Twenty-First Century Fox 2005 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2005 Twenty-First Century Fox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.> 8 <

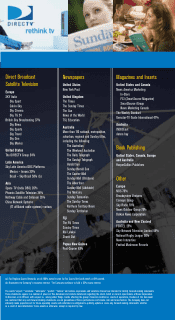

channels, providing an immediate 15 million subscribers at launch. And the cooperation between

Fox and DIRECTV in areas such as NFL broadcasts will lead to several ground-breaking interactive

advances in the coming season.

In the U.K., our 37 percent-owned BSkyB expanded its DTH subscriber base by 6 percent

to 7.8 million this past year while revamping its pricing and package structure to offer consumers

increased choice and flexibility. As the number of subscribers increased – a number expected to

exceed 8 million by the end of calendar 2005 – the number of multi-room households also

rose, more than doubling this past year and providing a strong boost to average revenue per user.

As you know, we have long been big believers in the potential for satellite to deliver

a top-quality and innovative service to customers around the world. Fiscal 2005 showed that

our predictions were justified.

While the development of our newer satellite assets continued apace, few would have

predicted the exceptional growth we achieved at our print assets, especially among our newspapers.

At the Newspapers segment, operating income was up 31 percent on the year, to $740

million. Our Australian papers delivered record profits during fiscal 2005, with the inclusion of

100 percent of the results of Queensland Press, and with advertising revenues benefiting from

the strong local economy. We also grew our market share at several of our U.K. newspapers,

including The Times, which shifted fully to a compact version that consumers and advertisers

alike prefer, and at the New York Post, which posted its ninth consecutive six-month period of

daily circulation growth.

In the past year we also made long-term capital investments in our Australian properties

to increase their color capacity and we are in the process of undertaking an even greater expansion

in the U.K. where we have begun a five-year effort to build modern new plants and buy new color

printing presses to serve our papers and enable large wage savings.

We also achieved growth across our other print assets. HarperCollins enjoyed another

year of record profits – all the more remarkable this year considering the enormous gains made

a year ago, spurred by the runaway success of The Purpose Driven Life. And our Magazines and

Inserts segment grew operating income 10 percent, led by continued growth in our InStore division.

Our publishing assets are major

cash generators for our Company, cash that

enabled us to develop new businesses.

Given that they are the foundation of our

Company, I was extremely pleased with

their performance in the past year.

Across the board in fiscal 2005, our

established businesses performed admirably

in the face of many challenges and our

developing businesses made great strides

towards sustained growth and profitability.

It was, as I said earlier, a record year. But to maintain our steep growth trajectory, we must

continue to develop new assets in new areas. To that end, we have spent the past six months

focusing on reformulating our Internet strategy. The shell-shock of the dot-com bubble is

dissipating and smart companies are realizing that the digital revolution is only accelerating. The

achievers in the digital age are going to be those who fashion their Internet presence in line with

the expectations of their increasingly web-savvy customer base – especially the “digital natives,”

as I called them earlier this year in a speech I gave to the American Society of Newspaper Editors.

In that speech I acknowledged that more and more young people are embracing the Internet as

NEWS CORPORATION Chief Executive Officer’s Review

> Across the board in fiscal 2005, our

established businesses performed

admirably in the face of many challenges

and our developing businesses made

great strides towards sustained growth

and profitability.