TomTom 2014 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2014 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

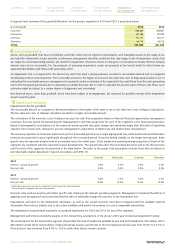

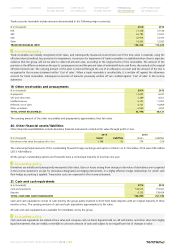

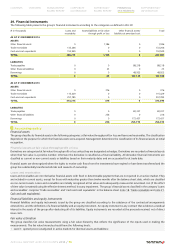

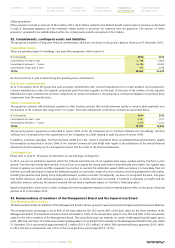

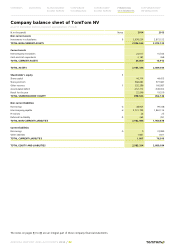

29. Financial instruments

The following table presents the group's financial instruments according to the categories as defined in IAS 39:

(€ in thousands) Loans and

receivables

Assets/liabilities at fair value

through profit or loss

Other financial assets/

liabilities at amortised cost

Total

AS AT 31 DECEMBER 2014

ASSETS

Other financial assets 0 1,186 0 1,186

Trade receivables 133,266 0 0 133,266

Cash and cash equivalents 152,949 0 0 152,949

TOTAL 286,215 1,186 0 287,401

LIABILITIES

Trade payables 0 0 88,218 88,218

Other financial liabilities 0 23 0 23

Borrowings 0 0 48,925 48,925

TOTAL 0 23 137,143 137,166

AS AT 31 DECEMBER 2013

ASSETS

Other financial assets 0 376 0 376

Trade receivables 115,429 0 0 115,429

Cash and cash equivalents 257,785 0 0 257,785

TOTAL 373,214 376 0 373,590

LIABILITIES

Trade payables 0 0 82,337 82,337

Other financial liabilities 0 236 0 236

Borrowings 0 0 173,437 173,437

TOTAL 0 236 255,774 256,010

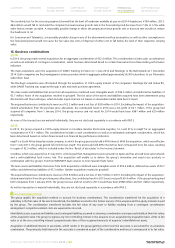

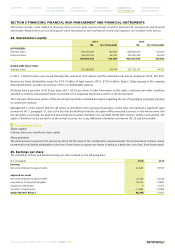

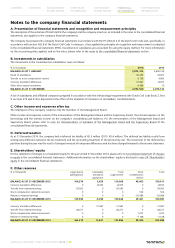

Accounting policy

Financial assets

The group classifies its financial assets in the following categories: at fair value through profit or loss and loans and receivables. The classification

depends on the purpose for which the financial assets were acquired. Management determines the classification of its financial assets at initial

recognition.

Financial assets at fair value through profit or loss

Derivatives are categorised at fair value through profit or loss unless they are designated as hedges. Derivatives are recorded as financial assets

when their fair value is a positive number; otherwise the derivative is classified as a financial liability. All derivative financial instruments are

classified as current or non-current assets or liabilities based on their maturity dates and are accounted for at trade date.

Financial assets are derecognised when the rights to receive cash flows from the investments have expired or have been transferred and the

group has substantially transferred all risks and rewards of ownership.

Loans and receivables

Loans and receivables are non-derivative financial assets with fixed or determinable payments that are not quoted in an active market. They

are included in current assets, except for those with maturities greater than twelve months after the balance sheet date, which are classified

as non-current assets. Loans and receivables are initially recognised at fair value and subsequently measured at amortised cost (if the effect

of time value is material) using the effective interest method, less any impairment. The group's financial assets classified in the category 'Loans

and receivables' comprise 'Trade receivables' and 'Cash and cash equivalents' in the balance sheet (note 18. Trade receivables and note 21.

Cash and cash equivalents).

Financial liabilities and equity instruments

Financial liabilities and equity instruments issued by the group are classified according to the substance of the contractual arrangements

entered into, and the definitions of a financial liability and an equity instrument. An equity instrument is any contract that evidences a residual

interest in the assets of the group after deducting all of its liabilities. Equity instruments are recorded at the proceeds received, net of direct

issue costs.

Fair value estimation

The group classifies fair value measurements using a fair value hierarchy that reflects the significance of the inputs used in making the

measurements. The fair value hierarchy should have the following levels:

• Level 1: quoted prices (unadjusted) in active markets for identical assets and liabilities;

CONTENTS OVERVIEW MANAGEMENT

BOARD REPORT CORPORATE

GOVERNANCE SUPERVISORY

BOARD REPORT FINANCIAL

STATEMENTS SUPPLEMENTARY

INFORMATION

ANNUAL REPORT AND ACCOUNTS 2014 / 75