US Bank 2011 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2011 US Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4 U.S. BANCORP

Momentum

continues

Fellow Shareholders:

U.S. Bancorp has created momentum by

remaining disciplined with our business

strategy and investing for our future

U.S. Bancorp ended 2011 on a high note, reporting both record

net revenue and record net income. We experienced notable

growth in deposits, loans and commitments year-over-year, and

credit quality continued to improve. Our capital position remains

very strong as we continued to generate signifi cant capital each

quarter through solid and predictable earnings. Indeed, 2011

marked another year of robust and sustainable fi nancial

performance — at the very top of our peer group — and we

achieved these results despite a very challenging and uncertain

economic and regulatory environment. We begin 2012 as a

stronger company than we were just one year ago.

U.S. Bancorp has differentiated itself from the peer banks throughout

the economic downturn, validating our franchise strengths, including

our remarkable employees, our focus on customer satisfaction, the

company policies of prudent risk controls, the management and

use of our shareholders’ capital and our disciplined, effi cient opera-

tions. These results have made us the benefi ciary of a continuing

fl ight to quality, as customers — as well as employees, prospects

and investors — seek out U.S. Bancorp as a very solid company in

which to place their fi nancial trust.

While we are pleased with our fi nancial results, we also recognize

that our nation’s economy is still in the midst of a very slow recovery.

Yes, there are clear areas of improvement, but some of our regions

and customers are still struggling and, despite some improvement,

the unemployment level is still too high and the housing market is

still without direction. We expect to remain steadfast in working

through these challenges with our customers and our communities

— for our collective and future success.

Contextual information is often as enlightening as the fi nancial data.

Therefore, on the pages following this letter, we tell you more about

our strategies and accomplishments, new products and services

and some examples of how we work with our customers. We will

focus on our continuing momentum and showcase our talented

employee leaders.

Unsettled regulatory and legislative

climate continues

The myriad rules, regulations, legislation and government scrutiny

following the economic downturn represent efforts by the Adminis-

tration, the regulators and the Congress to strengthen the fi nancial

services industry and prevent another crisis for our industry and

for our country. These efforts are being repeated on a global scale

which create a “trebling effect”, making it more challenging to

determine the “new normal” for banking rules and policies in the

future. This new paradigm also requires us to spend increasingly

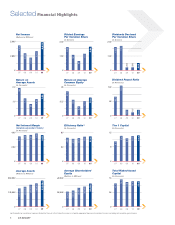

32

16

0

12

6

Solid Capital Position

2009 2010 2011

• Tier 1 Capital

• Tier 1 Common Ratio

22.6

(Dollars in Billions)

(In Percents)

25.9

29.2

8.6%

6.8%

7.8%

28%

20%

9%

43

%

• Payment Services

• Wholesale Banking and Commercial Real Estate

• Wealth Management and Securities Services

• Consumer and Small Business Banking

Diversified Revenue Mix

By business line 2011 YTD

28%

20%

8%

44%