US Bank 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 US Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

continues

Momentum

U.S. BANCORP 2011 Annual Report

Table of contents

-

Page 1

Momentum continues U.S. BANCORP 2011 A n n u a l Report -

Page 2

... equity Customers Bank branches ATMs Consumer and business banking and wealth management Wholesale banking and trust services Payment services, merchant processing and corporate trust NYSE symbol Year founded Information on this page is as of December 31, 2011 Sustainability This annual report... -

Page 3

..., download the Digimarc Discover App from the iTunes App Store or Android Market. Look for this symbol: Hold your iPhone or Android about 3-5 inches parallel to the page with your phone's screen facing you. Slowly move your phone toward the page, allowing your camera to focus on the image. The... -

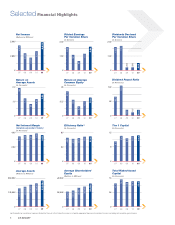

Page 4

... on Average Assets (In Percents) Return on Average Common Equity (In Percents) Dividend Payout Ratio (In Percents) 1.93 1.53 21.3 1.16 13.9 15.8 1.21 .82 8.2 12.7 1.0 12.5 50 66.3 104.9 2.0 25 100 11.5 0 07 08 09 10 11 0 07 08 09 10 11 0 07 08 09 10 11 Net Interest Margin... -

Page 5

...ciency ratio (a) ...Average Balances Loans ...Investment securities ...Earning assets ...Assets ...Deposits ...Total U.S. Bancorp shareholders' equity ...Period End Balances Loans ...Allowance for credit losses ...Investment securities ...Assets ...Deposits ...Total U.S. Bancorp shareholders' equity... -

Page 6

...22.6 8.6% 20% 20 8% % 7.8% 9% 43% 16 6.8% 6 • Payment Services • Wholesale Banking and Commercial Real Estate • Wealth Management and Securities Services • Consumer and Small Business Banking 0 2009 2010 2011 • Tier 1 Capital • Tier 1 Common Ratio 4 U.S. BANCORP (In Percents) -

Page 7

...: well-priced banks in growth markets that help us get closer to achieving our goals of being in the top three in market share in targeted, growing markets. In January of 2011, we acquired the banking operations of First Community Bank of Albuquerque, New Mexico from the FDIC, adding the 25th... -

Page 8

... commercial and consumer banking background, along with her ï¬rst-hand experience in the California banking market, will be an excellent asset to our company. Roland's broad retail consumer insights and extensive corporate governance experience will make him a great addition to U.S. Bancorp... -

Page 9

...in both our dividend and share buyback program and should receive their response by mid-March. Prospects for the future Despite the continuing economic uncertainty here and in Europe, this management team, Board of Directors and 63,000 highly engaged U.S. Bancorp employees join me in looking to the... -

Page 10

... has been a valued U.S. Bank customer since 1929, utilizing a wide range of U.S. Bank credit, treasury management, merchant processing and trust services, a testimony to the importance of building deeper customer relationships. Shown left to right: Mike Staloch of U.S. Bank, Ziegler's Relationship... -

Page 11

... specialized customer segments. Money® Magazine cited U.S. Bank checking as the best national checking account, in part due to our high customer satisfaction ranking by J.D. Power & Associates. We introduced real-time ATM card and check card alerts to our consumer and business cardholders' mobile... -

Page 12

...launch of new mobile banking enhancements in 2011, customers now can use their mobile devices to deposit checks and monitor credit card activity, in addition to features already offered such as person-toperson payments, access to account balances and transaction history, transfer funds and pay bills... -

Page 13

...Barlow Research Associates, Inc. honored U.S. Bank with a 2011 Monarch Innovation Award, recognizing the company's ScoreBoard online payments management tool for small businesses which helps small businesses make smarter decisions about the ï¬nancial operations of their business. U.S. BANCORP 11 -

Page 14

... U.S. Bank Mobile Banking. Ascent Private Capital Management has arrived In 2011, U.S. Bank Wealth Management developed and launched its newest business, Ascent Private Capital Management, serving the needs of ultra high net worth clients. Ascent offers clients a unique array of services centered... -

Page 15

... to acquire business as other banks look at sales to raise capital to meet new regulatory requirements. U.S. Bank Global Corporate Trust Services is one of the largest providers of trustee services in municipal, corporate, asset-backed and international bonds, providing a wide range of trust and... -

Page 16

... new accounts, more closely tying credit and debit cards to their customers' core accounts. Despite a subdued economy and well-known consumer challenges, we have seen growth in automobile, home equity lending and credit cards, while maintaining our acknowledged standards of underwriting and quality... -

Page 17

... Bank, Forster Tool & Manufacturing believes in strong client relationships Founded in 1958, Forster Tool & Manufacturing is a second-generation business providing precision custom machining services. Today the company, located in Bensenville, Illinois, continues the tradition of dependable service... -

Page 18

... support them with paid time off to volunteer. Our new online volunteer site gives employees easy access to local volunteer opportunities and our 59 local Development Network chapters emphasize and organize community service events. In our Dollars for Doing program, we donate a "match" of employee... -

Page 19

... non-banks; changes in customer behavior and preferences; effects of mergers and acquisitions and related integration, effects of critical accounting policies and judgments; and management's ability to effectively manage credits risk, residual value risk, market risk, operational risk, interest rate... -

Page 20

... to operational efficiency. Total net revenue reflected growth in both the balance sheet and fee-based businesses. The Company grew both loans and deposits substantially in 2011, benefiting from investments it made in its business lines and the overall "flight-to-quality" by customers. The Company... -

Page 21

... equity ...Net interest margin (taxable-equivalent basis) (a) ...Efficiency ratio (b) ...Net charge-offs as a percent of average loans outstanding ...Average Balances Loans ...Loans held for sale ...Investment securities (c) ...Earning assets ...Assets ...Noninterest-bearing deposits ...Deposits... -

Page 22

...FCB acquisition, higher payments-related revenue, higher commercial products revenue and a decrease in net securities losses, partially offset by lower deposit service charges, trust and investment management fees and mortgage banking revenue. Total noninterest expense in 2011 increased $528 million... -

Page 23

...to growth in Wholesale Banking and Commercial Real Estate, and Wealth Management and Securities Services balances. Average total savings deposits were $13.8 billion (13.7 percent) higher in 2011, compared with 2010, primarily due to growth in corporate and institutional trust balances, including the... -

Page 24

... (a) 2011 v 2010 2010 v 2009 Total Volume Yield/Rate Total Volume Yield/Rate Year Ended December 31 (Dollars in Millions) Increase (decrease) in Interest Income Investment securities ...Loans held for sale ...Loans Commercial loans ...Commercial real estate ...Residential mortgages ...Credit card... -

Page 25

... 2010 2010 v 2009 Year Ended December 31 (Dollars in Millions) Credit and debit card revenue ...Corporate payment products revenue ...Merchant processing services ...ATM processing services ...Trust and investment management fees ...Deposit service charges ...Treasury management fees ...Commercial... -

Page 26

... real estate transaction in 2009, a payments-related contract termination gain that occurred in 2009 and lower customer derivative revenue. Mortgage banking revenue decreased 3.1 percent in 2010 compared with 2009, principally due to lower origination and sales revenue and an unfavorable net change... -

Page 27

... for further information on the Company's pension plan funding practices, investment policies and asset allocation strategies, and accounting policies for pension plans. The following table shows an analysis of hypothetical changes in the long-term rate of return ("LTROR") and discount rate: LTROR... -

Page 28

... 31, 2011 and 2010, respectively. The Company also finances the operations of real estate developers and other entities with operations related to real estate. These loans are not secured directly by real estate but are subject to terms and conditions similar to commercial loans. These loans were... -

Page 29

...percent) in 2011, compared with 2010. The growth reflected the net effect of origination and prepayment activity in the portfolio due to the low interest rate environment. Most loans retained in the portfolio are to customers with prime or near-prime credit characteristics at the date of origination... -

Page 30

... due to a decrease in home equity and second mortgages and student loans, partially offset by increases in retail leasing and automobile loans primarily during the second half of the year. Average other retail loans increased $513 million (1.1 percent) in 2011, compared with 2010. The increase was... -

Page 31

...Indiana, Kentucky, Tennessee ...Idaho, Montana, Wyoming ...Arizona, Nevada, New Mexico, Utah ...Total banking region ...Outside the Company's banking region Florida, Michigan, New York, Pennsylvania, Texas ...All other states ...Total outside Company's banking region ...Total ... $ 4,339 2,354 2,560... -

Page 32

... loan changes, it is transferred to loans held for sale. TABLE 12 Selected Loan Maturity Distribution One Year or Less Over One Through Five Years Over Five Years Total At December 31, 2011 (Dollars in Millions) Commercial ...Commercial real estate ...Residential mortgages ...Credit card... -

Page 33

... available-for-sale and held-to-maturity securities are computed based on amortized cost balances. Average yield and maturity calculations exclude equity securities that have no stated yield or maturity. 2011 At December 31, (Dollars in Millions) Amortized Cost Percent of Total Amortized Cost 2010... -

Page 34

... in Wholesale Banking and Commercial Real Estate, and Wealth Management and Securities Services balances. Interest-bearing savings deposits increased $5.5 billion (4.8 percent) at December 31, 2011, compared with December 31, 2010. The increase in these deposit balances was related to increases... -

Page 35

... Wealth Management and Securities Services balances. Average interest-bearing savings deposits in 2011 increased $13.8 billion (13.7 percent), compared with 2010, primarily due to growth in corporate and institutional trust balances, including the impact of the securitization trust administration... -

Page 36

... in interest rates, foreign exchange rates, and security prices that may result in changes in the values of financial instruments, such as trading and available-for-sale securities, certain mortgage loans held for sale, MSRs and derivatives that are accounted for on a fair value basis. Liquidity... -

Page 37

... loans and leases made to consumer customers including residential mortgages, credit card loans, and other retail loans such as revolving consumer lines, auto loans and leases, student loans, and home equity loans and lines. Home equity and second mortgage loans are junior lien closed-end accounts... -

Page 38

... commercial lease financing, agricultural credit, warehouse mortgage lending, commercial real estate, health care and correspondent banking. The Company also offers an array of consumer lending products, including residential mortgages, credit card loans, retail leases, home equity, revolving credit... -

Page 39

... sub-prime borrowers based on credit scores from independent agencies at loan origination, compared with $2.1 billion at December 31, 2010. In addition to residential mortgages, at December 31, 2011, the consumer finance division had $.5 billion of home equity and second mortgage loans to customers... -

Page 40

...'s focus on consumers within its geographical footprint of branches and certain niche lending activities that are nationally focused. Approximately 69.8 percent of the Company's credit card balances relate to cards originated through the Company's branches or co-branded, travel and affinity programs... -

Page 41

... of Ending Loan Balances 2011 2010 2009 2008 2007 At December 31, 90 days or more past due excluding nonperforming loans Commercial Commercial ...Lease financing ...Total commercial ...Commercial Real Estate Commercial mortgages ...Construction and development ...Total commercial real estate... -

Page 42

... mortgages, credit card and other retail loans included in the consumer lending segment: Amount The following table provides information on delinquent and nonperforming consumer lending loans as a percent of ending loan balances, by channel: Consumer Finance Other Consumer Lending 2011 2010... -

Page 43

... the acquisition date and are accounted for in pools. Losses associated with modifications on covered loans, including the economic impact of interest rate reductions, are generally eligible for reimbursement under the loss sharing agreements. During 2011, the Company adopted new accounting guidance... -

Page 44

...to return to accrual status, other real estate and other nonperforming assets owned by the Company. Nonperforming assets are generally either originated by the Company or acquired under FDIC loss sharing agreements that substantially reduce the risk of credit losses to the Company. Interest payments... -

Page 45

... principal assets are other real estate owned. (e) Charge-offs exclude actions for certain card products and loan sales that were not classified as nonperforming at the time the charge-off occurred. (f) Residential mortgage information excludes changes related to residential mortgages serviced by... -

Page 46

... 17 Net Charge-Offs as a Percent of Average Loans Outstanding 2011 2010 2009 2008 2007 Year Ended December 31 Commercial Commercial ...Lease financing ...Total commercial ...Commercial Real Estate Commercial mortgages ...Construction and development ...Total commercial real estate ...Residential... -

Page 47

... information on net charge-offs as a percent of average loans outstanding for the consumer finance division: Average Loans Year Ended December 31 (Dollars in Millions) 2011 2010 Percent of Average Loans 2011 2010 Residential mortgages Sub-prime borrowers ...Other borrowers ...Total ...Home equity... -

Page 48

... commercial real estate ...Residential mortgages ...Credit card ...Other retail Retail leasing ...Home equity and second mortgages ...Other ...Total other retail...Covered loans (a) ...Total recoveries ...Net Charge-Offs Commercial Commercial ...Lease financing ...Total commercial ...Commercial real... -

Page 49

... financing ...Total commercial ...Commercial Real Estate Commercial mortgages ...Construction and development ...Total commercial real estate ...Residential Mortgages ...Credit Card ...Other Retail Retail leasing ...Home equity and second mortgages ...Other ...Total other retail ...Covered Loans... -

Page 50

... for credit losses is available for the entire loan portfolio. The actual amount of losses incurred can vary significantly from the estimated amounts. Residual Value Risk Management The Company manages its risk to changes in the residual value of leased assets through disciplined residual valuation... -

Page 51

... to develop, maintain and test these plans at least annually to ensure that recovery activities, if needed, can support mission critical functions, including technology, networks and data centers supporting customer applications and business operations. While the Company believes it has designed... -

Page 52

...potential interest rate changes. The Company manages its interest rate risk position by holding assets on the balance sheet with desired interest rate risk characteristics, implementing certain pricing strategies for loans and deposits and through the selection of derivatives and various funding and... -

Page 53

... cash flows associated with floating-rate loans and debt from floating-rate payments to fixed-rate payments; • To mitigate changes in value of the Company's mortgage origination pipeline, funded mortgage loans held for sale and MSRs; and • To mitigate remeasurement volatility of foreign currency... -

Page 54

...2010, TABLE 20 Debt Ratings Moody's Standard & Poor's Fitch Dominion Bond Rating Service U.S. Bancorp Short-term borrowings ...Senior debt and medium-term notes ...Subordinated debt ...Preferred stock ...Commercial paper ...U.S. Bank National Association Short-term time deposits ...Long-term time... -

Page 55

... obligations, without access to the wholesale funding markets or dividends from subsidiaries, for 12 months when forecasted payments of common stock dividends are included and 24 months assuming dividends were reduced to zero. The parent company currently has available funds considerably greater... -

Page 56

... from securities lending activities in which indemnifications are provided to customers; indemnification or buy-back provisions related to sales of loans and tax credit investments; merchant charge-back guarantees through the Company's involvement in providing merchant processing services; and... -

Page 57

... and servicer, U.S. Bank National Association, through its mortgage banking division, is required to maintain various levels of shareholders' equity, as specified by various agencies, including the United States Department of Housing and Urban Development, Regulatory Capital Ratios 2011 2010 At... -

Page 58

... "Non-GAAP Financial Measures" for further information regarding the calculation of these ratios. Fourth Quarter Summary The Company reported net income attributable to U.S. Bancorp of $1.4 billion for the fourth quarter of 2011, or $.69 per diluted common share, compared with $974 million, or $.49... -

Page 59

... major lines of business are Wholesale Banking and Commercial Real Estate, Consumer and Small Business Banking, Wealth Management and Securities Services, Payment Services, and Treasury and Corporate Support. These operating segments are components of the Company about which financial information is... -

Page 60

... fees, service charges, salaries and benefits, and other direct revenues and costs are accounted for within each segment's financial results in a manner similar to the consolidated financial statements. TABLE 24 Line of Business Financial Performance Wholesale Banking and Commercial Real Estate... -

Page 61

...Banking and Commercial Real Estate Wholesale Banking and Commercial Real Estate offers lending, equipment finance and small-ticket leasing, depository, Wealth Management and Securities Services 2011 2010 Percent Change 2011 Payment Services 2010 Percent Change Treasury and Corporate Support 2011... -

Page 62

... banking offices, telephone servicing and sales, on-line services, direct mail, ATM processing and over mobile devices. It encompasses community banking, metropolitan banking, in-store banking, small business banking, consumer lending, mortgage banking, consumer finance, workplace banking, student... -

Page 63

... and commercial real estate loans and related other real estate owned, funding, capital management, asset securitization, interest rate risk management, the net effect of transfer pricing related to average balances and the residual aggregate of those expenses associated with corporate activities... -

Page 64

... Company's calculation of these Non-GAAP financial measures: At December 31 (Dollars in Millions) 2011 2010 2009 2008 2007 Total equity ...Preferred stock ...Noncontrolling interests ...Goodwill (net of deferred tax liability) ...Intangible assets, other than mortgage servicing rights ...Tangible... -

Page 65

... the level of capital available to withstand unexpected market or economic conditions. Additionally, presentation of these measures allows investors, analysts and banking regulators to assess the Company's capital position relative to other financial services companies. Regulatory assessments of the... -

Page 66

... on the balance sheet for a particular asset or liability with related impacts to earnings or other comprehensive income (loss). When available, trading and available-for-sale securities are valued based on quoted market prices. However, certain securities are traded less actively and therefore... -

Page 67

... servicing is retained, or may be purchased from others. MSRs are initially recorded at fair value and remeasured at each subsequent reporting date. Because MSRs do not trade in an active market with readily observable prices, the Company determines the fair value by assets and liabilities acquired... -

Page 68

In assessing the fair value of reporting units, the Company may consider the stage of the current business cycle and potential changes in market conditions in estimating the timing and extent of future cash flows. Also, management often utilizes other information to validate the reasonableness of ... -

Page 69

... as defined by Rules 13a-15(f) and 15d-15(f) under the Securities Exchange Act of 1934. The Company's system of internal control is designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of publicly filed financial statements in accordance with... -

Page 70

... balance sheets of U.S. Bancorp as of December 31, 2011 and 2010, and the related consolidated statements of income, shareholders' equity, and cash flows for each of the three years in the period ended December 31, 2011. These financial statements are the responsibility of U.S. Bancorp's management... -

Page 71

...Accounting Oversight Board (United States), the consolidated balance sheets of U.S. Bancorp as of December 31, 2011 and 2010, and the related consolidated statements of income, shareholders' equity, and cash flows for each of the three years in the period ended December 31, 2011 and our report dated... -

Page 72

U.S. Bancorp Consolidated Balance Sheet At December 31 (Dollars in Millions) 2011 2010 Assets Cash and due from banks ...Investment securities Held-to-maturity (fair value $19,216 and $1,419, respectively) ...Available-for-sale ...Loans held for sale (included $6,925 and $8,100 of mortgage loans ... -

Page 73

...Noninterest Income Credit and debit card revenue ...Corporate payment products revenue ...Merchant processing services ...ATM processing services ...Trust and investment management fees ...Deposit service charges ...Treasury management fees ...Commercial products revenue ...Mortgage banking revenue... -

Page 74

... U.S. Bancorp Shares Preferred Common Capital Retained Treasury Comprehensive Shareholders' Noncontrolling Outstanding Stock Stock Surplus Earnings Stock Income (Loss) Equity Interests (Dollars and Shares in Millions) Total Equity Balance December 31, 2008 ...Change in accounting principle ...Net... -

Page 75

... Flows Year Ended December 31 (Dollars in Millions) 2011 2010 2009 Operating Activities Net income attributable to U.S. Bancorp ...Adjustments to reconcile net income to net cash provided by operating activities Provision for credit losses ...Depreciation and amortization of premises and equipment... -

Page 76

... and commercial real estate loans and related other real estate ("OREO"), funding, capital management, asset securitization, interest rate risk management, the net effect of transfer pricing related to average balances and the residual aggregate of those expenses associated with corporate activities... -

Page 77

... loans and related indemnification assets are recorded at fair value at date of purchase. Commitments to Extend Credit Unfunded residential originates as held for investment are reported at the principal amount outstanding, net of unearned income, net deferred loan fees or costs, and any direct... -

Page 78

... The Company also assesses the credit risk associated with off-balance sheet loan commitments, letters of credit, and derivatives. Credit risk associated with derivatives is reflected in the fair values recorded for those positions. The liability for off-balance sheet credit exposure related to loan... -

Page 79

... days past due; and revolving consumer lines are charged off at 180 days past due. Similar to credit cards, other retail loans are generally not placed on nonaccrual status because of the relative short period of time to charge-off. Certain retail customers having financial difficulties may have the... -

Page 80

... decreases in value along with holding costs, such as taxes and insurance, are reported in noninterest expense. Loans Held for Sale Loans held for sale ("LHFS") represent mortgage loan originations intended to be sold in the secondary market and other loans that management has an active plan to sell... -

Page 81

... credit and debit card revenue and corporate payment products revenue. Payments to partners and expenses related to rewards programs are recorded when earned by the partner or customer. Merchant Processing Services Merchant processing services revenue consists principally of transaction and account... -

Page 82

... includes revenue related to ancillary services provided to Wholesale Banking and Commercial Real Estate customers including standby letter of credit fees, non-yield related loan fees, syndication and other capital markets related revenue, non-yield related leasing revenue and foreign exchange fees... -

Page 83

...credit losses methodology. These newly classified TDRs primarily relate to In January 2011, the Company acquired the banking operations of First Community Bank of New Mexico ("FCB") from the FDIC. The FCB transaction did not include a loss sharing agreement. The Company acquired 38 branch locations... -

Page 84

... of discounts and credit-related other-than-temporary impairment. Available-for-sale securities are carried at fair value with unrealized net gains or losses reported within accumulated other comprehensive income (loss) in shareholders' equity. Prime securities are those designated as such by... -

Page 85

... investment securities: Year Ended December 31 (Dollars in Millions) 2011 2010 2009 In 2007, the Company purchased certain structured investment securities ("SIVs") from certain money market funds managed by an affiliate of the Company. Subsequent to the initial purchase, the Company exchanged its... -

Page 86

...(Losses) (b) Year Ended December 31 (Dollars in Millions) Total Total Total Held-to-maturity Other asset-backed securities ...Total held-to-maturity ...Available-for-sale Mortgage-backed securities Non-agency residential Prime (a) ...Non-prime ...Commercial non-agency ...Asset-backed securities... -

Page 87

... those with underlying asset characteristics and/or credit enhancements consistent with securities designated as prime. The Company does not consider these unrealized losses to be credit-related. These unrealized losses primarily relate to changes in interest rates and market spreads subsequent to... -

Page 88

... type, was as follows: (Dollars in Millions) 2011 2010 Commercial Commercial ...Lease financing ...Total commercial ...Commercial real estate Commercial mortgages ...Construction and development ...Total commercial real estate ...Residential mortgages Residential mortgages ...Home equity loans... -

Page 89

... Real Estate Residential Mortgages Credit Card Other Retail Total Loans, Excluding Covered Loans Covered Loans Total Loans (Dollars in Millions) Commercial Balance at December 31, 2009 ...Add Provision for credit losses ...Deduct Loans charged off ...Less recoveries of loans charged off ...Net... -

Page 90

...detail of the allowance for credit losses by portfolio class was as follows: Commercial Residential Commercial Real Estate Mortgages Credit Card Total Loans, Other Excluding Retail Covered Loans Covered Loans Total Loans (Dollars in Millions) Allowance balance at December 31, 2011 related to Loans... -

Page 91

... loans, restructured loans not performing in accordance with modified terms, other real estate and other nonperforming assets owned by the Company. For details of the Company's nonperforming assets as of December 31, 2011 and 2010, see Table 16 included in Management's Discussion and Analysis... -

Page 92

... class was as follows: Period-end Recorded Investment (a) Unpaid Principal Balance Commitments to Lend Additional Funds (Dollars in Millions) Valuation Allowance December 31, 2011 Commercial ...Commercial real estate ...Residential mortgages ...Credit card ...Other retail ...Total impaired... -

Page 93

... as TDRs for the year ended December 31, 2011, by portfolio class: Pre-Modification Outstanding Loan Balance Post-Modification Outstanding Loan Balance (Dollars in Millions) Number of Loans Commercial ...Commercial real estate ...Residential mortgages ...Credit card ...Other retail ...Total... -

Page 94

... included in commercial real estate loans. Net gains on the sale of loans of $546 million, $574 million and $710 million for the years ended December 31, 2011, 2010 and 2009, respectively, were included in noninterest income, primarily in mortgage banking revenue. Leases 2011 2010 The components... -

Page 95

...$436 million for the years ended December 31, 2011, 2010 and 2009, respectively. At December 31, 2011, approximately $5.6 billion of the Company's assets and $4.0 billion of its liabilities included on the consolidated balance sheet were related to community development and tax-advantaged investment... -

Page 96

... million for the years ended December 31, 2011, 2010 and 2009, respectively. The Company serviced $191.1 billion of residential mortgage loans for others at December 31, 2011, and $173.9 billion at December 31, 2010. The net impact included in mortgage banking revenue of fair value changes of MSRs... -

Page 97

...Balance 2011 2010 Intangible assets consisted of the following: At December 31 (Dollars in Millions) Goodwill ...Merchant processing contracts ...Core deposit benefits ...Mortgage servicing rights ...Trust relationships ...Other identified intangibles ...Total ... 10 years/8 years 18 years/5 years... -

Page 98

...carrying value of goodwill for the years ended December 31, 2011 and 2010: (Dollars in Millions) Wholesale Banking and Commercial Real Estate Consumer and Small Business Banking Wealth Management and Securities Services Payment Services Treasury and Corporate Support Consolidated Company Balance at... -

Page 99

... accreted principal amount of the debentures plus, if the market price of the Company's stock exceeds the conversion price in effect on the date of conversion, a number of shares of the Company's common stock, or an equivalent amount of cash at the Company's option, as determined in accordance with... -

Page 100

... and payments on liquidation or redemption of the Trust Preferred Securities, but only to the extent of funds held by the trusts. The Company has the right to redeem the Debentures in whole or in part, on or after specific dates, at a redemption price specified in the indentures plus any... -

Page 101

... value of all shares issued and outstanding at December 31, 2011 and 2010, was $1.00 per share. During 2010, the Company issued depositary shares representing an ownership interest in 5,746 shares of Series A Preferred Stock to investors, in exchange for their portion of USB Capital IX Income Trust... -

Page 102

... income (loss) included in shareholders' equity for the years ended December 31, is as follows: Transactions (Dollars in Millions) Pre-tax Tax-effect Net-of-tax Balances Net-of-Tax 2011 Changes in unrealized gains and losses on securities available-for-sale ...Other-than-temporary impairment not... -

Page 103

...of the Currency. Earnings Per Share The components of earnings per share were: Year Ended December 31 (Dollars and Shares in Millions, Except Per Share Data) 2011 2010 2009 Net income attributable to U.S. Bancorp ...Preferred dividends ...Equity portion of gain on ITS exchange transaction, net of... -

Page 104

...' accounts. Effective January 1, 2010, the Company established a new cash balance formula for certain current and all future eligible employees. Participants receive annual pay credits based on eligible pay multiplied by a percentage determined by their age and years of service. Participants... -

Page 105

... the changes in benefit obligations and plan assets for the years ended December 31, and the funded status and amounts recognized in the consolidated balance sheet at December 31 for the retirement plans: Pension Plans (Dollars in Millions) 2011 2010 Postretirement Welfare Plan 2011 2010 Change In... -

Page 106

... the years ended December 31 for the retirement plans: Pension Plans (Dollars in Millions) 2011 2010 2009 Postretirement Welfare Plan 2011 2010 2009 Components Of Net Periodic Benefit Cost Service cost ...Interest cost ...Expected return on plan assets ...Prior service cost (credit) and transition... -

Page 107

... pension plans at December 31, 2011 is 45 percent passively managed global equities, 25 percent actively managed global equities, 10 percent domestic midsmall cap equities, 5 percent emerging markets equities, 5 percent real estate equities, and 10 percent long term debt securities. The target asset... -

Page 108

... the years ended December 31: 2011 (Dollars in Millions) Debt Securities Other 2010 Debt Securities Other Balance at beginning of period ...Unrealized gains (losses) relating to assets still held at end of year ...Purchases, sales, principal payments, issuances, and settlements ...Balance at end of... -

Page 109

... outstanding and exercised under various stock options plans of the Company: Stock Options/Shares WeightedAverage Exercise Price Weighted-Average Remaining Contractual Term Aggregate Intrinsic Value (in millions) Year Ended December 31 2011 Number outstanding at beginning of period ...Granted... -

Page 110

... of the status of the Company's restricted shares of stock and unit awards is presented below: 2011 WeightedAverage GrantDate Fair Value 2010 WeightedAverage GrantDate Fair Value 2009 WeightedAverage Grant-Date Fair Value Year Ended December 31 Shares Shares Shares Nonvested Shares Outstanding... -

Page 111

...value adjustments on securities available-for-sale, derivative instruments in cash flow hedges, pension and post-retirement plans and certain tax benefits related to stock options are recorded directly to shareholders' equity as part of other comprehensive income (loss). In preparing its tax returns... -

Page 112

... (Dollars in Millions) 2011 2010 Deferred Tax Assets Allowance for credit losses ...Accrued expenses ...Pension and postretirement benefits ...Stock compensation ...Securities available-for-sale and financial instruments ...Federal, state and foreign net operating loss carryforwards ...Partnerships... -

Page 113

... a hedge of the volatility of an investment in foreign operations driven by changes in foreign currency exchange rates ("net investment hedge"); or a designation is not made as it is a customer-related transaction, an economic hedge for asset/liability risk management purposes or another standalone... -

Page 114

... ...Foreign exchange forward contracts ...Equity contracts ...Credit contracts ...December 31, 2010 Fair value hedges Interest rate contracts Receive fixed/pay floating swaps ...Foreign exchange cross-currency swaps ...Cash flow hedges Interest rate contracts Pay fixed/receive floating swaps...Net... -

Page 115

... Gains (Losses) Reclassified from Other Comprehensive Income (Loss) into Earnings 2011 2010 2009 Asset and Liability Management Positions Cash flow hedges Interest rate contracts (a) ...Net investment hedges Foreign exchange forward contracts ... $(213) 34 $(235) (25) $114 (44) $(138) - $(148... -

Page 116

... years ended December 31: Location of Gains (Losses) Recognized in Earnings Gains (Losses) Recognized in Earnings 2011 2010 2009 (Dollars in Millions) Asset and Liability Management Positions Fair value hedges (a) Interest rate contracts ...Foreign exchange cross-currency swaps ...Other economic... -

Page 117

...value. Cash and Cash Equivalents The carrying value of cash, amounts due from banks, federal funds sold and securities purchased under resale agreements was assumed to approximate fair value. Investment Securities When quoted market prices for identical securities are available in an active market... -

Page 118

...and/or credit enhancements consistent with securities designated as prime. Certain mortgage loans held for sale MLHFS measured at fair value, for which an active secondary market and readily available market prices exist, are initially valued at the transaction price and are subsequently valued by... -

Page 119

... value hierarchy. Deposit Liabilities The fair value of demand deposits, savings Short-term Borrowings Federal funds purchased, securities sold under agreements to repurchase, commercial paper and other short-term funds borrowed have floating rates or shortterm maturities. The fair value of short... -

Page 120

... subdivisions ...Obligations of foreign governments ...Corporate debt securities ...Perpetual preferred securities ...Other investments ...Total available-for-sale ...Mortgage loans held for sale ...Mortgage servicing rights ...Derivative assets ...Other assets ...Total ...Derivative liabilities... -

Page 121

... loan obligations ...Other ...Corporate debt securities ...Total available-for-sale ...Mortgage servicing rights ...Net derivative assets and liabilities ...2010 Available-for-sale securities Mortgage-backed securities Residential non-agency Prime ...Non-prime ...Commercial non-agency ...Asset... -

Page 122

... assets or portfolios for the years ended December 31: (Dollars in Millions) 2011 2010 2009 Loans held for sale ...Loans (a) ...Other intangible assets ...Other assets (b) ...(a) Represents write-downs of loans which were based on the fair value of the collateral, excluding loans fully charged... -

Page 123

... table below: 2011 (Dollars in Millions) Carrying Amount Fair Value Carrying Amount 2010 Fair Value Financial Assets Cash and due from banks ...Investment securities held-to-maturity ...Mortgages held for sale (a) ...Other loans held for sale ...Loans ...Financial Liabilities Deposits ...Short-term... -

Page 124

... one year or more, consisted of the following at December 31, 2011: Capitalized Leases Operating Leases participates in securities lending activities by acting as the customer's agent involving the loan of securities. The Company indemnifies customers for the difference between the market value of... -

Page 125

...after the date the transaction is processed or the receipt of the product or service to present a charge-back to the Company as the merchant processor. The absolute maximum potential liability is estimated to be the total volume of credit card transactions that meet the associations' requirements to... -

Page 126

... a related liability of $20 million. Company's payment services business issues and acquires credit and debit card transactions through the Visa U.S.A. Inc. card association or its affiliates (collectively "Visa"). In 2007, Visa completed a restructuring and issued shares of Visa Inc. common stock... -

Page 127

... related to the remaining Visa Litigation matters, net of its share of the escrow fundings, was zero. The remaining Class B shares held by the Company will be eligible for conversion to Class A shares, and thereby marketable, upon settlement of the Visa Litigation. Checking Account Overdraft Fee... -

Page 128

... 23 U.S. Bancorp (Parent Company) 2011 2010 Condensed Balance Sheet At December 31 (Dollars in Millions) Assets Due from banks, principally interest-bearing ...Available-for-sale securities ...Investments in bank subsidiaries ...Investments in nonbank subsidiaries ...Advances to bank subsidiaries... -

Page 129

... of Cash Flows Year Ended December 31 (Dollars in Millions) 2011 2010 2009 Operating Activities Net income attributable to U.S. Bancorp ...Adjustments to reconcile net income to net cash provided by operating activities Equity in undistributed income of subsidiaries ...Other, net ...Net cash... -

Page 130

... Balance Sheet-Five Year Summary (Unaudited) At December 31 (Dollars in Millions) 2011 2010 2009 2008 2007 % Change 2011 v 2010 Assets Cash and due from banks ...Held-to-maturity securities ...Available-for-sale securities ...Loans held for sale ...Loans ...Less allowance for loan losses ...Net... -

Page 131

...Noninterest Income Credit and debit card revenue ...Corporate payment products revenue ...Merchant processing services ...ATM processing services ...Trust and investment management fees ...Deposit service charges ...Treasury management fees ...Commercial products revenue ...Mortgage banking revenue... -

Page 132

...Noninterest Income Credit and debit card revenue ...Corporate payment products revenue ...Merchant processing services ...ATM processing services ...Trust and investment management fees ...Deposit service charges ...Treasury management fees ...Commercial products revenue ...Mortgage banking revenue... -

Page 133

... based upon historical data and are not indicative of, nor intended to forecast, future performance of the Company's common stock. Total Return 150 125 100 100 105 97 92 84 78 75 66 50 41 40 25 2006 2007 USB 99 84 86 77 70 50 38 2010 2011 2008 S&P 500 2009 KBW Bank Index U.S. BANCORP 131 -

Page 134

...) 2011 Average Balances Yields and Rates Average Balances 2010 Yields and Rates Year Ended December 31 (Dollars in Millions) Interest Interest Assets Investment securities ...Loans held for sale ...Loans (b) Commercial ...Commercial real estate ...Residential mortgages ...Credit card ...Other... -

Page 135

2009 Average Balances Yields and Rates Average Balances 2008 Yields and Rates Average Balances 2007 Yields and Rates 2011 v 2010 % Change Average Balances Interest Interest Interest $ 42,809 ...7,866 3.29% 3.23 5.87% 2.21 3.66% 3.60% $ 6,764 2.93% 2.89 6.84% 3.37 3.47% 3.43% U.S. BANCORP 133 -

Page 136

...financial services, including lending and depository services, cash management, foreign exchange and trust and investment management services. It also engages in credit card services, merchant and ATM processing, mortgage banking, insurance, brokerage and leasing. U.S. Bancorp's banking subsidiaries... -

Page 137

... regulation, changes the base for deposit insurance assessments, introduces regulatory rate-setting for interchange fees charged to merchants for debit card transactions, enhances the regulation of consumer mortgage banking, limits the pre-emption of state laws applicable to national banks, and... -

Page 138

... of financial products and services at more competitive prices. The Company competes with other commercial banks, savings and loan associations, mutual savings banks, finance companies, mortgage banking companies, credit unions, investment companies, credit card companies, and a variety of other... -

Page 139

... unable to timely develop competitive new products and services in response to these changes that are accepted by new and existing customers. Changes in interest rates could reduce the Company's net interest income The operations of financial institutions such loan money, it incurs credit risk, or... -

Page 140

... credit losses to the Company. The Company faces increased risk arising out of its mortgage lending and servicing businesses During 2011, Changes in interest rates can reduce the value of the Company's mortgage servicing rights and mortgages held for sale, and can make its mortgage banking revenue... -

Page 141

...the Company's actual or alleged conduct in any number of activities, including lending practices, mortgage servicing and foreclosure practices, corporate governance, regulatory compliance, mergers and acquisitions, and related disclosure, sharing or inadequate protection of customer information, and... -

Page 142

... Accounting Policies" in this Annual Report. Changes in accounting standards could materially impact the Company's financial statements From time to time, the If new laws were enacted that restrict the ability of the Company and its subsidiaries to share information about customers, the Company... -

Page 143

.... Any failure, interruption or breach in security of these systems could result in failures or disruptions to its accounting, deposit, loan and other systems, and could adversely affect its customer relationships. While the Company has policies and procedures designed to prevent or limit the effect... -

Page 144

competitors; operating and stock price performance of other companies that investors deem comparable to the Company; new technology used or services offered by the Company's competitors; news reports relating to trends, concerns and other issues in the financial services industry; and changes in ... -

Page 145

... is Vice Chairman, Wealth Management and Securities Services, of U.S. Bancorp. Mr. Dolan, 50, has served in this position since July 2010. From September 1998 to July 2010, Mr. Dolan served as U.S. Bancorp's Controller. He additionally held the title of Executive Vice President from January 2002... -

Page 146

... Credit Portfolio Management of U.S. Bancorp since January 2002. Richard B. Payne, Jr. Mr. Payne is Vice Chairman, Wholesale Banking, of U.S. Bancorp. Mr. Payne, 64, has served in this position since November 2010, when he assumed the additional responsibility for Commercial Banking at U.S. Bancorp... -

Page 147

... Ho4,6 President San Francisco Port Commission (Government) San Francisco, California 1. Executive Committee 2. Compensation and Human Resources Committee 3. Audit Committee 4. Community Reinvestment and Public Policy Committee 5. Governance Committee 6. Risk Management Committee U.S. BANCORP 145 -

Page 148

... Transfer Agent and Registrar Computershare Investor Services acts as our transfer agent and registrar, dividend paying agent and dividend reinvestment plan administrator, and maintains all shareholder records for the corporation. Inquiries related to shareholder records, stock transfers, changes of... -

Page 149

U.S. Bancorp 800 Nicollet Mall Minneapolis, MN 55402 usbank.com