Texas Instruments 2007 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2007 Texas Instruments annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

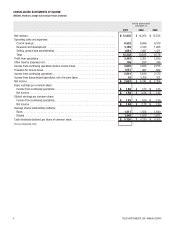

TEXAS INSTRUMENTS 2007 ANNUAL REPORT 15

Assumptions:

The fair values for the non-qualified stock options and stock options offered under the TI Employees 2002 Stock Purchase Plan (both

actual and pro forma) were estimated using the Black-Scholes option-pricing model with the weighted-average assumptions listed

below. The TI Employees 2005 Stock Purchase Plan, which began October 1, 2005, is a discount-purchase plan. Consequently, the

Black-Scholes option pricing model is not used to determine the fair value per share of these awards. The fair value per share under

this plan is equal to the amount of the discount.

2007 2006 2005

Long-term Plans (a)

Weighted average grant date fair value, per share .............................. $9.72 $ 11.82 $ 10.07

Weighted average assumptions used:

Expected volatility..................................................... 28

% 34

%50

%

Expected lives........................................................ 5.6 yrs 5.0 yrs 5.0 yrs

Risk-free interest rates ................................................. 4.73%4.50

%3.77

%

Expected dividend yields................................................ 0.57

%0.37

%0.48

%

Stock Purchase Plans (b)

Weighted average fair value, per share....................................... $ 5.10 $4.68 $ 4.56

Weighted average assumptions used:

Expected volatility..................................................... — — 36

%

Expected lives........................................................ — — .58 yrs

Risk-free interest rates ................................................. — — 2.44

%

Expected dividend yields................................................ — — 0.45

%

(a) Includes stock options under the long-term incentive plans and the director plans.

(b) Includes assumptions for the TI Employees 2002 Stock Purchase Plan.

Expected volatility on all options granted after July 1, 2005, is determined solely on available implied volatility rates rather than on an

analysis of historical volatility. We believe that market-based measures of implied volatility are currently the best available indicators of

the expected volatility used in these estimates.

Expected lives of options are determined based on the historical share option exercise experience of our optionees, using a rolling

10-year average. We believe the historical experience method is the best estimate of future exercise patterns currently available.

Risk-free interest rates are determined using the implied yield currently available for zero-coupon U.S. government issues with a

remaining term equal to the expected life of the options.

Expected dividend yields are based on the approved annual dividend rate in effect and the current market price of our common stock at

the time of grant. No assumption for a future dividend rate change has been included unless there is an approved plan to change the

dividend in the near term.

Inventories: Inventories are stated at the lower of cost or estimated net realizable value. Cost is generally computed on a currently

adjusted standard cost basis, which approximates costs on a first-in first-out basis. With the adoption of SFAS No. 151, “Inventory

Costs, an amendment of ARB No. 43, Chapter 4,” effective January 1, 2006, standard costs are based on the normal utilization of

installed factory capacity, which is not materially different from the optimal utilization rates previously used. Costs associated with

underutilization of capacity are expensed as incurred.

We conduct quarterly inventory reviews for salability and obsolescence. A specific allowance is provided for inventory considered

unlikely to be sold. Remaining inventory has a salability and obsolescence allowance based upon an analysis of historical disposal

activity. Inventory is written off in the period in which disposal occurs.