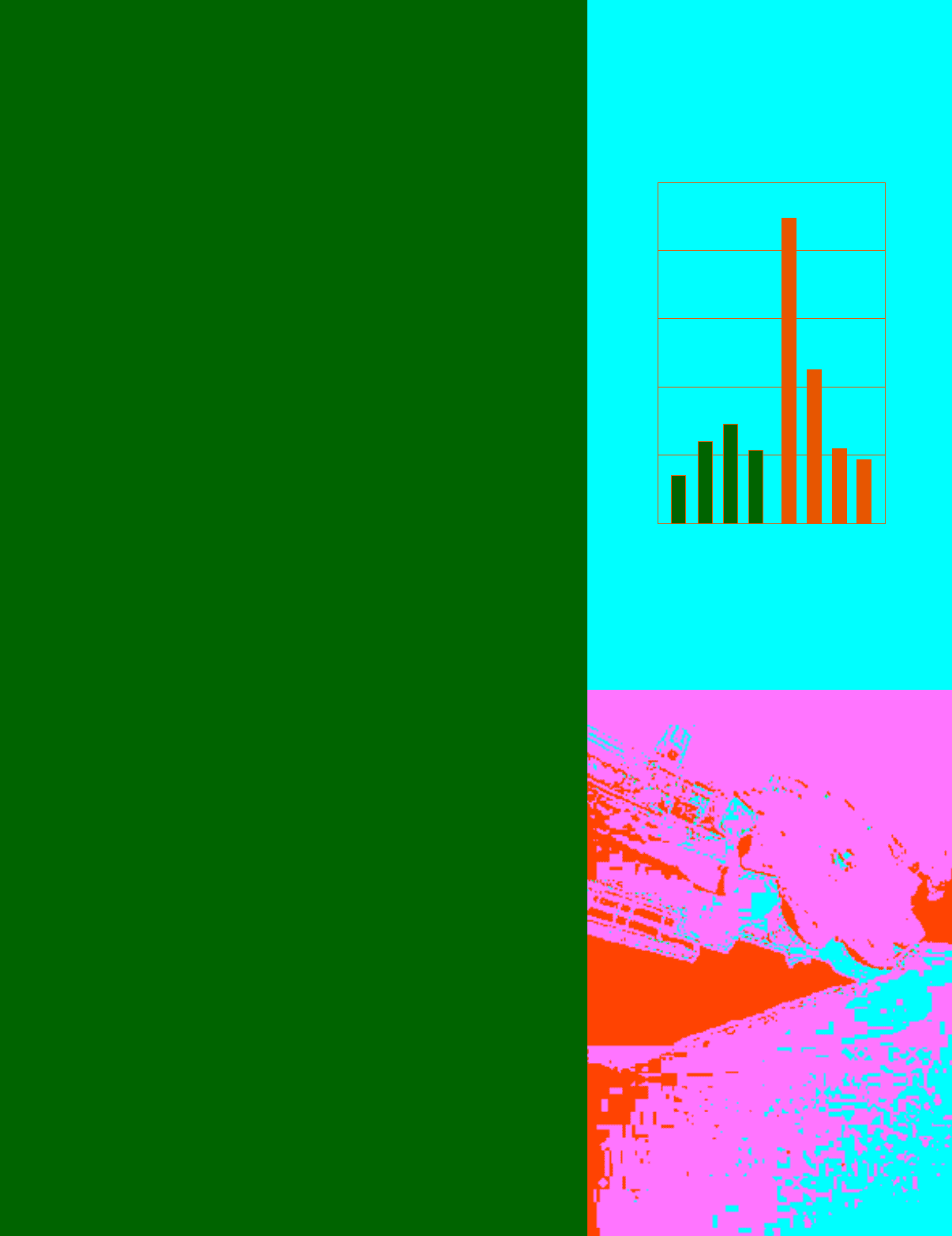

XCEL ENERGY’S COMMODITY TRADING

AND SHORT-TERM WHOLESALE MARGINS REFLECT

THE VOLATILITY OF THE WHOLESALE MARKET

DURING THE FIRST HALF OF 2001.

COMMODITY TRADING AND

SHORT-TERM WHOLESALE MARGINS

dollars in millions

30

60

120

90

150

0Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

2000 2001

21 36 44 32 135 68 33 28