Sunoco 2003 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2003 Sunoco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Ohio. The coke production will be sold to

International Steel Group under a long-term

contract and the heat recovery steam

associated with the facility will provide

lower cost energy to our adjacent chemical

manufacturing complex. This agreement is

a tangible step forward in our development

plans for Sun Coke and our efforts to

realize added value for our advantaged

cokemaking technology. In addition, we are

much further along in discussions to

expand the use of our technology around

the world which could improve Sun Coke’s

contribution to Sunoco’s earnings.

The actions taken over the past year will

significantly increase the asset base of

each of our five businesses. Upon the

closing of a pending acquisition of retail

sites from ConocoPhillips and the early

2005 completion of our new coke plant in

Haverhill, Ohio, we will have added over

$900 million of new assets and investments

across our businesses and, we believe,

increased the Company’s earnings power

by over $1.65 per share. We have been

patient, opportunistic and value-driven in

our pursuit of growth.

In 2003, we also continued to return signifi-

cant cash to our shareholders. We

increased our dividend by 10 percent (to

$1.10 per share annually) and repurchased

2.9 million shares ($136 million) of common

stock during the year. We consider our

share repurchase program as an invest-

ment in the Company we know best – and

a way for each shareholder to own an

increasing percentage of a bigger, better

and more diversified Sunoco. A competitive

dividend and an active and opportunistic

share repurchase program have been an

integral part of our plan to increase the

share price and reduce price volatility for

long-term owners of Sunoco.

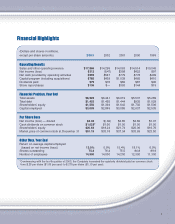

Financially, we enter 2004 on a solid foun-

dation with $431 million in cash, no short-

term borrowings and a balance sheet

improved from a year ago. In 2003, we

were able to meet our ongoing capital

needs, and fund substantial acquisition and

share repurchase activity, while reducing

our net debt-to-capital ratio from 43 percent

at the beginning of the year to 40 percent

at year end. While our capital needs are

higher in 2004 as we spend to meet new

Clean Fuels specifications, complete the

construction of the Haverhill coke plant

and fund our refining and retail marketing

acquisitions, we expect to follow the same

model – strong operating cash flow, pru-

dent divestments and effective management

of working capital – to fund our capital

needs and continue to opportunistically

grow the Company.

The outlook for our businesses is favorable,

particularly for Refining and Supply and

Chemicals, where we are most leveraged

to changing market conditions and margins.

Strong demand growth and various regula-

tory changes to gasoline specifications

have clearly tightened the supply/demand

balance and increased the complexity to

manufacture and distribute refined prod-

ucts in our markets. We expect refining

margins to remain strong. With the

Eagle Point refinery acquisition,

we have increased our

refining capacity by

over 20 percent

5