Walgreens 2006 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2006 Walgreens annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006 Walgreens Annual Report Page 27

As of August 31, 2006, there was $46.9 million of total unrecognized compensation

cost related to nonvested awards. This cost is expected to be recognized over a

weighted average of 1.56 years.

Prior to fiscal 2006, the company presented all tax benefits of deductions resulting

from the exercise of stock options as operating cash flows in the Consolidated

Statement of Cash Flows. SFAS No.123(R) requires excess tax benefits, the cash

flow resulting from the tax deductions in excess of the compensation cost recog-

nized for those options, to be classified as financing cash flows. The total excess tax

benefit for fiscal 2006 was $56.5 million.

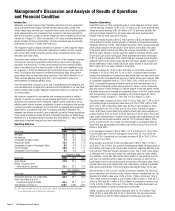

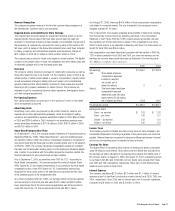

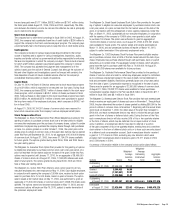

Had compensation costs been determined consistent with the method of SFAS No.

123 for options granted in fiscal 2005 and 2004, pro forma net earnings and net

earnings per common share would have been as illustrated in the following table

(In Millions, except per share amounts):

2005 2004

Net earnings $1,559.5 $1,349.8

Add: Stock-based employee

compensation expenses

included in reported

net income, net of

related tax effects .2 .4

Deduct: Total stock-based employee

compensation expense

determined under fair value

based method for all awards,

net of related tax effects (72.5) (44.1)

Pro forma net income $1,487.2 $1,306.1

Earnings per share:

Basic – as reported $ 1.53 $ 1.32

Basic – pro forma 1.46 1.27

Diluted – as reported 1.52 1.31

Diluted – pro forma 1.45 1.27

Income Taxes

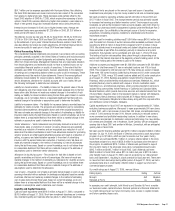

The company provides for federal and state income taxes on items included in the

Consolidated Statements of Earnings regardless of the period when such taxes are

payable. Deferred taxes are recognized for temporary differences between financial

and income tax reporting based on enacted tax laws and rates.

Earnings Per Share

The dilutive effect of outstanding stock options on earnings per share is calculated

using the treasury stock method. Stock options are anti-dilutive and excluded from

the earnings per share calculation if the exercise price exceeds the market price of

the common shares. At August 31, 2006, and August 31, 2004, outstanding options

to purchase 3,505,834 and 2,902,996 common shares were excluded from fiscal

year 2006 and 2004 calculations, respectively. There were no anti-dilutive shares

related to stock options in fiscal 2005.

Interest Expense

The company capitalized $3.3 million, $4.2 million and $1.1 million of interest

expense as part of significant construction projects during fiscal 2006, 2005 and

2004, respectively. Fiscal 2006 had no interest paid, net of amounts capitalized,

compared to $.8 million in 2005 and $.2 million in 2004.

Revenue Recognition

The company recognizes revenue at the time the customer takes possession of

the merchandise. Customer returns are immaterial.

Impaired Assets and Liabilities for Store Closings

The company tests long-lived assets for impairment whenever events or circum-

stances indicate. Store locations that have been open at least five years are

reviewed for impairment indicators at least annually. Once identified, the amount of

the impairment is computed by comparing the carrying value of the assets to the

fair value, which is based on the discounted estimated future cash flows. Included

in selling, occupancy and administration expense were impairment charges of

$22.1 million in 2006, $14.5 million in 2005 and $9.2 million in 2004.

The company also provides for future costs related to closed locations. The liability

is based on the present value of future rent obligations and other related costs (net

of estimated sublease rent) to the first lease option date.

Insurance

The company obtains insurance coverage for catastrophic exposures as well as

those risks required by law to be insured. It is the company’s policy to retain a sig-

nificant portion of certain losses related to workers’ compensation; property losses,

as well as business interruption relating from such losses; and comprehensive

general, pharmacist and vehicle liability. Provisions for these losses are recorded

based upon the company’s estimates for claims incurred. The provisions are

estimated in part by considering historical claims experience, demographic factors

and other actuarial assumptions.

Pre-Opening Expenses

Non-capital expenditures incurred prior to the opening of a new or remodeled

store are expensed as incurred.

Advertising Costs

Advertising costs, which are reduced by the portion funded by vendors, are

expensed as incurred. Net advertising expenses, which are included in selling,

occupancy and administration expense, were $306.9 million in 2006, $260.3 million

in 2005 and $230.9 million in 2004. Included in net advertising expenses were

vendor advertising allowances of $174.8 million in 2006, $180.2 million in 2005

and $163.6 million in 2004.

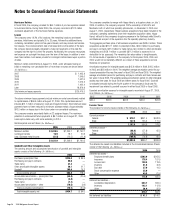

Stock-Based Compensation Plans

As of September 1, 2005, the company adopted Statement of Financial Accounting

Standards (SFAS) No.123(R), “Share-Based Payment,” using the modified prospec-

tive transition method. Under this method, compensation expense is recognized for

new grants beginning this fiscal year and any unvested grants prior to the adoption

of SFAS No.123(R). The company recognizes compensation expense on a straight-

line basis over the employee’s vesting period or to the employee’s retirement eligible

date, if earlier. In accordance with the modified prospective transition method, the

financial statements for prior periods have not been restated.

Prior to September 1, 2005, as permitted under SFAS No.123, “Accounting for

Stock-Based Compensation,” the company applied Accounting Principles Board

(APB) Opinion No. 25 and related interpretations in accounting for its stock-based

compensation plans. Under APB Opinion No. 25, compensation expense was

recognized for stock option grants if the exercise price was below the fair value

of the underlying stock at the measurement date.

As a result of adopting SFAS No.123(R), our earnings before income tax expense

and net earnings for the fiscal year-end were $102.5 million and $59.3 million

lower, respectively, than if the stock-based compensation was still accounted for

under APB Opinion No. 25. The recognized tax benefit was $36.7 million.