Washington Post 2000 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2000 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

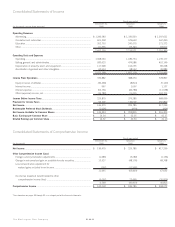

The Washington Post Company 43

Stock Options. The Company’s employee stock option plan, which was

adopted in 1971 and amended in 1993, reserves 1,900,000 shares of

the Company’s Class B common stock for options to be granted under

the plan. The purchase price of the shares covered by an option

cannot be less than the fair value on the granting date. At December

31, 2000, there were 503,575 shares reserved for issuance under the

stock option plan, of which 166,450 shares were subject to options

outstanding and 337,125 shares were available for future grants.

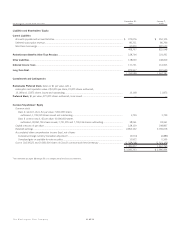

Changes in options outstanding for the years ended December

31, 2000, January 2, 2000, and January 3, 1999 were as follows:

2000 1999 1998

Number Average Number Average Number Average

of Option of Option of Option

Shares Price Shares Price Shares Price

Beginning of year .... 156,497 $ 470.64 246,072 $ 404.48 251,225 $371.35

Granted................... 89,500 544.90 3,750 516.36 25,500 519.32

Exercised ................ (20,425) 345.46 (87,825) 288.43 (30,653) 228.53

Forfeited.................. (59,122) 643.71 (5,500) 450.86 — —

End of year.............. 166,450 $ 465.55 156,497 $ 470.64 246,072 $404.48

Of the shares covered by options outstanding at the end of 2000,

75,463 are now exercisable, 31,612 will become exercisable in 2001,

25,375 will become exercisable in 2002, 20,250 will become exercis-

able in 2003, and 13,750 will become exercisable in 2004.

Information related to stock options outstanding at December 31,

2000 is as follows:

Weighted

Average Weighted Weighted

Number Remaining Average Number Average

Range of Outstanding Contractual Exercise Exercisable Exercise

exercise prices at 12/31/00 Life (yrs.) Price at 12/31/00 Price

$ 173 2,500 1.0 $ 173.00 2,500 $ 173.00

222-299 23,750 3.3 247.91 23,750 247.91

344 13,750 6.0 343.94 13,750 343.94

472-484 31,450 7.6 473.89 18,713 472.00

500-586 95,000 9.3 542.81 16,750 526.03

All options were granted at an exercise price equal to or greater

than the fair market value of the Company’s common stock at the date

of grant. The weighted-average fair value for options granted during

2000, 1999, and 1998 was $161.15, $157.77, and $126.57, respec-

tively. The fair value of options at date of grant was estimated using

the Black-Scholes method utilizing the following assumptions:

2000 1999 1998

Expected life (years) ............................. 7 7 7

Interest rate .......................................... 5.98% 6.19% 4.68%

Volatility................................................ 17.9% 16.0% 14.6%

Dividend yield....................................... 1.0% 1.1% 1.2%

Had the fair values of options granted after 1995 been recog-

nized as compensation expense, net income would have been

reduced by $3.8 million ($0.40 per share, basic and diluted), $1.9

million ($0.19 per share, basic and diluted), and $2.0 million ($0.19

per share, basic and diluted) in 2000, 1999, and 1998, respectively.

The Company also maintains a stock option plan at its Kaplan

subsidiary that provides for the issuance of stock options representing

15 percent of Kaplan, Inc. common stock to certain members of

Kaplan’s management. Under the provisions of this plan, options are

issued with an exercise price equal to the estimated fair value of

Kaplan’s common stock. Options vest ratably over five years from

issuance, and upon exercise, an option holder has the right to require

the Company to repurchase the Kaplan stock at the stock’s then fair

value. The fair value of Kaplan’s common stock is determined by

the Company’s compensation committee. At December 31, 2000,

options representing 12.5 percent of Kaplan’s common stock were

issued and outstanding. For 2000, 1999, and 1998, the Company

recorded expense of $6,000,000, $7,200,000, and $6,000,000,

respectively, related to this plan. No options have been exercised

to date under this plan.

Average Number of Shares Outstanding. Basic earnings per share are

based on the weighted average number of shares of common stock

outstanding during each year. Diluted earnings per common share are

based upon the weighted average number of shares of common stock

outstanding each year, adjusted for the dilutive effect of shares issuable

under outstanding stock options. Basic and diluted weighted average

share information for 2000, 1999, and 1998 is as follows:

Basic Dilutive Diluted

Weighted Effect of Weighted

Average Stock Average

Shares Options Shares

2000 ..................................... 9,445,466 14,362 9,459,828

1999 ..................................... 10,060,578 21,206 10,081,784

1998 ..................................... 10,086,786 42,170 10,128,956

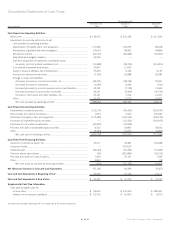

IH IPENSIONS AND OTHER POSTRETIREMENT PLANS

The Company maintains various pension and incentive savings plans

and contributes to several multi-employer plans on behalf of certain

union represented employee groups. Substantially all of the

Company’s employees are covered by these plans.

The Company also provides healthcare and life insurance benefits

to certain retired employees. These employees become eligible for

benefits after meeting age and service requirements.