TomTom 2014 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2014 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

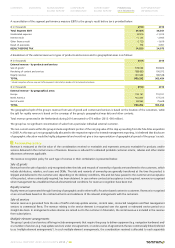

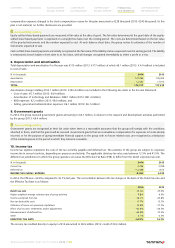

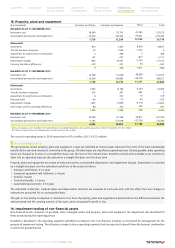

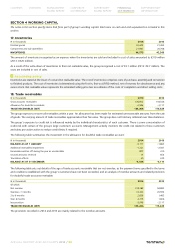

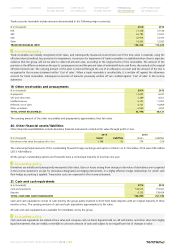

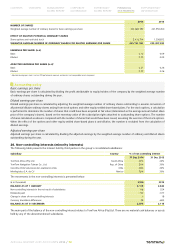

13. Property, plant and equipment

(€ in thousands) Furniture and fixture Computer and harware Other1Total

BALANCE AS AT 31 DECEMBER 2012

Investment cost 18,069 70,703 43,383 132,155

Accumulated amortisation and impairment –16,340 –58,404 –30,641 –105,385

1,729 12,299 12,742 26,770

Movements

Investments 810 7,467 8,600 16,877

Transfer between categories 25 1,500 –1,525 0

Acquisitions through business combination 0 466 0466

Disposals (net) –61 –233 –817 –1,111

Depreciation charges –643 –8,593 –7,779 –17,015

Currency translation differences –122 –151 90 –183

9 456 –1,431 –966

BALANCE AS AT 31 DECEMBER 2013

Investment cost 14,328 51,638 48,089 114,055

Accumulated amortisation and impairment –12,590 –38,883 –36,778 –88,251

1,738 12,755 11,311 25,804

Movements

Investments 1,945 8,186 6,354 16,485

Transfer between categories 270 297 –567 0

Acquisitions through business combination 6 303 10 319

Disposals (net)2–60 –73 –50 –183

Depreciation charges –647 –5,859 –6,116 –12,622

Net foreign currency exchange differences 86 242 163 491

1,600 3,096 –206 4,490

BALANCE AS AT 31 DECEMBER 2014

Investment cost 10,499 53,769 36,811 101,079

Accumulated amortisation and impairment –7,161 –37,918 –25,706 –70,785

3,338 15,851 11,105 30,294

1Other assets balance as at 31 December 2014 mainly comprises of leasehold improvements with a carrying value of €4.2 million (31 December 2013: €5.0 million).

2The total gross amount of the assets disposed across all asset classes was €31.8 million.

The costs for operating leases in 2014 amounted to €13.0 million (2013: €15.5 million).

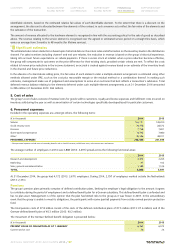

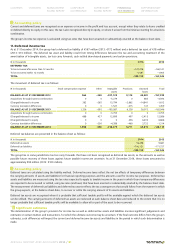

Accounting policy

The group leases certain property, plant and equipment. Leases are classified as finance leases whenever the terms of the lease substantially

transfer all the risks and rewards of ownership to the group. All other leases are classified as operating leases. Rentals payable under operating

leases are charged to income on a straight-line basis over the term of the relevant lease. Benefits received and receivable as an incentive to

enter into an operating lease are also spread on a straight-line basis over the lease term.

Property, plant and equipment are stated at historical cost less accumulated depreciation and impairment charges. Depreciation is recorded

on a straight-line basis over the estimated useful lives of the assets as follows:

• Furniture and fixtures: 4-10 years

• Computer equipment and hardware: 2-4 years

• Vehicles: 4 years

• Tools and moulds: 1-2 years

• Leasehold improvements: 4-10 years

The estimated useful lives, residual values and depreciation methods are reviewed at each year-end, with the effect that any changes in

estimate are accounted for on a prospective basis.

The gain or loss arising on disposal or retirement of an item of property, plant and equipment is determined as the difference between the

sales proceeds and the carrying amount of the asset, and is recognised in profit or loss.

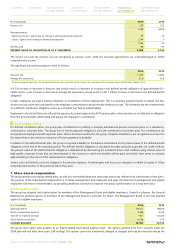

14. Impairment testing of non-financial assets

Non-financial assets comprises of goodwill, other intangible assets and property, plant and equipment. No impairment was identified for

these assets during the reporting period.

Goodwill is allocated to the operating segments identified according to the core business activities as monitored by management for the

purpose of impairment testing. The allocation is made to those operating segments that are expected to benefit from the business combination

in which the goodwill arose.

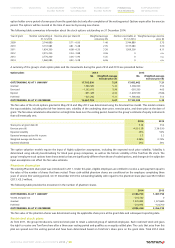

CONTENTS OVERVIEW MANAGEMENT

BOARD REPORT CORPORATE

GOVERNANCE SUPERVISORY

BOARD REPORT FINANCIAL

STATEMENTS SUPPLEMENTARY

INFORMATION

ANNUAL REPORT AND ACCOUNTS 2014 / 64