Wacom 2010 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2010 Wacom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7

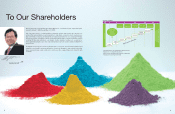

How did we do in our 27th year?

The 27th fiscal year started in the midst of a global

economic crisis, full of uncertainty. Up to Q2, our

business suffered from weak demand for tablets and a

slowdown in our component business. In Q3 the tablet

business began to recover, along with the global

economic recovery, just in time for the launch of our

new products. On the other hand, the component

shipments for Windows 7 PCs did not reach our original

expectations.

Further impacted by appreciation of the Japanese yen

against other key currencies, we closed the fiscal year

with negative growth in both revenue and profit.

In the area of technology and product development, we

made significant progress and launched many new

products. Intuos4 - wireless model, the new Bamboo

series with pen and multi-finger touch functions, the

new interactive pen display models and the Nextbeat

digital DJ device, are among those launched during the

fiscal year. We also successfully started volume

production of multi-finger touch sensors for major PC

manufacturers.

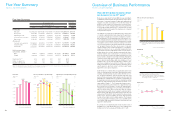

As a result, for the fiscal year ending March 31, 2010,

we recorded net sales of ¥32,045 million (down 5.2%),

operating income of ¥3,128 million (down 27.5%),

ordinary income of ¥3,156 million (down 24.5%), and

net income of ¥1,968 million (down 23.7%).

Where are we heading in our 28th year?

For the 28th fiscal year, we expect to see continued

recovery of the global economy and some acceleration

driven by emerging markets in the second half. In addi-

tion to the growth of professional markets, we expect

interactive pen display markets to grow in medical,

education, and security segments. For the component

business, new product categories such as Slate type

PCs and e-Books will emerge as new customer seg-

ments.

Taking into account our business outlook and neces-

sary investments for the future, we project net sales of

¥37,800 million (up 18.0%), operating income of ¥3,820

million (up 22.1%), ordinary income of ¥3,780 million

(up 19.8%), and net income of ¥2,370 million (up

20.4%) for the fiscal year ending March 31, 2011.

We also announced the new mid-term business plan

WP-1015 that targets net sales of ¥100 billion and oper-

ating income over 15% by the fiscal year ending March

31, 2014.

During the mid-term period, we expect to see strong

expansion of digital content industries in emerging

regions and growth of our consumer business following

the growth of the digital content industry globally. Fur-

thermore, continued IT investments in medical and

educational fields, including investments in digital gov-

WP1015

100,000

80,000

60,000

40,000

20,000

0

2010 2011 2012 2013 2014

Net sales Operating income

For the year ended March 31

(Millions of yen)

ernment, and improved digital security, will increase our

business opportunities. We expect to grow our compo-

nent business beyond traditional PC segments, serving

new segments such as Slate PCs, e-Books and other

new mobile platforms.

While we will continue to enhance our global leadership

in natural user interface solutions, we will invest in

development of emerging markets such as China, India,

and South America. Building solid business founda-

tions and global brand leadership for the future is our

focus for emerging markets and to leverage our com-

ponent business, continuing to strive in delivering natu-

ral and intuitive user interface technologies for a wide

range of IT platforms.

Your dividend

To thank you for your support and in reflecting the

financial result for the fiscal year, we offered an ordi-

nary dividend of ¥3,000 per share to our shareholders

as of March 31, 2010. While we will manage the finan-

cial base carefully, we intend to continue stable divi-

dend payouts and take other investor return measures

as we see fit.

Our message to you

We are committed to enhancing our corporate value

through the ongoing development of exciting new tech-

nologies, investment in talented people and develop-

ment of our business infrastructure. We will accelerate

our business growth, improve efficiency and profitabil-

ity. We take our social responsibility seriously and con-

tinue to improve our corporate governance and compli-

ance.

Your support is invaluable and is essential to our con-

tinuing success. We thank you very much for your

unchanging support.

8

Business Model

Customers

Tablet business

Management Platform

R & D Marketing &

Sales

Supply Chain

Management

Product

Management

Partnerships

User Needs

• Professional tablets

• Consumer tablets

• Interactive displays

Other businesses

• Software of CAD systems

for electrical and mechani-

cal engineering

• Professional DJ device

• Graphic Design

film, animation, comics, games, automo-

tive,advertising, broadcasting, etc

• Medical

hospitals, dental clinics,

medical offices, etc.

• Education

universities, schools, prep schools,

e-learning, etc.

• Business

office systems, shop systems,

call centers, signature verification, etc.

• Administraion

national and local government

• Pen Sensor Technology

PCs, mobile phones, PDAs, games,

ePaper, etc.

• Touch Sensor Technology

PCs, mobile phone, games,

ePaper, POS terminal, digital signage,

game console, TV, etc.

• Control Panel Industry

• Electrical Machinery Industry

• Machine Assembling Industry

• Automotive Industry

• Food Industry

• Medical Equipment Industry

• Operating Systems (OS) vendor

• Application vendor

• Display vendor

• Stationary goods / vendor

Component

business

• Pen sensor components

• Touch sensor components