Vtech 2005 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2005 Vtech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Letter to Shareholders

Write & Learn ArtboardTM

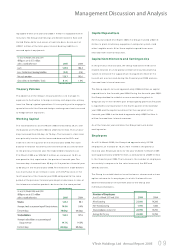

telecommunication products business to

be im proved in the financial year 2006.

Revenue, however, is expected to suffer in

the short term and will not return to a

grow th path until the financial year 2007,

when the revamped products hit the

shelves in the US market in early 2006. This

is despite further expansion in Europe,

which will support sales.

We expect the strong m om entum for the

ELP business to continue in the financial

year 2006. We will develop and expand the

V.Smile product range, which provides a

good platform for future growth. Although

competing products are beginning to

appear, we believe we have a head start in

product awareness and that V.Smile offers

the superior interactivity and software

choice which will allow it to remain the

market leader. We will invest further in

R&D to increase the number and variety of

Smartridges, and continue to negotiate

license agreements to expand our

portfolio of children's characters. We will

also continue to invest in our traditional

product lines and to support all our

products with the prom otional dollars

required to make them compelling from a

marketing perspective.

The global EMS industry is still in an

uptrend and is expected to deliver further

grow th in the financial year 2006. VTech's

CMS business is well positioned to take

advantage of this favourable situation to

deliver top and bottom line growth, given

its stable customer base and efficient

operations. The programme to meet RoHS

requirements w ill continue to be a m ajor

focus and new market segments will be

developed. Input costs are forecast to

rem ain stable, although manufacturing

costs will rise as a result of RoHS. The CMS

business will work to maintain margins

through strict cost control and working

closely with material suppliers.

Finally, I would like to thank my fellow

directors and senior management, as well

as all VTech employees for their

commitm ent to ensuring continued

improvem ent for the Group. My

appreciation also goes out to our

shareholders, bankers and business

partners for their invaluable support.

Looking ahead, I believe VTech has an

improved cost structure, enhanced

product ranges and the right management

to allow the Group to capitalise on its core

competencies to achieve continued

progress, and bring solid long-term returns

to shareholders.

Allan WONG Chi Yun

Chairman

Hong Kong, 22nd June 2005

VTech Holdings Ltd Annual Report 2005 05

VoIP 5.8GHz cordless phone