World Fuel Services 2008 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2008 World Fuel Services annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

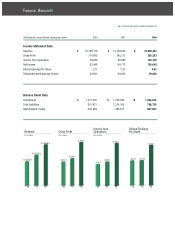

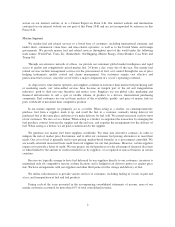

Gross Profi t

($ in millions)

$ 6.0

$ 8.0

$ 26.2

MARINE AVIATION

LAND

Revenue

($ in billions)

Revenue

($ in billions)

Revenue

($ in millions)

Paul H. Stebbins

‘06

$ 420.7

$ 602.9

$ 1,299.6

‘07 ‘08

Income from

Operations

($ in millions)

$ 1.1 $ 1.2

$ 3.5

‘06

$ 5.8 $ 4.6

$ 7.7 $ 5.5

$ 9.9 $ 7.3

‘07 ‘07 ‘07‘08 ‘08 ‘08

Income from

Operations

($ in millions)

$ 44.2 $ 50.8

$ 121.8

Income from

Operations

($ in millions)

$ 56.6

$ 60.8

$ 68.1

Gross Profi t

($ in millions)

$ 106.9

$ 122.8

$ 165.8

Gross Profi t

($ in millions)

$ 101.2 $ 114.5

$ 203.3

This comprehensive service offering continues to drive value for

customers and suppliers alike as we help them navigate through a very

diffi cult marketplace.

Worthy of special note is the systemic concern about counter-party

risk which has prompted our customers to scrutinize more carefully

the fi nancial viability, transparency and corporate governance of their

vendors. This is a welcome trend for World Fuel. What were strong

competitive differentiators for us in a good market have become

essential requirements for doing business in a diffi cult market. This new

level of counter-party scrutiny has only served to highlight the strength

of our business model and validate the value of our global offering. At a

tactical level we are better positioned than ever to continue to service

our core business in an uncertain market.

At a strategic level, we believe the company has secured a leadership

position in a market rich with opportunity across all three of our business

segments. The upheaval in the global economy has precipitated tectonic

shifts in the energy, transportation and fi nance industries. Enterprise

valuations are at all time lows and good businesses are starved for

capital in a climate of unrelenting scarcity of credit. Our strong liquidity

position should allow us to capitalize on these conditions as we look to

compliment organic growth with strategic acquisitions, as evidenced

by the acquisitions of AVCARD in 2007, Texor in 2008 and TGS and

Henty Oil thus far in 2009. As we look forward, we will be reviewing

additional opportunities to make accretive acquisitions with a focus on

our core space of fuel distribution, services and logistics.

For World Fuel, 2008 was a remarkable year. We successfully launched

our new ERP system, achieved new milestones in organizational

maturity, effectively managed risk in a wildly volatile market and

delivered record fi nancial performance. In the most recent Fortune 500

listing, World Fuel was ranked fourth in total return to shareholders for

2008. And, as evidence of our ability to drive long-term shareholder

value, we were ranked 11th in total return to shareholders over 10 years.

As we look forward, we harbor the same concerns our shareholders

have about the tough economic conditions faced by our country and the

world and we will continue to engage the marketplace with discipline

and caution. But, we take a great deal of comfort in the fact that we

enter 2009 with a strong fi nancial foundation. And while we remain

cautious about over-promising on our ability to drive growth in this

challenging operating environment, it is important to note that we

believe the crisis has created signifi cant strategic opportunity for World

Fuel. The position we have achieved in the marketplace represents the

culmination of years of effort and investment, and we are optimistic

about our ability to continue to deliver signifi cant value to all of our

stakeholders going forward.

‘06 ‘06 ‘07 ‘07 ‘07‘08 ‘08 ‘08‘06 ‘06 ‘06

‘06 ‘06‘07 ‘07‘08 ‘08

Michael J. Kasbar