Wacom 2007 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2007 Wacom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

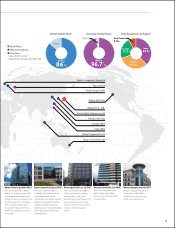

0

5,000

10,000

15,000

20,000

25,000

30,000

0

5

10

15

20

25

30

40

50

60

70

80

(Millions of yen)

(%)

(%)

’03 ’04 ’05 ’06 ’07

’03 ’04 ’05 ’06 ’07

’03 ’04 ’05 ’06 ’07

Overview of Business Performance

Market Environment and

Business Results

The business environment for Wacom group companies

in the scal year under review (from April 1, 2006 to

March 31, 2007) was generally favorable, in spite of high

oil prices and fear of a slowdown in growth of the U.S.

economy. Japanese business investment was made

possible due to economic recovery; however, the rate

of PC-related market growth was negative due to the

increased demand for large-size LCD TVs, the

postponement of the Windows Vista release, and the

resulting trend by consumers to hold o purchasing

new PCs. In the United States, IT-related investment

growth rate slowed, but consumer spending was not as

bad as previously feared. In the EU, domestic

demand-propelled economic expansion continued in

both plant investment and consumer spending. East EU

market expansion continued as well. The Chinese

economy continued to grow at a fast pace and its

market expansion continued. In Asian areas other than

China and Japan, the market environment remained

positive.

Under these circumstances, Wacom was able to

maintain sales growth due to market penetration and

continuous expansion of professional product users,

expansion of sales channels for consumer products, and

rapid growth in sales of interactive pen displays. Wacom

was also involved in new user-interface technology

development, new product development related to

Windows Vista, business expansion in Asia-Pacic,

preparation for a global branding initiative, J-SOX Act

compliance, application for APA, and integration of

environmental and quality management. Wacom

initiated proactive IR with foreign investors, visiting the

EU and Asia beginning this scal year, and received the

rst “Disclosure Newcomer Award” by the TSE in

recognition of the high quality of its IR activities.

As a result, net sales ended at ¥28,787 million, or U.S.

$244 million (up 20.0% year-over-year); operating

income ¥4,565 million, or U.S. $39 million (up 33.3%

year-over-year); and net income ¥2,853 million, or U.S.

$24 million (up 33.0% year-over-year).

(ROE)

(ROA)

Note: Common shares were split on a ve-for-one basis on November

20, 2003 and on a four-for-one basis on November 18, 2005.

Wacom Co., Ltd. and Its Subsidiaries

Net income per share (basic)

ROE/ROA

Equity ratio

28,089

6,154

9,826

5,421

6,886

10.6 11.1

15.2

21.5

19.3

4.3 4.7

7.0

12.2 12.4

39.8

43.9

47.5

63.2 64.9

Note 1: ROA equals net income/average total assets.

Note 2: During its 23rd scal year, the Group procured through a public

oering approximately 4.2 billion yen in capital funds by

allocating new shares to a third party.

16