THQ 2007 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2007 THQ annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THQ INC.PG.2

Pixar videogame to date. We shipped more than four million

units of

WWE® SmackDown® vs. Raw®

videogames and

four million units of our new Nickelodeon titles combined.

In the growing market of games aimed at girls, we shipped

more than 1.5 million units of our

Bratz™

title.

Life-to-date shipments now stand in excess of 30 million

units for each of our Disney•Pixar, Nickelodeon and WWE

franchises, and shipments of

Bratz

have now exceeded

three million units life-to-date.

In fi scal 2007, THQ added to this foundation of strong

licensed brands by securing the exclusive global

rights to publish games based on the Ultimate Fighting

Championship. The UFC is one of the fastest-growing

sports targeting the coveted 18–34 male demographic.

We look forward to continuing to build on our solid

foundation of both owned and licensed franchises to

support our future growth.

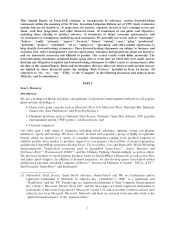

And although we believe we have one of the strongest

portfolios of licensed franchises, over time we expect

revenue from owned intellectual properties to increase at

a faster rate than from our licensed properties. We are

currently targeting about one third of revenues from

owned properties in fi scal 2008, up from 20% in fi scal 2007.

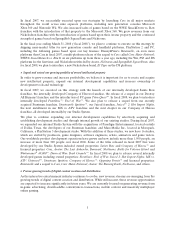

industry growth of 13% in the US. Our revenue from

Europe climbed 35% versus 11% market growth in the

major European territories and our Asia-Pacifi c revenue

increased 31% compared to 4% market growth in Australia/

New Zealand, our primary Asia-Pacifi c market.

Our global product portfolio and expanding marketing and

sales footprint drove THQ’s international revenue increase

to $427 million, or 42% of total revenue, up from $317

million and 39% of total revenue in fi scal 2006. In fi scal

2007, we opened new offi ces in Italy, Mexico and Switzerland.

In fi scal 2008, we expect continued growth in our international

revenue, which will help drive operating leverage as we ship

more units of each title.

Owned and Licensed Franchises to Support Future Growth

We’ve built a solid foundation of both owned and licensed

franchises. In fi scal 2007 we successfully launched new

owned and internally developed titles

Saints Row

and

Company of Heroes.

We now have six owned and internally

developed franchises that have exceeded the one-million-

unit shipment threshold.

THQ also grew revenue from our proven licensed franchises.

In fi scal 2007, we shipped nearly eight million units of games

based on Disney•Pixar’s

Cars

, making it the fastest-selling

FY07

$1.0B

L

I

C

E

N

S

E

D

I

P

8

0

%

O

W

N

E

D

I

P

FY08E

$1.1B

L

I

C

E

N

S

E

D

I

P

6

7

%

O

W

N

E

D

I

P

3

3

%

2

0

%

LICENSED IP OWNED IP

A FOCUS ON GROWING OWNED IP

THQ REVENUE MIX

Source: THQ

29%

38% 39%

42%

FY 04 FY 05 FY 06 FY 07

$0

$100

$200

$300

$400

$500

$ Millions

% of total revenue

INCREASING INTERNATIONAL REVENUE

INTERNATIONAL REVENUE - ABSOLUTE DOLLARS

AND AS PERCENT OF TOTAL THQ REVENUE

Source: THQ