Twenty-First Century Fox 2005 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2005 Twenty-First Century Fox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

> 5 <

As a result of our longer-term focus and capital allocation, News Corporation today boasts

among the best mix of assets in the business, and a corporate structure that enables us to get

the most out of those assets. We produce award-winning. critically acclaimed and popular content.

We have also invested in the world’s largest distribution platform and the only one that is truly

global in scope. Most importantly, we’ve learned how to integrate our content and distribution assets

into a seamless whole that allows us to get the most out of each individual asset – an attribute

that further distinguishes us from our peers.

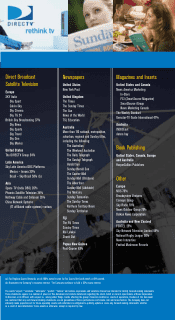

Our diverse businesses encompass all forms of modern media: from print to broadcast

to cable to satellite to film to home entertainment to the Internet. We generate revenue around

the world, with more than 40 percent coming from outside the U.S. And those revenues are

diversified by a broad base of sources.

This past fiscal year, News Corporation’s net income exceeded $2.1 billion, a 39 percent

increase over the prior year with combined earnings per share of $0.69, up 28 percent. The

Company’s balance sheet is also stronger than ever before, with $6.5 billion in cash and a strong

debt-to-equity position. As a result of our strong financial position, we increased our dividends for

the fiscal year for both Class A and Class B Common Stock, to $0.12 and $0.10, respectively.

In addition, we announced a $3 billion stock buyback in June 2005, and by the end of August

had already purchased 34 million shares for approximately $585 million.

Sustained financial growth was not the only measure of our success in fiscal 2005,

however. Strategically, we also excelled. We completed our reincorporation in the U.S., moving

our primary listing to the New York Stock Exchange. This has already resulted in the Company’s

inclusion in several major U.S. equity indices, including the S&P 500, and a significant reduction

in the discount of the non-voting to voting shares. We continue to believe that this change in

domicile will help the Company attain greater value for our shareholders longer term.

With News Corporation’s domicile change, there was no further need to maintain the Fox

Entertainment Group as a separate corporate entity. Consequently, earlier this year we completed

a successful exchange offer for all outstanding shares of Fox stock. In so doing, we simplified

our corporate reporting, eliminated a duplicative U.S. listing and achieved some minimal cost

savings from redundant operations.

This year also saw us acquire the 58 percent controlling interest in Queensland Press

Pty Ltd that the Company did not already own. Queensland Press is one of Australia’s best-run,

fastest-growing newspaper operations, boasting two metro and eight regional newspapers

in some of the most desirable newspaper

markets in the country. Additionally, we

acquired Telecom Italia’s 20 percent

stake in SKY Italia, making the platform a

wholly owned subsidiary of our Company.

Queensland Press and SKY Italia are

both businesses with significant growth

potential and we are now fortunate to capture 100 percent of their results in the future.

While we made these strategic moves and acquisitions and reasserted ourselves in

the Internet – something I will refer to later – we also continued to expand and reinvigorate our

so-called traditional media businesses.

There is no better example of this than the momentum we maintained and grew across our

cable programming business. It was our biggest growth driver during fiscal 2005, recording

yet another year of double-digit revenue and operating income growth. We believe that we

have the fastest-growing collection of cable and satellite programming assets in the industry. And

while much of our profit growth today stems from our established channels – FOX News, FX

and our Regional Sports Networks – we have been diligent in developing their successors.

> News Corporation today boasts among

the best mix of assets in the business

and a corporate structure that enables us

to get the most out of those assets.