Washington Post 2000 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2000 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

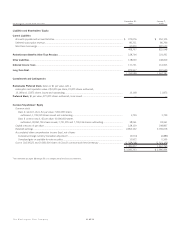

Mr. Warren Buffett, is a member of the Company’s Board of Directors.

Neither Berkshire nor Mr. Buffett participated in the Company’s evalu-

ation, approval, or execution of its decision to invest in Berkshire

common stock. The Company’s investment in Berkshire common

stock is less than 1 percent of the consolidated equity of Berkshire.

At December 31, 2000, the unrealized gain related to the Company’s

Berkshire stock investment totaled $25,271,000; the unrealized

loss on this investment was $19,134,000 at January 2, 2000. The

Company presently intends to hold the Berkshire common stock

investment long term; thus the investment has been classified as

a non-current asset in the Consolidated Balance Sheets.

During 2000, 1999, and 1998 proceeds from sales of marketable

equity securities were $6,332,000, $54,805,000, and $38,246,000,

respectively, and gross realized gains on such sales were $4,929,000,

$38,799,000, and $2,168,000, respectively. Gross realized gains or

losses upon the sale of marketable equity securities are included in

“Other (expense) income, net” in the Consolidated Statements of

Income. For purposes of computing realized gains and losses, the

cost basis of securities sold is determined by specific identification.

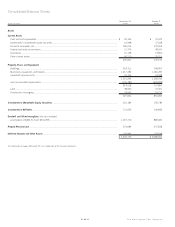

Investments in Affiliates. The Company’s investments in affiliates

at December 31, 2000 and January 2, 2000 include the following

(in thousands):

2000 1999

BrassRing, Inc.................................................. $ 73,310 $ 75,842

Bowater Mersey Paper Company ...................... 40,227 39,885

International Herald Tribune ............................. 17,561 19,890

Other ................................................................ 531 5,052

$ 131,629 $ 140,669

The Company’s investments in affiliates consist of a 42 percent

interest in BrassRing, Inc., which provides recruiting, career develop-

ment and hiring management services for employers and job candi-

dates; a 49 percent interest in the common stock of Bowater Mersey

Paper Company Limited, which owns and operates a newsprint mill in

Nova Scotia; a 50 percent common stock interest in the International

Herald Tribune newspaper, published near Paris, France; and a 50

percent common stock interest in the Los Angeles Times-Washington

Post News Service, Inc.

Summarized financial data for the affiliates’ operations are as

follows (in thousands):

2000 1999 1998

Financial Position:

Working capital .......................... $ 29,427 $ 69,155 $ 34,628

Property, plant, and equipment.. 143,749 133,425 125,025

Total assets ................................ 432,458 365,694 252,231

Long-term debt .......................... — — —

Net equity .................................. 291,481 236,597 122,267

Results of Operations:

Operating revenues.................... $ 345,913 $ 267,788 $ 279,779

Operating (loss) income ............. (27,505) (37,889) 10,978

Net loss...................................... (77,739) (40,035) (63)

The following table summarizes the status and results of the

Company’s investments in affiliates (in thousands):

2000 1999

Beginning investment ....................................... $ 140,669 $ 68,530

Issuance of stock by BrassRing, Inc.................. 21,973 83,493

Additional investment ....................................... 12,480 8,734

Equity in losses................................................. (36,466) (8,814)

Dividends and distributions received................. (940) (930)

Foreign currency translation.............................. (1,685) (3,289)

Other ................................................................ (4,402) (7,055)

Ending investment ............................................ $ 131,629 $ 140,669

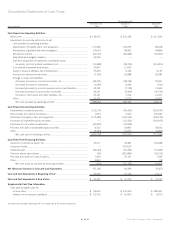

On September 29, 1999, the Company merged its career fair and

HireSystems businesses together and renamed the combined opera-

tions BrassRing, Inc. On the same date, BrassRing issued stock repre-

senting a 46 percent equity interest to two parties under two separate

transactions for cash and businesses with an aggregate fair value of

$87,000,000. As a result of this transaction, the Company’s ownership

of BrassRing was reduced to 54 percent and the minority investors

were granted certain participatory rights. As such, the Company

de-consolidated BrassRing on September 29, 1999 and recorded its

investment under the equity method of accounting. The 1999 increase

in the basis of the Company’s investment in BrassRing resulting from

this transaction of $34,571,000, net of taxes, has been recorded as

contributed capital.

During 2000, BrassRing issued stock to various parties in

connection with its acquisitions of various career fair and recruiting

services companies. The effect of these transactions reduced the

Company’s investment interest in BrassRing to 42 percent, from

54 percent at January 2, 2000, and increased the Company’s invest-

ment basis in BrassRing by $13,332,000, net of taxes. The increase

in investment basis has been recorded as contributed capital.

40 The Washington Post Company