TomTom 2009 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2009 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

/ 65

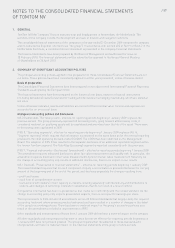

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

OF TOMTOM NV

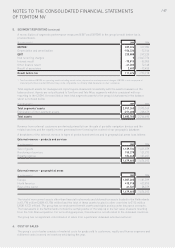

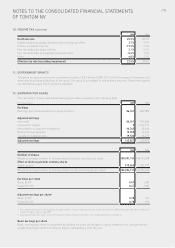

3. FINANCIAL RISK MANAGEMENT (continued)

Capital risk management

The group’s financing policy aims to maintain a capital structure which enables the group to achieve its strategic

objectives and daily operational needs, and to safeguard the group’s ability to continue as a going concern.

In order to maintain or adjust the capital structure, the group may issue new shares, adjust its dividend policy,

return capital to shareholders or sell assets to reduce debt.

With respect to debt financing, the group focuses on interest cover and leverage. Net debt is calculated as total

borrowings less cash and cash equivalents plus our financial lease commitments.

Further quantitative disclosures are included throughout these consolidated financial statements.

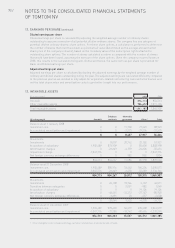

4. CRITICAL ACCOUNTING ESTIMATES AND JUDGEMENTS

The group makes estimates and assumptions concerning the future. The resulting accounting estimates will, by

definition, seldom equal the related actual results. The estimates and assumptions that have a significant risk of

causing a material adjustment to the carrying amounts of assets and liabilities within the next financial year are

discussed below.

a) Revenue recognition

When returns are probable, an estimate is made of the expected financial impact of these returns. The estimate

is based upon historical data on the return rates and information on the inventory levels in the distribution

channel. The estimated probable returns are recorded as a direct deduction from revenue and cost of sales.

The group reduces revenue for estimates of sales incentives. We offer sales incentives, including channel

rebates and end-user rebates for our products. The estimate is based on our historical experience taking into

account future expectations on rebate payments.

If there is excess stock at retailers when a price reduction becomes effective, the group will compensate its

customers on the price difference for their existing stock. Customers are eligible for compensation if certain

criteria are met. To reflect the costs related to known price reductions in the income statement, an accrual is

created against revenue.

Multiple Deliverable Arrangements (MDA) require TomTom to deliver hardware and/or a number of services

under one agreement, or under a series of agreements which are commercially linked. Revenue recognition

must be determined separately for each of the deliverables identified, and for that purpose TomTom must

attribute a reliable fair value to each deliverable. IFRS permits the use of a combination of estimation and

allocation methods if that combination best reflects a transaction’s substance. The absence of a reliable fair

value for any of the deliverables indicates that the goods and services do not operate independently. In this

situation, the whole revenue is allocated over the subscription period.

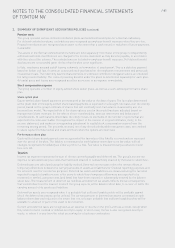

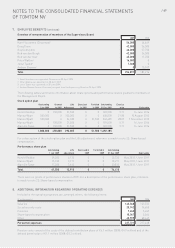

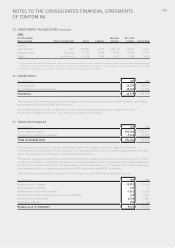

b) Impairment of non-financial assets

The group reviews impairment of non-financial assets at least on an annual basis. This requires an

estimation of the fair value of the cash-generating units to which the non-financial assets are allocated.

Estimating the fair value amount requires management to make an estimate of the expected future cash

flows from the cash-generating unit and also to determine a suitable discount rate in order to calculate the

present value of those cash flows. For additional information on goodwill impairment test, refer to note 13.

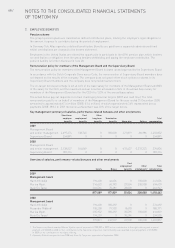

c) Stock compensation plan

In order to calculate the charge for share-based compensation as required by IFRS 2, the group makes

estimates, principally relating to the assumptions used in its models to calculate the stock compensation

expenses as set out in note 22.

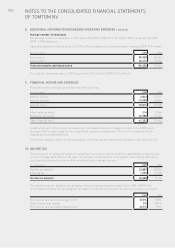

d) Provisions

For our critical accounting estimates and judgements on provisions, refer to note 26.

e) Doubtful receivables allowance

The group makes allowances for doubtful receivables arising from its trading activities. In doing so, it makes

estimates based on its historical experience of doubtful receivables rates, depending on the age of the

relevant receivable and specific knowledge of the client and the industry.

Revisions to accounting estimates are recognised in the period in which the estimate is revised if the revision

affects only that period, or in the period of revision and future periods if the revision affects both current and

future periods.