Visa 2014 Annual Report Download

Download and view the complete annual report

Please find the complete 2014 Visa annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2014

Table of contents

-

Page 1

Annual Report 2014 -

Page 2

-

Page 3

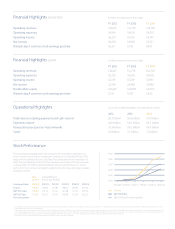

... 9/30/12 9/30/13 9/30/14 Visa Inc. S&P 500 Index S&P 500 Data Processing Index 1 2 3 For further discussion of ï¬scal years 2014 and 2012 non-GAAP adjusted operating expenses, net income and diluted earnings per share, see Item 7 - Management's Discussion and Analysis of Financial Condition and... -

Page 4

A letter from our CEO Charles W. Scharf Dear Shareholders, Visa had a good year in 2014. Net revenue was $12.7 billion, an 8% increase over 2013. Adjusted net income increased 15% to $5.7 billion, and adjusted diluted earnings per share increased 19% to $9.07, compared to 2013 results. Our results... -

Page 5

...everywhere we do business and across all of our products. We come to work every day pursuing these opportunities and believe that rigorous focus on clear goals will enable us to drive growth and achieve continued success as the premier global payments company. Our six goals are: 1. Evolve our client... -

Page 6

... and merchants), developing the underlying infrastructure and operations to support those relationships, and differentiating themselves based on value-added services over and above the network offering. Financial Institutions I have talked of our rich history of building strong relationships... -

Page 7

... to integrate into their websites and mobile experiences. The simple consumer experience was designed to beneï¬t merchants as well by increasing conversion rates. And we have worked closely with merchants to develop joint marketing campaigns that drive new customers and higher volume to their sites... -

Page 8

... of the Internet and mobile is changing our business now. Not only is it providing a new means for consumers, merchants and companies to connect, but it also serves as a tremendous growth platform for the payments ecosystem by creating a commercial environment where cash and check are virtually... -

Page 9

... clients - the issuers and acquirers. Building these access points requires us to rethink how we interact with partners as well as the software assets that exist and requires a signiï¬cant new set of activities inside of Visa. Going forward, we will expose our core network capabilities to a broader... -

Page 10

... do want to support as much innovation as possible and to promote competition that will drive to a better and broader set of experiences that grow commerce and demand for our products. To that end, in 2014 we created Visa Digital Solutions, a suite of offerings to facilitate secure payments across... -

Page 11

..., a quick and easy payment service that allows consumers in the U.S., Australia and Canada to pay for goods online on any device in just a few clicks. In just three months, nearly two million users have registered with Visa Checkout through both merchant and issuer channels. Digital Payments... -

Page 12

... doubled the number of certiï¬ed devices in 2014. • We are building partnerships with mobile network operators to reach consumers in developing markets where ï¬nancial institutions are less accessible. For example, in Botswana we partnered with Orange on the Orange Money Visa card which allows... -

Page 13

...signiï¬cant investments in layered security for our network and data and application protection. • We achieved faster, more effective data breach responses by upgrading systems and client communication processes. Joint Visa and client efforts have kept fraud rates essentially ï¬,at despite the... -

Page 14

...history, every member of our Executive Committee personally taught in our leadership program. We also continually build on the great culture within Visa. We stress integrity, innovation, execution, independent thought, partnership and success. We work hard to live these values every day and evaluate... -

Page 15

...shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ' The aggregate market value of the registrant's class A common stock, par value $0.0001 per share, held by non-affiliates (using the New York Stock Exchange closing price as of March 31, 2014, the last business day of the registrant... -

Page 16

... Item 10 Item 11 Item 12 Item 13 Item 14 Business ...Risk Factors ...Unresolved Staff Comments ...Properties ...Legal Proceedings ...Mine Safety Disclosures ... 5 14 33 33 33 33 Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities ...Selected... -

Page 17

... markets globally; • general stock market fluctuations which may impact consumer spending; • material changes in cross-border activity, foreign exchange controls and fluctuations in currency exchange rates; and • material changes in our financial institution clients' performance compared... -

Page 18

..., including but not limited to, Item 1-Business, Item1A-Risk Factors and Item 7-Management's Discussion and Analysis of Financial Condition and Results of Operations. You should not place undue reliance on such statements. Except as required by law, we do not intend to update or revise any forward... -

Page 19

... advanced processing networks - VisaNet - which facilitates authorization, clearing and settlement of payment transactions worldwide. It also offers fraud protection for account holders and rapid payment for merchants. Visa is not a bank and does not issue cards, extend credit or set rates and fees... -

Page 20

..., and takes advantage of Visa's global network of 14,000 financial institutions and 2.2 billion accounts to facilitate fast and secure money transfers. • Regulation. Rules were implemented in the United States during 2011 and 2012 with respect to debit products under the Dodd-Frank Wall... -

Page 21

...holders. Interchange reimbursement fees represent a transfer of value between the financial institutions participating in our open-loop payments network. On purchase transactions, interchange reimbursement fees are paid by the acquirers to the issuers. We generally do not receive any revenue related... -

Page 22

... and other business partners for various programs designed to build payments volume, increase Visa-branded card and product acceptance and win merchant routing transactions over our network. These incentives are primarily accounted for as reductions to operating revenues. • • • U.S. dollar... -

Page 23

... risk scoring and loyalty applications, while the transaction data is being routed through our network. Visa's processing services continue to expand to address the needs of all participants in the evolving payments ecosystem, through such offerings as our merchant gateway and Visa Debit Processing... -

Page 24

... in this report. Competition We compete in the global payment marketplace against all forms of payment. These include: • paper-based payments, principally cash and checks; • card-based payments, including credit, charge, debit, ATM, prepaid and private-label products; • eCommerce and mobile... -

Page 25

... brands compete with Maestro, owned by MasterCard, and various regional and country-specific debit network brands, including STAR, NYCE and PULSE in the United States, EFTPOS in Australia, NETS in Singapore and Interac in Canada. In addition to our PLUS brand, the primary cash access card brands... -

Page 26

... as India, the governing authorities have begun to regulate other rates or practices such as the merchant discount rate. See Item 1A-Risk Factors-Additional regulation of interchange reimbursement rates may have a material, adverse impact on our financial condition, revenues, results of operations... -

Page 27

...via payment cards and products, and offer new types of payment programs, which could decrease our transaction volumes and revenues. Available Information We are subject to the reporting requirements of the Securities Exchange Act of 1934, as amended (the "Exchange Act") and its rules and regulations... -

Page 28

... our operating regulations and related practices, are subject to continuing or increased government regulation. These jurisdictions include, for example, Australia, Canada, Brazil, Europe, India, Mexico, Malaysia, Russia and South Africa. When we cannot set default interchange reimbursement rates at... -

Page 29

... cards enabled with Visa-affiliated networks or reduced the number of debit cards they issued and investments they made in marketing and rewards programs, while others imposed new or higher fees on debit cards or demand deposit account relationships. Many merchants have used the routing regulations... -

Page 30

... dynamic currency conversion, point of sale transaction rules and practices, and operating regulations that may differ from country to country or by product offering. If widely varying regulations come into existence worldwide, we may have difficulty rapidly adjusting our product offerings, services... -

Page 31

... these laws and regulations could result in fines, sanctions, litigation and damage to our global reputation and our brands. These measures may increase Visa's and our clients' costs, decrease the number of Visa-branded cards our clients issue, and decrease our payments volume and revenue. Evolving... -

Page 32

... of various intellectual property rights. In addition, new mobile regulatory requirements could impact our business practices. Money transfer regulations. As we expand our product offerings, we may become subject to U.S. state money transfer regulations, as well as international payments laws, which... -

Page 33

... in Item 8 of this report. Beginning in 2005, a series of complaints (the majority of which were styled as class actions) were filed on behalf of merchants against us, MasterCard and/or other defendants, including certain Visa member financial institutions. We refer to this as the interchange... -

Page 34

... or future lawsuits, we may have to pay substantial damages. Like many other large companies, we are a defendant in a number of civil actions and investigations alleging violations of competition/antitrust law, consumer protection law or intellectual property law, among others. Examples of such... -

Page 35

...our revenues and profits. Pressure on client pricing poses challenges for our business. In order to stay competitive, we offer incentives to our clients to increase payments volume, enter new market segments and expand their Visa-branded card base. These include up-front cash payments, fee discounts... -

Page 36

... include cash, checks, electronic, eCommerce, and mobile payments, as well as traditional general purpose card networks. In addition, our open-loop payments network competes against other alternate payment systems such as closed-loop payment systems. The Dodd-Frank Act increased this competitive... -

Page 37

..., private-label card networks and certain alternate payments systems, operate closed-loop payments systems, with direct connections to both merchants and consumers without any intermediaries. These competitors seek to derive competitive advantages from this business model. Regulatory actions such as... -

Page 38

... and on their relationships with account holders and merchants to support and to compete effectively for our programs and services. We do not issue cards, extend credit to account holders or determine the interest rates or other fees charged to account holders using cards that carry our brands. Each... -

Page 39

..., Visa Europe is not required to spend any minimum amount of money conducting research on brand performance, promoting or maintaining the strength of our brands. We may be associated with adverse developments with respect to our industry, and with new rules and regulations concerning human rights... -

Page 40

... exchange rates could negatively affect the dollar value of our revenues and payments in foreign currencies. The current economic environment could lead some clients to curtail or postpone near-term investments in growing their card portfolios, limit credit lines, modify fees and loyalty programs... -

Page 41

... currency exchange rates for multi-currency transactions as a result of regulation, changes to tax policy, litigation, competitive pressures, reduced volatility in currency markets, or other reasons may also adversely affect our revenues. Cross-border travel may be adversely affected by global... -

Page 42

...from time to time, we review and revise our risk management methodology and inputs as necessary. See Note 11-Settlement Guarantee Management to our consolidated financial statements included in Item 8 of this report. Some of our clients are considered group members under Visa's operating regulations... -

Page 43

... or enforcement actions against the company. If we are sued in any lawsuit in connection with any material data security breach, we could be involved in protracted litigation. If unsuccessful in defending such lawsuits, we may have to pay damages or change our business practices or pricing structure... -

Page 44

... in Item 8 of this report. In addition, we are required to assess any change in the fair value of the put option on a quarterly basis and record adjustments as necessary on our consolidated statements of operations. Consequently, the adjustments affect our reported net income and earnings per share... -

Page 45

... ongoing or future regulatory disputes as a result of EU regulations that govern the operations of Visa Europe. We may also be required to assume any ongoing or future litigation involving Visa Europe. If we cannot remain organizationally effective, we will be unable to address the opportunities and... -

Page 46

...their voting rights are limited, holders of our class B and C common stock can vote on certain significant transactions. These include a proposed consolidation or merger, a decision to exit our core payments business and any other vote required under Delaware law. The holders of these shares may not... -

Page 47

... amount must be paid on each class or series of our common stock. ITEM 1B. Unresolved Staff Comments Not applicable. ITEM 2. Properties At September 30, 2014, we owned and leased approximately 3.2 million square feet of office and processing center space in 40 countries around the world, of which... -

Page 48

PART II ITEM 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities Price Range of Common Stock Our class A common stock has been listed on the New York Stock Exchange under the symbol "V" since March 19, 2008. At September 30, 2014, we had ... -

Page 49

... the Company during the quarter ended September 30, 2014. Total number of shares purchased as part of publicly announced plans or programs (2) Period Total number of shares purchased (1) Average price paid per share Approximate dollar value of shares that may yet be purchased under the plans or... -

Page 50

... included in Item 8-Financial Statements and Supplementary Data of this report. Number of shares of class A common stock remaining available for future issuance under equity compensation plans (excluding shares reflected in column (a)) Plan Category (a) Number of shares of class A common stock... -

Page 51

...of Operations Data: 2014 (1) Fiscal Year Ended September 30, 2013 2012 (2) 2011 (in millions, except per share data) 2010 Operating revenues ...Operating expenses ...Operating income ...Net income attributable to Visa Inc...Basic earnings per share-class A common stock ...Diluted earnings per share... -

Page 52

... payments infrastructure and support services for the delivery of Visa-branded payment products, including credit, debit and prepaid. We facilitate global commerce through the transfer of value and information among financial institutions, merchants, consumers, businesses and government entities... -

Page 53

... in infrastructure, technology and network processing to support our global growth initiatives. Adjusted financial results. Our financial results for fiscal 2014 and 2012 reflect the impact of several significant items that we believe are not indicative of our operating performance in the prior or... -

Page 54

... tax liabilities attributable to changes in the California state apportionment rules. See Note 19-Income Taxes to our consolidated financial statements. (2) Interchange multidistrict litigation. On October 19, 2012, Visa, MasterCard, various U.S. financial institution defendants and the class... -

Page 55

...the U.S. dollar. On a constant-dollar basis, which excludes the impact of exchange rate movements, our international payments volume growth rate for the 12 months ended June 30, 2014 is 15% compared to 14% for the prior year comparable period. Continued double-digit growth in the number of processed... -

Page 56

... ended ended June 30, June 30, 2013 2012 Visa Inc. 12 months 12 months ended ended June 30, June 30, 2013 2012 (2) (2) % Change Nominal payments volume Consumer credit ...Consumer debit(3) ...Commercial(4) ...Total nominal payments volume ...Cash volume ...Total nominal volume(5) ...$ 786 1,046... -

Page 57

... PLUS cards processed on Visa's networks. (3) Transactions include, but are not limited to, authorization, settlement payments network connectivity, fraud management, payment security management, tax services and delivery address verification. Results of Operations Operating Revenues Our operating... -

Page 58

...and other business partners for various programs designed to build payments volume, increase Visa-branded card and product acceptance and win merchant routing transactions over our network. These incentives are primarily accounted for as reductions to operating revenues. Operating Expenses Personnel... -

Page 59

... due to the negative impact of lower foreign currency exchange volatility on international transaction revenues and the general strengthening of the U.S. dollar in fiscal 2014, combined with the absence of pricing modifications that benefited fiscal 2013. Our operating revenues, primarily service... -

Page 60

... payments volume for the comparable period mainly due to lower volatility in a broad range of currencies. Other revenues increased in fiscal 2014 and 2013 due to an increase in license fees as well as increases in optional service or product enhancements. Client incentives increased in fiscal... -

Page 61

... of our total operating expenses. Fiscal Year ended September 30, $ Change 2014 2013 vs. vs. 2013 2012 % Change(1) 2014 2013 vs. vs. 2013 2012 2014 2013 2012 (in millions, except percentages) Personnel ...Marketing ...Network and processing ...Professional fees ...Depreciation and amortization... -

Page 62

... effective income tax rate of 31% in fiscal 2013 mainly due to: • a $264 million tax benefit related to a deduction for U.S. domestic production activities, of which $191 million related to prior fiscal years, as a result of the completion of a study in the second quarter of fiscal 2014; and the... -

Page 63

... litigation settlements; • make planned capital investments in our business; • pay dividends and repurchase our shares at the discretion of our board of directors; and • optimize income earned by investing excess cash in securities that enable us to meet our working capital and liquidity needs... -

Page 64

... $940 million in fiscal 2014, 2013 and 2012, respectively. The decrease in fiscal 2014 and increase in fiscal 2013 are primarily due to changes in cash used to repurchase shares of our class A common stock in the open market. See Note 3-Retrospective Responsibility Plan, Note 14-Stockholders' Equity... -

Page 65

... are not limited to, changes to credit ratings of the securities, uncertainty related to regulatory developments, actions by central banks and other monetary authorities, and the ongoing strength and quality of credit markets. We will continue to review our portfolio in light of evolving market and... -

Page 66

..., while settlement currencies other than the U.S. dollar generally remain outstanding for one to two business days, which is consistent with industry practice for such transactions. During fiscal 2014, we were not required to fund settlementrelated working capital. Our average daily net settlement... -

Page 67

... purchase price of the Visa Europe shares, which subject to certain adjustments, applies Visa Inc.'s forward price-to-earnings multiple, or the "P/E ratio" (as defined in the option agreement) at the time the option is exercised to Visa Europe's adjusted sustainable income for the forward 12-month... -

Page 68

...any point in time in the future. Should Visa Europe elect to exercise its option, we believe it is likely that it will implement changes in its business operations to move to a for-profit model in order to maximize its adjusted sustainable income and, as a result, to increase the purchase price. The... -

Page 69

... in accordance with our operating regulations. The amount of the indemnification is limited to the amount of unsettled Visa payment transactions at any point in time. We maintain global credit settlement risk policies and procedures to manage settlement risk, which may require clients to post... -

Page 70

...acceptance and win merchant routing transactions over our network. These agreements, which range in terms from one to fifteen years, can provide card issuance and/or conversion support, volume/growth targets and marketing and program support based on specific performance requirements. Payments under... -

Page 71

... clients and other business partners for various programs designed to build payments volume, increase Visa-branded card and product acceptance and win merchant routing transactions over our network. These incentives are primarily accounted for as reductions to operating revenues; however, if... -

Page 72

... purchase price of the Visa Europe shares, which, subject to certain adjustments, applies our forward price-to-earnings multiple, or the P/E ratio (as defined in the option agreement), at the time the option is exercised to Visa Europe's projected adjusted sustainable income for the forward 12-month... -

Page 73

... the purchase price by adopting a for-profit business model in advance of exercising the put option. The foreign exchange rate used to translate Visa Europe's results from Euros to U.S. dollars reflects a blend of forward exchange rates observed in the marketplace. The assumed timing of exercise... -

Page 74

... are also required to inventory, evaluate and measure all uncertain tax positions taken or to be taken on tax returns and to record liabilities for the amount of such positions that may not be sustained, or may only be partially sustained, upon examination by the relevant taxing authorities. Impact... -

Page 75

... of foreign currency exchange rate movements. The aggregate notional amounts of our foreign currency forward contracts outstanding in our exchange rate risk management program, including contracts not designated for cash flow hedge accounting, were $1.3 billion at September 30, 2014 and 2013. The... -

Page 76

...and/or the discount rate for benefit obligations would result in a decrease in the funded status of the pension plan, an increase in pension cost and an increase in required funding. We will continue to monitor the performance of pension plan assets and market conditions as we evaluate the amount of... -

Page 77

... 30, 2014 and 2013 and for the years ended September 30, 2014, 2013 and 2012 Report of Independent Registered Public Accounting Firm ...Consolidated Balance Sheets ...Consolidated Statements of Operations ...Consolidated Statements of Comprehensive Income ...Consolidated Statements of Changes in... -

Page 78

... of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement and whether effective internal control over financial reporting... -

Page 79

... BALANCE SHEETS September 30, September 30, 2014 2013 (in millions, except par value data) Assets Cash and cash equivalents ...Restricted cash-litigation escrow (Note 3) ...Investment securities (Note 4): Trading ...Available-for-sale ...Income tax receivable (Note 19) ...Settlement receivable... -

Page 80

... other comprehensive (loss) income, net: Investment securities, available-for-sale ...Defined benefit pension and other postretirement plans ...Derivative instruments classified as cash flow hedges ...Foreign currency translation adjustments ...Total accumulated other comprehensive (loss) income... -

Page 81

... 30, 2014 2013 2012 (in millions, except per share data) Operating Revenues Service revenues ...Data processing revenues ...International transaction revenues ...Other revenues ...Client incentives ...Total operating revenues ...Operating Expenses Personnel ...Marketing ...Network and processing... -

Page 82

... OPERATIONS-(Continued) For the Years Ended September 30, 2014 2013 2012 (in millions, except per share data) Basic earnings per share (Note 15) Class A common stock ...Class B common stock ...Class C common stock ...Basic weighted-average shares outstanding (Note 15) Class A common stock ...Class... -

Page 83

... the Years Ended September 30, 2014 2013 2012 (in millions) Net income including non-controlling interest ...Other comprehensive (loss) income, net of tax: Investment securities, available-for-sale: Net unrealized (loss) gain ...Income tax effect ...Reclassification adjustment for net (gain) loss... -

Page 84

...630 Conversion of class C common stock upon sale into public market ... 70 Share-based compensation (Note 16) ... Excess tax benefit for share-based compensation ... Cash proceeds from exercise of stock options ... Restricted stock and performance-based shares settled in cash for taxes(1) ... Cash... -

Page 85

... Conversion of class C common stock upon sale into public market ... Share-based compensation (Note 16) ... 71 (33) 508 245 27 (1,414) $ 18,875 Excess tax benefit for share-based compensation ... Cash proceeds from exercise of stock options ... Restricted stock and performance-based shares settled... -

Page 86

...) Conversion of class C common stock upon sale into public market ... Share-based compensation (Note 16) ... 72 (20) 495 245 22 (843) $ 18,299 Excess tax benefit for share-based compensation ... Cash proceeds from exercise of stock options ... Restricted stock and performance-based shares settled... -

Page 87

..., 2014 2013 2012 (in millions) Operating Activities Net income including non-controlling interest ...Adjustments to reconcile net income including non-controlling interest to net cash provided by (used in) operating activities: Amortization of client incentives ...Share-based compensation ...Excess... -

Page 88

...taxes ...Excess tax benefit for share-based compensation ...Payments for earn-out related to PlaySpan acquisition ...Principal payments on capital lease obligations ...Net cash used in financing activities ...Effect of exchange rate changes on cash and cash equivalents ...(Decrease) increase in cash... -

Page 89

... processing networks - VisaNet - which facilitates authorization, clearing and settlement of payment transactions worldwide. VisaNet also offers fraud protection for account holders and assured payment for merchants. Visa is not a bank and does not issue cards, extend credit or set rates and fees... -

Page 90

... by observable market data. The Company's Level 3 assets and liabilities include auction rate securities and the Visa Europe put option. Trading investment securities include mutual fund equity security investments related to various employee compensation and benefit plans. Trading activity... -

Page 91

...at the time of purchase and are carried at fair value. The Company considers these securities to be available-for-sale to meet working capital and liquidity needs. Investments with original maturities of greater than 90 days and stated maturities of less than one year from the balance sheet date, or... -

Page 92

...Guarantee Management. Client incentives. The Company enters into long-term contracts with financial institution clients and other business partners for various programs designed to build payments volume, increase Visabranded card and product acceptance and win merchant routing transactions over Visa... -

Page 93

... relies on a number of factors when completing impairment assessments, including a review of discounted net future cash flows, business plans and the use of present value techniques. The Company completed its annual impairment review of indefinite-lived intangible assets as of February 1, 2014, and... -

Page 94

... the country of origin of the issuer is different from that of the merchant. International transaction revenues are primarily generated by cross-border payments and cash volume. Other revenues consist mainly of license fees for use of the Visa brand, revenues earned from Visa Europe in connection... -

Page 95

... 2014, 2013 and 2012. For certain foreign operations, the Company's functional currency may be the local currency in which a foreign subsidiary executes its business transactions. Translation from the local currency to the U.S. dollar is performed for balance sheet accounts using exchange rates... -

Page 96

... instruments. The Company uses foreign exchange forward derivative contracts to reduce its exposure to foreign currency rate changes on forecasted non-functional currency denominated operational cash flows. Derivatives are carried at fair value on a gross basis in either prepaid and other current... -

Page 97

... statements and related disclosures. The Company has not yet selected a transition method and is evaluating the full effect of the standard on its ongoing financial reporting. In June 2014, the FASB issued ASU No. 2014-12, which requires a performance target in stock compensation awards that... -

Page 98

... purchase price of the Visa Europe shares, which, subject to certain adjustments, applies Visa Inc.'s forward price-to-earnings multiple, or the P/E ratio (as defined in the option agreement), at the time the option is exercised to Visa Europe's adjusted sustainable income for the forward 12-month... -

Page 99

... P/E differential used in the calculation include material changes in the P/E ratio of Visa and those of a group of comparable companies used to estimate the forward price-to-earnings multiple applicable to Visa Europe. The Company determined the fair value of the put option to be approximately $145... -

Page 100

...also guarantee the obligations of their respective clients and members to settle transactions, manage certain relationships with sponsors, clients and merchants, and comply with rules relating to the operation of the Visa enterprise. Under the Framework Agreement, the Company indemnifies Visa Europe... -

Page 101

... by the board of directors and the Company's litigation committee, all members of which are affiliated with, or act for, certain Visa U.S.A. members. The escrow funds are held in money market investments along with the interest earned, less applicable taxes, and are classified as restricted cash on... -

Page 102

...or Visa International in the covered litigation after the operation of the interchange judgment sharing agreement, plus any amounts reimbursable to the interchange judgment sharing agreement signatories; or (ii) the damages portion of a settlement of a covered litigation that is approved as required... -

Page 103

...-sale: U.S. government-sponsored debt securities ...U.S. Treasury securities ...Equity securities ...Corporate debt securities ...Auction rate securities ...Prepaid and other current assets: Foreign exchange derivative instruments ...Total ...Liabilities Accrued liabilities: Visa Europe put option... -

Page 104

...Auction rate securities are classified as Level 3 due to a lack of trading in active markets and a lack of observable inputs in measuring fair value. There were no substantive changes to the valuation techniques and related inputs used to measure fair value during fiscal 2014. Visa Europe put option... -

Page 105

... related to various employee compensation and benefit plans. Trading activity in these investments is at the direction of the Company's employees. These investments are held in trust and are not available for the Company's operational or liquidity needs. Interest and dividend income and changes... -

Page 106

... the balance sheet date. However, these investments are generally available to meet short-term liquidity needs. Amortized Cost Fair Value (in millions) September 30, 2014: Due within one year ...Due after 1 year through 5 years ...Due after 5 years through 10 years ...Due after 10 years ...Total... -

Page 107

...Ended September 30, 2013 (in millions) 2014 2012 Interest and dividend income on cash and investments ...Gain on other investments ...Investment securities, trading: Unrealized (losses) gains, net ...Realized gains (losses), net ...Investment securities, available-for-sale: Realized gains (losses... -

Page 108

... deferred tax assets-(See Note 19-Income Taxes) ...Total ...(1) $ 597 164 35 51 8 $ 253 192 30 46 - $ 855 $ 521 The increase in non-current income tax receivable is mainly due to a tax benefit related to the deduction for U.S. domestic production activities taken during fiscal 2014. 94 -

Page 109

...2012, respectively. Note 7-Intangible Assets and Goodwill At September 30, 2014 and 2013, the Company's indefinite-lived intangible assets consisted of customer relationships of $6.8 billion, Visa tradename of $2.6 billion and a Visa Europe franchise right of $1.5 billion, all of which were acquired... -

Page 110

... $ 402 There was no impairment related to the Company's indefinite-lived or finite-lived intangible assets during fiscal 2014, 2013 or 2012. In April 2014, the Company acquired a business in which it previously held a minority interest. Total purchase consideration was approximately $170 million... -

Page 111

... of management's expectation of exercise and simply reflects the fact that the obligation resulting from the exercise of the instrument could become payable within 12 months. The fair value of the put option does not represent the actual purchase price that the Company may be required to pay if... -

Page 112

... be charged at the London Interbank Offered Rate ("LIBOR") or an alternative base rate, in each case plus applicable margins that fluctuate based on the applicable credit rating of the Company's senior unsecured long-term debt. Visa also agreed to pay a commitment fee, which will fluctuate based on... -

Page 113

... 30, 2014 2013 2014 2013 (in millions) Benefit obligation-beginning of fiscal year ...Service cost ...Interest cost ...Actuarial loss (gain) ...Benefit payments ...Plan amendment ...Benefit obligation-end of fiscal year ...Accumulated benefit obligation ...Change in Plan Assets: Fair value of plan... -

Page 114

... Benefit obligations in excess of plan assets related to the Company's non-qualified plan: Pension Benefits September 30, 2014 2013 (in millions) Accumulated benefit obligation in excess of plan assets Accumulated benefit obligation-end of year ...Fair value of plan assets-end of year ...Projected... -

Page 115

... Net periodic pension and other postretirement plan cost: Pension Benefits 2014 2013 Other Postretirement Benefits 2013 2012 Fiscal 2012 2014 (in millions) Service cost ...Interest cost ...Expected return on assets ...Amortization of: Prior service credit ...Actuarial loss (gain) ...Net benefit... -

Page 116

...asset class on a quarterly basis. An independent consultant assists management with investment manager selections and performance evaluations. Pension plan assets are broadly diversified to maintain a prudent level of risk and to provide adequate liquidity for benefit payments. The Company generally... -

Page 117

... consist of mortgage-backed securities. Asset-backed securities are classified as Level 3 due to a lack of observable inputs in measuring fair value. There were no transfers between Level 1 and Level 2 assets during fiscal 2014 or 2013. A separate roll-forward of Level 3 plan assets measured at fair... -

Page 118

... daily volumes during the quarter multiplied by the estimated number of days to settle plus a safety margin; (2) four months of rolling average chargebacks volume; and (3) the total balance for outstanding Visa Travelers Cheques. The Company maintains and regularly reviews global settlement risk... -

Page 119

...-Derivative Financial Instruments The Company maintains a rolling cash flow hedge program with the objective of reducing exchange rate risk from forecasted net exposures of revenues derived from and payments made in non-functional currencies during the following twelve months. The aggregate notional... -

Page 120

... changes in the cash flows of the hedged items and whether those derivatives may be expected to remain highly effective in future periods. The Company uses regression analysis to assess effectiveness prospectively and retrospectively. The effectiveness tests are performed on the foreign exchange... -

Page 121

... of its net operating revenues in fiscal 2014, 2013 or 2012. Note 14-Stockholders' Equity The number of shares of each class and the number of shares of class A common stock on an asconverted basis at September 30, 2014, are as follows: Shares Outstanding Conversion Rate Into Class A Common Stock As... -

Page 122

... price per share is calculated based on unrounded numbers. The stock repurchases and litigation escrow deposit discussed above reduced the funds from the $5.0 billion share repurchase program authorized by the Company's board of directors in October 2013. As of September 30, 2014, the program... -

Page 123

...applicable conversion rate in effect on the record date. Dividends declared. The Company declared and paid $1.0 billion in dividends in fiscal 2014 at a quarterly rate of $0.40 per share. In October 2014, the Company's board of directors declared a quarterly cash dividend of $0.48 per share of class... -

Page 124

... fiscal 2014.(1) Basic Earnings Per Share WeightedAverage Shares Outstanding (B) Diluted Earnings Per Share WeightedAverage Shares Outstanding (B) (in millions, except per share data) Income Allocation (A) (2) Earnings per Share = (A)/(B) Income Allocation (A) (2) Earnings per Share = (A)/(B) Class... -

Page 125

... The Company's 2007 Equity Incentive Compensation Plan, or the EIP, authorizes the compensation committee of the board of directors to grant non-qualified stock options ("options"), restricted stock awards ("RSAs"), restricted stock units ("RSUs") and performance-based shares to its employees and... -

Page 126

...management believes is generally comparable to Visa. The Company's data is weighted based on the number of years between the measurement date and Visa's initial public offering as a percentage of the options' contractual term. The relative weighting placed on Visa's data and peer data in fiscal 2014... -

Page 127

... cost before estimated forfeitures for RSAs and RSUs is calculated using the closing price of class A common stock on the date of grant. The weighted-average grant-date fair value of RSAs granted during fiscal 2014, 2013 and 2012 was $199.91, $147.18 and $96.39, respectively. The weighted... -

Page 128

...$111 (2) Calculated by multiplying the closing stock price on the last trading day of fiscal 2014 of $213.37 by the number of instruments. Represents the maximum number of performance-based shares which could be earned. For the Company's performance-based shares, in addition to service conditions... -

Page 129

... Visa-branded card and product acceptance and win merchant routing transactions. These agreements, with terms ranging from one to fifteen years, can provide card issuance and/or conversion support, volume/growth targets and marketing and program support based on specific performance requirements... -

Page 130

...of this disclosure if that entity owns more than 10% of Visa's total voting common stock at the end of the fiscal year, or if an officer or employee of that entity also serves on the Company's board of directors. The Company considers an investee to be a related party if the Company's: (i) ownership... -

Page 131

... 30, 2014 and 2013, are presented below: 2014 2013 (in millions) Deferred Tax Assets: Accrued compensation and benefits ...Comprehensive (income) loss ...Investments in joint ventures ...Accrued litigation obligation ...Client incentives ...Net operating loss carryforward ...Tax credits ...Federal... -

Page 132

... differences are deductible. The fiscal 2014 and 2013 valuation allowances relate primarily to foreign net operating losses from subsidiaries acquired in recent years. As of September 30, 2014, the Company had $16 million state and $154 million foreign net operating loss carryforwards. The state net... -

Page 133

... effective income tax rate of 31% in fiscal 2013 mainly due to: • a $264 million tax benefit related to a deduction for U.S. domestic production activities, of which $191 million related to prior fiscal years, as a result of the completion of a study in the second quarter of fiscal 2014; and the... -

Page 134

...on diluted earnings per share was $0.27, $0.24 and $0.19 in fiscal 2014, 2013 and 2012, respectively. In accordance with Accounting Standards Codification 740-Income Taxes, the Company is required to inventory, evaluate and measure all uncertain tax positions taken or to be taken on tax returns, and... -

Page 135

... in its other long-term liabilities. The Company's fiscal 2009, 2010 and 2011 U.S. federal income tax returns are currently under Internal Revenue Service ("IRS") examination. The Company has filed federal refund claims, mostly related to foreign tax credits, for fiscal years 2002 through 2008... -

Page 136

... of no more than 25% of the original cash payments made into the settlement fund, based on the percentage of payment card sales volume for a defined period attributable to merchants who opted out (the "takedown payments"). On January 14, 2014, the court entered the final judgment order approving... -

Page 137

... as attorneys' fees and injunctive relief. The class plaintiffs also filed a Second Supplemental Class Action Complaint against Visa Inc. and certain member financial institutions challenging Visa's reorganization and IPO under the antitrust laws and seeking unspecified money damages and declaratory... -

Page 138

... class action was filed in federal district court in California against certain financial institutions alleging that they conspired to fix interchange fees and imposed other alleged restraints on competition. The complaint was filed on behalf of an alleged class of all Visa and MasterCard payment... -

Page 139

... continuing to set default interchange rates, maintaining its "honor all cards" rule, enforcing certain rules relating to merchants, and restructuring itself, did not violate federal or state antitrust laws. Visa and the other defendants in the opt-out cases in MDL 1720 filed a motion to dismiss the... -

Page 140

... International). The complaints allege, among other things, that Visa U.S.A.'s "honor all cards" rule and a similar MasterCard rule violated state antitrust and consumer protection laws, and common law. The claims in these class actions asserted that merchants, faced with excessive merchant discount... -

Page 141

... companies), Visa Inc. and Visa International relating to interchange rates in Europe, and seek damages for alleged anti-competitive conduct primarily in relation to U.K. domestic and/or Irish domestic and/or intra-EEA interchange fees for credit and debit cards. After a successful application... -

Page 142

... Visa policies related to the provision of DCC services contravened Australian competition law. The ACCC later filed an amended claim adding Visa International as a respondent. DCC refers to conversion from one currency to another, either of the price of goods or services by the merchant, or of cash... -

Page 143

... at this time. U.S. ATM Access Fee Litigation National ATM Council Class Action. On October 12, 2011, the National ATM Council and thirteen non-bank ATM operators filed a class action lawsuit against Visa (Visa Inc., Visa International, Visa U.S.A., and Plus System, Inc.) and MasterCard in the... -

Page 144

... of Utah unfair competition law, invasion of privacy, negligence and breach of contract as a result of unauthorized access in November and December 2013 to certain personal information and payment card data stored by Target. The complaint also alleges that Visa and MasterCard unlawfully failed to... -

Page 145

... Events In October 2014, the Company's board of directors authorized a new $5.0 billion share repurchase program. See Note 14-Stockholders' Equity. In October 2014, the Company's board of directors declared a dividend in the aggregate amount of $0.48 per share of class A common stock (determined... -

Page 146

... 2014 and 2013 for the Company: Sep. 30, 2014 (1) Quarter Ended (unaudited) Jun. 30, Mar. 31, Dec. 31, 2014 2014 2013 (in millions, except per share data) Fiscal Year 2014 Total Visa Inc. Operating revenues ...Operating income ...Net income attributable to Visa Inc...Basic earnings per share Class... -

Page 147

... on Accounting and Financial Disclosures Not applicable. ITEM 9A. Controls and Procedures Evaluation of Disclosure Controls and Procedures We maintain a system of disclosure controls and procedures (as defined in the Rules 13a-15(e) and 15(d)-15 (e) under the Securities Exchange Act of 1934, as... -

Page 148

... In preparation for management's report on internal control over financial reporting, we documented and tested the design and operating effectiveness of our internal control over financial reporting. During fiscal 2014, there were no significant changes in our internal controls over financial... -

Page 149

...on the Investor Relations page of our website at http://investor.visa.com, under "Corporate Governance." Printed copies of these documents are also available to stockholders without charge upon written request directed to Corporate Secretary, Visa Inc., P.O. Box 8999, San Francisco, California 94128... -

Page 150

... item concerning director independence pursuant to Item 407(a) of Regulation S-K is incorporated herein by reference to the section entitled "Corporate Governance-Independence of Directors" in our Proxy Statement. ITEM 14. Principal Accountant Fees and Services The information required by this Item... -

Page 151

... and Financial Statement Schedules (a) The following documents are filed as part of this report: 1. Consolidated Financial Statements See Index to Consolidated Financial Statements in Item 8-Financial Statements and Supplementary Data of this report. 2. Consolidated Financial Statement Schedules... -

Page 152

...duly authorized. VISA INC. By: Name: Title: Date: /s/ Charles W. Scharf Charles W. Scharf Chief Executive Officer November 20, 2014 Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, this report has been signed below by the following persons on behalf of the registrant... -

Page 153

..., Visa Canada Association, Inovant LLC, Inovant, Inc., Visa Europe Services, Inc., Visa International Transition LLC, VI Merger Sub, Inc., Visa USA Merger Sub Inc. and 1734313 Ontario Inc. Form of Visa Europe Put-Call Option Agreement between Visa Inc. and Visa Europe Limited 1 Form 8-K 10-Q File... -

Page 154

..., dated February 7, 2011, regarding Interchange Litigation Judgment Sharing and Settlement Sharing by and among Visa Inc., Visa U.S.A. Inc., Visa International Service Association, MasterCard Incorporated, MasterCard International Incorporated and the parties thereto Form S-4 File Number 333... -

Page 155

..., MasterCard International Incorporated, various U.S. financial institution defendants, and the class plaintiffs to resolve the class plaintiffs' claims in the matter styled In re Payment Card Interchange Fee and Merchant Discount Antitrust Litigation, No. 05-MD-1720 Visa 2005 Deferred Compensation... -

Page 156

...the CEO, with limited vesting upon termination for awards granted after November 1, 2012 Form of Visa Inc. 2007 Equity Incentive Compensation Plan Stock Option Award Agreement for awards granted after November 18, 2013 4 Form 10-K File Number 001-33977 Exhibit Number 10.35 Filing Date 11/18/2011 10... -

Page 157

... for awards granted after November 18, 2013 Form of Visa Inc. 2007 Equity Incentive Compensation Plan Performance Share Award Agreement for awards granted after November 18, 2013 Form of Alternate Visa Inc. 2007 Equity Incentive Compensation Plan Stock Option Award Agreement for awards granted after... -

Page 158

Incorporated by Reference Exhibit Number 10.44*+ Exhibit Description Form of Visa Inc. 2007 Equity Incentive Compensation Plan Performance Share Award Agreement for awards granted after November 1, 2014 Form of Alternate Visa Inc. 2007 Equity Incentive Compensation Plan Stock Option Award Agreement ... -

Page 159

Incorporated by Reference Exhibit Number 23.1+ 31.1+ Exhibit Description Consent of KPMG LLP, Independent Registered Public Accounting Firm Certification of the Chief Executive Officer pursuant to Exchange Act Rules 13a-14(a) and 15d-14(a), as adopted pursuant to Section 302 of the Sarbanes-Oxley ... -

Page 160

Board of Directors Robert W. Matschullat (Independent Chair) Former Vice Chairman and Chief Financial Officer The Seagram Company Limited Charles W. Scharf Chief Executive Officer Visa Inc. Mary B. Cranston Retired Senior Partner Pillsbury Winthrop Shaw Pittman LLP Francisco Javier Fernández-... -

Page 161

... 7644 http://investor.visa.com Media Relations Visa Inc. [email protected] +1 650 432 2990 http://corporate.visa.com Corporate Secretary Visa Inc. P.O. Box 8999 San Francisco, CA 94128-8999 USA [email protected] Independent Registered Public Accounting Firm KPMG LLP Transfer Agent Wells...