Texas Instruments 2007 Annual Report Download

Download and view the complete annual report

Please find the complete 2007 Texas Instruments annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report

2007

Table of contents

-

Page 1

Annual Report 2007 -

Page 2

... 2 Summary of Operations 4 CEO Q&A 5 Financial Statements 64 Stockholder and Other Information 65 Board of Directors, Executive Officers and TI Fellows ABOUT TI Texas Instruments (NYSE: TXN) helps customers solve problems and develop new electronics that make the world smarter, healthier... -

Page 3

... India to serve customers there. In Eastern Europe, we added three sales offices and a customer support center. We expanded our sales force in most regions of the world and increased the technical support we provide customers by adding 20 percent more analog applications engineers to work directly... -

Page 4

...companies in 2007, Integrated Circuit Designs and POWERPRECISE Solutions, that brought new products and engineering talent to the company. These acquisitions complement TI's 2006 purchase of Chipcon, a market leader in short-range, low-power radio frequency technology. DSP: The company's sale of its... -

Page 5

... and testing semiconductors with a new facility in the Philippines that will be the most environmentally efficient semiconductor assembly-andtest site in the world. EDUCATION TECHNOLOGY TI revenue from sales of graphing calculators in its largest market, the U.S., was slightly lower as customers... -

Page 6

... market. Modems, which connect the handset to the network, are becoming more standardized and the market for these products is becoming more competitive. As a result, customers are increasingly adopting these off-the-shelf products and are redirecting more 4 TEXAS INSTRUMENTS 2007 ANNUAL REPORT -

Page 7

... of Operations - Financial Condition - Liquidity and Capital Resources - Long-term Contractual Obligations Quarterly Financial Data Common Stock Prices and Dividends Comparison of Total Shareholder Return Safe Harbor Statement Stock-based Compensation Postretirement Benefit Plans Profit Sharing and... -

Page 8

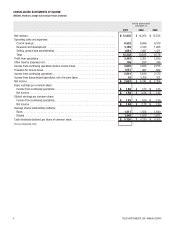

... STATEMENTS OF INCOME (Millions of dollars, except share and per-share amounts) For the years ended December 31, 2007 2006 2005 Net revenue ...Operating costs and expenses: Cost of revenue...Research and development ...Selling, general and administrative ...Total ...Profit from operations... -

Page 9

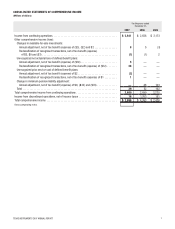

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (Millions of dollars) For the years ended December 31, 2007 2006 2005 Income from continuing operations ...Other comprehensive income (loss): Changes in available-for-sale investments: Annual adjustment, net of tax benefit (expense) of ($3), ($2) ... -

Page 10

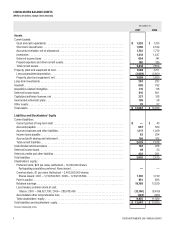

...plant and equipment, net ...Long-term investments ...Goodwill ...Acquisition-related intangibles ...Deferred income taxes ...Capitalized software licenses, net ...Overfunded retirement plans...324) 9,975 $ 12,667 - 1,739 885 17,529 (8,430) (363) 11,360 $ 13,930 8 TEXAS INSTRUMENTS 2007 ANNUAL REPORT -

Page 11

... by discontinued operations ...Effect of exchange rate changes on cash ...Net increase (decrease) in cash and cash equivalents ...Cash and cash equivalents at beginning of year ...Cash and cash equivalents at end of year ...See accompanying notes. TEXAS INSTRUMENTS 2007 ANNUAL REPORT $ 2,657... -

Page 12

... plans and the change in measurement date of non-U.S. pension plans (see Note 10). Reflects the impact of recording the reduction of the liability for uncertain tax positions and related accrued interest expense (see Note 12). See accompanying notes. 10 TEXAS INSTRUMENTS 2007 ANNUAL REPORT -

Page 13

... Business: Texas Instruments (TI) makes, markets and sells high-technology components; more than 50,000 customers all over the world buy our products. We have two reportable operating segments: Semiconductor, which accounted for 96 percent of our revenue in 2007, and Education Technology. Over... -

Page 14

... the terms of the sales order. Estimates of returns for product quality reasons and of price allowances (calculated based upon historical experience, analysis of product shipments and contractual arrangements with customers), are recorded when revenue is recognized. Allowances include discounts for... -

Page 15

... under employee stock purchase plans and acquisition-related stock option awards). Compensation cost has previously been recognized for restricted stock units (RSUs). Effective July 1, 2005, we adopted the fair value recognition provisions of FASB Statement of Financial Accounting Standards (SFAS... -

Page 16

...under the employee stock purchase plans. We issue awards of non-qualified stock options generally with graded vesting provisions (e.g., 25 percent per year for four years). In such cases, we recognize the related compensation cost on a straight-line basis over the minimum service period required for... -

Page 17

... 2005 Stock Purchase Plan, which began October 1, 2005, is a discount-purchase plan. Consequently, the Black-Scholes option pricing model is not used to determine the fair value per share of these awards. The fair value per share under this plan is equal to the amount of the discount. 2007 2006 2005... -

Page 18

... over the shorter of the remaining lease term or the estimated useful lives of the improvements. Acquisition-related costs are amortized on a straight-line basis over the estimated economic life of the assets. Capitalized software licenses generally are amortized on a straight-line basis over the... -

Page 19

... for these types of collaborative arrangements and is effective for fiscal years beginning after December 15, 2008. We are currently evaluating the potential impact this standard will have on our financial position and results of operations. TEXAS INSTRUMENTS 2007 ANNUAL REPORT 17 -

Page 20

... operations in 2007 includes an income tax benefit related to a reduction of a state tax liability associated with the sale. Continuing Involvement: Upon closing of the sales transaction, we entered into a Transition Services Agreement (TSA) with Sensata to provide various temporary support services... -

Page 21

... by the U.S. Department of Education, and all were rated AAA/Aaa as of December 31, 2007. Our intent in these investments is not to hold these securities to maturity, but rather to use the periodic auction feature to provide liquidity (see Note 17). TEXAS INSTRUMENTS 2007 ANNUAL REPORT 19 -

Page 22

... losses from sales of these investments in 2007, 2006 and 2005. Other-than-temporary declines and impairments in the values of long-term investments recognized in the income statement were $18 million, $8 million and $8 million in 2007, 2006 and 2005. 20 TEXAS INSTRUMENTS 2007 ANNUAL REPORT -

Page 23

... 2007, 2006 and 2005, primarily related to developed technology. The following table sets forth the estimated amortization of acquisition-related intangibles for the years ended December 31: 2008 ...2009 ...2010 ...2011 ...2012 ...Thereafter ...$ 35 30 29 14 5 2 TEXAS INSTRUMENTS 2007 ANNUAL REPORT... -

Page 24

... to sell Japanese yen). Also at December 31, 2007, we had a series of forward purchase contracts denominated in Philippine pesos to hedge specified forecasted transactions associated with the construction of a new assembly and test facility in the Philippines. These contracts are primarily intended... -

Page 25

... 2003 Long-Term Incentive Plan. Each RSU represents the right to receive one share of TI common stock on the vesting date, which is generally four years after the date of grant. Upon vesting, the shares are subject to issuance without payment by the grantee. TEXAS INSTRUMENTS 2007 ANNUAL REPORT 23 -

Page 26

...2006, each grant is an option to purchase 15,000 shares with an option price equal to fair market value on the date of grant. Under the plan, we also make a one-time grant of 2,000 RSUs to each new non-employee director of TI. The plan provides for the issuance of 2,000,000 shares of TI common stock... -

Page 27

... outstanding under the Plan at December 31, 2007, had an exercise price of $27.50 per share (85 percent of the fair market value of TI common stock on the date of automatic exercise). Of the total outstanding options, none were exercisable at year-end 2007. TEXAS INSTRUMENTS 2007 ANNUAL REPORT 25 -

Page 28

... 123(R) on July 1, 2005). 10. Postretirement Benefit Plans On December 31, 2006, we adopted the recognition and disclosure provisions of SFAS No. 158, "Employers' Accounting for Defined Benefit Pension and Other Postretirement Plans, an amendment of FASB Statements No. 87, 88, 106, and 132(R)." SFAS... -

Page 29

...for the year ended December 31, 2006, or for any prior period presented, and it will not affect our operating results in future periods. Plan Descriptions: We provide various retirement plans for employees including defined benefit, defined contribution and retiree health care benefit plans, as well... -

Page 30

... 601,115 shares of TI common stock valued at $20 million and 661,409 shares valued at $19 million. Dividends paid on these shares for 2007 and 2006 were immaterial. Effect on the Statements of Income and Balance Sheets Expense related to defined benefit and retiree health care benefit plans was as... -

Page 31

... balance sheet as of December 31, 2007: U.S. Defined Benefit U.S. Retiree Health Care Non-U.S. Defined Benefit Total Overfunded retirement plans ...Accrued profit sharing and retirement ...Underfunded retirement plans ...Funded status (FVPA - BO) at end of year ... $ 19 (6) (35) $ (22) $ - - (71... -

Page 32

... the balance sheet as of December 31, 2006: U.S. Defined Benefit U.S. Retiree Health Care Non-U.S. Defined Benefit Total Overfunded retirement plans ...Accrued profit sharing and retirement ...Underfunded retirement plans ...Funded status (FVPA - BO) at end of year... $ 42 (4) (30) $ 8 $ - (1) (42... -

Page 33

... retiree health care plan; and ($3) million and $5 million for the non-U.S. defined benefit plans. As of December 31, 2007, we do not expect to return any of the assets of the plans to TI during the next 12 months. Assumptions and Investment Policies Defined Benefit Retiree Health Care 2007 2006... -

Page 34

... of the plan assets related to the defined benefit pension plans and retiree health care benefit plan are directly invested in TI common stock. Contributions to the plans meet or exceed all minimum funding requirements. We expect to contribute approximately $50 million to U.S. retirement plans and... -

Page 35

... no shares of TI common stock are actually held for the account of participants, as of December 31, 2007, we have a forward purchase contract with a commercial bank to acquire 550,000 shares of TI common stock at a fixed price of $32.37 per share at the end of the contract term or, at our option, to... -

Page 36

...communicated by tax authorities ...U.S. tax benefits for manufacturing and foreign sales...Other ...Total provision for income taxes ... $ 1,292 (94) - (69) - (24) (54) $ 1,051 $ 1,269 (80) - (78) - (106) (18) $ 987 $ 965 (144) 55 (62) (147) (82) (3) $ 582 34 TEXAS INSTRUMENTS 2007 ANNUAL REPORT -

Page 37

The primary components of deferred income tax assets and liabilities at December 31 were as follows: December 31, 2007 2006 Deferred income tax assets: Accrued retirement costs (defined benefit and retiree health care) ...Inventories and related reserves ...Stock-based compensation ...Accrued ... -

Page 38

... open to audit represent the years still subject to the statute of limitations. Years still open to audit by foreign tax authorities in major jurisdictions include Germany (2003 onward), France (2005 onward), Japan (2000 onward) and Taiwan (2002 onward). 36 TEXAS INSTRUMENTS 2007 ANNUAL REPORT -

Page 39

... also accounted for as operating leases. Lease agreements frequently include purchase and renewal provisions and require us to pay taxes, insurance and maintenance costs. Rental and lease expense incurred was $123 million in 2007, $125 million in 2006 and $126 million in 2005. Capitalized Software... -

Page 40

... to our former memory business operations in Italy. Consists of refunds of overpayments attributable to previously divested businesses and interest on refunds relating to settlements of audits of sales and use taxes paid to the State of Texas. Includes lease income of approximately $20 million per... -

Page 41

... property, plant and equipment expenditures in future years were $416 million at December 31, 2007. Accrued Expenses and Other Liabilities December 31, 2007 2006 Accrued salaries, wages and vacation pay ...Customer incentive programs and allowances ...Property and other non-income taxes ...Other... -

Page 42

... prices). Assets of Corporate include unallocated cash; short-term investments; non-current investments; property, plant and equipment; and deferred income taxes. Segment Information Semiconductor Education Technology Corporate Total Net revenue 2007 ...2006 ...2005 ...Profit (loss) from operations... -

Page 43

...product shipment destination and royalty payor location, and property, plant and equipment based on physical location: Geographic Area Information U.S. Asia Europe Japan Rest of World Total Net revenue 2007 ...2006 ...2005 ...Property, plant and equipment, net 2007 ...2006 ...2005 ...Major Customer... -

Page 44

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM The Board of Directors Texas Instruments Incorporated We have audited the accompanying consolidated balance sheets of Texas Instruments Incorporated and subsidiaries (the Company) as of December 31, 2007 and 2006, and the related consolidated ... -

Page 45

... because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. TI management assessed the effectiveness of internal control over financial reporting as of December 31, 2007. In making this assessment, we used the criteria set forth by the... -

Page 46

... sheets of Texas Instruments Incorporated and subsidiaries as of December 31, 2007 and 2006, and the related consolidated statements of income, comprehensive income, stockholders' equity, and cash flows for each of the three years in the period ended December 31, 2007 and our report dated February... -

Page 47

... ... $ 4,406 686 425 4,886 $ 2,454 1,272 199 5,302 $ 3,608 1,288 173 4,151 $ 2,973 1,260 154 753 $ 1,986 775 147 284 See Notes to Financial Statements and Management's Discussion and Analysis of Financial Condition and Results of Operations. TEXAS INSTRUMENTS 2007 ANNUAL REPORT 45 -

Page 48

... algorithms to process and improve a stream of digital data. DSPs are ideal for applications that require precise, real-time processing, such as cell phone conversations or receiving digital radio transmissions. The processing speed and power efficiency of a 46 TEXAS INSTRUMENTS 2007 ANNUAL REPORT -

Page 49

... share of the market in 2007. Most of this revenue comes from custom DSPs. A digital television broadcast provides an example of how analog semiconductors and DSPs work together in enabling modern electronic equipment. As a camera focuses on an event, its sensors and microphones send real-world... -

Page 50

...reflecting the quality of our product portfolio, the efficiency of our manufacturing strategies and our effective expense management. For the year, cash flow from operations was a record $4.41 billion, and return on invested capital was more than 25 percent. 48 TEXAS INSTRUMENTS 2007 ANNUAL REPORT -

Page 51

... made substantial market share gains again this year. Statement of Operations - Selected Items For the years ended December 31, 2007 2006 2005 Revenue by segment: Semiconductor ...Education Technology ...Net revenue ...Cost of revenue ...Gross profit ...Gross profit % of revenue ...Research and... -

Page 52

... from higher demand for products used in cell phone applications, this benefit was insufficient to offset normal price declines for those products. The collective declines in these areas more than offset strong growth from highperformance analog products. 50 TEXAS INSTRUMENTS 2007 ANNUAL REPORT -

Page 53

...products. End-equipment perspective: On an end-equipment basis, revenue in 2007 from DSP and analog products sold into cell phone applications declined 3 percent from 2006 to $4.91 billion in 2007, due to normal price...; and automotive was about 5 percent. TEXAS INSTRUMENTS 2007 ANNUAL REPORT 51 -

Page 54

....9 percent of revenue, increased $226 million from the prior year primarily due to the combination of higher marketing expense in the Semiconductor segment, particularly for DLP product advertising, and $77 million of higher stockbased compensation expense. 52 TEXAS INSTRUMENTS 2007 ANNUAL REPORT -

Page 55

... in 2006 came from DSP. Remaining Semiconductor revenue increased 14 percent as increased shipments resulting from growth in demand for standard logic products, DLP products, RISC microprocessors and microcontrollers more than offset a decline in royalties. TEXAS INSTRUMENTS 2007 ANNUAL REPORT 53 -

Page 56

... from discontinued operations for 2006, which includes the $1.67 billion gain from the sale of the former Sensors & Controls business, was $1.70 billion, compared with $151 million in 2005 (see Note 2 to the Financial Statements for further discussion). 54 TEXAS INSTRUMENTS 2007 ANNUAL REPORT -

Page 57

... Note 6 to the Financial Statements for additional information). As of December 31, 2007, these facilities were not being utilized. Cash flow from operations for 2007 was $4.41 billion, an increase of $1.95 billion from the prior year. In 2006, cash flows included income tax payments associated with... -

Page 58

... Due by Period Contractual Obligations 2008 2009/2010 2011/2012 Thereafter Total Operating lease obligations (a) ...Software license obligations (b) ...Purchase obligations (c) ...Retirement plans funding (d) ...Deferred compensation plan (e) ...Venture capital commitments (f) ...Total... -

Page 59

... historical experience, analysis of product shipments and contractual arrangements with customers. Distributor revenue is recognized net of allowances, which are management's estimates based on analysis of historical data, current economic conditions and contractual terms. These allowances recognize... -

Page 60

... contracts outstanding with a notional value of $487 million to hedge net balance sheet exposures (including $122 million to sell euros, $57 million to sell British pounds and $182 million to sell Japanese yen). Similar hedging activities existed at year-end 2006. 58 TEXAS INSTRUMENTS 2007 ANNUAL... -

Page 61

... related changes in deferred compensation liabilities such that a 10 percent increase or decrease in investment prices would not materially affect operating results (see Note 4 to the Financial Statements for details of equity and other long-term investments). TEXAS INSTRUMENTS 2007 ANNUAL REPORT... -

Page 62

... with Conexant Systems, Inc. Settlement of an audit of Texas state sales and use taxes paid on various purchases over a nine-year period. The 2006 U.S. federal research tax credit was reinstated in December 2006 and was retroactive to the beginning of 2006. 60 TEXAS INSTRUMENTS 2007 ANNUAL REPORT -

Page 63

... market. The table below shows the high and low closing prices of TI common stock as reported by Bloomberg L.P. and the dividends paid per common share for each quarter during the past two years. Quarter 1st 2nd 3rd 4th Stock prices: 2007 High ...Low ...2006 High...Low...Dividends paid: 2007... -

Page 64

... This graph compares TI's total shareholder return with the S&P 500 Index and the S&P Information Technology Index over a five-year period, beginning December 31, 2002, and ending December 31, 2007. The total shareholder return assumes $100 invested at the beginning of the period in TI common stock... -

Page 65

...Timely฀implementation฀of฀new฀manufacturing฀technologies,฀installation฀of฀manufacturing฀equipment฀and฀the฀ability฀to฀obtain฀ needed third-party foundry and assembly/test subcontract services. For a more detailed discussion of these factors, see the text under the heading... -

Page 66

... on the New York Stock Exchange. Ticker symbol: TXN COMPANY HEADQUARTERS Texas Instruments Incorporated P.O. Box 660199 Dallas, TX 75266-0199 Phone: 972-995-2011 www.ti.com INVESTOR INFORMATION Investor Relations P.O. Box 660199, MS 8657 Dallas, TX 75266-0199 Phone: 972-995-3773 FINANCIAL/PRODUCT... -

Page 67

... J. Engibous Chairman of the Board, Texas Instruments Ruth J. Simmons President, Brown University David R. Goode Retired Chairman of the Board, Norfolk Southern Corporation Richard K. Templeton President and Chief Executive Officer, Texas Instruments Christine Todd Whitman President, The Whitman... -

Page 68

10% Texas Instruments Incorporated P.O. Box 660199 Dallas, TX 75266-0199 www.ti.com Cert no. SW-COC-1941 An Equal Opportunity Employer © 2008 Texas Instruments Incorporated TI-30001H