Walgreens 2006 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2006 Walgreens annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

You acquired a regional pharmacy chain in 2006.

Does this mark a strategy change?

Bernauer: Absolutely not. Our merger with the 76-store,

Delaware-based Happy Harry’s chain was an exception to our

organic growth rule. We see building our own stores at the

right size in the right spots as a great competitive advantage.

We’ll continue to look at opportunities, but rarely do another

chain’s people, locations, market share and culture match

Walgreens as well as Happy Harry’s.

How is business at Walgreens Health Services,

your managed care division?

Bernauer: This is a small, growing and profitable business that

is integral to our strategy. Unlike our retail side, acquisitions

at WHS, as we call it, are important to growth. We’re acquiring

“best of breed” businesses like Schraft’s for fertility drugs and

Medmark, which provides pharmacy care for patients with

conditions such as hepatitis, multiple sclerosis and HIV/AIDS.

While such investments rarely yield significant earnings

growth immediately, they are critical to securing our position

in healthcare for the long term. Our goal is to “marry” WHS

services to our thousands of pharmacy counters. We want to

say “yes” to every prescription, from the common antibiotic

to specialty drugs, home infusion, oxygen, durable medical

equipment and prescriptions for assisted care residents.

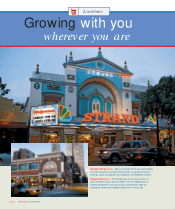

Is it more difficult to find store sites today than

10 years ago?

Rein: That depends on the market. We’re certainly finding

the numbers of sites we need, but in expensive markets like

Southern California or high density urban neighborhoods

on the East Coast, we’re getting more creative and flexible.

We don’t necessarily need prototype sites to serve customers

well. For example, we’ve run smaller stores very profitably in

San Francisco for decades. The challenge is to “edit”merchan-

dise to fit both the space available and the distinct needs of a

concentrated customer base, a skill we’ve honed for years.

We recorded our biggest store expansion year in company

history in 2006, with a net increase of 476 stores including

acquisitions and stores affected by Hurricane Katrina.

We’ll continue organic growth this year with an anticipated

500 new stores for a net increase of more than 400 stores

after relocations and closings. And when we open our first

Maine store in 2007, we’ll be in all 48 contiguous states.

Does America need more drugstores?

Bernauer: In one word, yes. An aging population … plus

new drugs … plus Medicare Part D prescription coverage

equals an exploding demand. Just look at the past five years:

While pharmacies industry-wide increased just 2 percent,

prescriptions filled were up 18 percent. Ongoing consolidation

in the drugstore industry represents solid opportunity for

chains like Walgreens.

What other accomplishments stand out for 2006?

Rein: Let me tick off a few.

• We increased our quarterly dividend 19.2 percent.

• Inventories increased just 8.2 percent versus 2005

on a sales gain of 12.3 percent.

• We opened our first in-store health clinics in the

Kansas City and St. Louis markets.

2006 Walgreens Annual Report Page 3

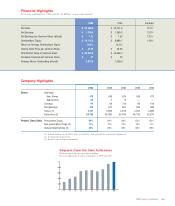

Sales

In billions of dollars

Earnings

In millions of dollars