Washington Post 2000 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2000 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Washington Post Company 45

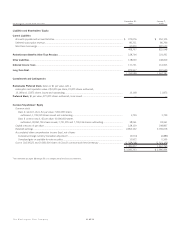

Minimum payments have not been reduced by minimum sublease

rentals of $3,250,000 due in the future under noncancelable subleases.

Rent expense under operating leases included in operating costs

and expenses was approximately $49,700,000, $33,600,000, and

$31,800,000 in 2000, 1999, and 1998, respectively. Sublease income

was approximately $1,150,000, $433,000, and $500,000 in 2000,

1999, and 1998, respectively.

The Company’s broadcast subsidiaries are parties to certain

agreements that commit them to purchase programming to be pro-

duced in future years. At December 31, 2000, such commitments

amounted to approximately $62,800,000. If such programs are not

produced, the Company’s commitment would expire without obligation.

IJ IACQUISITIONS AND DISPOSITIONS

Acquisitions. The Company completed acquisitions totaling approxi-

mately $212,300,000 in 2000 (including assumed debt and related

acquisition costs), $90,500,000 in 1999, and $320,600,000 in 1998.

All of these acquisitions were accounted for using the purchase

method, and accordingly, the assets and liabilities of the companies

acquired have been recorded at their estimated fair values at the

date of acquisition.

On August 2, 2000, the Company acquired Quest Education

Corporation (Quest) for approximately $177,700,000, including

assumed debt. The acquisition of Quest was completed through an all

cash tender offer in which the company purchased substantially all

of the outstanding stock of Quest for $18.35 per share. The acquisi-

tion was financed through the issuance of additional borrowings. Quest

is a provider of post-secondary education, currently serving nearly

13,000 students in 34 schools located in 13 states. Quest’s schools

offer Bachelor’s degrees, Associate’s degrees, and diploma programs

designed to provide students with the knowledge and skills necessary

to qualify them for entry-level employment, primarily in the fields of

healthcare, business, information technology, fashion, and design.

In addition, the Company acquired two cable systems serving

approximately 8,500 subscribers in Nebraska (in June 2000) and

Mississippi (in August 2000) for approximately $16,200,000, as well

as various other smaller businesses throughout 2000 for $18,400,000

(principally consisting of educational services companies).

During 1999, the Company acquired cable systems serving

10,300 subscribers in North Dakota, Oklahoma, and Arizona (April

and August 1999 for $18,300,000); two Certified Financial Analyst

test preparation companies (November and December 1999 for

$16,000,000), and a travel guide magazine (in December 1999 for

$10,200,000). In addition, the Company acquired various other

smaller businesses throughout 1999 for $46,000,000 (principally

consisting of educational services companies).

Acquisitions in 1998 included an educational services company

that provides English-language study programs (in January 1998 for

$16,100,000); a 36,000-subscriber cable system serving Anniston,

Alabama (in June 1998 for $66,500,000); cable systems serving

72,000 subscribers in Mississippi, Louisiana, Texas, and Oklahoma

(in July 1998 for $130,100,000); and a publisher and provider of

licensing training for securities, insurance, and real estate profession-

als (in July 1998 for $35,200,000). In addition, the Company acquired

various other smaller businesses throughout 1998 for $72,700,000

(principally consisting of educational and career service companies

and small cable systems).

The results of operations for each of the businesses acquired are

included in the Consolidated Statements of Income from their respec-

tive dates of acquisition. Pro forma results of operations for 2000,

1999, and 1998, assuming the acquisitions occurred at the beginning

of 1998, are not materially different from reported results of operations.

Dispositions. In June 1999, the Company sold the assets of Legi-Slate,

Inc., its online services subsidiary that covered Federal legislation and

regulation. No significant gain or loss was realized as a result of the sale.

In March 1998, Cowles Media Company (“Cowles”) and

McClatchy Newspapers, Inc. (“McClatchy”) completed a series of

transactions resulting in the merger of Cowles and McClatchy. In the

merger, each share of Cowles common stock was converted (based

upon elections of Cowles stockholders) into shares of McClatchy stock

or a combination of cash and McClatchy stock. As of the date of the

Cowles and McClatchy merger transaction, a wholly-owned subsidiary

of the Company owned 3,893,796 shares (equal to about 28 percent)

of the outstanding common stock of Cowles, most of which was

acquired in 1985. As a result of the transaction, the Company’s sub-

sidiary received $330,500,000 in cash from McClatchy and

730,525 shares of McClatchy Class A common stock. The market

value of the McClatchy stock received approximated $21,600,000. The

gain resulting from this transaction, which is included in 1998 “Other

(expense) income, net” in the Consolidated Statements of Income,

increased net income by approximately $162,800,000 and basic and

diluted earnings per share by $16.14 and $16.07, respectively.

In July 1998, the Company completed the sale of 14 small cable

systems in Texas, Missouri, and Kansas serving approximately 29,000

subscribers for approximately $41,900,000. The gain resulting from

this transaction, which is included in 1998 “Other (expense) income,

net” in the Consolidated Statements of Income, increased net income

by approximately $17,300,000 and basic and diluted earnings per

share by $1.71.