Vtech 2005 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2005 Vtech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

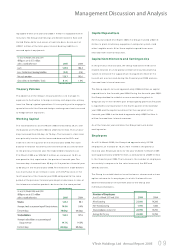

Management Discussion and Analysis

VTech Holdings Ltd Annual Report 2005 09

repayable within one year and US$0.1 million is repayable within

five years. The Group's borrowings are denom inated in Euro and

United States dollar and are on a fixed-rate basis. An amount of

US$0.1 million of the total gross interest bearing liabilities is

secured against equipment.

Capital Expenditure

For the year ended 31st March 2005, the Group invested US$21.5

million in plant, machinery, equipment, computer systems and

other tangible assets. All of these capital expenditures were

financed from internal resources.

Capital Commitments and Contingencies

In the previous financial year, the Group had committed to the

implementation of a new global enterprise resources planning

system to enhance the supply chain management. Most of the

investment was incurred during the financial year 2005 and was

financed from internal resources.

The Group expects to invest approximately US$48 million on capital

expenditure in the financial year 2006. During the financial year 2005,

the Group decided to establish a new manufacturing plant in

Qingyuan cit y in the northern part of Guangdong province. The plant

is expected to start operation in the fourth quarter of the calendar

year 2005 and the capital investment for the new plant in the

financial year 2006 is estimated at approximately US$22 million. It

will be financed from internal resources.

As of the financial year end date, the Group had no material

contingencies.

Employees

As at 31st March 2005, the Group had approximately 22,700

employees, an increase of 15.2% from 19,700 in the previous

financial year. Employee costs for the year ended 31st March 2005

were approxim ately US$107 million, as com pared to US$99 million

in the financial year 2004. The increase in the number of employees

was mainly in response to the sales increase at the ELP and

CMS businesses.

The Group has established an incentive bonus scheme and a share

option scheme for its employees, in which the benefits are

determined based on the performance of the Group and

individual employees.

Treasury Policies

The objective of the Group's treasury policies is to manage its

exposure to fluctuation in foreign currency exchange rates arising

from the Group's global operations. It is our policy not to engage in

speculative activities. Forward foreign exchange contracts are used

to hedge certain exposures.

Working Capital

The stock balance as at 31st March 2005 increased by 29.2% over

the balance at 31st March 2004 to US$124.2 million. The turnover

days increased from 69 days to 78 days. The increase in stock level

was primarily to cater for the increased demand for ELPs and

V. Smile in the first quarter of the financial year 2006. The stock

balance in relation to other businesses remained at a similar level

to the previous financial year. The trade debtors balance as at

31st March 2005 was US$162.3 million, an increase of 18.0% as

compared to that reported for the previous financial year. The

turnover days increased from 60 days in the previous financial year

to 65 days in the financial year 2005. The increase in trade debtors

was mainly due to an increase in sales at the ELP business in the

fourth quarter of the financial year 2005 compared to the sam e

period of the previous financial year, despite a decrease in sales at

the telecommunication products business for the same period.