World Fuel Services 2008 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2008 World Fuel Services annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SHAREHOLDER LETTER

To Our Shareholders:

In a year that will be remembered for the worst economic collapse

since the 1930s, World Fuel delivered the best fi nancial performance

in the company’s history. Our earnings for the year were $105 million

or $3.62 per diluted share, a 62 percent increase over 2007. In the

fourth quarter, our return on working capital was 69 percent, our return

on equity was 19 percent and our net trade cycle was six days. Our

cash balance at the end of the year was $314 million, shareholders’

equity was $608 million and liquidity was more than $900 million,

including availability under our bank facilities. Notwithstanding an

extremely challenging operating environment, we were able to deliver

record results due to our continued focus on four key metrics: credit

and counter-party risk management, liquidity, margin, and return on

working capital. By any measure the company had an exceptional year

and our performance over time refl ects management’s commitment to

building durable and sustainable value for our shareholders.

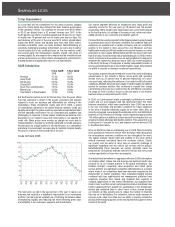

CAGR Calculations:

5 Year CAGR 5 Year CAGR

2008 2007

Revenue 47.3% 48.5%

Gross Profi t 31.4% 24.0%

Net Income 36.5% 35.6%

Diluted EPS 29.6% 28.0%

Stock Price (monthly AVG) 19.5% 33.4%

Market Cap 26.8% 39.6%

Total Return to Shareholders 17.3% 24.0%

But the fi nancial metrics do not tell the full story. Over the years, World

Fuel has continued to invest in the people, processes and systems

required to scale our business and differentiate our offering in the

marketplace. These investments clearly paid off in 2008, a period

of extraordinary upheaval in the global fi nancial markets. Credit and

liquidity were tight, the global economy experienced rapid deterioration

and the operating environment for our customers and suppliers was

challenging. In response to these market conditions we became more

discerning in our customer base and conservative in our appetite for

credit risk. When prices were moving up sharply we were able to

respond quickly to manage our working capital and our credit exposure.

And because our unique position in the market gave us a competitive

advantage in procurement, we were able to maintain margins despite

the drop in oil prices in the second half of the year.

0

20

40

60

80

100

120

140

$ 160

Jan

08

Feb

08

Mar

08

Apr

08

May

08

Jun

08

Jul

08

Aug

08

Sep

08

Oct

08

Nov

08

Dec

08

Crude Oil Trend 2008

The hard work we did in the second half of the year to reduce our

business risk resulted in a signifi cant improvement in our receivables

portfolio. Our team did an excellent job of fortifying the balance sheet,

strengthening liquidity and reducing risk while delivering great value

and reliability to our customers, suppliers and shareholders.

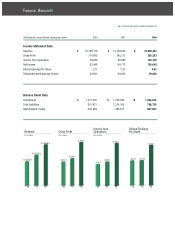

Our marine segment delivered an exceptional year. Gross profi t and

operating income for the year were up 78 percent and 140 percent

respectively. While freight rates deteriorated and overall trade slowed

in the fourth quarter, our strategy of focusing on risk, return and value-

added services to our customers and suppliers paid off.

It is clear that the overall prognosis for the shipping industry going forward

is uncertain given current economic conditions, but seaborne trade will

always be an essential part of global commerce and our competitive

position in the market is more secure than ever. Moreover, we have

traditionally excelled in diffi cult market environments because our value

proposition is more clearly differentiated and this has never been truer

than it is today. Overall the team did an outstanding job in 2008 on every

metric of success and we believe we are well positioned to respond to

whatever the market may bring our way in 2009. Our recent acquisition

of the Henty Oil Group of Companies, a leading independent provider of

marine and land based fuels in the United Kingdom, again demonstrates

our ability to execute on strategic investment opportunities.

Our aviation segment also performed well in one of the most challenging

environments in the industry’s history. Gross profi t and operating

income were up 35 percent and 12 percent respectively on a year-

over-year basis, refl ecting the resilience of our model in diffi cult market

conditions. AVCARD delivered solid results in 2008. Despite the diffi cult

market for business aviation, they continued to expand their charge

card offering and secure more contract fuel. As with Marine, we believe

the steps we took in 2008 to focus on risk and return in our Aviation

business leave us well positioned for 2009.

In 2008, our Land segment made a meaningful contribution to overall

results and we were pleased with the directional trend. The Texor

business acquisition, which was completed in June 2008, has proven

to be very successful and provides a platform for future expansion

in the area of branded wholesale supply as we enter 2009. Also, as

recently announced, we acquired the wholesale motor-fuel distribution

business of TGS Petroleum in Chicago, which represents approximately

100 million gallons of additional volume and will be integrated into our

growing branded wholesale distribution platform. This acquisition is an

exciting proof of concept for our Land segment and we welcome TGS

to the World Fuel family.

All in all, World Fuel had an outstanding year in 2008. What is certainly

most pressing on everyone’s mind is what the future might bring given

the extraordinary economic conditions we face throughout the world.

The capital markets remain tight and volatility in the stock market

refl ects continued uncertainty about the economic outlook. Clearly,

our country and the world at large face an economic challenge of

signifi cant magnitude and the road to full recovery will be diffi cult.

Notwithstanding these concerns, we remain optimistic about the

prospects for our business and take comfort in the fact that every crisis

creates opportunity for those who are prepared.

At a tactical level we believe our aggressive efforts in 2008 to strengthen

our balance sheet, reduce risk and leverage our business model have

secured for us an enviable position in the global marketplace. Our

fi nancial strength, compelling value proposition and robust global

service platform are signifi cant competitive differentiators in a market

where many of our competitors have been adversely impacted by the

deterioration of market conditions. Their weakened liquidity profi les

combined with less sophisticated risk management platforms have

negatively impacted their results and impaired their capacity to

compete aggressively in this market. Meanwhile, our suppliers have

made it clear to us that current and prospective market conditions have

further suppressed their appetite for participation in the downstream

market and motivated them to direct more of their volume through

our network as they actively seek to reduce the number of channels

they rely on for distribution. Our customers, who are under pressure to

manage costs, value more than ever our ability to provide competitive

pricing while managing quality control and operational support in every

market in the world.