Sunoco 2003 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2003 Sunoco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

units and we can and will do more in 2004

and beyond.

In Refining and Supply, we achieved record

production for the third consecutive year,

with an increase of over 15 million barrels

since 2000. We also continued to improve

the overall utilization and energy performance

throughout our refining system. The com-

petitiveness of our refineries, as measured

by industry benchmarking rankings, has

improved significantly and is now in the first

or second quartiles in most important

measures. In the current high commodity

price and margin environment, these

improvements translate into significant

savings and earnings for the business. In

early 2004, we completed the acquisition

of the Eagle Point refinery. This is our first

refinery acquisition since 1994 and is one

of the more cost-effective refinery acquisi-

tions in the industry in many years.

In Retail Marketing, we continued to grow

per-site fuel and merchandise sales,

expanded the footprint of the Sunoco®

brand, and effectively concluded a retail

divestment program in MidAmerica where

we sold our interests in certain sites into

the Sunoco distributor channel. In doing

so, we retained all the volumes within the

Sunoco®brand and harvested $46 million

in proceeds while improving the return on

invested capital for the business. This effort

is reflective of our strategy to high-grade

our retail portfolio and have Sunoco capital

invested only in sites and markets that will

yield an acceptable return well into the

future.

In Chemicals, significant productivity

enhancements and strategic actions were

taken to improve the future profitability of

the business. Manufacturing complement

has been reduced, low economic return

units in both phenol and polypropylene

have been shut down or mothballed, and,

like Refining and Supply, the competitive

standing of our facilities has been

improved. Also, the sale of the plasticizers

business in early 2004 is an excellent port-

folio management outcome for Chemicals –

garnering $90 million in divestment pro-

ceeds for a non-core part of the chemicals

business that had earned an average of

only $3 million over the past three years.

In Logistics, the value of our interest in

Sunoco Logistics Partners L.P. (NYSE:

SXL) grew by 54 percent in 2003. Since

the February 2002 initial public offering,

SXL distributions have increased from

3

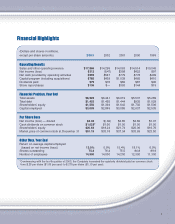

Sunoco 2003 Financial Highlights

• Income before special items* of $335 million or

$4.32 per diluted share

• Sector-leading Return on Capital Employed of

13.8 percent (based on income before special

items)* *

• Share price increase of 54 percent, reaching new

record highs

• Increased annual dividend from $1.00 to $1.10

per share

• Repurchased 2.9 million, or 4 percent, of

outstanding shares

* Net income (loss) for 2003 and 2002 amounted to $312 and $(47) million,

respectively, which includes net charges for special items of $23 and $22

million, respectively.

* * ROCE for 2003 (based on net incom e) was 13.0 percent.