Tesco 2001 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2001 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TESCO PLC 5

Joint ventures

Our total share of profits from joint ventures was £21m

compared to £11m last year.

Within this, our share of Tesco Personal Finance profits was

£3m (2000 – £4m loss).

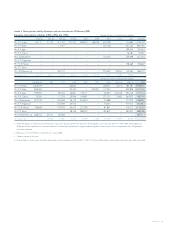

Financial risks and treasury management

The treasury function has been formally authorised by the Board to

manage the financial risks that arise in relation to underlying business

needs. The Board establishes the function’s policies and operating

parameters and routinely reviews its activities, which are also subject

to regular audit. The function does not operate as a profit centre

and the undertaking of speculative transactions is not permitted.

The main financial risks faced by the Group relate to the

availability of funds to meet business needs, the risk of default

by counterparties to financial transactions (credit risk), and

fluctuations in interest and foreign exchange rates. These risks

are managed as described below. The balance sheet positions at

24 February 2001 are representative of the positions throughout

the year.

Funding and liquidity

The Group finances its operations by a combination of retained

profits, bank borrowings, commercial paper, medium term notes,

long-term debt market issues and leases.The objective is to ensure

continuity of funding. The policy is to smooth the debt maturity

profile, to arrange funding ahead of requirements and to maintain

sufficient undrawn committed bank facilities and a strong credit

rating so that maturing debt may be refinanced as it falls due.

The Group’s long-term credit ratings from Moody’s and Fitch

are AA3 and AA respectively, consistent with last year. During the

year new funding of £700m was arranged including net new

committed bank facilities of £115m and medium term notes with

the following principal values and maturity dates, £200m 2016, and

£150m 2010. At the year end net debt was £2.8bn (2000 – £2.1bn)

and the average debt maturity was seven years (2000 – seven years).

98 99 00

0.4

0.75

1.5

01

2.0

NUMBER OF TESCO

PERSONAL FINANCE

ACCOUNTS million