Singapore Airlines 2016 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2016 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Performance of the Company

(continued)

SIA Cargo’s full year operating loss widened by

$28 million compared with FY2014/15. While operating

expenses declined $168 million, mainly due to lower

fuel costs, this could not fully cushion the $196 million

contraction in revenue, which was driven down by yield

erosion of 11.6 per cent, partially oset by higher freight

carriage (+2.6 per cent).

Overall cargo traic (in load tonne kilometers) increased

by 2.6 per cent, but lagged behind the growth in

capacity (in capacity tonne kilometers) of 4.9 per cent.

This resulted in cargo load factor declining by

1.4 percentage points to 61.9 per cent. Cargo breakeven

load factor remained unchanged at 65.2 per cent as the

yield decline (-11.6 per cent) was generally matched by

the drop in unit cost (-11.7 per cent).

Profit aer taxation included a refund amounting to

EUR76 million ($119 million), comprising a competition

law fine paid previously to the European Commission,

with interest therein, with respect to the air cargo

investigations by the Commission.

SilkAir’s revenue increased by $64 million (+7.0 per cent

to $966 million, as passenger revenue was boosted by

an 11.1 per cent improvement in passenger carriage,

partially oset by a 2.9 per cent decline in passenger

yield. Operating expenses rose in tandem with 9.1 per

cent capacity growth, but this was largely compensated

for by fuel cost savings. As a result, the operating profit

increased by $50 million (+122.1 per cent) to $91 million.

Yield declined by 2.9 per cent to 13.5¢/pkm and unit

cost declined by 7.2 per cent to 9.0¢/ask. Consequently,

the passenger breakeven load factor improved by

3.1 percentage points to 66.7 per cent. Achieved

passenger load factor improved by 1.3 percentage

points to 71.5 per cent.

Profit aer taxation improved 127.2 per cent to

$122 million.

SilkAir’s route network spanned 49 cities in 13 countries

including Singapore. During the year, SilkAir launched

new services to Cairns (Australia) and Male (Maldives),

and ceased operations to Hangzhou (China).

As at 31 March 2016, equity holders’ funds of SilkAir

stood at $951 million (+14.7 per cent).

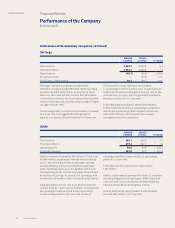

SilkAir

2015/16

$ million

2014/15

$ million % Change

Total revenue 965.7 902.5 + 7.0

Total expenditure 875.1 861.7 + 1.6

Operating profit 90.6 40.8 + 122.1

Profit after taxation 122.0 53.7 + 127.2

Performance of the Subsidiary Companies (continued)

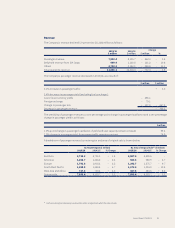

SIA Cargo

2015/16

$ million

2014/15

$ million % Change

Total revenue 2,045.0 2,240.8 – 8.7

Total expenditure 2,094.7 2,262.8 – 7.4

Operating loss (49.7) (22.0) – 125.9

Exceptional items –(83.3) n.m.

Profit/(Loss) after taxation 90.3 (99.7) n.m.

Singapore Airlines58

PERFORMANCE