Texas Instruments 2007 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2007 Texas Instruments annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14 TEXAS INSTRUMENTS 2007 ANNUAL REPORT

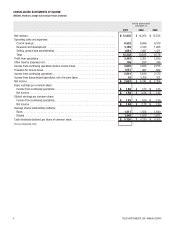

The amounts of stock-based compensation expense recognized in the periods presented are as follows:

2007 2006 2005

Stock-based compensation expense recognized:

Cost of revenue................................................................ $53 $64 $32

Research and development ....................................................... 83 101 53

Selling, general and administrative ................................................. 144 167 90

Total ........................................................................ $ 280 $ 332 $ 175

The amounts above include the impact of recognizing compensation expense related to RSUs, non-qualified stock options and stock

options offered under the employee stock purchase plans.

We issue awards of non-qualified stock options generally with graded vesting provisions (e.g., 25 percent per year for four years). In

such cases, we recognize the related compensation cost on a straight-line basis over the minimum service period required for vesting

of the award.

For awards to employees who are retirement eligible or nearing retirement eligibility, we recognize compensation cost on a straight-line

basis over the service period required to be performed by the employee in order to earn the award, but in no event less than a six-

month period.

Stock-based compensation expense has not been allocated between business segments but is reflected in Corporate.

Prior Period Pro Forma Presentations:

Under the modified prospective application method, results for periods prior to July 1, 2005, have not been restated to reflect the

effects of implementing SFAS 123(R). The following pro forma information, as required by SFAS No. 148, “Accounting for Stock-Based

Compensation – Transition and Disclosure, an amendment of FASB Statement No. 123,” is presented for comparative purposes and

illustrates the pro forma effect on income from continuing operations and related per-share amounts as if we had applied the original

fair value recognition provisions of SFAS 123 to stock-based employee compensation for periods prior to implementation of SFAS

123(R).

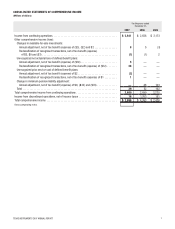

2005

Income from continuing operations, as reported ......................................................... $2,173

Add: Stock-based compensation expense included in reported income from continuing

operations, net of ($58) tax (including actual SFAS 123(R) total stock-based

compensation expense recognized since July 1, 2005) .................................................. 117

Deduct: Total stock-based compensation expense determined under fair value-based

method for all awards, net of $122 tax .............................................................. (250)

Deduct: Adjustment for retirement-eligible employees, net of $49 tax......................................... (93)

Adjusted income from continuing operations............................................................ $ 1,947

Earnings per common share from continuing operations:

Basic – as reported............................................................................. $1.33

Basic – as adjusted for stock-based compensation expense .............................................. $1.19

Diluted – as reported ........................................................................... $1.30

Diluted – as adjusted for stock-based compensation expense............................................. $1.17

In our first quarter 2005 pro forma footnote disclosures, we included a $93 million ($0.05 per share) inception-to-date adjustment of fair

value-based compensation expense to reduce the attribution period for both retirement-eligible employees and employees who would

become retirement eligible prior to vesting of certain grants of non-qualified stock options.