Tesco 2001 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2001 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38 TESCO PLC

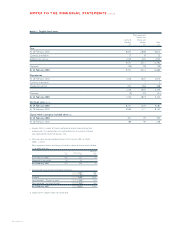

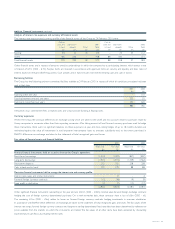

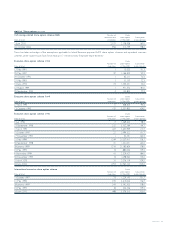

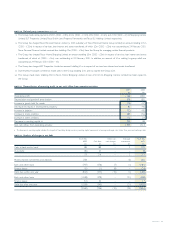

NOTE 26 Pension commitments

The Group operates a funded defined benefit pension scheme for full-time employees in the UK, the assets of which are held as

a segregated fund and administered by trustees. The total cost of the scheme to the Group was £71m (2000 – £60m).

An independent actuary, using the projected unit method, carried out the latest actuarial assessment of the scheme at 5 April 1999.

The assumptions that have the most significant effect on the results of the valuation are those relating to the rate of return on investments

and the rate of increase in salaries and pensions.

The key assumptions made were:

Rate of return on investments 7.25%

Rate of increase in salaries 4.50%

Rate of increase in pensions 2.75%

At the date of the latest actuarial valuation, the market value of the scheme’s assets was £1,297m and the actuarial value of these assets

represented 96% of the benefits that had accrued to members, after allowing for expected future increases in earnings. The actuarial

shortfall of £53m will be met via increased contributions over a period of 11 years, being the expected average remaining service lifetime

of employed members.

The Group also operates a defined contribution pension scheme for part-time employees which was introduced on 6 April 1988. The

assets of the scheme are held separately from those of the Group, being invested with an insurance company. The pension cost represents

contributions payable by the Group to the insurance company and amounted to £20m (2000 – £19m). There were no material amounts

outstanding to the insurance company at the year end.

The Group operates a number of pension schemes worldwide, most of which are defined contribution schemes.The contributions payable

for non-UK schemes of £7m (2000 – £3m) have been fully expensed against profits in the current year. A defined benefit scheme operates in

the Republic of Ireland. At the latest actuarial valuation carried out at 1 April 1998, the market value of the scheme’s assets was £42m and the

actuarial value of these assets represented 129% of the benefits that had accrued to members, after allowing for expected future

increases in earnings.

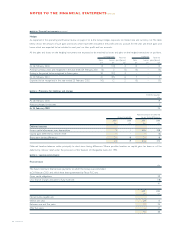

NOTE 27 Post-retirement benefits other than pensions

The company operates a scheme offering post-retirement healthcare benefits.The cost of providing for these benefits has been accounted for

on a basis similar to that used for defined benefit pension schemes.

The liability as at 24 February 1996 of £10m, which was determined in accordance with the advice of qualified actuaries, is being spread

forward over the service lives of relevant employees and £1m (2000 – £1m) has been charged to the profit and loss account. An accrual of £5m (2000

– £4m) is being carried in the balance sheet. It is expected that payments will be tax deductible, at the company’s tax rate, when made.

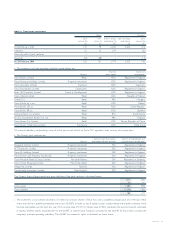

NOTE 28 Capital commitments

At 24 February 2001 there were commitments for capital expenditure contracted for but not provided of £725m (2000 – £303m), principally

relating to the overseas store development programme.

NOTE 29 Contingent liabilities

Certain bank loans and overdraft facilities of joint ventures have been guaranteed by Tesco PLC. At 24 February 2001, the amounts outstanding

on these facilities were £12m (2000 – £16m).

The company has irrevocably guaranteed the liabilities as defined in Section 5(c) of the Republic of Ireland (Amendment Act) 1986

of various subsidiary undertakings incorporated in the Republic of Ireland.

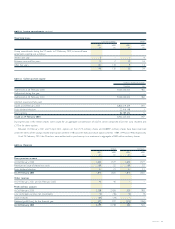

NOTE 30 Related party transactions

During the year there were no material transactions or amounts owed or owing with any of the Group’s key management or members

of their close family.

During the year the Group traded with its ten joint ventures: Shopping Centres Limited, BLT Properties Limited, Tesco British Land Property

Partnership, Tesco BL Holdings Limited, Tesco Personal Finance Group Limited, Tesco Personal Finance Life Limited,Tesco Personal Finance Investments

Limited,Tesco Home Shopping Limited, iVillage UK Limited and DunnHumby Associates Limited.The main transactions during the year were:

i Equity funding of £34m (£32m in Tesco Personal Finance Group Limited, and £2m in DunnHumby Associates Limited).

ii The Group sold a property to BLT Properties Limited for £14m and acquired a property from BLT Properties Limited for £15m.

NOTES TO THE FINANCIAL STATEMENTS continued