TomTom 2009 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2009 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90 / NOTES TO THE COMPANY FINANCIAL STATEMENTS

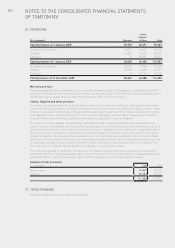

1. PRESENTATION OF FINANCIAL STATEMENTS AND PRINCIPLE ACCOUNTING POLICIES

The description of the activities of TomTom NV (the “company”) and the company structure, as included in the

notes to the Consolidated Financial Statements, also apply to the company financial statements.

In accordance with section 362.8 of Part 9 of Book 2 of the Netherlands Civil Code, the company has prepared its

company financial statements in accordance with accounting principles generally accepted in the Netherlands,

applying the accounting policies as adopted in the Consolidated Financial Statements (IFRS). Investments in

subsidiaries are stated at net asset value, as the company effectively exercises significant influence over them.

For more information on the accounting policies applied, and on the Notes to the Consolidated Financial

Statements, please refer to pages 57 to 87.

The total equity and profit in the company financial statements is equal to the consolidated equity.

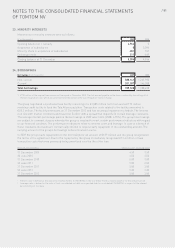

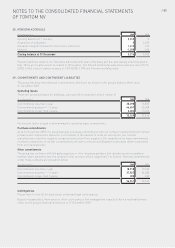

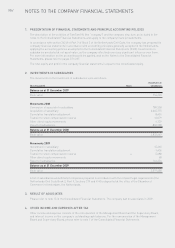

2. INVESTMENTS IN SUBSIDIARIES

The movements in the investment in subsidiaries were as follows:

Investments in

(€ in thousands) Notes subsidiaries

Balance as at 31 December 2007

Book value 756,243

Movements 2008

Conversion of associate to subsidiary 789,350

Acquisition of subsidiary 2,065,775

Cumulative translation adjustment 8,451

Transfer to stock compensation reserve 612,079

Other direct equity movements 6,139

Result of subsidiaries -802,388

Balance as at 31 December 2008

Book value 2,835,649

Movements 2009

Investment in subsidiary 15,265

Cumulative translation adjustment -1,436

Transfer to stock compensation reserve 65,688

Other direct equity movements 68

Result of subsidiaries 164,254

Balance as at 31 December 2009

Book value 3,019,488

A list of subsidiaries and affiliated companies prepared in accordance with the relevant legal requirements (the

Netherlands Civil Code Book 2, Part 9, Sections 379 and 414) is deposited at the office of the Chamber of

Commerce in Amsterdam, the Netherlands.

3. RESULT OF ASSOCIATES

Please refer to note 15 in the Consolidated Financial Statements. The company had no associates in 2009.

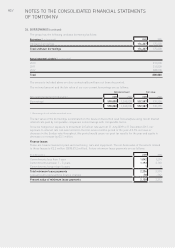

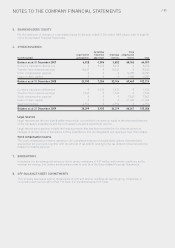

4. OTHER INCOME AND EXPENSES AFTER TAX

Other income and expense consists of the remuneration of the Management Board and the Supervisory Board,

and interest income on the company’s outstanding cash balances. For the remuneration of the Management

Board and Supervisory Board, please refer to note 7 of the Consolidated Financial Statements.